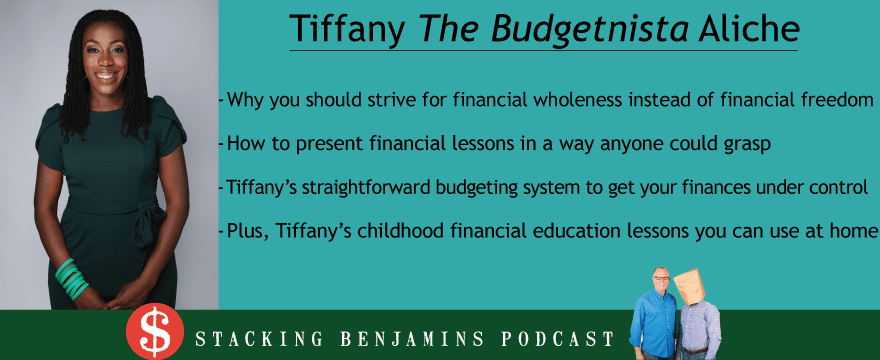

You may have financial security, but do you have financial wholeness? What’s the difference? Tiffany “The Budgetnista” Aliche says that she felt more whole BEFORE she had financial independence than she did after. We’ll talk about building a solid financial footing and understanding on today’s show. Tiffany has led women worldwide in paying off millions of dollars in debt, co-hosts the Brown Ambition podcast, and now has multiple financial education books published, including a pre-education book for children. With a decade of teaching experience behind her – that’s before she moved into financial education – Tiffany has used her experience to develop easy-to-follow, engaging financial education lessons.

Today we sit down with The Budgetnista for a wide-ranging interview including why you should strive for financial wholeness instead of financial freedom, how to present financial education so even children can grasp it, and her straightforward budgeting system.

A Case Study in Being Prepared

Model and Actress Brooke Shields had a horrific fall a few months ago that required her to undergo multiple surgeries. It’s an accident she’s still recovering from, and one she’ll need to dedicate time and resources too. Here’s the thing: Brook Shields (in all likelihood) can field the costs and loss of earnings in stride.

What would happen in your life after enduring the same experience Shields went through? Beyond the physical and emotional trauma, what type of shock test will your finances go through?

What vehicle gets the most mile for your buck?

Pushing mortgages and health costs to the side for a moment, vehicle purchases are among the most expensive reoccurring expenses you’ll have in life. Operating inside of a budget, there isn’t anything wrong with picking based on your aesthetic preferences.

However, at the very least, you should make informed decisions when any large amount of cash in on the table. We know cars depreciate in value the moment you drive off the lot, but which vehicles actually get you the most mileage for your cash over the long run? Joining us today with all the right answers, we welcome Karl Brauer from ISeeCars.com.

Getting Young Investors Started?

Sarah calls in asking the best way of setting up investment accounts for her two younger brothers, who are 16 and 20 years old. She knows her older brother could possibly setup a Roth IRA, but not sure what the best move is for her youngest brother. Sarah also asks about college financial aid implications. Thoughts?

Enjoy!

We couldn’t bring you three shows a week without our sponsors

Talking Real Money

Co-hosts Don McDonald and Tom Cock deliver straight forward, honest, advice on building the wealth you need for a more secure future. You can listen in wherever you listen to podcasts, or at TalkingRealMoney.com.

Geico

Whether you rent or own, Geico makes it EASY to bundle home and car insurance. Go to Geico.com today.

IPVanish

Headline Links:

Headline One: Brook Shields

Here’s our piece we used for today’s headline:

You can catch Shields’ update on yesterday’s Good Morning America airing:

Headline Two:

Thanks to Karl Brauer for joining us today! You can find more from the iSeeCars team and read Julie Blackley’s in-depth piece for yourself here: Longest-Lasting Cars to Reach 200,000 Miles and Beyond

Tiffany Aliche – The Budgetnista

Although she’ll say otherwise, Tiffany puts in some hard work. (Listen to the interview to understand that one). Check out everywhere you can find more from her below:

- Her Site: TheBudgetnista.com

- The Podcast: Brown Ambition Podcast

- Tiffany’s books:

You can hear Tiffany’s past appearances on the podcast below:

- Attack Your Debt With Tiffany Aliche the Budgetnista

- Rocking Your Debt Cleanse with Nick Clements & Mandi Woofruff (PLUS the Budgetnista!)

Doug’s Trivia

We dive into reliable cars and budgeting, and somehow Doug must have the Autobahn on his mind. Here’s his trivia question for today:

- What European car brand sells the most cars here in the US?

Need life insurance? You could be insured in 20 minutes or less and build your family’s safety net for the future. Use StackingBenjamins.com/HavenLife to calculate how much you need and apply.

- Sarah calls in asking how she can setup her younger brothers so they start investing. However, they’re 20 and 16 and she’s worried about harming their financial aid. Thoughts?

Written by: Richie Rutter-Reese

Did you love today’s show? Share below!

Leave a Reply