Wouldn’t you love a weather service advisory for the financial markets?

If there were such a thing, I think right now we might be under one….not a financial “thunderstorm warning,” but maybe just a “watch.”

Why?

Different than meteorology, which is WAY more scientific than you and I know, it’s just my gut that tells me it might be time for the market timers to exit stage left. Although I have some data (there’s data for every dumb theory)….after about 20 years of tracking the financial markets seriously you get a feel for the ebbs and flows.

Currently, here’s what bothers me:

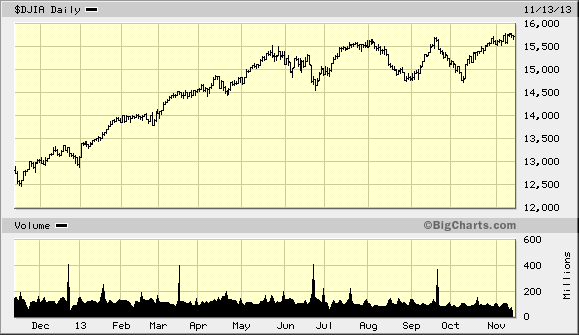

Wow, huh? If you’ve been following the financial press, you probably think that the market has been horrible this year. Your 401k plan would say otherwise, if you’ve been well diversified.

Why I’m Worried About The Stock Market

If you’ve followed the markets and don’t understand my consternation, it’s because I believe Warren Buffett’s classic quote:

Be fearful when others are greedy and greedy when others are fearful.

My accounts, across the board, are up significantly. That’s problem numero uno. Historically, whenever I start to giggle when watching my investments, there’s dangerous waters ahead.

Now, it’s not that I’m without any data. Factor in these thoughts:

– In the near future there’ll be another merry-go-round of imminent government shutdown, as Republicans and Democrats play Russian Roulette with the debt ceiling.

– The Fed may change hands at the top from Bernake to Janet Yellin, We have no idea if she’ll unwind the current Fed Treasury buying spree.

– According to the National Association of Realtors, home prices are predicted to rise, but sales will be flat.

Those could be a recipe for high winds.

Need more? My buddy Henry tends to agree with me.

So, I have a lot of reasons to exit the market. But will I do it?

Nope.

I will do nothing.

Why? Blodgett says it best in his article, but I’ll take a stab:

1) I’m a long term investor. When I began as a financial advisor, I’d often trust my gut. Over the years, I found out that my gut is about as wrong as anyone else’s gut. Getting “a feeling” about the market isn’t a reason to make a change. You learn not to trust your gut when managing your own money; you learn surprisingly fast when you make the mistake of acting on a feeling managing $60M dollars of other people’s money. Try telling a client that “I had a feeling.” That’s not the answer they’re looking for. Neither should you.

2) I have a mindset that’s prepared for a big dip in the market. I don’t want the market to go south, but if it does, I’m mentally ready for it. I think when many people buy stocks they mistakenly think that markets are going to be their friend. In two words: they aren’t.

Financial markets are brutal and quickly make lunch out of morons with itchy trigger fingers. Every time you invest you should understand that the market can nosedive. Once you realize the worst CAN happen over short periods, then you’ll prepare accordingly.

3) Which brings up my biggest point: I’ve prepared for the worst. Like any good investor, I do have an exit strategy. On some positions, I’ve placed stop losses in case the market drops so low that I don’t think I’ll be able to recover within a few years. These stop losses aren’t my friend either, by the way. If they hit, I’ll have a big problem on my hands….I’ll have to decide when to reinvest the money! Because I don’t have a crystal ball, that’s gonna be a challenge.

A bigger friend to me is the process of reallocating my money. By making sure my portfolio stays balanced, I’ll always sell high and buy low with my investments. Don’t know how rebalancing works? Listen to our latest 2 Guys & Your Money podcast on the topic.

So, if you’re like Mr. Blodgett and me and think the markets are poised for a fall, what should you do? I’d advocate making sure your defenses are in place, your portfolio is balanced, and walking away from talk of “what if” and “maybe” in a down market (of course, except for this article, which you were brilliant to decide to read…and finish).

j.

Good stuff Joe. Like you I see the market going up and up and am just waiting for the inevitable fall. And like you I plan to do nothing about it except for eventually rebalancing once things get too far out of whack. It’s a peaceful (and effective) simplicity.

“Peaceful” is maybe the perfect word here. I love having a plan for the downturn that doesn’t involve too much guesswork (only if those stop losses hit will my “peace” be interrupted).

I like your thought process and your attitude towards the markets. The saddest aspect of the 2008-09 downturn were the stories of investors who sold at the bottom and never got back into the markets (or at least did so late in the rally). Timing the markets is a fool’s errand, always has been and I suspect always will be.

I need a thumbs up button on this comment system, Roger. Every downturn I lived through I’ve been around at least one person who said, “I just can’t take it anymore” and sold. It makes my stomach turn just thinking about it.

Joe – the arrows on the Disqus system let you vote comments up or down. (Like Reddit) I just voted Roger up. =)

“Historically, whenever I start to giggle when watching my investments, there’s dangerous waters ahead.” Lol, I LOVE this Joe! You’re spot on in my opinion. I was just watching CNBC the other day and they were discussing whether or not the retail investor was “back” or not and they basically came back to a tentative yes. Having already seen a bit of that myself, the Buffett quote was the first thing that came to my mind. We’re bound for some sort of fall in the future, and other than a couple of stop losses to protect a few nice gains, I’ll largely be doing the same thing. That said, once the click and hopers drive some things down I’ll be waiting to take advantage through some rebalancing. Having that long term mindset is so vital, yet so few have it.

Why is that? (I know that’s a rhetorical question…..) Everyone’s heard BUY LOW SELL HIGH, yet it’s the same game over and over. I feel like this is another episode of Groundhog Day with Bill Murray.

Joe, is it stupid for us to simply continue to DCA as we have been, but then also to take some of our cash and move it into the markets if there’s a dip? I know this is still market timing but I figure, if it increases your amount of total investments, it can’t be all bad, right?

Yeah, that’s the move I always want to make, too. Here’s the issue for me: I’d have to assume that I know the market WILL drop and I’ll get the opportunity. What if it rises and only drops back to where we are today (or higher)? Here’s what I’m doing instead: I’m adjusting my DCA so it’s going into the portfolio portion that’s underfunded. For me, that’s the bond portion of my portfolio. I’m DCAing into the bond market while things are poor NOT to time that market but to realign my portfolio back to the correct allocation. I like that move better than selling off stocks or hoarding cash because I know bonds are low. They could go lower….but they’ll be back. And when that baby comes roaring up (and someday it will), I’m laughing all the way to the bank….liquor store….whatever…. 🙂

We’re pretty comfortable with our investments, so we’ll be staying the course when the inevitable market dip happens. The most we’d probably do is accelerate a little planned purchasing if valuations start to look good.

I like the way you look right past the short term dips toward the big picture. I think you have to look at your investments like a amanger looks at ball players. Sure, there’s some bad streaks, but if you’ve got an all-star athlete, hang on!

Would your advice be the same for every age cohort?

Hey, Kurt! Great point. As you know, people often confuse “age” with “time to the goal.” If you AREN’T a long term investor, then you shouldn’t have money in volatile places. If you do, then the issue isn’t whether to get out of the market or not….the real question should be, “what were you doing with short term money in a long term investment in the first place.” As goals get closer it’s important to begin skimming money from the pot periodically to transfer it to shorter-term pots, so you don’t have to sell it all in a panic when the market dives. We used to call that “landing the plane.” You don’t nose dive….you bring it in gradually and smoothly as you get closer to the goal.

If your asset allocation is set up with your goal in mind, even if you’re 65 any money in the stock market should be 10 year money or longer…..and that’s the same advice I’d have for a 25 year old.

Thanks!

I read the title and I was gunna be all like “Joe, stop trying to time the market you jerk!” But then I read the article. I’m in agreement, and the only movement I MAY look to do is to go to a more conservative split of my index funds (maybe 70/30), but mostly likely I’ll just keep on rockin’, and buy down and buy up! 🙂

I am waiting for it to fall and I plan on buying up stocks when it does. As Buffett said, that is time to get greedy and I will do it. I have diversified, but I also have a lot of time on my side, so if it falls, then I will be OK.

Thanks for this! I’ve been getting that feeling too, as I watch most of my stocks lift like the boats in that rising tide. I’ve thought about selling the ETFs I just bought, but I know I want to hold on to them for the long term. So I will just have to wait and see.

While I feel pretty old at almost 40, I still have a lot of time, so nope, I won’t be doing anything different. I wish the dip would hurry up and happen so we could stop worrying about it.

I’ve been thinking this same thing lately. Want to hear the messed up thing? I should be putting money in a retirement account, but I’m waiting to open it up until I see what will happen after the whole new/old debt ceiling debacle comes up in the new year. If things go to hell, I’d rather invest then than lose all my money for the past few months. I am aware this is stupid.

Portfolio balanced and we’re fully prepared to keep buying in as prices fall. In the meantime, we’ll celebrate the ridiculously good year that the markets helped deliver our way for 2013.