Last episode I shared how I opened my new Nvestly account (I’m partnering with them for six months to show my moves in one of our IRA accounts). If you aren’t familiar with Nvestly, it’s a cool social site where you can follow traders, check out the diversification and volatility in your portfolio (and other’s portfolios), and more.

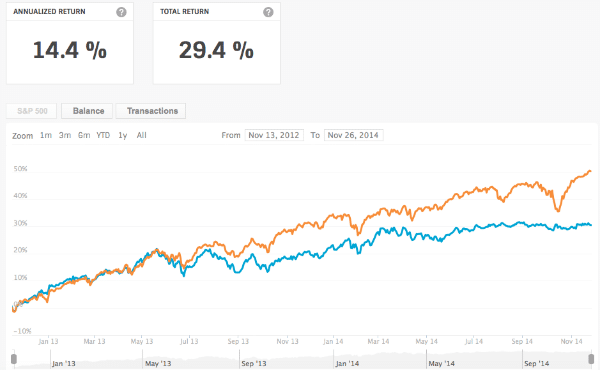

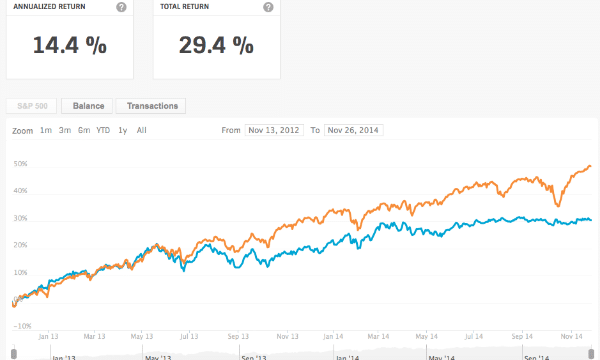

Last time we saw my positions. Today we’ll begin “weeding” the garden. I like this about Nvestly. Now that I’m sharing this particular IRA with you, I want it to look pretty. I know already we’ve got some changes to make. Check out this IRA vs. the S&P 500 according to Nvestly:

When you look at my portfolio, you might think many areas should be weeded. Lately my portfolio has lagged the market. I’m okay with that. Even though I get a little depressed when I look at the chart above, I know that the market means nothing to me. For me, consistent returns rule the day. I would love to see a little more growth without increasing my risk, though, so let’s weed.

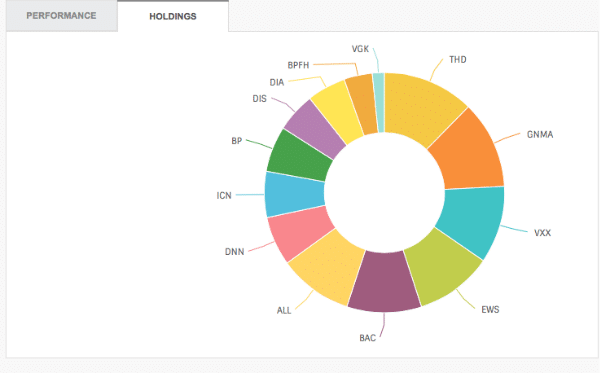

Let’s use Nvestly to dig into my positions. Here they are:

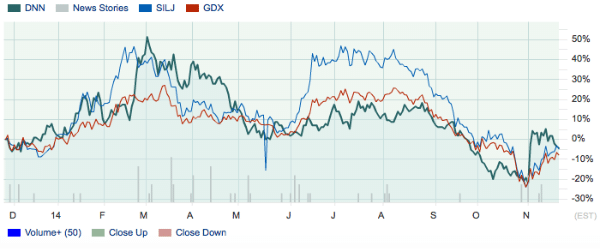

You’ll see that I own a mining company (DNN) that’s been crushed lately. Here’s the chart (via Bigcharts.com):

Here’s why I’m doing this: before you panic about returns, see if your positions are competing well against comparable ETFs. From these charts it’s clear there’s nothing wrong with DNN.

That doesn’t mean that I should be in a mining company or own metals OR that my allocation is correct, but we’ll discuss those points another day….

Let’s focus on my next laggard: my Singapore ETF.

Thailand was the big winner here, clearly. It would have been better if I’d been omniscient enough to purchase only Thailand, but I chose two economies rather than the bigger index to try and maintain SOME diversification.

So, I won’t be selling Singapore.

In the big scheme of things, I own both my mining stock and Singapore for the long term opportunities. First, I’m a big fan of these types of investments. I think southeast Asia is going to continue to be a fast growing portion of the world, and Singapore will be a shipping leader. I also think that metals in a portfolio–in small amounts–are a good idea. Because DNN goes where metal production goes, I’m not worried about that portion of my portfolio.

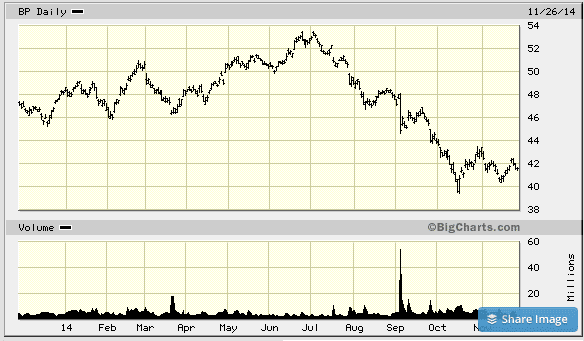

My biggest issue is when an individual stock doesn’t perform with it’s peers. That points me directly toward BP.

I’ll tell the history of why I bought BP another day because it’ll shine a light on most of my big winners and how I made money on them. However, today let’s just dive in to the numbers. Here’s BP:

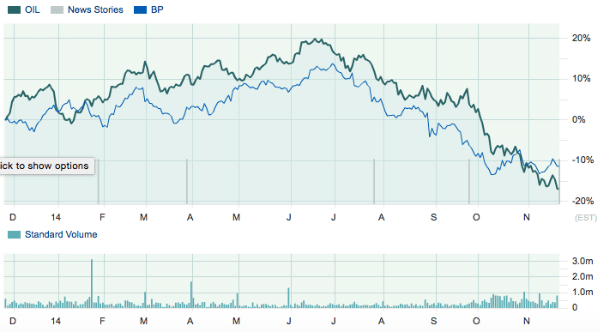

Of course, your first question should be, “how’s the index?” Here’s the Oil ETF:

Not only is BP “winning” vs. the index over the short term….check out the volume of oil in general in the lower graph. Everyone is trading oil right now. Good? I’ll bet, based on psychology, most are getting out. That’s why, if I move at all, I’ll stay in the sector and maybe buy more. Oil isn’t going away!

So, it’s time to decide whether to sell to a “better” play in this market. It seems silly to change while BP is beating the index, but if I’m going to sell, it should be while things are going well.

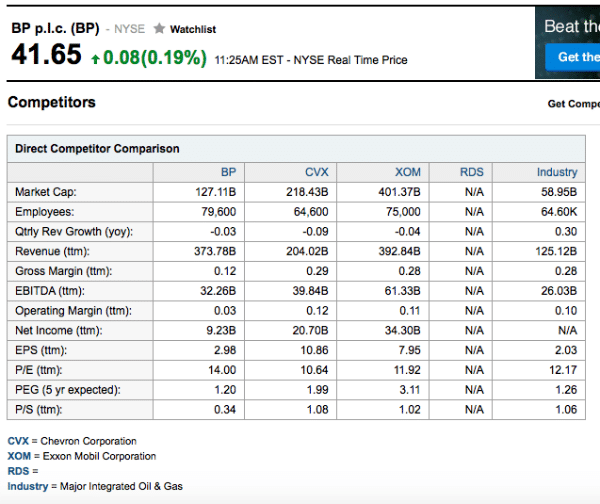

So, I turned to Yahoo!Finance to find the competition. Let’s take a look:

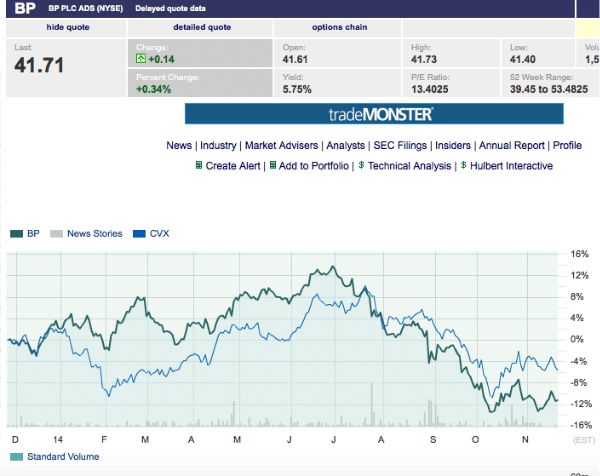

I’ll dive into these numbers another day, but CVX looks like my best target. I love the higher EPS, the lower PE, the higher gross revenues and net income. Let’s see if the stock has performed better than BP over the last year.

While CVX (Chevron) is “winning”, it isn’t by much. Whenever you trade, you have to justify the trading fees to make the swap. Is the return difference going to be worth it? Had I done this during this twelve month period, the returns would have been better, but by how much?

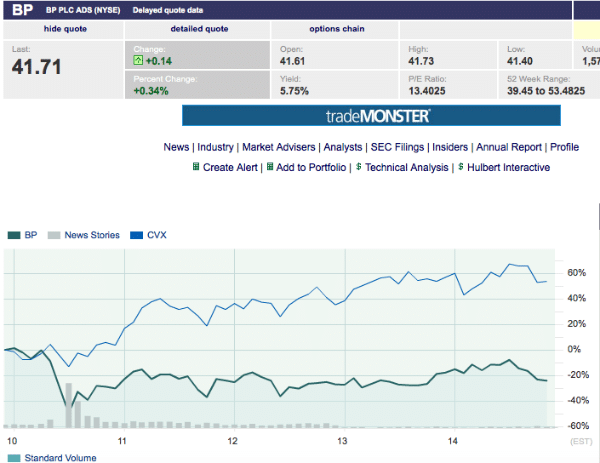

The surprise comes when I open up the shade to see the five year charts:

Now, past performance doesn’t mean future results will be good, but in this case I have an asset class in the tank (oil), and a stock that I like (Chevron).

It’s time to buy.

The bad news: by the time I finished this research, the market was closed. I want to show you the change via Nvestly, so I’ll pick up here next time!

Want to follow my trades on Nvestly? I’m jsaulsehy….and if you follow soon, you’ll see a couple trades on Monday!

Love the insights on Singapore and Thailand. I know Wealthfront portfolios are generally ‘heavily’ allocated to emerging and I’ve heard many moan and groan, but it’s indeed a long-term play.

Great analysis on CVX. I started an energy position recently and plan to add more as the commodity keeps dropping. One area I’m looking at is airlines ahead of Q4 earnings. I haven’t kept up with the sector too closely and I wonder if higher margins / profit from savings on fuel costs are already priced into stocks like LUV, VA and UAL.

I’m with you on airlines. They seem more clearly undervalued than they’ve been in a long time. I’m going to steer clear because I’m not generally looking for short term plays (I don’t have the time to watch it closely enough)….and I can’t imagine airlines ever being a good long term buy.