The tale thus far: I’m in this crazy (and some will say silly) contest to grow $1,000 as quickly as possible. It started January 1 of this year and the contest runs until Dec 31.

Why is this contest “silly”? Growing your dough over 12 months is a fool’s mission. Anyone familiar with investments that grow at speeds reliably faster than inflation know that in a one year time frame these types of investments fluctuate all over the place and you can’t predict an investment’s next move.

I decided to play to win, so I made a couple of unconventional choices:

– I purchased asset classes that were in the tank, hoping that they’d come roaring back within twelve months. Historically, your best chance of a short term win is by buying last year’s goat.

– I bet on a volatility index, which is a derivative, and not a true investment.

My positions: a mining stock, a 2x risk emerging markets ETF, an international alcohol stock (AmBev), and last month I added a small piece of an ETF that tracks the VIX volatility index.

What’s happened so far: After being shot out of a cannon when the market went south earlier in the year, my portfolio stagnated while others investing in the S&P 500 and other straightforward investments roared back. I went from 2nd place toward the back of the back in a hurry. When the market started shaking in mid July my portfolio rebounded (well, it still sank, but less than my straightforward competitors). I’m back near the top of the pack.

This Month:

It was a really good month for the portfolio because the S&P 500 hit new highs. Also, volatility began to rear its head and my volatility index made up the fee I paid to purchase it.

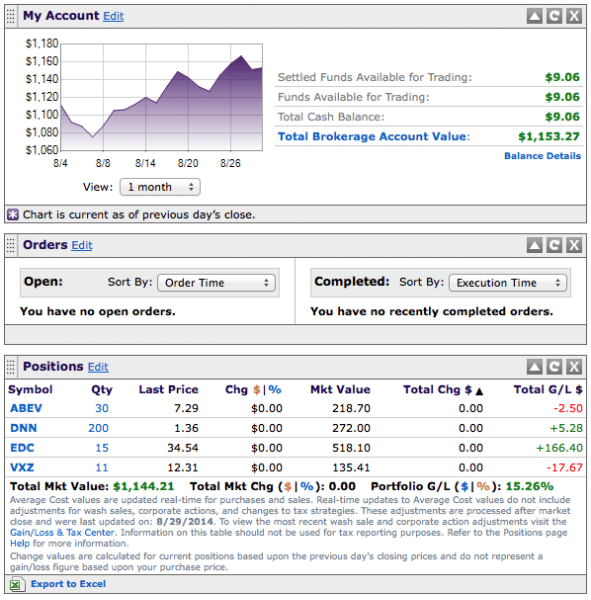

Here’s a snapshot:

This means I’m up 15.26% since January 1 (vs. the S&P which is up 6.25%).

I gained 4.4% this month (vs. the S&P which is up 3.8%).

Individual Positions

(Int’l Bev) ABEV: +5.6%

(Mining) DNN: +5.4%

(Emerging) EDC: +9.1%

(Volatility) VXZ: -5.8%

The Month’s Lessons:

1) Betting doesn’t always pay. If you’ve followed my portfolio for any length of time, you’ll know that I’m betting heavily on a down draft. That hasn’t happened, yet my emerging markets position has been so strong that it’s countered the ambivalence that represents the rest of my portfolio. I would have done better this month if I hadn’t bet on VXZ, but historically September is the worst month of the year for the stock market, so I may see a quick reversal.

2) If you don’t know what’s going to win, diversification is the key to success. I’ve been betting big on this portfolio all year and research shows that even when you pair aggressive positions with even more aggressive positions it decreases the volatility of your individual investments.

3) I’ll take this portfolio over the S&P 500 right now. I’m pretty happy because I’m sitting near the front of the pack (but far down from first place….maybe far enough away that I can’t win), yet if the market reverses I should come roaring through toward those people in front of me (and might hold on to my principal). I’ll be interested to see how my portfolio actually responds if the market reverses.

Moves on the Horizon?

Last month I thought about selling ABEV. This month it outperformed the S&P 500, and was the 2nd best performer in this portfolio. That shouldn’t cloud my judgement; bad companies should be sold. However, as I mentioned last month, most of the numbers on ABEV were mid-pack, not horrible. I’m glad I was patient and decided to wait to see if the position truly lagged.

I doubt I’ll pull the trigger this month, but who knows……

Fun competition! If the economy goes down, I bet the stock in alcohol shoots up. Just a novice’s probably faulty observation.

I know! I thought that’d be the case also. Historically, that’s been a good bet. I love to drink when my money’s going bye bye…..