What makes a great leader? What can you do to become one? We welcome the former CEO of United Airlines, Oscar Munoz, down in the basement to tackle these questions and learn from his business lessons over the span of his decades-long career in corporate leadership. He shares stories from his amazing turnaround, including his own story of a major health crisis early during his administration at the popular transportation company.

During our headlines segment we’ll dive into a story you’ve all probably been following: mortgage fees have changed and there’s been LOTS of rhetoric about it…but what’s the truth? We’ll share a story you (sadly) probably aren’t hearing enough. Are we returning to the dangerous mortgage business practices that resulted in the Great Recession of 2007-08 ? Or is it all overblown? Plus we’ll throw out the Haven Lifeline to Luke in California who has a question about what types of investments he and his wife might consider if they’re looking to retire early in about 10-12 years.

Deeper dives with curated links, topics, and discussions are in our newsletter, The 201, available at StackingBenjamins.com/201.

Enjoy!

Our Headlines

Our TikTok Minute

Oscar Munoz

Big thanks to Oscar Munoz for joining us today. Grab yourself a copy of the book Turnaround Time: Uniting an Airline and Its Employees in the Friendly Skies.

Watch the interview with Oscar on our YouTube channel:

Doug’s Trivia

- Who was the first Cuban-born CEO of Coca-Cola, going from a net worth of 40 bucks to leader of a company worth more the $200 billion?

Need life insurance? You could be insured in 20 minutes or less and build your family’s safety net for the future. Use StackingBenjamins.com/HavenLife to calculate how much you need and apply.

- Luke and his wife have diligently saved in their retirement accounts and, at almost 40, are considering retiring at 50. What are some ideas for how – and where – to save/invest if early retirement is their goal in 10-12 years?

Want more than just the show notes? How about our newsletter with STACKS of related, deeper links?

- Check out The 201, our email that comes with every Monday and Wednesday episode, PLUS a list of more than 19 of the top money lessons Joe’s learned over his own life about money. From credit to cash reserves, and insurances to investing, we’ll tackle all of these. Head to StackingBenjamins.com/the201 to sign up (it’s free and we will never give away your email to others).

Other Mentions

Written by: Kevin Bailey

Miss our last show? Listen here: Navigating Awkward Money Moments (plus Evil HR Lady) REWIND

Episode Transcript:

Time to get the Rust og. We’ve been away for a week and we start off every episode with a salute to our troops. So why don’t we raise our glasses? I got my M 22 mug, Northern Michigan. Yours is, what do you, what do you got there?

Mine says, losers make money, winners make excuses or the other way around. I mean, I think it’s the

other way around.

It might,

it might be,

uh, on behalf of the men and women making podcast in mom’s basement and the men and women at Navy Federal Credit Union, a big salute to our troops kept us safe while we had our nice, uh, relaxing off. Week was

relaxing. Thank you for that.

Thank you so much. Let’s go stacks and Benjamins together now, shall we?

Here’s the song that we’d like to do for all the younger set of people, the teenagers and what have you.

This one’s called Vacations Over,

over. It’s Over.

Live from Joe’s mom’s basement.

It’s the Stacking

Benjamin Show.

I’m Joe’s mom’s neighbor, Doug. And what does it take to be a great leader Today? We welcome a guy who taught his team to soar in the Clouds. Former CEO of United Airlines, Oscar Munoz. Big news today in our headline segment, mortgage fees are changing and you are seeing stories about it all over the place.

Some of them are even true. Well, what is the truth? We’ll share the good, the bad, and the ugly. Plus we’ll throw out The Haven Lifeline to Luke, who wants to know what are his best investment options for a 10 to 12 year time horizon? And don’t worry, I’ll be sure to share a really. Thirsty trivia question that you can reshare later and not quote me.

And now two guys who are leading by example, you know, like when it’s convenient for ’em, Joe, and,

and it’s always convenient here on the podcast. Hey everybody, I am Joe’s Sea. Hi, average Joe Money on Twitter. Happy Monday. Happy back to the show. Ma’am. We had a great greatest hits week last week, og one of, uh, my favorite podcasters, Betty Dusky. If you met, if you missed it, Betty in the sky with a suitcase.

We replayed that one bolus. Acube. Lots of, oh, that one great stuff. Wow. We awe however we are back. And if you’re new to the show, let me be the first to welcome you. This is the way to ease into your money situation. Begin to take control if you want the serious stuff. We follow that up with a great newsletter, with fantastic videos.

But, uh, we generally have a good time having some relaxed money talk and og the guy relaxing more than most of us sitting right across the car table from me.

I’m always relaxing, chilling in the car. I spent all day waxing,

Hey, we got a great show, Oscar Munoz. Gonna hit us up with some fantastic advice on how to be a good leader, how to be a better listener. Oscar is the, uh, former c e o of United Airlines and mm-hmm. He’s got some wonderful advice. Of course, when he took over United, I remember these days, og it was dark days there, and Oscar came in and, uh, turned the airline

out.

I’ll take over a couple other airlines here in the not too distant future if he plays his cards right. Seems like there’s a couple of them that aren’t too, too, too excitable right now. Excited. I guess I should say

Southwest might be looking for some help. Oscar, uh, maybe we’ll talk to him about that.

Maybe not, but we got that. We got a huge headline that happened while we were gone. So, lots to do. We need to get moving, but I think we really need og. Have a seat. I think we really, really need to talk about this. Wasn’t that important. Keeping the lights on in the basement so we could podcast. Important component.

Always important. Oscar Munoz from United Airlines coming up, but first man, a big headline. Hello Darlings. And now it’s time for your favorite part

of the show, our

Stacking Benjamins headlines, this headline og. We’re gonna start with the TikTok minute because I had this sent to me by multiple people, but I wanna play the TikTok that Zach sent me as a way of introducing this.

This is Peter St. PhD on TikTok talking about a new mortgage rule. Let’s listen.

A new Biden housing rule is coming May 1st. That amounts to a $14,000 tax on good credit home buyers and threatens to replay the entire 2008 financial crisis in double time. It’s as dumb as it is ugly. Obama’s fa, a director called it unprecedented, adding my email is full from mortgage CEOs telling me how unbelievably shocked they are by this move.

The new rule means anybody with a credit score over six 80, that’s about half the population, or who makes a meaningful down payment, will pay $14,000 more on a house while anybody with low credit gets subsidized. This is from a risk perspective, bonkers. It is paying people to take on loans they can’t afford.

It’s paying banks to crank out systemic risk all while literally hitting people with a $14,000 fine for paying their bills on time and for saving up

for a

down payment in the first place. It is raw vote buying, using a social credit system that punishes people for

doing the right thing.

Moreover, it threatens to replay the 2008 crisis because we’ve already seen this movie and it ended badly.

Going back to the early two thousands, the financial crisis was kicked off by intentional policies that pushed banks to make bad loans. Policies. The banks were happy to game since they got all the profits, but they dodged all

the risks. Uh, this, uh, gentleman, uh, continues to go on. We’re only about halfway done, but I think you get the gist year.

OG new mortgage rules took effect on May 1st. They changed the game. We are hearing like we did in this video from many sources about a third of this story. And it depends on your political view. Yeah. What piece of the story you’re actually hearing. I don’t know. I don’t know. Have you seen a lot on the way new mortgage loans are being calculated?

I did some looking into this cuz you and I talked about this a couple three weeks ago and you’re like, have you heard about this? And I hadn’t, not surprisingly, based on some of the thoughts here that this guy has talked about, not really a thing you wanna really advertise. I think a lot of this is gonna come down to how you interpret the new, the new rules.

You can make it very political on either side. You can turn it into a very, like thereafter us or we stuck it to ’em or you know, whatever. Like you can turn that like he’s using these dollar terms like a $14,000 fine. You know that, that that’s not exactly what’s happening. You’re not getting fined $14,000 near, as I can tell, the most, um, kind of middle of the road explanation on this is that there’s a fee when you get a mortgage, right?

Because banks take your mortgage if it’s a conventional, regular run of the mill, 80% mortgage, 20% down thing, right? So banks generally take your loan and they package it with a whole bunch of other loans, and then they sell it to Fannie Mae or Freddie Mac, right? So they remove that off their balance sheet, and in order to process that, the banks get paid a fee to do that, right?

Fannie Mae says, you, you guys do all the paperwork, send us the, you know, fine, okay? And there’s fees associated with that. And near, as I can tell, what’s happening is that they’re raising the fees for certain credit score demographics and lowering the fees for other credit score demographics, which is being.

Spun, maybe rightly so in a, you’re charging me more to charge them less. Ergo I’m paying for that person. You know, if that’s exactly how it is. I’m not sure. It doesn’t seem like it, but

let’s walk through it because I had to go to about 15 sources to get this because

of the fact that that’s kind of where I gave up too.

I was just kind like there’s like a paragraph of meat in every one of the stories. Yes, right. All the rest is sensationalism depending on where you’re fine and reading the story and then there’s like one paragraph of like, here’s what happened. So

frustrating and, and it actually is fairly straightforward.

Fees change from time to time. Freddie Mac and Fannie Mae, who to your point, buy a bunch of these loans from banks, so you won’t know if your loan is going to Fanny or Freddy when you take out the loan. You can ask and maybe they know ahead

of time and it may not. I mean, our first house loan stayed with the credit union.

That was an in-house loan. Yeah. Our current one is at JP Morgan. Whether or not Freddy has it or not, or Fannie, I don’t know, but JP is servicing it. When do they back it? Right? Yeah. Like it really depends on their

risk metrics, right? Even if your loan is serviced by somebody, Freddy or Fannie might be in the background.

Uh, what happened is there’s always been this fee that you’re talking about, and to your point, they’ve changed the fee structure across the board. Fees are changing. Now, let me give you the good news that Mr. St. Ange didn’t say people with higher credit still are going to pay a lower fee than people with low credit, period.

Yeah. People with higher credit are going to pay less than people low credit, however, but it’s higher than it was, right? So it is higher than it was for people with good credit and, and the fee rising went up less for people with low credit. And according to Freddy and Fanny officials, that was tell people without means and without.

A lot of support to be able to afford more housing and, and obviously being quasi-government officials. That’s what set off the rhetoric of this is. Yeah, subsidization. Right. We are subsidizing this by, by changing things and also og just to counteract, uh, I don’t know where Mr. St. AJ got his $14,000 number.

According to ABC News, on a $300,000 mortgage, a credit score of 659 would save $3,750 over the way. Things were the old way, while a credit score of seven 40 plus will spend $375 more. That’s on a 300,000 now. And everybody says, they said it’s really complicated because it’s a matrix. It’s like, think about the biggest Excel spreadsheet ever, right?

And it depends on how big a loan you have, how much money you put down. Like there’s all kinds of factors. So maybe on the top end, if you’ve got a million dollar mortgage and you’ve got a 6 59 credit score versus somebody with a seven 40 credit score, maybe those people’s $14,000 is gonna be the difference.

I don’t know. Yeah. But the difference is $375 of quote subsidization. And by the way, I do see it. So let’s talk about this a little bit. I do see this as subsidization. I do feel it. It does seem like if you’re changing the rules where people with better credit are going to pay a higher amount so that people with lower credit pay a lower amount, well then I don’t, I don’t think the word subsidization is truly out turn Wall Street Journal in their editorial.

Called it subsidization. I’m not sure that they’re wrong.

I don’t understand. Um, I thought that we had gone through this and the one thing that I do agree with the video that you played there was the housing crisis. And there’s a lot of people right now who don’t remember that or remember it because they were kids, right?

I mean, like it was 15 years ago now, so if you’re 25, you were 10, you were in college. If you’re 40, right? It was at the end of your college. You’re like, oh yeah, the housing market I guess sucks. But then there were those of us who bought houses right before it and watched the value of our house go down by 50% in the span of 18 months.

And that was a really big thing. And obviously it caused the biggest recession since, since the Great Depression, and a lot of people have suggested that part of that was because of the lending Ease. It was very simple to get money. It was very, I mean, our first, I’ve told everybody this, our first mortgage was interest only.

We moved after 10 years, and we had paid down 7,000 of principle on a $430,000 house after $3,000 a month payments for 10 years. And I hand to God, this is exactly how this went. I was standing on my mom’s porch, I remember being there, and the, and the loan guy called me and said, so I’m just going through your loan and, um, application.

You guys, uh, you guys pulling down about 12 K a month. And I was like, what? Good God, no. He goes, let me rephrase. You’re pulling down 12 K a month. Right, right. And I was like, uh oh. Yeah, yeah, yeah. Oh yeah. I mean, all in. Sure. And he goes, okay, cool. Loans approved. Congratulations on the new house. I mean, it was like, th and I’m not exaggerating that in one bit.

That is exactly how that went down. And, uh, I had no business buying that house. And, and so I wonder if there’s not some truth to that part of like if we start kind of bending the rules around things that we know to be true, right? Like if you just haven’t been good paying your bills, then that’s gonna be reflected in your credit score.

They’ve already gotten rid of medical debt, which was a huge, you know, huge burden for a lot of credit score issues, right? Which I completely agree with. If you have a medical issue and you’re dealing with trying to pay that off, whatever, that’s cool. But if you’ve got a bad credit score, it’s probably cuz you don’t pay your bills on time or you are high utilization.

I mean, there’s a very known factor on how this is done. So why do we wanna like jam houses down people’s throats? Who don’t necessarily fit the category for like being responsible money people right now it’s, and a credit score is not a life sentence. Right? I mean, I, my credit score was freaking in the 500

s once.

Oh, mine was, mine was horrible in the nineties. Yeah. I

don’t know what the lowest is. I mean, but I’m sure I was there. You know, it’s like it’s a two year sentence, right? You can fix your credit score from the worst imaginable to seven 50 in two years. Well, let’s

talk first, let’s acknowledge some of the stuff before we get emails.

Let’s acknowledge some of the systemic stuff, right? Yeah. People that grow up in some neighborhoods and some demographic groups have it easier because they’re born into families where it’s an easier task to figure out the financial system. In fact, I had a great email from a listener named Jonathan, who sent me a white paper about credit card rewards, and it showed that people with financial savvy do very well with credit card rewards.

On the backs of people that grew up and have, have never been taught any of these habits, don’t understand how the system works, pay their credit cards off. Suboptimally, do a horrible job, right? So a credit score when you first start off, you can get a leg up by being born into the right zip code, into the right area, into the right demographic.

However, even if you’re in the right or wrong demographic, I totally agree with you, og. If I have a low credit score, if our goal is to build a legacy of wealth, which is what we all are trying to do, if our goal is to build a legacy, the last thing I wanna do when I have a low flipping credit score is go buy a house I can’t afford.

Like that’s gonna help sink you. It’s not gonna help you.

So well, and, and remember too that at best it’s a two year sentence on whatever your number is today, but on the, you know, silver spoon kind of born that way type of deal, it also only takes one missed payment to crater it, to mess it up. So you may start with a leg up, but you still have to demonstrate good behavior all the time.

You can’t take one 30 day period off of going like, well this month I’m just not gonna pay my credit card on time. Yeah. You know, because one time, one time your score craters and it’s screws you for two years. And now whether or not that’s right or wrong, I don’t know either, but they’re really smart people who are really good at algorithms here that have figured out that there’s a profound difference between somebody who has a six 60 credit score and a seven 60 score as it relates to their propensity to pay back the debt in a reasonable time period at the predetermined pace.

They know that, and we should take that seriously.

If I’ve got a six 60, I should take that seriously. Yeah. Then I am not different that, you know what? They’ve done this work and I need to prove it to myself more than anything. I need to prove it to myself that I’m ready before I go do that.

Yeah.

One of the strategies that you and I have both implemented over the years as it relates to, you know, Hey, I wanna buy a house, or hey, I wanna buy, you know, this new thing, or, you know, I wanna get a vacation house, or, you know, whatever, like, whatever the next financial goal is. One of the things that you and I have both used successfully is cool.

Start writing that check today. So you, you, you think that in six months from now you’re ready to buy a house. Well, let’s do it. Let’s start paying that mortgage payment right now. Let’s dry run this. When there’s nothing on the line, you don’t have to worry about like trying to choose, you know, do I pay this or pay this, or whatever.

Like, let’s make that mortgage payment. And to your point, prove to yourself that you’re ready to do it. That you have the wherewithal to do it. I was

talking to that mortgage payment, by the way, before you get off this, for people wondering that mortgage payment goes into a savings account that you can take the money back if you’re over your head right away.

Yeah, a

hundred percent. Yeah. You’re paying the mortgage payment to yourself in advance. Like getting ready for Can I do this? Yeah. Can I, can I cash flow this? Right? Because it’s not usually as simple as, as you think. And I was talking to a family member who was trying to buy a car. It was awful. The rate was awful.

And I said, well, did you get a pay raise? No. Are you working extra hours? No. Did you get another job? No. Did your spouse have any of those things happen? No. Well, where the heck are you coming up with? Seven 50 a month. Then maybe you should try saving the seven 50 a month for the next year to keep the car that you got, the beater that you got paid the seven 50 a month into a savings account.

Then you won’t get the crappy rate cuz you have a nice down payment. Well, no, I need the car now. It’s like, well, what’s changing? You know what I mean? Like you, you know, if you’re gonna add an expense on the, on the income statement, but not add any revenue on the top line, it’s gotta come from savings or it’s gotta come from another expense.

It’s that simple. It’s a zero sum game when it comes to your income statement. Right? So if you haven’t built up a reserve to draw that excess from, or you don’t have some excess in your spending that you can move around, what’s gonna happen? It, it’s gonna go to debt. You’re gonna accumulate credit card debt.

And that’s what, I think, that’s what ends up happening, right? Is that we go down this path of going like, well, I can do this, or, you know, I need to have a house, or I need to have a car, I need to have whatever. And then all of a sudden in the background, we’ve got a medical bill that doesn’t get paid or in the background.

We’ve got a credit card balance that just kinda, it’s, it’s leaking up. It was a thousand and now it’s it’s little thousand three slope. Yeah. And then all of a sudden, a two years goes by and I’m wondering how come I don’t have any money? And I got $11,000 in credit card debt. Practice it in advance. I think that’s probably the best way to do it.

And I, and I think as you, if you’re going down this path of home ownership or you’re gonna buy a car, you’re gonna do whatever and it, it involves debt. You have to know what your credit score is. You have to know it. And I think also recognizing what those factors are, learning about what those factors are, that that influence that, it may seem like a long time, if you got kind of a crappy number, I’m telling you it’s inside of two years.

Do the right thing for two years and your score will be just

fine. Mr. St. Anj says that this could lead to another banking collapse. Obviously last week we saw, uh, first Republic, uh, bite the Dust, another one bite the dust og uh, you think that this, this mortgage fee change is gonna be the domino that breaks the camel’s back?

No. I don’t think so either. I think it’s big time hyperbole. And by the way, what I like stackers about where OG and I left this, forget what the banks are doing, forget what the banks are doing. If you’ve got a low credit score, build that muscle. Build the credit score, prove to yourself that you can do it.

Who cares what’s going on And zany world land. Yeah. Doesn’t matter what matters. I think it’s is what you do. We’re gonna dive into this much deeper in our newsletter, the 2 0 1 where the day after our Monday and Wednesday shows, uh, Kevin Bailey, who has worked both for Vanguard and T I a a dives deeper into curated links that we’ve come up with to help you get more financially literate.

The good news is you can dive into the pieces that you’re interested in, stack Benjamins dot com slash 2 0 1.

Coming up next, talk about, uh, somebody who’s dynamic charismatic. Oscar Munoz was the c e o of United Airlines from 2015 when United was just having a horrible time. And for people who fly United or Delta American a lot. I know there’s people out there going, oh, they’re not much better now. Oh, but oh yeah.

Oh yeah. Yeah. Statistically, when you look at industry patterns from 2015 to 2020, Oscar and his team definitely did quite a turnaround at United. He’s here to talk about not just that turnaround, but about working with people about leadership and whether you’re leading a family at home, you’re leading a group of friends, you’re leading a group of people at work.

Oscar’s got a lot to say, but to get there, we’ve got some trivia on a related topic, don’t we? Doug?

Hey there,

stackers. I’m Joe’s, mom’s neighbor,, Doug, and today in history, the very first Coca-Cola was sold. It was May 8th, 1886, when Dr. John Pemberton sold the first Coca-Cola at Jacob’s Pharmacy in Atlanta, Georgia. Little did he know that one red labeled Coca-Cola would become an iconic drink worldwide?

Speaking of the well-known and worldly at Coke, that leads me to my trivia question. Let’s connect this trivia question with today’s guest, Oscar Munoz, who was the first Latino CEO at not just United Airlines, but any major airline working his way up the corporate ladder of Coca-Cola from a bilingual engineer who came to the United States with only get this $40 in his pocket.

What man became the first Cuban born CEO at the Iconic Soft Drink Company? I’ll be back right after I go taste my feelings. That doesn’t roll off the tongue as much as when you see it on tv.

Hey there, stackers. I’m leading man and first trap. Joe’s mom’s neighbor, Doug in celebration. Both of today’s guest, Oscar Munoz, the first Latino to run a major airline, and today being the anniversary of World best-Selling soft drink Coca-Cola. How about this one? Who was the first Cuban born CEO of Coca-Cola?

Going from a net worth of 40 bucks to leader of a company worth more than 200 billion. If you answered Roberto Goa, you would’ve won a Coke. You know, if Joe would’ve listened to my hospitable idea of giving trivia winners an icy soft drink. Think of the word of mouth sales, Joe, but good news, if you got it right.

You can patch yourself on the back and go buy yourself a Coke or you know, Pepsi. Really, it’s your money. Do what you want. And now let’s dive into leadership and communication with the guy who led United Airlines, Oscar Munoz.

And I’m so happy this gentleman’s coming down to Mom’s basement to talk about leadership with us.

Oscar Munoz is here. How

are you? Well, you know, as I tell people in my new chapter of life, I am busy, I am healthy, and I’m happy. That encompasses a whole broad spectrum of things that usually takes a care of a good conversation. So I’m all of those, bill, and I’m delighted to be here with you. And I love the concept of your show.

I love the concept is simplification of, uh, you know, somewhat arcane things for the normal person, is just a real passion of mine, just from a, a perspective, especially in the financial planning world. And people like to use so many big words and concepts and kinda show you how smart they are. And it’s like, dude, I don’t need to figure out how smart I was like, can you just help me?

I was just looking at, hey, do I do a cd? Do I do this? No. And then breaking it down in simple terms. And I was with, uh, uh, I dunno if I can mention his name, but a prominent economist at a big event. Everybody’s asking him big prominent economic questions. And I, my hand sort of like this and say, you know, this may be the stupidest question or the hardest questions you’ve ever been asked, but I work with a lot of people that are kind of frontline essential workers.

Honestly, over the many years that I’ve been working you, you struggle. They struggle to understand what the hell all this means. So quantitative, easing, economic theory, money, policies, all of those things. It’s like, how do you talk to the person who just works for a living blue collar and you know, his truck is more expensive, his mortgage is rent, all of this stuff.

What is, you know, what does he have to do? What can he do? And uh, The funny part about, it’s that the background, the folks, the people that were serving US security people on this, there was a very August group gathered for the thing. There was literally clapping and hooting and hollering from the people in the background.

Like, yeah, of course he went on for five minutes of arcane economic stuff. So we didn’t solve anything there.

Can we change this into English? Right. I’m gonna ask you about that, because storytelling figures prominently, not just in your book, but in in, in your everyday work. You have to be able to tell a story that resonates with people.

But before we get to that, I just wanna ask you one current events question. Mm-hmm. Which is Y you see the videos as often as I do if I’m going through TikTok, so I’m sending stuff to the Chinese, or I’m going through Facebook reels or YouTube shorts. There is an altercation daily now it feels like Oscar on a plane somewhere, and it feels like over the last few years it is definitely escalated what’s going on in our skies because I feel horrible for our flight attendants today with all of the, the misery at 20,000 feet.

Well,

first of all, thank you for saying the magic words, which, you know, we have other humans that are just trying to do their job. They’re not paid to manage. Idiots and jerks and people mouthing off, and we, we try to train folks in the airline space that the anger that you feel from the person in front of you, a customer is usually not directed at you personally.

Something is going on in their lives. So your your question about what’s going on lately, why it is such a broader psychological question, because I think are, are people stressed, divided, feel like no one’s listening? I don’t know, but they seem to take it out. And, and I’m involved in a lot of those things when I’ve traveled quite a bit.

And I’ll always walk into a cabin and you’ll see the tension because people kind of know who you are. They expect you to kind of deal with it and take care of it. But, uh, uh, emotions run high. All I ever say to people is, what are the facts? And it’s like, would you be willing to do this or that? So you try to help out.

But oftentimes when people are so irate and they keep it going through the entire flight, yeah. You know, it’s just, and I always say, what’s the guide point that you would give to people? Or what is, you know, your biggest lesson or, or, uh, awareness point that you would make for folks? I says, you know what, it’s just care about others.

Just like, just for a little second, have a little empathy that, you know, everyone is going somewhere that matters. Everyone’s got the thing to do. It’s like, it’s not just you. And, and so that begs, you know, to your question, it’s like, what’s changed in America that we’ve now become self-absorbed and it’s only us that matters?

And, and he’s slight. It becomes a big altercation and people are angry and upset, and that’s a worrisome issue. There’s an old saying, really old, saying that all great civilizations first fall apart from within. And I, I’ve always worried about that because just as you know, we, we just, we are getting to a point where we just don’t really care for each other or just for a second even.

So I wanna ask

you a chicken to the egg question about your career. And then I wanna get into day 37 of your time as, as a ceo, which was a little bit bigger day than you planned for it to be. Oscar, which came first for you, you came from trains to flight. Was it a love of transportation that has brought you to this industry, uh, during your career?

Was it a love of leadership and management? And it just happened to be in transportation?

You talk a lot about leadership on your show, and you always ask, gee, how do I get to be where you are? Which is a such a broad question. There’s so many answers for that. But for me, uh, no. I, I never envisioned myself being certainly the c e of, uh, industry, like in, in airlines or at the railroad.

It’s just, you always focus yourself on the things that you do best. Collaborating and working with others, making the people around you successful, smiling, making it, oh, it’s a thousand little things that you do to get people together to make better decisions and actually own those decisions so that there’s a better objective.

And so I have followed that general principle of, of my own leadership. And of course it’s developed and it’s been improved by many people along the way. And then it just led to things, you know, one second, you’re doing something great. And then something comes in and says, Hey, would you like to do this?

And it’s like, Wow. Okay. And then you become for a while, the youngest to do all these things until you’re not, which eventually happens. But no, there was no particular passion for any of those things. I don’t wanna say happenstance, because I think there’s a broader plan for us out there somehow. But, uh, no, I mean the rail space, uh, and I, you know, I talk about it in the book as to how I chose to go there.

It’s just something that I was, you know, somebody found me and said, Hey, would you like to join the board? And it’s like, great. So I was on the board for a long period of time and then something happened and they said, gee, we like you as a board member. We might like you as a c e O. And so, so you develop a passion for the things that you do over time.

But no, I, I, I wish I had had this vision from day one that I was gonna be this, but it doesn’t always work that way for people. And I, I don’t like it when people say, you know, follow your passion and go get it. Uh, there’s a lot of hard work involved.

Well, if I’m trying to design a career though, you write in this piece that one of the reasons that they wanted you at United during their time of crisis was that you were a quote operations guy, right?

You weren’t somebody who was a talking head or a financial person. You were somebody that could get in the dirt and kind of knew how the, the machine operated. If I’m trying to design my career as I’m 20 to 25, that kind of spoke to me about what type of opportunities I might wanna pursue. Maybe it’s not a linear path, Oscar.

Maybe it’s a it’s a zigzag.

I, I think zigzag is probably understated, right? I mean, there is just so many, there’s a lot of angst every day about, you know, what I’m doing my career, uh, where am I headed? You know, we all go to school for something usually, and you focus on something cuz that’s what was available.

That doesn’t have to limit you. I think if you apply those broader leadership lessons that we, we briefly spoke about, you will find that people around you will. Get to know you for your intellect, for your, your capacity for not only IQ but iq, uh, for ability to get things done. And that tends to elevate you over the course of time.

I grew up as a finance person, so that was my training and I did that for quite a long time. But over time I really quickly learned that finance and its concepts was lost on a lot of my operational peers cuz they just didn’t have that training. And honestly, it’s a very important question. They didn’t understand the why.

They say, listen, I need more things to make this business work. And a finance person comes in and says, well, you know, you need to fill out this form and you need to do ROIs and IRS and MPVs and all foreign concepts to them. It’s like, well, whatever. I just need my stuff. And over time as a finance person, I really taught my organization and myself to be truly listening to folks.

It’s like, when y’all tell me why you need this, tell me how much you need and why, and what’s your background for it? Let us do the work and then we’ll do the math behind it. And so what that led is a more operationally based c f o was my sort of label, which when somebody decided to replace a chief operating officer, it’s like, well, why don’t we take a chance on this guy?

You know, he’s, he understands some of it. But I’ll tell you one thing. The one of the greatest lessons in my life was when I moved from a C F O role to A C O O role, running a large, you know, railroad company with huge amount of assets and safety orientation and labor and all those sorts of things. A lot of my, you know, wise college learnings and such became a little silly to me sometimes, right?

Because it’s like, okay, I’m sitting in a room with 500 men and women who, you know, just work for a living and, uh, they wanna know why something is. And so I learned to tell people, here’s the why in simple terms, you know, how do you talk about business results and why they’re important and why the street’s important.

They don’t care, right? And so that simplicity and communication is a key thing that I would ask for people. And whenever you can. If indeed you can get an operational role of some sort, that is always helpful and meaningful because it will change how you look at things when you’re actually responsible for a p and l, let’s say, or,

or results.

It’s interesting how in a personal financial plan, you know the money is not the object, and some people don’t like it because they think money’s the object. It’s having more life. Where, to your point, the money piece, if it follows operations, it makes it the world better for everybody instead of more frustrated.

You told a story later in your book about a quality program that was there before you got there, and when you were on your listening tour, people were complaining about it at everywhere you went. And to your point, nobody knew, knew the why behind it. I want to though not focus on that. I really, what I really wanna do is go to the beginning of, of your book, because I.

You tell this great story, Oscar, about taking off your headphones. When you walk through an airport, you’re walking through O’Hare and, and you see all these stories all around you, and already today, I’m sure our stacker community can see how important it is to be a storyteller and to tell good stories.

If you’re a leader, the whole aspect of storytelling, you compare to a symphony. Can you talk a little bit about how to construct good stories that resonate with a larger group of people? You

have to start with the comfort. About who you are as a person and why you do what you do, because that genuine nature allows you to tell stories, because you get stories to tell.

Every story I tell is based on, in rooted in a personal communication with another individual or another set of individuals. I think it resonates. So I, I try again. We talked about simplicity, which is one thing. It’s like you don’t bore people with a lot of details. Uh, you make it funny, you make it relevant.

You bring yourself down to it. I think especially at our c e levels and such, we we’re just so used to, you know, there’s this level of idolatry that follows us around, right? It’s like you walk into a room and you’re instantly funny and you’re the better looking. Yeah. All this sorts of stuff. I had, uh, worked for a man, I mean, Roberto Goetta way back in my Coca-Cola days, and he was the most soft spoken, quiet, unassuming man possible.

And he would just pull you over quietly and said, and what’s, look around and say, what do you see? And he taught me to always have an opinion about everything, but he also taught me an important thing. All of these people think they’re really, really important because of the job title they hold at this particular company.

And what’s true about all of this or what’s not true is that that doesn’t make you right. It’s that old saying, it’s, you know, that that’s what I do, but that’s not who I am. . Now, it’s important to have achieved things in your life to be able to tell stories from, cuz you see a lot of people who just want to talk a lot about everything.

Like, oh, I was on, I was getting in my Uber today and the guy was this, and we

had this conversation. Oh, please shut up. Please shut

up. Right? And so there, that’s probably the final point is just brevity, being concise and then being attuned to the, to your audience. Make sure that they’re actually listening.

So there’s no secret recipe for these things.

You tell a fantastic and very personal story that weaves its way all the way through this project, but it starts on day 37 of your career as c e o. Can you describe that morning, you are supposed to be going to one of your biggest meetings so far in 37 days, you’re headed to interview a great C F O candidate.

But tell me how that morning started off for you and what happened. Yeah,

so I think the, the key note there, as you mentioned, it’s 37 days into my job and I’ve been on this listening tour, which is where a lot of my stories come from back to the previous, uh, conversation. I’m learning a lot about our business.

I’m getting told a lot of things by a lot of folks. And I’m now heading back into Chicago where I have this important, uh, interview with a potential candidate for my CFO role. I also have a summit with all the labor leaders because I’ve been talking with a lot of union people in the audience, but the labor leaders like, Hey, we’re important here.

We’re the ones that lead these folks. You need to talk to us. So they’re all trying to set up individual meetings. And my point is like, you know what, why don’t we all talk together? Because for me, I was getting quickly understanding that the, one of the issues we had at United, that we weren’t in effect united.

We had so many different divisions and departments and organizations, and everybody up and down their own little silo was working, including our unions. So this was just my gentle way. I said, why don’t we all get together and talk? So two big meetings that day. And, uh, I am off my morning run as I usually do.

I was vegan. I had just raced at a hundred mile bike race like two weeks prior. So, um, you know, weekend athlete for sure. Uh, but, uh, no history of any disease, you know, all my, but on that morning, my phone, uh, buzzed across the room and when I went to go get it, I felt, for lack of a better term, weird. It. I, you know, I was a little lightheaded, uh, a little clammy.

And my legs were kind of just sort of not feeling like they don’t really, no, I hadn’t run that hard. So it wasn’t that. And so as I moved towards my phone, My legs gave out and I sort of fell to my knees and I tell the story of, I, uh, in part of my training for triathlons and for these, uh, bike races, I have a really close friend who happens to be a cardiologist.

And he is always telling us stories from the, or including dramatic stories. Like you’d be surprised at how relatively young and fit some of the people are that die on my operating table. And, you know, and you guys in our collective group that does all this stuff together, you should always think about if you ever feel anything weird, you know, call 9 1 1.

Just, you know, reach out, call the worst that you can be is embarrassed that it’s indigestion or something, but you know your body, you know what’s what’s right and you know what’s not, what’s maybe strange. So as I fell on my knees, my phone keeps buzzing and uh, those words came back to me. It’s like, okay, I kind of feel weird.

And so as I crawl to my phone, I also see my landline. Some of your listeners may not know what a landline is when you’re on the fifth, when you’re on the 50th floor of a Chicago apartment building. My immediate thought is, Hey, because one of the, one of the things that my friend said, uh, when he said, immediately, call 9 1 1, he added this point, like, and make sure you tell him where you are, which makes sense, and he goes, then he added, because you may not make it past the phone call.

And I remember, I remember exactly where I was sitting when he said those words. And I remember thinking, . That’s a little dramatic, right? It’s like, oh, okay. But fast forward a couple years, this, this event’s coming up to, I’m, I’m crawling to my phone. I call nine one one and I immediately tell him I’m on the 50th floor of the, I still had enough, uh, ability to communicate at this point.

And I, that’s what I told him. And then I realized that my door, my only door to the apartment was locked. I somehow crawled back, fell. That was bloodied in the face after I woke up from all of this. So I clearly fell into something, but I remember, uh, opening the door and two EMTs coming in, and that’s the last thing I remember for quite some time since I went into a medically induced coma.

But the concept behind all this is, you know, be aware. Communicate with someone about these things. . Now, I had no history that I knew of. I was an athlete, I was a vegan . So from a concept of, of, you know, the, all the different rules, there was nothing there other than I had this brilliant, life-saving thought that I had from one of my friends.

And I tell this story everywhere and everywhere I can.

Especially guys, we, we tend to kind of like, you know, I’ll fire, I’ll be fine. Yeah, yeah. I’ll just lay down, I’ll jump in the shower. And again, as, as my friend Mark says, you may not make it past that phone call. So, uh, so long story from that, you know, I was the EMTs that had that, uh, that found me, had just been coming around the corner and got the call.

Wow. Lucky Tash, my doorman at the place is somebody, I, again, I’m always friendly and talking with stuff and he knew who I was and he is, he realized they were coming to my room, so he kinda locked the elevator so no one could use it. He got me up in time and within, it was 37 days into the job. 37 minutes from when they, what I called, I was in a hospital on, uh, something called ecmo, which is a, a heart and lung machine where they bypassed my entirety.

That’s how serious, uh, it was. And uh, one of the funny stories that was told later is one of the doctors that saw me first, uh, I, he said, I, I kept saying something. So as he leaned over to hear what I was saying, I kept saying, I don’t have time for this. I don’t have time for this, which is so on brand for me, right?

It’s like I had these two big important meetings, uh, and somehow I got, I got the number of, uh, of my wife who just happened to be there. So there’s just so many nuances there. So I am blessed to be here. It’s a miracle and I’m happy to have made it through. But for all of your listeners, I hope that story resonates.

I hope you tell it to someone cuz it is a meaningful thing. That c certainly saved my life and apparently has helped others as well.

As I was reading it, Oscar, the fact that you remembered it the last second before you blacked out, to drag yourself over to the door and unlock it. . Is, is there any one thing, by the way, that we should be doing because you’ve just a little snippet in the book where you go, , medicine’s advanced since then. Some, there might be some stuff that you can do. So if you don’t think you’re a risk where, uh, average person maybe does.

Yeah, so two things. Uh, preventative medicine in America is probably in the early stages. We just don’t do enough of that to test people for things like heart disease early on, um, because it’s just preventative thing. It just doesn’t pay.

It appears or there’s just some reticence in the medical community and that’s not a shot at the medical community cause they saved my life. But importantly, what’s evolved now is that there’s a lot of new drugs, certainly, and there’s a company I’m personally involved with called Clearly. That does diagnostic imaging, but that runs it past artificial intelligence and machine learning concepts with, you know, hundreds of thousands of patients that have suffered the same things.

And the image can fold into this, this, this data-rich environment and come back to you as a, as a practitioner and as a patient, and kind of give you a sense of how your heart looks. Do you have blockage? And if you do, what type is it? And if you do have, whether it’s this type, what, what degree is it? And then even importantly, now we can tell you which of the medicines that are out there that actually will resolve that particular issue.

Oh, wow. Because for a while, if you present. To a medical professional with heart disease, they’ll give you this array of medicine, including nitroglycerin, which is the little pill that, yeah. Um, none of that necessarily may be something you need. And I’m telling you, if you take that many pills in the first two or three days, your life goes to poop.

You just, you’re you, you’re just, you’re, yeah. You know, you don’t know which way’s up. Yeah. And you don’t need any of that stuff necessarily. And so there’s much more to technology. So to your question, what you, what can you do? Remember this story, certainly take care of yourself. But if you had any history of this, just literally force your doctors to say, is there anything else I can do besides the E K G?

Which really doesn’t do anything. Unfortunately, most of the stuff is invasive. But just be aware of your own situation and be aware of the story and, uh, demand from your medical practitioners that you get something more, potentially. It’s a hard one.

There are three themes that I would love to get to. I just want to tell our stacker community that resonate throughout this book, and I’m gonna ask you about one of them, but I wanna make sure everybody’s aware.

You talk about the importance of listening and back to your storytelling stories are better if they’re relevant. You know your audience and you can simplify it. Number two is, uh, effectively merging teams, uh, is another theme with the, the merger with you and another airline that didn’t go as well as it probably should have when you show up.

But the one I do wanna ask you about is this. You come into this house completely divided Oscar, and you’ve got all these different places you can look. You can focus on the end user, which is, which is who you want to take care of. The passenger who depends on your airline to get from point A to point B.

You can focus on the investor. You’ve got one big investor who is climbing down your throat from the minute, the minute that you get there and you tell a longer story about that. And then there’s the, the employees. And you decide that of all these groups, that the employees as a leader, that is where that needs to be the tip of the spear.

Can you talk about making that decision and then about that beginning of building trust with employees that implicitly the day you get there, don’t trust

you? Yeah, it’s, you know, part of its experience, and this is a key leadership lesson that I try to provide for folks, because turnarounds are, are just that, right?

They’re the, the concept of a turnaround is that it’s broken and it’s broken in many, many places. So the lesson I try to teach is, you know, however you best do it as an individual leader. You need to find what the one thing you’re going to start with, uh, because again, everything’s broken. You just mentioned customer, customer service was crap.

Financial results were lagging the industry, employee relations, labor negotiations were off the charts, you know, and people just didn’t like us. And then we had this amazing global network that, you know, everybody had the, the greatest promise. And so if you think about all those spectrum, all that spectrum, any one of those things could have been things strategically, how we fly to different places, to all this.

And my experience, my heritage, all of that has always taught me. And, and this concept of tr that I, we talked about before, going from a CFO to a coo and that learning that I had myself. The, the learning I had is, wow, you know what, if I had just sat down with my operational counterparts and truly listened, visited with them, went out on the field and saw the actual results that they were seeing in their job that weren’t being, that wasn’t even being able to get done effectively because they didn’t have some of these assets in use.

That concept would’ve really given me a much better viewpoint on how I would’ve handled the request for money, right? Which is for me, which requests, oh my God, this is a lot of money. We have to do the analysis, and so

you’re talking about you just need to open the communication line so you better intel.

Well, and again,

and it’s not even open, it’s, it’s open your own darn communication line. Yeah. Because, hey, I’m smart. I control all this money. I’m cf. You can take that sort of lofty, somewhat arrogant attitude. And of course nobody doubts that you have a job to do, but there’s a more effective way of doing it if you truly, and the concept that I have is listen.

Learn, and only then can you really lead. So I learned that when I went to my c o O role. So I had lots of issues there. And so I just went out in the field and I just started listening to people and it proved to be so instrumental in what we did for two reasons. One, I actually got some really good ideas and nobody else was thinking about.

And B, you begin to win the hearts and minds of human beings who at the end of the day, the human dynamic is, I will do. Something for someone who I respect, I trust, I believe in, or I understand, uh, and all those things, right? We, we think of ourselves and look around people that influence our life. And we, why do we do that?

It’s like, I, I love my parents. I trust my parents. So even though I don’t always like what they say, I know that they have the best interest. So that, it’s a silly analogy, but it’s the same thing. So how do you build that with a hundred thousand workforce that’s disenfranchised, disengaged, right? And, and so my list of activities when I first arrived at, at, uh, United was broad and great consultants reports all my senior leader reports our board’s views, certainly the analysts and our, and our shareholders views.

And as I went through all of that, that instinct came back and it came from my first visit to the field when I went there. And the reception that I had from people was ridiculously nice. I mean, it was like they were very happy to have someone new. I had written a letter beforehand saying that I was gonna listen to them.

And then what I would notice in all these conversations is that somebody would come and say hello and they would just linger just a little long. They would hold onto your coat, leave just a little long and they’d say, hold your gaze for a little bit like ringing. I need to tell you something. I don’t know how.

Please make it easy for me is what I interpreted. And so we went on this listening tour and you know, it’s not without its consequences cuz on our first earnings call when I’m there, they’re like, all right, there’s new guys here. What’s he gonna do? And they’re looking for strategic financial, you know, share our concept, customer concept.

Uh, I’m gonna spend the next 90 days, I said, and I’m gonna go listen and learn from my folks to truly get a sense. And when I come back, I’m gonna come back with the one thing we’re gonna do first and build upon. The storm that resulted from that commentary. Right? Okay. This, this guy doesn’t know what he’s doing.

He doesn’t know these industry. He has to be taught, we eventually come back with a employee first strategy that we communicate and we had the same level of ranker and excitement from all those communities. Cuz what do you mean you’re gonna put employees first? Right? Aren’t, isn’t the customer first, isn’t your shareholders first?

And building of trust and genuine hearing and connection with your doesn’t compute on a spreadsheet. Right? So it’s hard for a financial analyst to actually put that. It’s like, oh, I, I, I like what he’s doing, but how that sounds like it’s gonna cost more money. People, what’s the o roi? Right? Right. And uh, as we proved, uh, time and time again over my tenure, how that trust and connection with our flying employees made the every bit of difference airline industries are what we call fragmented, right?

You don’t have a factory floor where the CO can stand up, up there and say, Hey guys, this, this is what we’re gonna do tomorrow. To this day, if I see two or three people together as I’m walking through a terminal, that’s a, that’s a crowd in our industry. So you had to get the message out in a way. And this listening concept, you get all that.

Plus you also get a sense of, people feel like they’re part of it. And I’d always tell people, it’s like, I hear you. I heard your point, and I’m telling you right now, I don’t know that we’re gonna implement your very thought, but I understand the thought. And so I reserve the right to accumulate all this data, figure out the right thing.

I’ll always remember your thought, but because I don’t do exactly what you tell me, you’ll think I haven’t followed. And that’s why a lot of people don’t like to go out and listening is like, oh, aren’t you in effect promising everyone something? No, you’re not. Again, if you have a genuine human conversation with somebody, you know, again, back to the silly example of a parent, right?

Parents are always gonna do what they think is the right thing for you. And you may not always agree, um, but you feel part of it. And so this concept of listen, Learn. Really learn, not just like nod your head, oh yeah, got it, got it. But come back to people. Here’s what I’ve heard. Run it past a lot of folks, and then lead makes for a really powerful message.

And it may seem like it takes a long time, but I’m telling you, you always have time to go back and do it right The second time is what people say, and this is, this couldn’t be true, or at least from my leadership

perspective. The book has turnaround time, uniting an airline and its employees in the Friendly Skies.

Oscar Munos, such a pleasure meeting you. Thank you for the stories, for the listening. And, uh, you know, I saw the Rolling Stones in concert, and Keith Richards said, Hey, it’s good to see all of you. And he goes, no, really, at this point in my life, it’s good to see anybody. And I kind of feel like it’s the same, it’s the same for you after that horrible

story.

Oh, you know, the, the Stones are, uh, one of my favorite bands. And, uh, I’ve had a great chance to see them in many different places around the world. Uh, and it’s been quite the journey. But, uh, you know, as they say, you can’t always get what you want, but if you try it really hard, you get what you need. And, and I, I feel blessed to have gotten what I need.

Hi, I’m David Hirsch, and when I’m not hosting the Dad to Dad podcast for the Special Fathers Network, which is a dad to dad mentoring program for fathers raising kids with special needs, I’m Stacking Benjamins.

Big thanks to Oscar for joining us og. This idea not lost on me, that the best leaders come in listening first.

Listen. What’s that? Sorry? I’m not paying attention.

What you think is going on might not be exactly what is going on. It might be something completely different. Also, by the way, Doug, uh, Oscar also spent time at Coca-Cola and Pepsi, so we got a, we got another trivia connection there between Oscar and uh, Coca-Cola.

Hey, let’s throw out Haven Lifeline and tackle some of life’s most important questions. Our friends at Haven Life Insurance Agency, og, they put what you value first.

Oof, um, leftover birthday cake for my wife’s birthday last

weekend. Yum. I gotta stay away from the leftover birthday cake. I gotta lose some weight.

I am, we just kind have

a sequence here. We had, we had my sons two weeks ago. Alyssa’s and then Caroline’s is in a couple weeks. We got a confirmation in between. I mean, like it’s kk KKK cake,

sugar frosting. Sugar frosting sugar. Yes. I don’t like frosting though, so I just Oh, I only eat the frosting. I prefer

the, I prefer frosting where all the frosting went.

Just because I just leave it in a

bowl. Oh, that frosting in a bowl. Way better. Just get rid of that cakey part. You’re, you’re good. Right. You know. Um. I went on a trip for about 18 days and, uh, we didn’t know anything about it and I went off my Met Pro Diet and man, am I feeling it? Time to get back before Jesse met Pro yells at me too much.

It says here they put what you value first, which is your loved ones and your time. And that’s why they made buying quality term life insurance actually simple. You go to stack Benjamins dot com slash HavenLife now to get a free quote. Their application is simple online. You get an instant coverage decision.

They don’t even ask you how much cake you ate yesterday on that application, which is always good. Prices are affordable, all policies issued by their parent company, mass Mutual, more than 160 years old. Get this done. Get your life insurance done, people Stacking Benjamins dot com slash. Haven life. Uh, today we’re gonna throw the Haven Lifeline out to Luke.

Luke, how’s it going, Luke?

Hey,

Joe and og. This is Luke from California. I wanted to reach out with a quick question regarding investments. My wife and I are in our late thirties, and we’ve been pretty heavily focused on saving for retirement since we got married 11 and a half years ago, and that savings rate is now around 50%.

It’s been a combination of frugality and resisting lifestyle creep anyways, we just realized a year or so ago that we’re a bit closer to retirement than we had originally planned, and we’re now thinking we could be retired

around age 50 because

we hadn’t really been planning on retiring early until recently.

Most of our retirement savings are in 401K and IRA accounts, along with some investment real estate. While the investment real estate will provide income and early retirement, we’re thinking we need to now focus on investments that we can start withdrawing from at an earlier retirement

age. Could

you give us an overview of the various investment vehicles, types of accounts, et cetera, and investment classes most appropriate for different time horizons, especially considering those that would be best suited for a 10 to 12 year timeframe?

Thank you. And looking forward to rocking my Stacking Benjamins shirt at the beach this summer. Oh yeah. And Doug, give me a call so we can discuss the delivery.

I don’t, not sure what he’s talking about there. Og Uh, and Doug. No. Doug easy. You keep him away from the microphone. You dumped him. Gotta mute the emergency.

Mute of Doug’s mic. Luke, right there. By the way, this is super cool. I wanna focus on this first big, high five to Luke. Because og, 50% savings rate. But the fact that he grew into that didn’t start at 50, just avoided lifestyle creep. Stayed frugal. Yeah. And as he got pay raises, his life changed. He just made sure that extra money went in the bucket.

It’s a great way to go. It’s a good way to kind of get used to this lifestyle instead of, you know, some people, I think, get so excited about saving money. They save a ton of money. They do it for about six weeks, and then they abandon it because they went too far. So, I wanna say first, nice job there. It’s

pretty sweet.

I, I don’t know why everybody’s so frustrated with, uh, putting money in workplace plans, 401ks, IRAs, and that sort of thing, and then planning on retiring early. The IRS has a path for you. The only issue with taking money out of a retirement plan before 59 and a half is if you’re not retired. The government doesn’t care if you take money out of your retirement plan and you’re retired.

They care if you take it out to buy a Ferrari or something and you’re not retired. If you’re retired and you wanna buy a Ferrari with your retirement account, you can. There’s a path for that. So there’s ways to do that, but I think you wanna make sure that you’ve got some flexibility for no other reason than just a tax standpoint.

You know, we know that if you put money in your 401K pre-tax, it’s gonna sit there. You get a tax break today, it’s gonna grow tax deferred. So whatever it does, you don’t pay taxes on while it sits there. And then when you go to take it out, you’re gonna have to pay taxes. And that tax rate is gonna be just like your ordinary income rate, right?

You take a hundred grand out of your 401k, it’s just like you made a hundred thousand dollars in your job. So you pay that. Those federal taxes or state taxes, whatever, a Roth ira or if you use the Roth 401k, operates a little differently. You don’t get any tax breakup front. You’ve already paid taxes of the money.

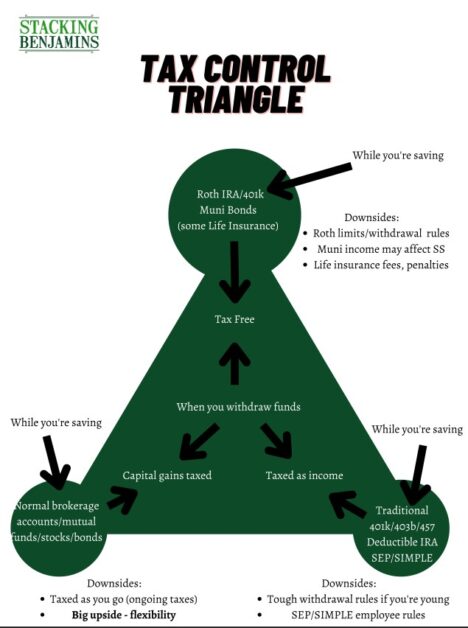

It goes in. It’s invested and grows tax deferred so you don’t pay any taxes while it, while it grows. And then when you take it out, there’s no taxes due. Those are like the two kind of opposite ends of the spectrum, right? I’m gonna be fully taxed or I’m gonna be no taxed. And then there’s kind of the third area, which is money that you’ve already been taxed on and money you get taxed along the way on, right?

And we’re talking about your regular investment account, what we would say, a non-qualified account or a regular brokerage account. And that money is gonna go in, you’ve already paid taxes on it, it grows, it does its thing. It may pay dividends, it may have capital gains. You’re gonna pay taxes on those along the way.

And then when you take the money out, you only pay taxes on the gains that you’ve made from your original investment. So it’s kind of partially taxable. We call that the tax control , but we wanna make sure that you’ve got some opportunity to withdraw money from any one of those buckets because throughout your life, and frankly from from, you know, you kind of fast forward, if you’re 35 right now, what are tax laws gonna look like when you’re 45?

What are they gonna look like when you’re 65 or 95? We don’t have any clue at all. But what we know is, is that we’ll probably wanna pay some taxes. We’ll probably want to have somebody be tax free and probably have somebody be partially taxable so that we can control our tax bill in, in retirement.

Listen, if you got 40 million in your ira, I don’t think you give a crap if you’re gonna pay a little tax along the way, but for the majority of us who kind of don’t have profound amount of, of wealth, this is gonna matter. Right? If you, if you retire with 2 million in an ira, that’s really a million dollars, right?

Cuz a million’s gonna go to the government, a million’s gonna go to you. So having the flexibility there, what I would focus on is in the additional savings, is building up that third bucket. You know, let’s make sure that you’ve got some Roth money. Let’s make sure you’ve got some brokerage account money to give you flexibility when you get to that retirement thing.

The other thing, Luke, that you asked about was, uh, investment time horizons. This is a big issue for most people. Uh, most people are far too conservative with their money, and for some reason we’ve got this thing in our brain that says, well, I’m gonna retire in five years, therefore I should, you know, my money needs to be conservative.

That is the absolute worst thing that you can do from an investment standpoint. You need money in five years. Like if you’re gonna retire in five years, you need the, you need one years of money in five years, but you need money in 45 years also, and 44 years, and 43 years and 42 years. So the preponderance of your wealth.

Needs to be invested for that time horizon, which is forever, basically. And if you’re doing it the right way and really kind of thinking in the direction that you should from a wealth transfer standpoint, wealth growth standpoint, why would you ever have any money that’s not invested long term for long-term time horizons?

I get it. If you need money tomorrow, that money can’t be invested. Long term time horizon, right? You can’t have tomorrow’s money dependent on what the stock market does today. That’s a bad mix. But anything beyond five or seven years that needs to be a hundred percent invested all the time for you and for every other generation beyond you, too many people, you know, get kind of sucked into these awful target date funds whose goal it is, is to zero you out basically at retirement day.

So you pick the 2035 fund. And their goal is by the time you get to 2035, you’re mostly conservative. And by the way, that slope down starts in 2020. And so the time when you should be growing your wealth the most is the time where it’s starting to get more and more conservative, which is taking the opportunity for you to have that growth off the table, which is really silly.

And then you get to 65 and it’s really conservative and you go, well, I got another 40 years and my kids have a hundred years behind that. My grandkids have 150 years behind that. So why would you have your money be invested? Your momentum is

all gone. It’s all gone. Yeah.

Why? If you’re thinking about this the right way and you’re going, I’m gonna, I’m saving so much money that I will never run out.

Isn’t that everybody’s goal that I will never run out? Now, for some people, that means I’m not gonna run out and I’m gonna have a dollar left on my hundredth birthday. You know, you checked the box, you didn’t run out. Okay, cool. But most people don’t wanna play it that tight. Most people go, no, I want my portfolio value to increase.

If not, you know, maybe a flat line’s a little bit, you know, kind of plateaus maybe is a better word to use, but maybe plateaus. And if you’re thinking that way, you’re gonna die with some money. And who’s it gonna go to? Your kids and your grandkids, the charities that you care about, the people and places that are important to you.

Why do you wanna take all the M thought of it, you know? Well, I’m 65, I have to be conservative now. Hogwash, man, hammer down. You got 30 years, plus your kids have 40 years

beyond that. But his point OG, is it he’s gonna spend the money in 10 years, or he is anticipating spending the money in 10 years. If he’s doing that, I’m still with you.

He’s

spending one year in 10 years,

but then he is spending one year in 11, one year in 12. Yeah. So he’s gotta look at how much money he needs for that year. And position that for that year 10.

Well, in seven years from now or five years from now, yes, you should probably be thinking about that. But you don’t need to think about any of that right now.

I think he does in one way, and it is because on the asset allocation guide, there are two things that historically have beaten the pants off of inflation and hit stocks in real estate. And the only problem with real estate there, I have no problem with real estate is a long term investment, but real estate, if you’re gonna try to sell it, is a bear.

So I would use real estate for an income stream for a long sell whenever, but if I want something that’s liquid, I’m going to equities for that 10 year money. I’m not, I’m taking real estate off the table. But your asset allocation for that long term money might say real estate on it. If I’m looking at, if I’m looking at 10 years out now, to your point, o gee, he might already have other money invested right now.

That’s in equities. That’s enough money in stocks that he can get at that money. So he could just invest in real estate then and he’ll be, he’ll be fine. Grow that, but Well,

and, and yes. So stocks in real estate are the only places that beat inflation over long periods of time, which is the only thing that matters, by the way.

That’s the only thing that matters because if you can’t beat inflation, you will lose, but you can also have enough money that the income from your portfolio pays you enough money. Right. Agreed. The dividend rate, yeah, I just sent this out to all of our clients. The dividend rate of the s and p 500 has increased 11 times in the last 50 years.

Not that it’s increased 11 times that it’s increased. 11 x it was $6, now it’s $66, like it’s, it’s gone up. 11 fold is a better way to put that. And even last year when the market went down, dividends went up. And so you could have a portfolio that’s a hundred percent equities. Back to our time horizon of like, when do I need this money?

You could have a portfolio that’s a hundred percent equities that kicks off enough dividend income that you never have to be conservative. You never have to go, well, what am I gonna do? I need money in like five years from now. The dividends from your portfolio could be enough money that you, you don’t have to say why I take a little bit off the table now.

You know what I mean? Like, if you’re gonna live on a hundred grand, you could figure that out and say, how much money do I need in a, in an investment account between, in his case, real estate and, you know, whatever to fund my lifestyle. Yeah. Because dividends increase with inflation more than, and so does rental property r uh, income, right?

So you got some rental properties, you’re gonna raise the raise higher than inflation. So it’s a fun problem to have.

Luke, thanks for that question. And if people got lost a little bit on the different taxation of investments, we do have a resource that you can get for free. Just go to stacky Benjamins dot com slash tax triangle.

Stacking Benjamins dot com slash tax triangle. That will lead you to a very simple drawing, which will show you exactly what this tax control is. Did you tray on one that you did? It is, it’s, uh, a magic marker. It is, it is. Love it. Wonderful. Stacking Benjamins dot com slash tax triangle. Of course. Uh, Kevin will go deeper into tax control in the 2 0 1 as well, our newsletter.

All right. Uh, that’s gonna do it for today, man. A lot going on in the community this week. O gee, I’m super excited to be back. We this week are talking a lot about divorce. If you’re somebody who doesn’t know where your money is or you feel like you might not be able to trust your partner, or you can trust your partner now, but you just wanna make sure that you what, what’s that?

Uh, sun Sue from the Art of War, the best battle’s, the one that’s never fought. Tonight, Tracy Conan, who is a, uh, forensic accountant, a k a A money detective joins us on Instagram live. She’s gonna be talking about her new divorce summit called Win Your Divorce. And if you go to Stacking Benjamins dot com slash divorce summit, you will see that that’s taking place on Thursday.

I’ll be on a panel og, not just with with Tracy, but also with Jill Schlesinger, of course, from Jill on Money and CBS News. And, uh, Jen Hemphill will be there who coaches a lot of people in our armed forces, uh, on how to manage their money. So financial coach, c a p, and me all together on a panel on Thursday, but on Monday, if you’d like to just hang out with Tracy and I, that’s 5:00 PM tonight on Instagram.

It’s 5:00 PM Eastern, 2:00 PM Pacific coming up also later this week. Tracy will be our guest right here on Wednesday on the show, along with Sarah Jacobs talking about divorce. That’s a topic. Og. We have not, I, I can’t think of a time where we’ve had a show where our main guest are focused specifically on divorce, and so we’re, we’re gonna do that on Wednesday.

I mean, not cool, but cool I guess. No, not cool, but yeah. But if, if you’re a stacker, cool. But not cool. Yeah. I mean, being prepared for anything right is cool, but I’m with you. The divorce situation, not cool. All right. That’s what’s coming up on the community calendar. But if you’re not here for that, you’re not here for the community thing.

You’re worried about what we talked about in our headline about, uh, the latest bank rumblings, about weirdness in the economy, about maybe a recession. I saw another TikTok video about, man, we might have a recession. What did this guy called it? A recession, non-res recession, but whatever. If you are anxious to make some moves with your finances, I’d like you to do this instead.

Check out this free guide from OG and his team. They put it together to help you plan more and panic less. No matter what the market does, has some great questions to ask yourself so that you make financial decisions your future self will. Thank you for head to stacky Benjamins dot com slash guide to get that free guide from OG the Stacking Benjamins dot com slash guide.

All right, that is what’s going on here. Doug. Ma’am, we had a lot of takeaways today, og but Doug, why don’t you, um, give us our top three? What should we have learned today?

So what should we have learned today? First from Oscar Munoz, lead with empathy and communication. If you listen first and speak later, you are much more likely to make good decisions.

Second, new mortgage fees. Maybe not as ugly as you’d thought if you actually read the slanted story, but the big lesson. Turns out Koch floats aren’t what you think. Koch does not float.

Thanks to Oscar Munos for joining us today. You’ll find his new book Turnaround Time, wherever books are sold. You know what? We’ll also include links in our show notes at Stacking Benjamins dot com. Just thank

me later.

This show is the property of SB podcast’s L L C, copyright 2023, and is created by Joe Saul-Sehy. Our producer is Karen Repine. This show was written by Lacy Langford, who’s also the host of the Military Money Show. With help from me, Joe, and Doc G from the Earnin Invest podcast, Kevin Bailey helps us take a deeper dive into all the topics covered on each episode.

In our newsletter called the 2 0 1, you’ll find the four 11 on all Things Money at the 2 0 1. Just visit Stacking Benjamins dot com slash 2 0 1. Tina Eichenberg makes the video version of this show. Once we bottle up all this goodness, we ship it to our engineer, the amazing Steve Stewart. Steve helps the rest of our team sound nearly as good as I do right now.

Wanna chat with friends about the show later? Mom’s friend Gertrude and Kate Youngin are our social media coordinators, and Gertrude is the room mother in our Facebook group called The Basement. So say hello when you see us posting online to join all the basement fun with other stackers, type Stacking Benjamins dot com slash basement.

Not only should you not take advice from these nerds, don’t take advice from people you don’t know. This show is for entertainment purposes only. Before making any financial decisions, speak with a real financial advisor. I’m Joe’s mom’s neighbor, Doug, and we’ll see you next time back here at the Stacking Benjamins

Show.