Walking away from a secure city government job to eventually run one of the world’s most recognizable handbag brands sounds like fiction. For Lew Frankfort, it became his career story, and the path between those two points is exactly what makes this conversation so valuable.

Lew joins Joe Saul-Sehy and OG in the basement to break down how a combination of discipline, curiosity, and what he calls “magic and logic” shaped his journey from city hall to the corner office at Coach. This isn’t just inspiration for aspiring executives. Lew’s insights about making better decisions, taking calculated risks, and building a meaningful life apply whether you’re 25 or 55, whether you’re climbing the ladder or considering jumping to a different one entirely.

Lew shares how preparation became his secret advantage, why curiosity beats confidence during major transitions, and what he learned about leadership while helping transform Coach into a global powerhouse. His framework for balancing intuition with analysis gives the Confident Explorer a practical lens for evaluating their own big moves, career pivots, or midlife reinventions.

Then Joe and OG shift gears to tackle a different kind of transition. The first year of retirement. When excitement runs high and “go-go” energy meets newfound freedom, spending can spiral in ways that derail decades of careful planning. They break down the crucial financial decisions retirees face right out of the gate, why that first year can be surprisingly dangerous, and how to set yourself up for long-term stability without killing the joy of finally having time to live.

Plus, Doug delivers trivia involving time travel and underwear, because even episodes about CEO wisdom and retirement planning need a reality check from the basement.

What You’ll Walk Away With:

- How Lew Frankfort pivoted from city government work to leading Coach and what that path teaches about career reinvention

- The “magic and logic” framework anyone can apply to big decisions and career moves

- Why curiosity and thorough preparation matter more than confidence when making your next leap

- Leadership lessons from someone who helped build a global brand from the inside

- What retirees absolutely must understand about spending during that crucial first year

- Why the “go-go years” of early retirement can wreck your finances if you’re not careful

- Strategies for aligning your early retirement excitement with long-term financial stability

- Permission to reinvent yourself at any age, armed with both inspiration and practical wisdom

This Episode Is For You If:

- You’re considering a career change but worried you’re too far along to pivot

- You want to understand how successful people actually made their big moves

- You’re approaching retirement and want to avoid the spending traps that catch most people

- You’re curious how to balance intuition with analysis when making major life decisions

- You believe it’s never too late to build something meaningful or try something new

Before You Hit Play, Think About This:

What’s one career move or life transition you’ve been thinking about but haven’t pulled the trigger on yet? What’s actually holding you back? Drop your answer in the comments because Lew’s story might be exactly the perspective shift you need to take that next step.

Deeper dives with curated links, topics, and discussions are in our newsletter, The 201, available at https://www.stackingbenjamins.com/201

Enjoy!

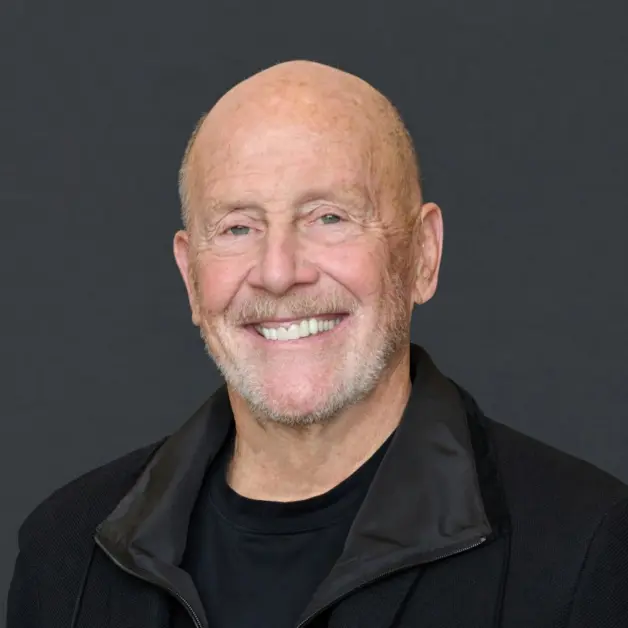

Our Mentor: Lewis (“Lew”) Frankfort

Big thanks to Lew Frankfort for joining us today. To learn more about Lew, visit LewFrankfort.com. Grab yourself a copy of the book Bag Man: The Story Behind the Improbable Rise of Coach

Our Headline

- The ‘First Year of Retirement’ Rule (Kiplinger)

Doug’s Trivia

- This iconic designer became even more famous when, in the movie Back to the Future, Michael J. Fox’s mother thought his first name was this designer’s because the moniker appeared on the waistband of his underwear. Which ‘Benjamin Stacking’ designer is it?

Have a question for the show?

Want more than just the show notes? How about our newsletter with STACKS of related, deeper links?

- Check out The 201, our email that comes with every Monday and Wednesday episode, PLUS a list of more than 19 of the top money lessons Joe’s learned over his own life about money. From credit to cash reserves, and insurance to investing, we’ll tackle all of these. Head to StackingBenjamins.com/the201 to sign up (it’s free and we will never give away your email to others).

Join Us Friday!

Tune in on Friday when our expert roundtable answers the question how do we solve the issue of good money management as the zeros begin (hopefully) piling up?

Written by: Kevin Bailey

Miss our last show? Listen here: How to Actually Enjoy Holiday Small Talk (And Give Better Gifts for Less) SB1771

Episode transcript

[00:00:00] Doug: My podcast has a first name. It’s S-T-A-C-K ing. My podcast has a second name. It’s B-E-N-J-A. Hmm.[00:00:19] Doug: Live from Joe’s mom’s basement. It’s the Stacking Benjamin Show.

[00:00:33] Doug: I’m Joe’s Mom’s Neighbor, Doug. And what’s a better gift for a money geek than a nice coach handbag? How about the longtime CEO of Coach delivered directly to your listening device? Today we talk about changing course over your career, betting on yourself, and when to think about happiness over money.

[00:00:54] Doug: With Lew Frankfort in our headline segment, Kiplinger is out with a new piece. Diving into the one year, you should focus on when considering retirement. What year is it? We’ll share. And because we are talking about sharing, how about I share with you some of my incredible trivia. You can then. Share it with all your friends and now two guys who are your smart money friends every Monday, Wednesday, and Friday.

[00:01:22] Doug: It’s Joe and O Jean.

[00:01:29] Joe: Everybody needs a money friend and we are happy to be yours, especially here during the holiday season. The Gift of Money Geek Friendship. I am Joe Saul-Sehy, and across the card table from me is my friend. Mr. Og. How are you man?

[00:01:45] OG: Good

[00:01:47] Joe: reporting for duty. Good. A is good. Present. Well, we got a great show because, oh gee, today in a rare two mentor week, we normally have one show per week where we have our mentor of the week.

[00:02:03] Joe: But man, a great appearance on Monday by Charles Duhig and then today, one end of the

[00:02:07] OG: week as a mentor, the other end of the week. As a mentor, it’s like a double ender week. It’s great.

[00:02:12] Joe: It is a fantastic week. We’ve got Lew Frankfort today. Longtime CEO of coach is Doug so brilliantly explained earlier, and man, if you want a guide to how do you switch careers midstream a b, go into a thing where you totally feel like a pretender.

[00:02:31] Joe: We’ve all gone into a place before where we felt like we didn’t have whatever it took to succeed in this new area. He went from kids programs in New York City. To running one of the premier handbag manufacturers in the United States. And not just manufacturers, but retailers, right? Mm-hmm. Yeah. Premier retailers.

[00:02:50] Joe: So Lew is upstairs talking to mom now, and he’s going to, uh, be coming down shortly. But first we got a couple of sponsors who make sure that we can keep on keeping on and you’ll get great people like Lew and like Charles on Monday, helping us communicate. You don’t pay a dime. So sit back, relax. We’re gonna hear from them.

[00:03:10] Joe: And then the legendary Lew Frankfurt joins us

[00:03:23] Joe: and I am so happy stackers. We finally have him here with us. Lew Frankfurt’s here. How are you man? I’m doing well.

[00:03:29] Lew: It’s been a good day so

[00:03:30] Joe: far. Well, that is good. We’re gonna try to make it even better, Lew. We’re gonna help a lot of stackers make their day better. I wanna tell my stackers that you are the only guest.

[00:03:39] Joe: We’ve been doing this for almost 15 years, the Stacky Benjamin Show. You are the only guest who ever asked for a pre-interview. I’ve had pre-interviews before Lew where I said, you know what? I’m not sure about this guest. Maybe they’re not ready for prime time. You have these two pieces, logic and magic that go together that we’re gonna talk about today.

[00:04:05] Joe: But it strikes me that having this pre-interview is part of the Lew Frankfurt logic and magic. Let’s logically get together first so we can make this as good as we can for stackers. Is that your thinking as a CEO? Like how does that happen?

[00:04:19] Lew: Absolutely. Because I’m driven for a drive for excellence and a fear of failure.

[00:04:26] Lew: My immersive curiosity, which uh, is on the magic side, forces me to. Gain as much knowledge as I can in the situation before I actually need to make a decision or go into it. So preparation when possible is always a plus.

[00:04:47] Joe: Lew, that reminds me of Sun Sue the Art of War. You know, the best battle’s, the one you never fight.

[00:04:53] Lew: Yes, I get it. And I developed a term that I use both at home and in the office. Ski battles and wars, and whether you’re speaking to employees or you’re speaking with your children or your parents or your spouse or anyone, you need to be conscious of if there’s a friction, any form of friction, whether it’s a child that wants to stay up, who’s 10 years old and at school the next day, but wants to stay up to see the Monday night football game end, whether you go into allow an exception or not, and understanding that a skirmish unexpectedly can turn into a battle or a war.

[00:05:39] Lew: So with employees, you try also to understand who they are and what motivates them, and how do you get the best outcome that you want to achieve. I’ve counseled my kids with their kids, my CEOs with their teams, and myself. I try to be real. Conscious. If I’m feeling tense in the conversation or it’s not going well, why am I feeling this way and how do I want to change things so that I can not feel this way and get an outcome?

[00:06:11] Lew: That’s for the grade of good.

[00:06:14] Joe: It’s interesting. We’re talking to Charles Duhig this month as well about super communicators and how they’re always in the discussion and feeling, why am I feeling the way I am? Why is this. Thing coming out. What is this emotion that maybe I didn’t expect? I find that interesting.

[00:06:32] Joe: I also find interesting though, Lew, this idea, this shared language that you and everyone at Coach had that you develop, which was magic and logic. And you said in your book that when you talked about magic and logic, like everybody coach got it. But it was truly in the art of bagman, right? That you kind of put it together and more codified it.

[00:06:52] Joe: But can you describe this language for me? What does magic and logic really mean?

[00:06:58] Lew: Okay. Some people refer to magic as ought and logic is science. When I think of magic, I think of the qualities that come from within, not things that you do outside. So you need to have belief in possibilities. That’s magic.

[00:07:20] Lew: You need to have a north star. If you don’t have a vision for what can be or how a vacation can occur or how you can build a brand or save the money that you need for the down payment, you’re never gonna get there. Or if you’re gonna get there, it’s gonna be luck. So you need to have a vision for what can be, and then you need to have belief that you can get there.

[00:07:44] Lew: Those are two aspects of magic, and part of it is imagination. That’s another piece. Instinct is also another factor, and curiosity is magic. It’s not logical. So people often stop when they get. The answer to the question as opposed to listening to the answer. That leads to many more questions. So I coin that immersive curiosity.

[00:08:15] Lew: On the logic side, data analysis is critical. Consumer insights where you use data and factoids applied research or actual experience in the marketplace to understand the situation. That’s logical. Extreme collaboration is not something that comes naturally to us as Americans and most people culturally anywhere in the world.

[00:08:47] Lew: We grow up, we’re competitive with each other. We go to school, we go to work, we look at our, we benchmark ourselves against our friends, against peers, against others, and in a high performing culture. You need a high performing team, and to have a high performing team, you need to create processes and accountabilities that require extreme collaboration.

[00:09:15] Lew: One of them, as an example is transparency. Let everyone know everything and have a consistent way of looking at things. So collaboration is a second one, a third one, which is logic is a greater good mindset. Very frequently we think about our own silo or what concerns us and not the overall community.

[00:09:43] Lew: And part of being transparent and being collaborative enables you to create a mindset among all of the players down to an entry level worker to understand what the mission is, what our purposes, what success looks like. And you need to apply that consistently. And what I often say is there’s magic and logic, and there’s logic and magic.

[00:10:12] Lew: Another logic piece is adaptability. You need to adapt. You need to adapt to changing situations. Adaptability is critical. On the magic side, there’s a cousin to that, and that’s lateral thinking, which means you go down a path and it seems to be okay, but it may not be exactly what you want. Rather than continue down that path, you need to pause mentally and ask yourself, is there another route I could take?

[00:10:46] Lew: Whether that’s a business plan, a relationship that you’re looking to develop or repair, and not just be stuck. So you need to really look at things in the 360 view.

[00:11:00] Joe: It’s interesting how much this applies not just to the boardroom or the corporate environment, but, but even in your family and just your own career.

[00:11:10] Joe: I’d like to ask you about a few of the touchpoint that you go through through your career to ask you specifically about some of the magic and logic points. And the one, the one that I really wanna start with is. Early career and your leap, which is to me, this is immersive curiosity, the magic piece, and adaptability, which is logic.

[00:11:34] Joe: So you went from running this child development programs for New York City to the world of handbags, which I don’t know if you know this, Lew, that’s not exactly a straight line. I don’t know if you know that. I I know that. I do know that. So how do you go into this new world with a bunch of industry insiders, right?

[00:11:57] Joe: A bunch of people that already know the industry, they know of the lay of the land. You don’t know any of that and begin to truly make your mark.

[00:12:07] Lew: It’s a great question. In my case, and I believe others who make a major shift. You need to have immersive curiosity. So you need to pause and try to understand what problems you’re trying to solve and who are the key audiences.

[00:12:27] Lew: So in the case of coach specifically, I was very mindful from my 10 years in government that I was at service to children and families in need, lower income families, and it was my job to make sure that the children got the type of daycare services and families got the type of support they needed. So I was in service and I felt purposeful about that.

[00:12:57] Lew: When I went to coach not knowing anything about fashion or bags, I decided I would start. With the customer. And that was before the term consumer centricity was developed. Before I joined Coach. And this was key in my decision to go there. I pretended to be a business reporter, freelance, and I was doing an article on coach and I went in and I spoke to buyers and merchants.

[00:13:28] Lew: And what I learned was it was a small, regional business. The product were always sold out, great product, sturdy on natural leather, functional, good price point. And the last person I went to was the owner of a specialty store on the west side of Manhattan who had one bag in stock below the shelf. And she showed it to me and said, it’s reserved for someone else.

[00:13:54] Lew: And I said, tell me about Coach. And she said It has a cult following and being a product of the sixties, the idea that you can have a product. That can be so beloved that people who own it feel part of a community intrigued me. And with that morsel of knowledge, I decided my purpose would be to build upon this incredible populous brand that was beloved in the northeastern part of the country.

[00:14:25] Lew: Only $6 million in sales we sold to anyone who paid their bills. And I decided I would dig deeply and learn about how a consumer makes a handbag purchase. How did she decide upon coach? How did she decide on a competitor? What does she like about coach? What doesn’t she like? What’s her future purchase intent?

[00:14:48] Lew: I secondly went to look at competitive brands around the world and the brand that I admire the most. 1979 was a small French brand called Louis Vuitton. They had about 20 stores around the world based in France, and they controlled their destiny because they only sold through their own stores. And I thought to myself, if we could sell directly to consumers, we could do a better job messaging, we would be better listeners because we would have their information.

[00:15:22] Lew: And my first assignment with the support of the founder was a catalog business. So I started a catalog that was 20 years before the internet, and that was a direct to consumer. A year later, we made a much bigger leap at my initiative and we opened the first coach store in 1981 on Madison Avenue and 65th Street.

[00:15:47] Joe: Everybody wasn’t on board with the first door though, Lou.

[00:15:50] Lew: That’s true. I was actually asked by a colleague if I can get my job back in city government. And uh, I knew why he was asking me, uh, he ran the wholesale business and I said, why? And he said, well, when the store’s not successful and Bloomingdale’s drops us because we’re down the street from Bloomingdale’s, the founder is gonna be fickle and he’s gonna say he doesn’t want to sell direct.

[00:16:15] Lew: And, um, he was not. Right. Uh, the first year we actually knocked it out of the park. At the time we did over $1 million in 450 square feet. It would be equivalent to $4 million today, drawings down the street. And I knew. That it was a beloved brand and that if we could control the environment, the service components, and innovate product that consumers wanted that from us, that we did not offer, that we would be able to grow the business.

[00:16:48] Joe: Was it just the brand the way that it was and there was a thirst for it that people weren’t getting? Or was there something you were doing with that 400 square feet that helped create some of that magic?

[00:16:59] Lew: Yes. That’s another great question. What we decided we would do was to design a store, like a closed section of a library.

[00:17:10] Lew: So I went to Columbia University and took pictures of one of the libraries that was the closed shelves, wooden shelves, all the books. You saw the the bound edge of the book. And the modification we made, we, so we stacked bags side by side and one bag facing out. So that’s the logic side. It’s organizing principle for efficiency.

[00:17:33] Lew: One of the magic things we did, because people loved the notion that our bags were natural leather and developed a patina, was that we imbued the store with leather. So when you enter the store from a tactile perspective, you smelled and felt wonderful smell, great smell, natural leather. So you are going across the portal, you’re coming into a store.

[00:17:59] Lew: On one side are library shelves stacked with bags that look like books except for the facing, and there’s a great smell. Third was we brought in. Team members and I spent probably a third of my time in the first year in the store to focus on treating customers as if they’re guests in our home, giving them the benefit of the doubt, believing that 99% of people are honest and they are, and we built a very strong relationship.

[00:18:32] Lew: Fourth. Is a blend of magic and logic, which has to do with merchandising and storytelling. So we were able to show a much broader world of coach that people could walk into, and it was immersed. So they would walk in and there would be coach everywhere, and we would’ve photographs back then of the people at the sewing machines.

[00:18:54] Lew: It would be a microcosm of America, white, black, blue, tall, short, young men, women. And because we are a country of immigrants and we were providing a product largely to the middle classes, the growing middle class that wanted branded bags, and that’s women much more than men. Women really value brands, especially handbags.

[00:19:19] Lew: Enormous loyalty to the handful of brands that they might own.

[00:19:24] Joe: It strikes me a couple things. You know, you hear one CEO talk about something and it might be their shtick or their thing or or how they’re different. You hear multiple CEOs, multiple successful companies talk about things, and then I think you start getting into some truth and two them.

[00:19:43] Joe: That I heard you talk about Lou one was, I remember a story that Walt Disney back in the early days of Disneyland, would disguise himself and would stand in line for a ride and would go, so what do you think about this place? How do you like this? So you disguising yourself ahead of time as a reporter, I think is just brilliant intel.

[00:20:03] Joe: And the more you know, the more you know there. And that it also strikes me treating people with the benefit of the doubt that most people are not going to steal from you. Reminds me of a story about Nordstrom versus Macy’s. Way back in the day, where of course in any high end mall you’d have Nordstrom at one end, you’ve have Macy’s at the other Macy’s, I believe, off the top of my head, and you may already know this story, Lou spent maybe five times the amount of money on security that Nordstrom spent.

[00:20:30] Joe: Nordstrom treated people like they weren’t going to steal from them. Macy’s treated people like they were going to steal from them, and you already know which those two, two companies. Had more theft. Macy’s, by far had people steal more from them than Nordstrom did.

[00:20:45] Lew: And that’s true and I do know that not the exact numbers, but Nordstrom’s is actually, has done much better and has avoided the bankruptcy.

[00:20:54] Lew: Completely avoided them because they were also innovative. They went into e-commerce earlier. They decided they were going to develop their own off price channel, Nordstrom’s Rack to dispose of excess inventory. They were smart and they were innovative.

[00:21:11] Joe: So much of this is about the idea, your magic idea of bold innovation.

[00:21:15] Joe: I want to go to another part of your history. This is a 2000 sales have kind of hit a wall, right? You’ve done a lot of what you can do with the resource that you have. You decide it’s time that you really need to go public. How do you begin to imagine this future that doesn’t now exist? Because this feels to me also, you know, for a stacker that doesn’t run a company and they’re not going public, but they might be looking at the next promotion, the next raise, this future that’s coming up, how are you able to push through that wall and take this private company public in 2000?

[00:21:53] Lew: Well, my journey, uh, like everyone’s, is an individual journey. We were part of the Sarah Lee Corporation from 1985 to the year 2000. Sarah Lee purchased coach from its founder with my active involvement working with a boutique banker when we were $25 million in sales. And what intrigued this $20 billion holding company was that we were, what I called at the time, a multichannel business.

[00:22:24] Lew: Today, they’re called omnichannel. There was no brand in their portfolio that sold to consumers in catalog, their own stores and wholesale. And somehow this small brand was able to do this. And they thought that not only would coach grow, but it would be a model for other, much larger businesses within the, uh, sportswear, activewear.

[00:22:50] Lew: Brands like Haynes and Playtex and Champion and the other brands that were sold within the, uh, Sarah Lee Personal Products company and coach grew rapidly and I learned a great deal, uh, during my time at Sarah Lee, particularly in the first year or two, because as a public company we had to develop plans.

[00:23:16] Lew: There were metrics. Uh, we had to do monthly budget presentations, zero base. So I learned financial disciplines early and that was very helpful. I also learned how to do sophisticated marketing for the packaged goods brands that they had, which are more commodity brands. And I of course interpreted that for discretionary brands where you don’t run out of the product and you wanna replace it.

[00:23:46] Lew: So I learned a lot and along the way. They asked me to become a group officer, and I was in line one of two people to potentially succeed the CEO of this $20 billion company. I was a group officer. I had coach always in my portfolio, but I was responsible also for, let’s call it three or $4 billion of businesses when coach was 500 million.

[00:24:14] Lew: I didn’t really like being a group officer, particularly in a conglomerate where the goal was to make plan, not go to a North Star, and the culture was different than the culture I built at Coach, and even though I had direct reports. They were CEOs of businesses and they may have been there for 20 and 30 years, and they felt it was discretionary to follow my advice if they were meeting their plans.

[00:24:49] Lew: And in that environment, it largely was I wasn’t being particularly successful. I decided I would migrate back to coach, and along the time of my migration, I received an opportunity from Burberry to be CEO of Burberry in London. And Sarah Lee gained wind of that and met with me and I explained to them, which.

[00:25:17] Lew: I felt strongly, which did not surprise them. The coach at this point could not thrive and be its best within the rules and guidelines of a major holding company around compensation, around marketing strategies that we needed to blend magic much more strongly in our formula and recruit people such as Chief Creative Officers, which was not an approved position within any Sarah Lee Corporation.

[00:25:51] Lew: And the net of it was that I made a deal with Sarah Lee that I would stay a coach and if they could get $1 billion for coach, they would give us our freedom. What they said at the time, which was of course complimentary to me, was that they did not see coach without Lou Frankfurt because there was no real connectivity.

[00:26:17] Lew: Above me and the rest of the company. We were like an alien species. We had our own culture. We were motivated. To blow out Clan. Clan didn’t have anything to do with it. It had to do with North Stars and, and new mountains to climb and fortunately they kept their word and we were liberated in the fall of the year 2000.

[00:26:42] Joe: I wanna unpack all of what you just said, ’cause I think this is so important for people. I felt like a hundred percent Lou, that your move back to migrate toward Coach had nothing to do with money. It didn’t have anything to do with Career Ladder. It felt like to me it had 100% to do with happiness.

[00:27:04] Lew: Correct. And purpose. And purpose, yes. Because I was no longer fulfilled. And even though I might have still spent 25 or 30% of my time on Coach, I dreaded the other 75 and 80% and learned that I wasn’t equipped to lead CEOs. A conglomerate where making plan was the North Star. So I wanted to work with purpose where I felt I was needed and wanted and I was prepared.

[00:27:41] Lew: They did not cut my compensation, but I was prepared for them to cut it dramatically. I also had an experience where I recruited someone who was required more money than I was making at a lower level, and they couldn’t understand how that would be acceptable to me, that I could hire someone making more than me.

[00:28:03] Lew: And that person was a creative officer whose salary history demanded it. So for me it was only natural, and I did things like that in city government where I brought people in as consultants because they couldn’t live on my salary and I could pay them more as consultants because of their skillset I needed.

[00:28:26] Joe: It always blows me away when you’ve got these managers that wanna keep people quote below them. Yet I’ve always found that managers that spend all of their time lifting their people up and serving their people, those are the people that never leave. I mean, if you help them leave the organization by building their resume, giving them exciting things to do, they stay longer than the boss who’s like, no, no, no low.

[00:28:48] Joe: You can’t leave, you know, NDAs and shackles and all this rat race stuff drives me absolutely crazy. I wanna end because you know this move toward purpose. I want to talk about that greater good mindset before we say goodbye, because I think your public service background, it was funny that Mayor Ed Koch said to you that, uh, he wasn’t gonna give you a promotion becau, because you were too principled.

[00:29:13] Joe: Is that true?

[00:29:14] Lew: Well, that’s what he said to me, and I actually repeated it publicly and he and I had a conversation afterwards. We remained friendly until his passing. He denied that he ever said it, and I understood his denial, but that was a catalyst for me because I’m such a big believer in meritocracy.

[00:29:37] Lew: Again, when you serve. People you need to serve the greater good, not a particular interest.

[00:29:43] Joe: It strikes me though that to serve the greater good and to have this north star that you’re serving really begins with, you have to be able to serve yourself. And this is what I really appreciated and I thought was brave about Bagman.

[00:29:58] Joe: Was you diving into some of the dark periods and depression while leaving. How are you able to negotiate those periods? Is it looking at what the North Star is? Is it taking time off? What’s the key? Because this happens, I think in everybody’s career,

[00:30:14] Lew: it’s probably, uh, one of the things that differentiates my memoir, I’m told from most other successful corporate leaders is that I share with people.

[00:30:26] Lew: Both are my low and high points and what I want to really convey to Gen Z and millennials. Life is not a bowl of cherries no matter where you are. Everyone at some point fears failure. Most people at some point feel that their imposters. One of the things I encourage. My team and I started to practice 40 years ago, was listening to my body.

[00:30:53] Lew: If I was waking up with body aches or I was feeling sluggish or a Monday morning came and I wanted to stay under the covers, I forced myself, why do you feel this way and what do you wanna do about this? And I developed a host bevy of techniques to both stop my declines. And one is pattern recognition to try to avoid getting into situations where you’re gonna go down a well.

[00:31:21] Lew: And once you recognize if that’s the case, you gotta get out of it or change this.

[00:31:26] Joe: This is another battle. Never fought situation.

[00:31:29] Lew: Exactly. I believe very strongly in exercise and which I practice. I do believe in meditation and naps, and I, I define two types of naps. One is a, a power in nap. Which is similar to meditation in that it gives you mind, even if it’s five minutes, an ability to reset your fatigue.

[00:31:54] Lew: It’s four o’clock, it’s two o’clock, whatever time it might be. You got five hours to go or you need to be at your best. If you can slow your breathing with meditation or without and have a power nap, that’s great. I also believe in longer naps, refueling naps. That’s a nap under the covers, lights out, and you are gonna go through a whole series of different RHYTHMIA while you’re asleep.

[00:32:22] Lew: I also believe in coaching and therapy. I also believe under certain conditions in medication acupuncture. I also believe that if all of that doesn’t work. Or is it working? You really need to get out of that situation and also try to avoid them in the future. You need to listen to your body is what I tell people.

[00:32:48] Lew: And when I see CEOs or senior members of teams where I’m active on the board mentoring and I see someone looking flat where you know their energy’s normally higher when there’s a break in the meeting or after the meeting, I take someone out and I sit with them and I say, what’s going on Besides empathic, I try to be helpful.

[00:33:12] Lew: And mental health is an important component and responsibility of employers to get the best out of their employees and also to create a culture where you are looking at the entire mind, body, and spirit of your employees.

[00:33:31] Joe: How do you think, even in something like what Coach is doing, how do you think AI is gonna change the game for a company like Coach, which ostensibly is not in the AI game at all, but I gotta imagine you’ve thought this through a thousand times.

[00:33:46] Lew: The short answer is from a process perspective, the tools that AI provides can enable you to do repetitive work at a much lower cost than employees, and in some instances better than employees. But for Coach, we sell products one at a time, whether it’s online, in a store, or through other channels where agnostic to where consumers shop, it’s not going to change the equation.

[00:34:22] Lew: For us,

[00:34:23] Joe: it’s so important. It’s still customer first. It still is North Star customer first.

[00:34:29] Lew: Yeah. And it’s about the customer journey. If any of your listeners, and there are many, many who are in various different positions, I encourage people in whatever area they are, if they’re providing a service or a product at any level, you need to think of the customer journey.

[00:34:48] Lew: Where was the customer before? Where is she today and where is she traveling? And you need to be there when she gets there three years from now. So you can’t be complacent even if your numbers are great and business is roaring and not look ahead because there are societal shifts, shifts in values, shifts in customer preferences.

[00:35:14] Lew: So it’s not only product innovation, it’s also innovation in the ways in which you reach consumers and trying to be a little bit ahead of that.

[00:35:25] Joe: Lou, that sounds like magic and logic. Crazy talk. The book is Bagman, the story behind the Improbable Rise of Coach. I also think of it as the rise of Lou Frankfurt as well.

[00:35:38] Joe: Thank you so much, Lou, for mentoring our stackers today. I’ve loved the time. It’s been fantastic learning from you. I appreciate it so much.

[00:35:46] Lew: I appreciate you and I will say that, um, you have a very interesting method of inquiry because you get to the essence of things pretty quickly, so more stimulating than most interviews for me.

[00:35:59] Lew: I might add.

[00:36:05] Doug: Hey there, stackers. I’m Joe’s mom’s neighbor, Doug, and let’s move from designer handbags to straight up designers because I’m here to share a big birthday with you more on today’s date. In 1942, this iconic designer became even more famous when in the movie Back to the Future, Michael j Fox’s mother played by Leah Thompson.

[00:36:29] Doug: It was, I mean, dude, can we just pause for a minute? No, you are Leah Thompson and back to the future. Why do you even have to ask if we could pause when you just totally did? Oh, yeah. It was a major part of my adolescence. Anyways, she thought it was Marty Mc Fly’s first name because this designer’s moniker appeared on the waistband of his underwear.

[00:36:50] Doug: Which Benjamin Stacking Designer is it? If you haven’t guessed yet, I’ll share right after. I go check to see how much a DeLorean would cost. I’m sure Joe and OG can afford it. Right.

[00:37:10] Doug: Hey there Stackers. I’m DeLorean lover and Guy who OG calls McFly. Hello. Joe’s mom’s neighbor, Doug. Newsflash. Joe just shared that a DeLorean would be just a bit outside of our basement budget slightly, but if we had one Benjamin Stacker’s budget, we might be able to afford a few. This designer born in 1942 goes by the name Leah Thompson called Michael J.

[00:37:38] Doug: Fox in the movie Back to the Future. What name was it? Of course Thompson thought Fox was Calvin because Calvin Klein’s name appeared on Marty Mcflys underwear. And now back to two guys who never wear underwear. Don’t ask me how I know Joe and og,

[00:37:58] Joe: I don’t even want to go there.

[00:37:59] Doug: Hop bending over to pick up paper clips,

[00:38:01] Joe: but do wear kilts.

[00:38:04] Joe: Nope. For people that uh, didn’t know anything about Coach, I think you figured out very quickly guys that uh, Lou Frankfort wasn’t your gym coach might be a little bit slightly different coach.

[00:38:16] Doug: And by the way, not is that the reason? Did you have him on just so you could set that joke up? Probably.

[00:38:21] Doug: Probably like, oh, this’ll be great. Hey Lou, you

[00:38:24] Joe: wanna come on the show? ’cause I got this one lighter that is like a four On a scale of one to 10 that I really wanna lay on our stackers. Y you know what, not only did he just make coach explode, but he also, I mean, that success gave way to all these counterfeit bags.

[00:38:44] Joe: Have you ever been in the streets of New York City where they set that carpet up that they can quickly, when they see the cops coming, they can quickly take it down? You can get coach, you can get Rolex.

[00:38:55] Doug: Let me ask you, Doug, have you ever been to Guadalajara? Well, I have.

[00:39:00] Joe: Would you like to go pick up some coach bags?

[00:39:03] Joe: Wink, wink, yes. From our, from our manufacturing facility. But that seriously is big business. How many people do you know? Like I know so many people over the years that have had bags that said Coach on the side, that probably weren’t coach bags.

[00:39:20] Doug: No, not if they were your friends. I don’t know. Let’s do a headline.

[00:39:25] headlines: Hello Doling. And now it’s time for your favorite part of the show, our Stacking Benjamin’s headlines.

[00:39:32] Joe: Our headline today comes to us from Kiplinger, and this is, uh, an important piece because what they’re suggesting here, OG, is that there truly is one year of your retirement. While as you’re planning for retirement, as you’re saving up money, you’re dreaming about the future, or you’re at the day and it’s time to go, there is one year in retirement that you should think about.

[00:39:55] Joe: And Jacob Schroeder wrote. It is the first year of retirement. Just think about that one year more than any other year. He writes, while the first year retirement generally features fewer keg parties, football, tailgates, and all-nighters, how do they know what my retirement vision is? False. I got all the above in mind.

[00:40:16] Joe: It shares one unique similarity with college. It’s a new beginning for thousands of new retirees Every day it’s a time to spread their wings and discover or rediscover their sense of self. And like college. If you take too much advantage of that freedom and neglect your responsibilities, it can hurt the whole experience.

[00:40:31] Joe: So here, here’s what Jacob’s setting up og. You know they talk about the freshman 15, right? Because you’re, you’re not working out anymore. You’re eating a bunch. You’re partying your first year retirement. You no longer have the job. You’re spending money in a different way. You’re living your best life. He says that if you don’t.

[00:40:52] Joe: Have a financial plan and kind of lock it down a little bit. So you get used to having that budget every single month that you could really kill your entire retirement by not paying enough attention in year one.

[00:41:05] OG: I think that, generally speaking, anybody who has gotten to a place of financial independence and is not forced into it, meaning they have chosen when they want to retire or be done with work or make work optional, I think most of those folks have done so through discipline and structure and accountability and doing the right thing, even when it didn’t want to be the right thing.

[00:41:34] OG: Some people got there with luck, you know, hit a, hit a great investment, got a great buyout, you know, whatever. And that’s a different scenario. But I think that the people who did it, let’s say the normal way if, if I could say it that way. Do not all of a sudden turn into these wild party animals who spend like there’s no tomorrow?

[00:41:55] OG: No, I don’t think that, I’ve never seen this happen.

[00:41:57] Joe: I don’t think that’s the point at all. I’ve never

[00:41:58] OG: seen it happen where somebody gets to retirement successfully and then bombs the first year because. They didn’t think about it. I, I don’t,

[00:42:07] Joe: I

[00:42:07] OG: don’t.

[00:42:07] Joe: 58% of Americans, this is a real issue. Number one, it is a real issue, I think, because number one, 58% of Americans, oh, well then in that

[00:42:14] OG: case,

[00:42:15] Joe: are calling it quits earlier than they expected.

[00:42:18] Joe: 58%. So what could,

[00:42:20] OG: could I say? I

[00:42:20] Joe: said the people who

[00:42:21] OG: got there on a normal

[00:42:21] Joe: path, right? So more than half of our audience can expect that they’re going to have a surprise retirement that’s a different year, a different time than they thought that they were gonna retire. So that’s an issue, number one.

[00:42:34] Joe: Number two is, well, it’s not parting. Parting is the college analogy. The actual story that I skipped for brevity, but I’ll go ahead and dive into it, is that this woman. Who retire with a large pension after 30 years at a major corporation. Within six months, she traveled extensively. People dream about travel, so she travels.

[00:42:54] Joe: She goes first class traveling, gives her adult children money. Considering a second home, all without a financial plan, a surprise tax bill soon follows, and the risk of dropping out of retirement all of a sudden becomes real. It wasn’t real at all. She had a plan going one way. All of a sudden, her plan’s going a different way because she had this huge tax bill that she totally didn’t expect was going to be coming her way.

[00:43:20] Joe: So it isn’t about partying as much as it’s about paying attention to the little things to set the tone for this whole new phase of your life.

[00:43:31] OG: I don’t know. I mean, again, I would say that the people who have retirement thrust upon them have a greater likelihood of mucking it up, but I don’t know that they have a greater likelihood of screwing it up because.

[00:43:45] OG: They didn’t plan for it or they didn’t think about this first year. It’s just they didn’t expect that first year to happen. So I just have a hard time with this as an argument of, well, we need to think about the first year of retirement. It’s like, all right, cool. I expect that to be in five years. No, it’s tomorrow.

[00:43:59] OG: It’s like, okay, well yeah, I’m gonna screw it up. I haven’t thought about it yet. And maybe that’s what they’re saying here. Maybe that’s what the article is eventually saying here, is that you have to be a little bit more intentional when you do get to that spot of whether you retire in on your terms or on somebody else’s terms.

[00:44:16] OG: Um, maybe the best thing is to like be the lottery winner and say, okay, for the first six months, I’m not gonna do anything. I’m gonna just kind of hit pause and get my lifestyle, see what’s going on, and then make the big purchase or the, the big trip or whatever,

[00:44:32] Joe: different than college. Retirement, of course, isn’t a four year stint.

[00:44:36] Joe: Jacob Wright. It could span over a third of your life. And while every year matters. Experts say the first year may stand apart. It can trigger mistakes. That snowball set the stage for a fulfilling second act quote, the first year of retirement’s, one of the most defining periods of a person’s financial life says, Renee Collins, founder of Ready, retire Ready, Inc.

[00:44:54] Joe: It’s not just about leaving the workforce, it’s about your new identity, your new routine, and your new relationship with money. That’s going to be different because you’re living on a fixed income now. So setting the tone that first year for 30 years is gonna be a really important year to focus on.

[00:45:11] OG: Well, I hope it’s not a fixed income, but, um, you know, you’re probably not saving anymore money.

[00:45:16] OG: I think that a lot of people have a big bucket list, you know, and say, when I finally can do, do, do, then I will finally do, do, do, you know, whatever that is. And sometimes it’s things like, and I, I witnessed this in my own household, not like more of a extended family. Somebody I knew retired in our kinda extended family.

[00:45:39] OG: The wife was like, oh, I gotta buy him a motorcycle. And I’m like, what are you talking about? Buy him a motorcycle. Wait, well, for what? And this person hadn’t ridden in forever. I was just like, yeah, here’s this, here’s this retirement gift for you. And now it sits in the garage. You know, it was used like 10 times because somewhere along the line this person had said like, oh, I, you know, I have this.

[00:46:04] OG: I have this vision of what this looks like.

[00:46:06] Joe: Well, to your point, og, this period is often referred to as the go-go years. Jacob writes, when retirees is the most likely to spend money on things like travel, recreation, and bucket list experiences. So it is the time when people might tip too far, even with a good financial plan, because it’s the go-go years, they will go go maybe too much according to a 2024 consumer expenditure survey.

[00:46:30] Joe: The average annual spending for adults 65 to 74 is 65,149. Listen to this, 10 years later, by age 75, it drops nearly 20% to 53,000. So another reason why that first year when you got all those bucket list items that you’re talking about, the bucket list tips too far one way.

[00:46:51] OG: Well, and and I would take this a step further and say.

[00:46:55] OG: Let’s assume for a second that you’re one of the people that are saving and you’re investing and you know you’re doing the thing that you think is right and maybe you don’t have a lot of concern over, you know, getting forced out early. The thing that I find most exciting about working with people kind of in that 10 year period right before as we get closer to retirement, especially people that have been successful, is they only know one thing, right?

[00:47:18] OG: Live within your means and save and invest as much as you can. But there comes a point in time where you’re on track for your goal or maybe you’re even overfunding it, right? And it sounds really weird to say like, you have too much money for this particular thing, but you could clearly do that for any other goal, right?

[00:47:38] OG: You could say, you know, Hey, I’ve got a kid just born. I want to like, um, you know, what’s the most I could put in a 5 29? Well, the answer is like $80,000, you know, day one. I think most people would do the math on that and go, that’s kind of probably too much. 18 years of $80,000 is gonna double a whole. I mean, unless your kid’s gonna be a doctor, which might happen, you know, your normal state’s, public school, you know, whatever.

[00:48:04] OG: That’s probably too much. And we would say, Hey, you’ve got too much money in your 5 29. Well, believe it or not, you can actually have too much money allocated in your long-term retirement bucket and foregoing things today. And, and I find it really exciting and interesting to work with people on this because once we have confidence around, I’m on track for my goal, I’m on track for this thing, and now let’s stress test it.

[00:48:25] OG: What happens if I get laid off early and all that sort of stuff. Let’s say that you’re still good. Well, what can we do now? Well, we can pull forward some of those bucket list items into today’s cash flow where you have extra resources, where you have extra time to make up for like. Yeah, we planned this Europe trip, but the dollar did this thing and now it’s like actually 30% more than we thought it was gonna be when we booked it a year and a half ago.

[00:48:47] OG: Um, but I don’t wanna cancel it because, you know, I’ll just kind of eat it and, you know, we’ll make it work one way or the other. You have a lot more flexibility, a lot more margin of safety in your plan 10 years before plus. When is it more fun to go to Europe? I don’t know. I’ve never been. Is it more fun to go when you’re like 50 or is it more fun to go when you’re like 71?

[00:49:06] OG: Like, I’m gonna guess 50, you know, generally speaking, maybe you’re a little bit healthier and you know, whatever. So the, I think the solution to this isn’t always to be hypervigilant over that first year of, of retirement, although that’s probably the case. But if, if you also can expand that bucket list into the five or eight years before retirement and the five or eight years after retirement, you’re spreading out that, you know, that spend, you know, and you’re not gonna spend, like your example, this woman.

[00:49:35] OG: Gifting all the money away and doing the magic trip and being first class for six straight months. They have experiences like that. Disney has that experience. The Four Seasons has that experience. It’s like the everything included, like yeah, go see the world package ’cause you haven’t done for your entire lifetime and you’re running out of tomorrows.

[00:49:53] OG: Give us $400,000 and we’ll hit all the highlights in one trip. And you’re good.

[00:49:57] Joe: I’m glad you brought this up. Uh, we’ll link to another show we did on this very topic. Benjamin Brandt talks about half the success of retirement is not just visioning what you’re gonna do. ’cause you could be hugely disappointed if you wait till retirement to do the thing and instead treat your life like a science experiment.

[00:50:14] Joe: And even when you’re in your thirties and forties and fifties, do these things you think you’re gonna wanna do in your sixties and seventies. Try them out so that you see if it’s actually a

[00:50:23] OG: fit. People say like, I can’t wait to retire so I can move to the mountains. Like, okay, cool. What do you like about the mountains?

[00:50:29] OG: Oh, I like the change of weather. Or, I like to snow ski, or I like to cross country ski. Or, I like, you know, the altitude’s better for my, you know, skin or whatever. It’s like, what are you doing right now? Go take a week vacation in the thing that you wanna do. Go do that because you might find out that that sucks.

[00:50:48] OG: Or it’s not as great as you thought, or the price is too high, or guess what? You suck at skiing. That’s what Doug would tell me.

[00:50:55] Joe: Doug would be like, you go way too slow. OG sucks to suck. Well, you’re enjoying it, og. I mean, you’re enjoying it. Doug is not getting his money’s worth. You’re using the whole slope.

[00:51:04] Joe: That’s right.

[00:51:04] OG: Taking your time. Doug does get his money’s worth, honestly, uh, more than I anticipated. I knew that skiing with him would be a little different experience. He was quite the mother hen at different times, but you know, it was okay. I know it’s because he cares for me and wants to, you know, make sure I’m safe.

[00:51:20] OG: Well, before

[00:51:21] Joe: we get into an I Love You man moment, let’s continue with this discussion because Jacob continues og, where you began this piece and really the bigger fear for people that listened to a show like ours, the vast majority of our audience, is this is the opposite risk scaling back too far in that first year and living in preservation mode, which could mean missing out on goals and experiences you could otherwise afford to enjoy.

[00:51:46] Joe: If you don’t have a well-defined plan and you are just paranoid that I’m gonna all of a sudden have that college party, which you would to your point, would never have in a million years because you’re not gonna change overnight, you all of a sudden go into preservation mode. I have a good friend who did the financial independence, retire early, retired before he was 50.

[00:52:07] Joe: He’s totally already in preservation mode. He drives me crazy. He could spend far more money than he spends. His spouse says that he could, they could spend a lot more money and he is just completely in. It. Drives me crazy. No, I can’t afford to do that. I can’t afford to live. I can’t afford to do anything.

[00:52:25] OG: Yeah, I think there are two great crimes when it comes to financial planning and all the publicity goes around the first, which is not saving enough money. You know, and I don’t know the percentages here, but I’m gonna say it’s probably 70% of people. That’s the struggle, right? You gotta save more money to reach your goals, but that’s where everybody focuses and goes, oh, well if I’ve solved that problem, then I’m good.

[00:52:47] OG: Well, the other side of that coin, the other great crime is saving too much money. And it sounds really stupid to say, especially from a person who is, is tasked in his life with convincing people to save money for future goals. But there comes a time when you have too much, you have saved too much money, and it’s time to.

[00:53:05] OG: Do those experiences. And I’m not in charge from a client standpoint in charge of telling you, Joe, hey, you have to consume this money in this way that I see. But when I see you foregoing things as a client, when I see you saying, oh, well we can’t do that because of whatever, or I catch win that you know, you’re not gonna go see the kids during the holidays because the flights are too expensive this time of year.

[00:53:28] OG: Yet I know that you have the resources yet I know that the, the plan is bulletproof and it’s not gonna make a hill of beans a difference whether the flight’s 500 bucks or 700 bucks, you know, it’s just now if you don’t wanna travel ’cause it’s too busy in the holidays, I totally understand that, but don’t tell me it costs too much money when you have the resources.

[00:53:44] OG: To me that’s just a great, uh, crime as not saving enough money. It’s not, it’s not spending enough money or dedicating the resources in the manner in which you can experience, um, a better outcome for the people around you. So it doesn’t mean you have to consume it in the sense of like, I have money. I’m never gonna run out.

[00:54:03] OG: I should buy a Ferrari. That’s not a good use. No. Maybe it could be for you if that were your thing that you’re into, but maybe it’s making sure that you fill up the Toys for Tots bin, you know, at your local ACE hardware this year or something. You know, like whatever it is that is important to you. I don’t want you foregoing those things because of a scarcity mindset.

[00:54:22] OG: But by the same token, you have to have a little bit of that so you don’t blow it all in year one. And maybe that’s just where planning comes in to give you the consumer, the confidence to know that the decision that you’re making is gonna give you the most flexibility in the future.

[00:54:36] Joe: Scott Vandenberg, who is the president of Century Management Echoes something that you said.

[00:54:42] Joe: He calls the first six months of retirement, the victory lap phase, and just, you’re so emotional. You have this euphoria. Research from a gentleman named Ken Dyal says that people have 18 months of this euphoric feeling. And then there’s a reason why people go back to work. Number one is they may need money, but number two is boredom.

[00:55:02] OG: Yeah.

[00:55:02] Joe: People are bored in retirement and once that euphoric feeling goes away and you realize there’s no longer vacation, it’s a whole new

[00:55:09] OG: phase of I’m not on vacation, I don’t have anything to go back to. Yeah. You know, it’s a whole new, I, I better better find some stuff to do. Yeah. Whole new

[00:55:15] Joe: phase of your life.

[00:55:16] Joe: So he advises, oh gee, what you said earlier, but not as a money thing. He just says, take six to 12 months and just feel how you’re feeling, feel how you’re changing before you go make any big, huge purchases or make any big changes the first six months. You know, it’s almost like when a relative dies or you win the lottery.

[00:55:36] Joe: Just, just sit on it. Yeah.

[00:55:38] OG: Just like when you win the lottery, just sit on it.

[00:55:40] Joe: Yeah. We’ll link to this in our show notes at stacky Benjamins dot com. Good discussion at, uh, Kiplinger here. And, uh, nice job here by the author Jacob Sch. Doug, let’s wheel out on the back porch. Maybe re echo what we talked about on, uh, on Monday, if that’s all right with you.

[00:55:56] Joe: Because we got a couple re echo. Yeah. Isn’t that redundant? Re re. It’s T Echo, echo, echo. Again, again, again, again, again. Wait a minute. Isn’t that echo though? Yeah. I didn’t think that through. I guess. Two things on the back porch. Number one is we are getting ready to launch our success sessions in January.

[00:56:18] Joe: Again, these are 10, 90 minute sessions with me and a small group of people. We, once we get to 30 people, we cap it, so it’s gonna be 30 people or less, 10, 90 minute sessions walking through your financial plan from beginning to the end. We use my book Stacked as our teaching tool, and we’ve done this two years in a row.

[00:56:39] Joe: The average person sees a huge lift in their understanding of money and understanding where the holes are in their financial plan. Imagine that it’s the beginning of the second quarter and you know so much more about finance and you know where the holes are in your financial plan. But if the big thing that you need is not to go to stacky Benjamins dot com slash success to join our success sessions, you just already know.

[00:57:04] Joe: You need a team to help push you and move you and do the heavy lifting when it comes to helping you develop the financial plan. Well, OG and his team, OG and Anna and the rest of their team are taking clients head to Stacking Benjamins dot com slash OG for that link. So if you know you need to help Stacking Benjamins dot com slash og, if you wanna dive in with me in a small group, Stacking Benjamins dot com slash success.

[00:57:29] Joe: Our goal for both OG and I is to help you do better next year. And, uh, we’re giving you plenty of ways to get to train on track in the next next season of your life. Make next year better. Speaking of making things better, Doug is going to really take, wow, we went through a lot today. Take a lot of these and help you get more succinct with what the top three things are.

[00:57:53] Joe: You should have learned in today’s episode.

[00:57:55] Doug: Well, Joe first take some advice from Lou Frankfurt. Sometimes an outside perspective is exactly what the marketplace needs, so don’t be afraid to switch careers midstream and the key to success, magic, and logic. Second, focus hard on that first year of retirement, and the rest should be smooth sailing, except don’t buy a boat.

[00:58:17] Doug: But the big lesson I just realized, it’s back to the future. Here in Joe’s mom’s house, this basement looks like the 1970s are alive and well. Brown shag carpeting on the wall. Who does that? Actually, my dad does that. Thanks to the He totally did. Thanks to the legendary coach, CEO, Lou Frankfort for mentoring us today.

[00:58:41] Doug: You’ll find his new memoir, bagman great name. Wherever books are sold. We’ll also include links in our show notes at Stacking Benjamins dot com. This show is the property of SB podcast LLC, copyright 2025 and is created by Joe Saul-Sehy. Joe gets help from a few of our neighborhood friends. You’ll find out about our awesome team at Stacking Benjamins dot com, along with the show notes and how you can find us on YouTube and all the usual social media spots.

[00:59:12] Doug: Come say hello. Oh yeah, and before I go, not only should you not take advice from these nerds, don’t take advice from people you don’t know. This show is for entertainment purposes only. Before making any financial decisions, speak with a real financial advisor. I’m Joe’s Mom’s neighbor, Duggan. We’ll see you next time back here at the Stacking Benjamin Show.

[01:00:30] Joe: We were recording and uh, mom, whenever she runs the mixer upstairs scares Cooper. So Cooper now is sitting right next to us, and as he was running down the stairs while we were spending the 45 seconds of silence, we could do this segment. Doug announced that there is a new member of the Stacky Benjamins family.

[01:00:48] Doug: Everybody. Yeah. We got a new dog to be a companion for our other dog. So we have two, we’ve always had two Dobermans and we lost one of ours, very sadly, uh, back in October. Very abruptly. Unfortunately. That hit you hard. Oh, it hit really hard. Uh, I, we’ve had unfortunately, you know, it’s just part of being a pet owner.

[01:01:10] Doug: You know, when it’s time to go, you have to put ’em down and it’s, it’s a tough thing. When it was Sasha’s time, it happened quickly. She got injured, and when we went to get X-rays, they found cancer and we just had to make a very quick decision. Sure. And it hit us very hard, harder than other dogs that we’ve had to put down.

[01:01:29] Doug: It was just a different attachment we had with her and so, so hard.

[01:01:31] Joe: He got a new one OG a month later.

[01:01:34] Doug: Yeah. Well, I mean, we just, we love dogs and I’ve

[01:01:36] OG: stayed away from even talking about this other than sorry to hear. I have a different level of emotion around animals. He’s not a pet person, I think other people do.

[01:01:46] OG: So.

[01:01:47] Doug: So anyway, we got another rescue, a, a beautiful 10 month old female doberman, and we’re trying to figure out a name for her because the name that she came with, it’s kind of cool, but it, it doesn’t work for us because I don’t know what the story is. So her name was Tulsa and we’re like, it’s kind of cool, but I’ve never even been like, Tulsa.

[01:02:10] Doug: Tulsa. Like, what are we gonna tell, tell people. Tulsa’s a cool

[01:02:12] Joe: town, but you’ve never been. Yeah, I mean, I don’t

[01:02:14] Doug: have a story behind it. They’re gonna be like, why Tulsa? But you have a story. The story is we rescued a dog. I mean, look at, look at how cool that sounds from Tulsa. Oh, so no, the dog’s from the dog is from Holland, Michigan.

[01:02:28] Doug: No, no, no, no,

[01:02:29] OG: no. You’re not hearing me. From Tulsa. From Tulsa.

[01:02:33] Doug: Hello? Problem solved.

[01:02:36] Joe: But you rescued a dog and the dog had the name Tulsa. I mean, that’s nice. So

[01:02:40] Doug: it’s a way, it’s an excuse for me to virtue signal. Like, oh yeah, I’m a dog rescuer. Gee,

[01:02:44] Joe: humble brag. Right, right.

[01:02:46] Doug: Okay.

[01:02:46] Joe: I think on that note, why don’t you just name it 5K so you can say, well, I walked 5K this morning, like every morning.

[01:02:53] Doug: Well, ’cause we’re so committed to our five Ks, we just name it Marathon or, uh, oh, I walked marathon this morning. It was tough. We can name her orphan. Yeah. We save orphans

[01:03:05] OG: from burning buildings. It’s like that, uh, video I saw the other day on YouTube that the person sitting at the coffee shop or whatever and she says, Hey, uh, what’s the wifi password?

[01:03:15] OG: He says, you gotta order a bagel. And she goes, oh, um, cool. I’ll get a, can I get a bagel? He goes like, you wanna order a bagel? She’s like, yeah. He gets a bagel. It out. She’s like, cool, can I get the wifi password? ’cause I already told you it’s, you gotta order a bagel. All caps.

[01:03:33] Joe: That’s where they get you.

Leave a Reply