I’ve partnered with NVestly to discuss my personal account trading. It’s a cool social sharing site for investors. While others can’t see your totals, they CAN follow your trades (and you can follow theirs!). Find out more about how I opened my NVestly social account here and you’ll find my latest trading post here.

Now that I’ve switched to a better oil company in my portfolio, Chevron, I’m actively looking for more ways to go on the attack.

Why?

Wasn’t the market tumbling? It did last week.

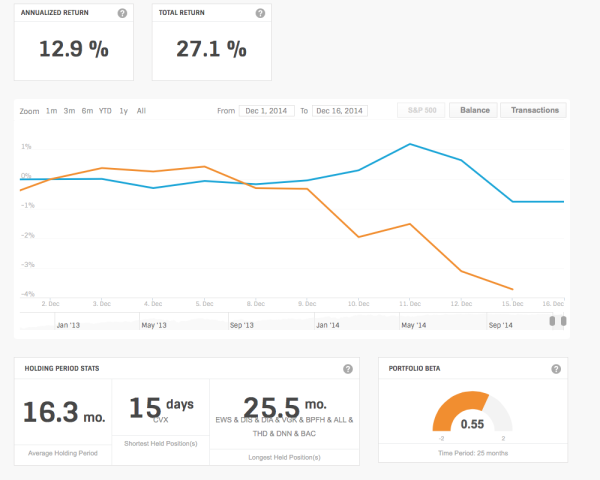

Here’s the NVestly screen showing my results:

Check out how I performed when the market hit the fan….while I’m not making money, my beta of 0.55 is helping me hold on to my money. Now I’m going to ramp up that beta (risk):

Shouldn’t I be afraid of current market conditions? When it comes to the overall market, I am worried. However, in two area I’m looking to move:

– Oil

– Bonds

Why now? As you’ve probably guessed, I’m a contrarian. Any good investment moves I’ve made have happened because I’m always looking to buy when the sheep are selling. I feel no emotion besides “Let’s buy now.”

This isn’t because of my experience as an advisor. I felt this way before I was an advisor, before I knew what I was doing. My nature is to look for value. The first question I enjoy asking is, “Why is this stock in the tank?”

I always recommended to my clients they invest according to their nature. Mine? Whenever things drop I ask, “Is this for me?”

Let’s talk about oil first, because that’s where I’m excited. Right now I’m paying nearly $2 at the pump. Oil prices are low. Can they dip further? Sure they can. Will there be a world without oil? That’ll happen no time soon.

That means I want to buy more oil stocks. First, they pay a nice dividend. Second, they’re all down in the dumps right now, even without the overall market tumble. But should I load up now or just go straight oil ETF? Let’s compare.

The company I currently own, Chevron, looks like this on BigCharts.com:

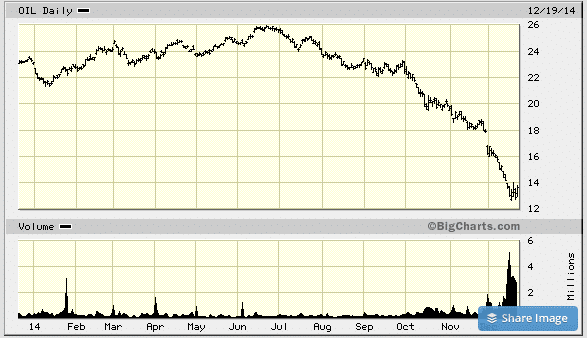

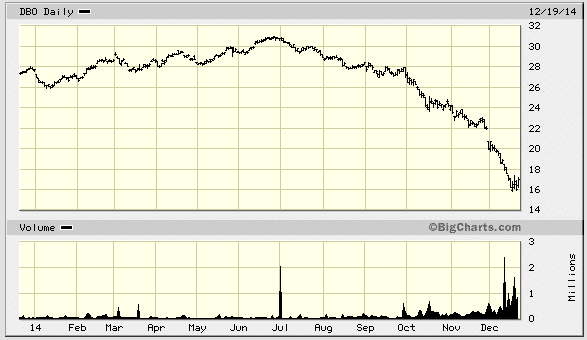

Alternatively, I could buy an ETF that just buys into the oil sector. Do those exist? Absolutely! Let’s look at our choices:

or

There are probably others, but either of these will do just fine for my needs….which brings us to the important question: Where am I going to get the money for this?

Let’s turn to my NVestly platform. I have GNMA bonds in this particular account. Why? The market was high when I had money available and didn’t want to invest it. Plus, bonds had dipped and I thought GNMA bonds were cheap. If you’re unsure of the market and want money on the sideline, I’m a big fan of the GNMA risk/reward proposition. More on that in the future.

For now, I really don’t like the bond market. Janet Yellen and the Fed have made it abundantly clear that the party for bonds is over. For that reason, I sold GNMAs Monday and posted it to my NVestly account:

For this move, I really like Chevron, but it’s already bouncing back while the ETFs aren’t. However, if I dump oil, I won’t have tons of positions all over the place…only one good stock.

Should I Split My Trades In Case Oil Goes Lower?

If I’m reading this, I’m probably wondering if I’m not working hard enough to time oil. It appears oil may go down more in the future. I agree. However, one of my favorite books on trading (called, appropriately, Trading Rules) explains that you shouldn’t bet on the future of the market. Let’s be realistic. We don’t know what the market’s going to do tomorrow. Our little brain will never call the right shot. If I like the price today, why would I wait on an uncertain future? Buy at the market. Sell with limits. Don’t be a pig.

What About Asset Allocation?

I know that this move gives me FAR too much oil, but let’s be realistic. These low prices aren’t going to stay low forever. Even if oil doesn’t return to past levels, there’s still plenty of room for a fairly quick 15-20% upside. That’d be a great six month return, wouldn’t it?

At the end of that period, I’ll need to pare down my exposure to oil and return to my well-diversified approach.

The Case For ETFs

While I love CVX, I’m not excited about the fact that it’s bounced back nicely while oil ETFs are still in the tank. Like me, people think CVX is the place to be….which is great, but my window to buy more closed while the window on ETFs is still wide open. Because of that I’ll buy an ETF.

The only decision now is which to buy. Because they’re ETFs, there’s only one decision for me to make: which one is cheaper? That’s my only criteria….which I love.

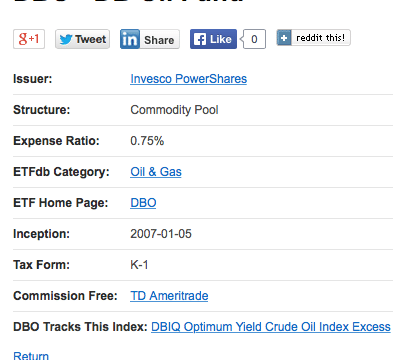

A quick Google search shows me that OIL has an expense ratio of 0.75% while DBO’s expense is also 0.75%.

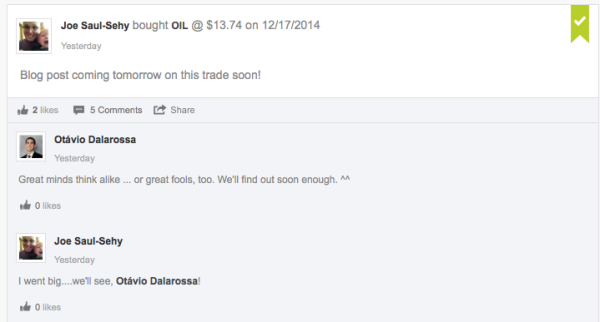

I pulled the trigger on OIL because there should be no difference:

…And Then I Realize….I’m An Idiot

I hate costing myself money. Everything was NOT the same between OIL and DBO. While I was pulling together this article, I noticed this:

Ouch. What a silly mistake. Lesson learned. It didn’t just cost me now….it’ll cost me again when I want to sell.

I shared mine…..have you made any “rookie” mistakes investing lately? Let’s commiserate in the comments!

I went in with you. I like the prospects for OIL, though OPEC is still a wildcard in my mind.

I guess current consensus is that some expensive drillers could get pushed out of business in the next 2-3 months and oil would rebound to reflect lower expected supply. Let’s see what happens…

At some point when you have time would love to hear more about your take on GNMA!

You hit the nail on the head Otavio. Did you see that one billionaire driller has already announced cutting back this morning? Nice call! For you and I, I hope that happens….

I like GNMA as a substitute whenever I’m thinking about government bonds because I get very similar reactions to Fed action and inflation but I also get a higher interest rate and not significantly more risk. GNMA is close enough to the government that I wonder why I’d ever buy a treasury rather than a GNMA…..maybe if I’m REALLY worried? I’ve never found a scenario….