Our mentor today is one of the foremost thinkers and practitioners in the financial planning space. Peter Mallouk joins us to dispel the myth that the stock market is like the stock market, that the bond market is still dangerous (a year later), that AI is coming for our jobs, that you’ll find safety in a savings account, and that gold is a great investment. It’s a dynamic discussion with the man who wrote a financial book with Tony Robbins a few years ago, who owns the Kansas City Royals baseball team, and who is one of the top financial planners in the country.

In our headline segment, we do something we often don’t engage in: philosophy. But today, philosophical discussion meets behavioral finance (much more our strong suit), in a Wall Street Journal piece about passive investing and capitalism. Is passive investing killing the stock market, and then by extension, capitalism? While we probably won’t solve the world’s problems or “fix” the stock market, we will discuss the basics of passive investing (positives and negatives), the problem of (and also the advantages in) not knowing what’s going on with the companies in which you’ve invested, and the importance of diversification, balanced portfolios, and avoiding recency bias.

Of course, Doug shares a trivia question fresh out of Scotland. He’ll use an important marker of today’s date in history (Robert the Bruce’s birthday) to shine the light on one of the most iconic pieces of real estate in the world, Robert’s castle.

Deeper dives with curated links, topics, and discussions are in our newsletter, The 201, available at https://www.stackingbenjamins.com/201

Enjoy!

Our Headlines

- Is Your 401(k) Destroying Capitalism? (Wall Street Journal)

Our TikTok Minute

Watch On Our YouTube Channel:

Peter Mallouk

Big thanks to Peter Mallouk for joining us today. To learn more about Peter, visit Peter Mallouk | President and CEO of Creative Planning. Grab yourself a copy of the book Money, Simplified.

Doug’s Trivia

- What city is Scottish king Robert the Bruce’s castle perched high above?

Better call Saul…Sehy & OG

- Stacker Eric is passionate about helping others with their finances and considering a career change in his late 40s. He has questions about the education/professional experience requirements for the Chartered Financial Consultant (ChFC) designation.

Have a question for the show?

Want more than just the show notes? How about our newsletter with STACKS of related, deeper links?

- Check out The 201, our email that comes with every Monday and Wednesday episode, PLUS a list of more than 19 of the top money lessons Joe’s learned over his own life about money. From credit to cash reserves, and insurance to investing, we’ll tackle all of these. Head to StackingBenjamins.com/the201 to sign up (it’s free and we will never give away your email to others).

Other Mentions

- Watch David Einhorn Says the Markets Are ‘Fundamentally Broken’ – Bloomberg

- Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story, Updated with New Epilogue

Join Us Wednesday!

Tune in on Wednesday when you’ll learn how to make it to where your money can survive a 30-plus year retirement when we’re joined by CPA and CFO of Los Angeles’ Comedy Store, Bob Wheeler.

Written by: Kevin Bailey

Miss our last show? Listen here: Passive Investing: Is Active Investing (finally) Dead? (SB1493)

Episode transcript

Fine. Monday, the last weekend of March. Oh gee. What do you got going on besides uh, doing your taxes? My taxes

are done, bro. What? Done what? Who are you done? Do I know? You done refund in the bank. Already spent like a good American, got a nice fat refund.

I just helping the economy

needed a washer. So I got a couple of them.

I bought

a big screen tv. I made the first three payments on the living room set. That’s right.

And I got a Corvette 0% interest till September.

I took my refund and I bought something with payments. No, not a great idea. You know what is a great idea? Saluting our troops to begin the week. Ah indeed. So raise the mugs gentlemen.

Here’s to the men and women keeping us safe. On behalf of the men and women at Navy Federal Credit Union and the Men and Women Making Podcast in their mom’s basement, let’s all go stacks and Benjamins together, shall we? Thanks everybody.

Cheers.

Hello,

my name is Y,

you killed my father, prepare to Die,

live from Joe’s mom’s basement. It’s the Stacking Benjamin

Show.

I’m Joe’s mom’s neighbor, Doug, and when you want great financial planning, do you start with the myths or the facts here to share some lesser known facts about planning, investing, and your world. We welcome the guy who wrote a financial planning book with Tony Robbins. Owner of the Kansas City Royals and the man behind Creative Planning, Peter Mallouk in our headlines is Your Retirement Plan Destroying Capitalism.

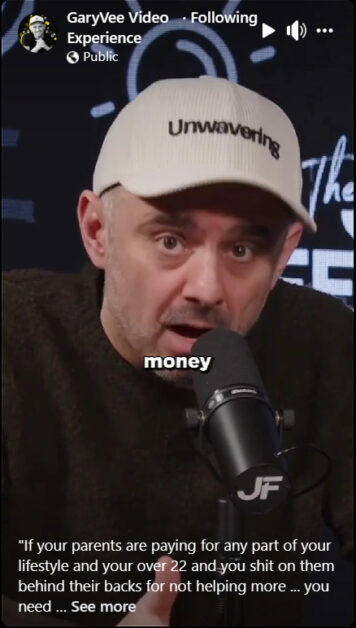

We’ll Talk Passive Investing Your Future, and maybe a smidge about the usage of hyperbole in headlines. Someone outdoing me with hyperbole not in a million years. Oh wait, I can amp that up a little bit. Make that not in a trillion years for our TikTok Minute, some brutal honesty about your financial obligations from one big name influencer.

Plus, we’ll find out who thought, you know, I’d better call Saul. See, hi and og and I’ll also save room for my delicious trivia portion. And now two guys who mom calls the two sides of a coin.

It’s Joe and OG.

Ah, hey there, stackers, and happy Monday to you. Sit back and relax. You found us time for a phenomenal hour of finance and well hanging out with a couple of good looking dudes and the guy across the table and Doug from me, Doug, Mr. Oji,

as we all pointed each

other. Who’s the third one? Who’s not? How are you man?

I’m

just excited to be here. Just, I’m

just so happy you know why you’re excited to be here. You were excited. Let’s, let’s tell the truth. You were excited when we said that Peter Mallouk was coming, and as you know, he’s upstairs talking to mom right now. Pretty swell fellow. That guy is good representative of the personal finance community, Mr.

Malu. And, uh, I think we have to talk to him though seriously about, uh, whether he’s going to cry or not after our, uh, motor City kitties beat up on his Kansas City Royals.

Well, that would be if you’re a Motor City Kitty fan. I live in Dallas, so Oh, I The Rangers

whatever. Rangers. Yuck.

Never heard of ’em.

Ranger. What? That minor league team you’ve got down there. Well,

I, I’d say of the two last year, I think the Rangers might have done a little better. We’ve got, uh, Peter Mallouk fantastic show today. Uh, uh, wow. Big headline to, it’s, we’re exploding at the seams, but speaking of exploding, I heard OG that you had some good Mexican food last week.

Tell us that story.

I promised myself I’d never go back to Taco Bell, but there I was needing fourth meal.

That’s how you found out what the beef really was.

Yeah. I mean, if you dip it in the nacho sauce, it kind of all tastes the same at that point. So it’s really quite surprising how many of those things you can put down.

That

was three days ago and you still

haven’t eaten. Don’t need to. Yeah, it’s like a week’s worth of tacos. It’s amazing. So why we should

talk to Angelo Polley about that diet? Have you heard of the Taco Bell once a week? Diet Peter Mallouk coming down to the basement. But first, big, big, big headline. Hello Darlings.

And now it’s time for your favorite part of the show, our Stacking Benjamins headlines. Our headline today comes to us from the Wall Street Journal. This is, uh, a little disturbing written by Spencer Jacob. Former guest on the show is your 401k destroying capitalism. There’s a big headline. OG is your 401k.

Just are, are, are you trying to destroy capitalism with your 401k

trying to participate in capitalism by

401k? Well, let’s see what he’s actually talking about here. ’cause it does, he does raise some interesting points. A respected Wall Street strategists was lambasted when he wrote in 2016. The index funds are, quote, worse than Marxism.

No, Lenin won’t be plundering your 401k. But serious people are again pointing to what they say are the hazards of retirement funds on autopilot for America’s savers and maybe even for markets themself. The reason people such as hedge fund manager David Einhorn are sunning the alarm isn’t just the relentless rise of the AI inspired magnificent Seven now collectively more valuable than any foreign stock market, but the huge sums being plowed into stocks and bonds with regard only to price, not value.

Basically what he’s saying here, OG, is a couple things. Number one is. People don’t know what they’re doing. They don’t understand how the fund works. They put money into these stocks without any regard for the stock market or what it is. It’s just, Hey, this is what I do. And they go passive because they’ve heard that it’s very difficult for a fund manager to beat an index.

Or worse they go into a target day fund just ’cause they don’t care. And so now you have all these people investing in these companies that don’t care. And the stock market arguably is the heart of capitalism.

I’m failing to see why this is a problem. This is exactly what we hope people do, right? Just put money in, let it sit there.

Don’t try to discern what, what you know. Is Ford gonna do better than gm Just. Let her buy one of everything and let it ride for 60 years. That’s the play nowadays,

isn’t it? Yeah, I was, I was really trying to listen carefully as you took us through the beginning of that. Joe and I didn’t hear the downside of this yet, so that could have just been me going get another cup of coffee, but I didn’t catch

it.

I think what Einhorn is saying is two separate things. Number one is that when you’re buying a stock, you’re buying it because you think that it is a good deal, that the stock is, is worth the price that it’s worth On paper. I don’t know that there’s a lot of people out there who look at Nvidia today. I.

And go, I believe that stock is worth that amount of money. But there’s more money now plugging into Nvidia, increasing amounts of money plugging into Nvidia. Because when you, when you put money into an index fund, it goes into each of the stocks inside of that fund by proportion of market share. And because more and more people are going passive, Nvidia becomes bigger and bigger and bigger and bigger.

And I’m just using one company. You could say the same for Microsoft. Yeah, I get it. You know, he talks about the Magnificent seven. So now what you have is instead of a capitalist approach of good companies win, bad companies lose. You have an approach of we don’t care who wins or loses. I’m just going passive, which ends up meaning that you end up with and, and by the way, there’s another side of this, which is increasingly, there’s a few companies, Vanguard, BlackRock, fidelity, and a few others that control more and more the voting interest Now.

Around these companies. So if Vanguard decided to, Vanguard could decide, Hey, you know, we’re gonna vote for a board of directors that we like, we’re gonna vote out people we don’t like, we’re gonna, and once again, the, the democracy around the stock market begins to also go away because we’re increasingly passive.

I’ve heard

that as a major issue or projected major issue, I should say, as it relates to the shareholder voting. I, I suspect that the SAC is thinking about that and trying to figure out ways around that. I mean, like right now, for example, you know, obviously if you own a share of stock, you get to vote in that, uh, shareholder vote, and you get a, you get a letter every year when there’s a vote that comes out.

I’m not aware that that happens in ETFs, although I suspect that that’s on the table to kind of help offset some of that liability that you’re talking about there. I can also see what you’re saying around. Blindly investing in, in an index that’s all focused on growth or something like that, is really not rewarding any of the stocks that are particularly doing well, but rather just a whole sector.

But again, I just go back to the whole idea of passive investing is to not have to try to pick the winners in advance. And if you’re not a professional investor and hell, even professional investors, can’t do it 50 50, why would you want to do anything other than that? And I don’t, I don’t know that there’s, I don’t know that that becomes a problem because inside of the indexes, inside of the things that the ETFs are modeled after is self-cleaning because those things will clean themselves if they’re not.

You know, doing well, the individual positions that is, you know, SAP replaced the stuff. Dow Jones replaced

the stuff, whatever. It’s funny, a piece of this, and I’ll link to it in the show notes for people that wanna dive even deeper, but, uh, a piece of this, Spencer Jacob points at David Einhorn, one of the people raising this alarm and saying, isn’t this just sour grapes?

Because Einhorn’s having trouble beating the market or keeping up with the market, and Einhorn saying quote, the market is broken. Sounds like it could be an excuse for I’m not performing well, because we’re, we’re so focused on these stocks, and I, you wrote a

great book some years ago called Fooling Some of the People all of the time.

It’s probably one of my more favorite finance books that I’ve ever read. Ihorn did, yeah. At the time, and I certainly don’t know how his, his hedge fund is managed now, but at the time he was decidedly a short seller. He wasn’t trying to find companies that were gonna be successful. He was trying to find ones that were failing but hadn’t figured it out yet.

And the book. Which was based on a, a, an event that he went through doing, trying to prove that this company was full of crap, almost bankrupted him and his firm because he was so certain that this position was gonna go down, that he, he bet a lot on it. So, you know, if he’s still a short seller, if he’s still trying to wait for the market to go down, then uh, you know, throwing some fire in the, uh, the market sucks.

Camp certainly does help his cause for sure.

Does it bother you at all, OG that increasingly, let’s go back to these seven stocks that increasingly when somebody thinks they’re buying an index, let’s take the s and p 500, you think you’re buying s and p 500. A huge part of that is just a few companies.

You’re truly not getting the 500 companies that you think you’re getting as much as you’re getting just a concentrated view. And one thing this piece, uh, talks about is when that day a reckoning comes because people in target date funds, for example, and blind indexers don’t have any idea what the mechanisms are and why.

The market would go down, they’re likely then to get off at the wrong time. They’re gonna get off the rollercoaster at the wrong time. ’cause they’re like, whoa, what happened? Because man, the second Nvidia or Microsoft start falling, you’re gonna see your s and p 500, uh, fund go, go down by uh, big amount with it.

Well, and that’s one of the big problems with indexing that people don’t realize is that the purpose of an index fund is not to do anything other than perform exactly as the index does. And they have a metric for that. It’s called tracking error. And the whole idea is how far off of the actual index is your ETF that’s supposed to model the index.

So they try to get as close as they can to the exact outcome. You know, whether you’re Fidelity or BlackRock or you know, Vanguard or whatever you want your ETF to be exact, as close as possible to the exact s and p representation or the Russell or whatever your thing is so that you can say that, Hey, we track the index exactly perfectly.

Inside of that, you don’t actually care. And if you’re a fund manager of that ETF, you don’t care because you don’t care whether it goes up or down. You just care whether or not your fund exactly matches it. Obviously there’s a big concern if you’re not paying attention to the weightings of the positions within there.

And I don’t have the latest data, but I do know that at one point in time it was close to 50% of the s and p waiting was basically the top 10, and then the other 50% was the other 486, give or take, you know? So, but that’s also a representation of how the economy is and the representation of how the, the stock market is.

So you, you get one side, you get the other. I do find it a little concerning that there hasn’t been a, a real long term recession that people have had to go through. You know, in the last probably 15, 16 years, we’ve had a couple, certainly we’ve had some, covid was a stock market recession by the term.

There was obviously a small recession in 2022 by the term of the stock market going down. But it was so short and such a quick whiplash back to even money that you just had to really just not pay attention for a period of time and, and it was fine. I’m not begging for a market to go down the way. Where are you going

with this man?

Yeah. But there is an evening out that we need, I mean, we look at large cap stocks. Yeah. At the expense of everything else has been increasingly the place to be. And you’re seeing investors get rid of their international, get rid of their small cap value, get rid of their, their diversified positions, because baby, this is a rocket ship and I wanna be on the rocket ship.

And there’s a reckoning to be paid later for that. I think that’s where

I was going. I, I, I don’t think that there’s so much of a recession coming. Not that anybody could predict it anyway, but much more of a likelihood of, uh, transition to other sectors of the market that are gonna outperform the other, the, the current winning sectors.

You know, if you look back over the last 10 or 12 years and you see the s and p or you see what’s done really well, it’s the nasdaq, it’s the tech companies, it’s the high growth oriented stocks. And if you’ve been an investor in those things. To your point, you’re riding the wave, you’re like, this is the easiest thing in the world.

You know, I just dump money in and a year later it’s doubled. Like, how hard is this? But the reality is, is that over long periods of time, when you look at data, you see that statistically small companies should outperform big companies. You see that value companies, companies have been around a long time, should outperform tech companies and they’re not recently.

And the disparity between those is widening every single day. So the question is, is is this the quote new normal and there’s never gonna be small companies again that are successful or value companies again, that are successful international companies again, that are successful. Or is there going to be the pendulums shift the other way where the lusters off the, the high flying growth companies and it and it transitions back to the other side of the economy, real estate and value and small and international and that sort of thing.

And I think that’s really likely. There was an article, Larry Swed Row wrote, I think. It was him recently, very recently, within the last couple of weeks, if we can find it, we’ll put it in the 2 0 1. That was about the same topic, that people are just abandoning international investing and they’re aban, you know, they’re just running away from small company investing and value because of the reason you’re talking about, like, I’m losing ground by not being in all tech.

And the reality is, is that you need to be diversified because you don’t know when that’s gonna turn. And here’s the great thing about diversification. You get all the returns of all the stocks all the time. It just comes in random order. You know, if you have all tech stocks, you get the ups and the downs, right?

If you have some tech stocks at some value stocks, the value stocks eventually will do well, and then they won’t do as well. And then they’ll do well, they’ll be, you know, a different rollercoaster. But you get all the return, you get all of it, you just have to hold it longer. You know, it’s, it’s not, it’s not a day trade.

So I think that that’s probably much more likely than, than a big. Giant long-term, 2007, 2009 recession type thing. But, but even so, when it happens, it’ll feel pretty crappy. Here’s an interesting thing. Since 2021, you know, stock market went up, it went down in 22, came back in 23, it’s on a tear right now, the market is actually only 10% higher since 2021.

It feels way more than that because of how 2022 went, and then how quickly it’s risen since the late summer of 23. But the reality is, is that it’s still only 10 or 11% higher in two and a half years. That’s, that’s

not a lot. There’s a few takeaways here. I think number one, this is why when you start out worry about putting money in, there’s a whole piece of this about young people getting into target date funds.

I don’t understand it, og, just by the total stock market, stay with the stock market, it’s a great place to be long term. It’s gonna go up and down. And if you use the total stock market index, you’re gonna get small, you’re gonna get mid, you’re gonna get big, you’re gonna get international companies, you’re gonna get a lot of different things.

But then I totally agree with what Nick Majuli says, which is when your swings over a week, a month, whatever period, matter more than the amount you’re putting in it, then I think you need to look at the efficient frontier and you need to get your butt diversified because of the risk OG that you’re talking about, that you’re under diversified, right?

Then there is significant risk that you’re not doing it right when those swings become bigger. And then the third thing is. And I like what Spencer Jacob says here. He says, it also doesn’t help if millions of Americans preemptively shift their holdings to actively manage funds. Go, oh, you’re right. This is a problem.

I gotta go to actively do not do that. And he says, because of the expenses, the uh, uh, active managers just mimicking the index anyway, just trying to keep up so they keep their job. That’s a whole nother episode of this show. Three things I think that we wanna be, be vigilant about. Time for our TikTok minute.

This is the part of the show where we shine a light on a TikTok creator. And today we got a big one. I think that a lot of people know og. It is a, uh, TikTok creator who is either doing something brilliant or air quotes brilliant. And I am going to you og uh, OGs presence. No, I said,

isn’t me? You said a big giant TikTok influencer.

Probably not. Oh, but I will. Well, actually, you know what? Let’s go to Doug. Doug, uh, Doug. You think this can be brilliant or air quotes brilliant.

What’s lower than air quotes? Dumpster Fire. Brilliant. Dumpster Fire.

Brilliant.

Yeah, that’s where I’m going with this. That’s just a vibe I’m getting right now at six 30 in the morning Pacific time.

That’s kind of the vibe I’m getting.

I think that

you’re, uh, it’s specific time. Yes. Specific time specifics. Specific time specific, specifically six 30 where you are. Get it right.

Uh, this is, this, this could be a dumpster fire if you are in your twenties, maybe your early twenties, and you are, or maybe even in high school, and you’re hanging out with us and, and your parents are in the car because a guy named Gary Vanerchuk has some choice words for, uh, what you can think about spending in the house that you live in if you’re living with your parents.

If you take money from your parents and you are over the age of 22, get their names out of your mouth in any negative form. Kiss the ground. They walk on, shut your mouth. You don’t want them to have say, stop taking the bag. Mm-Hmm. Whoever pays for something has say you don’t want your parents to have say stop taking the money and don’t do it.

Cute. Like, let them still pay for your Uber. ’cause it’s on their credit card. Uber, their cell phone. Yeah. Or you’re on the family plan. Get the fuck off. The family

plan. Is

Netflix okay? No.

Okay. Not even the shared password, even though they shuts that down. Good job. Netflix

attention. Steve had fun beeping that out, but I think everybody got the, got the point

of that.

My hero, Ron, you come out with stink like that. Fucking poop. My, did I poop my ear man?

Course.

A lot of parents though. I think OG nodding their head on that one. Mm, preach. And by the way, a lot of people over the age of 22 should be nodding their head.

Yeah. I couldn’t have been more wrong on that one. My prediction for dumpster fire was, it was the opposite.

I dunno what the opposite of that is, but it was, it was like angels singing,

have accountability. Literally, the day after I graduated high school, I was sleeping in a tent in my backyard. No joke. I was joking. Your choice. Or dad’s the night that I graduated high school. Was that your choice or dad? I was sleeping in a tent.

Well, it was unrelated to the whole, it was just kind of how the party went. But, but I, but I do think that the, the, the synergy and two days after that, I was still sleeping in the tent and I went to the bootcamp and my dad’s parting words at four in the morning as he went to work was he kicked the tent and kicked my feet.

And he goes, Hey, keep your head down. That was it. That was the parting logic of See Ya on the other side, kid. Wow. Basically.

Did they give you raw hides to eat for breakfast? Is that how tough your childhood was?

It was different than others. I assure you it’s different than my kids are getting. That’s for damn sure.

Thanks to Kevin for sending that to us. If you’ve got, uh, a piece you’d like us to take a look at, send those to me, joe stacky Benjamins dot com and uh, by the way, you can see that and maybe send it to your loved ones. Maybe some kids that need to see it by kids being anybody over 22, stop taking who is on your family

plan.

Stop taking the bag. I like that.

I like that. Uh, we’ll have that in the 2 0 1 newsletter. Stacking Benjamins uh.com/ 2 0 1. Signs you up. Comes out every Tuesday, Thursday, always chock full of links. Interesting stories always starts by the way, with the story, which is just in a bunch of numbers, some very simple facts.

We call it the four one one. And it’s funny you put this list of about 10 to 15. Statistics together, and they form these stories much, much longer than those 10 to 15 lines. Alright, coming up next man, Peter Mallouk is a man who not only runs one of the biggest financial planning shops in the nation called Creative Planning.

He also is a part owner of a little baseball team called the Kansas City Royals. He also, in his spare time co-wrote a book a few years ago with this guy named Tony Robbins, who a few people might know and much bigger highlight. He’s coming on the Stacking Benjamin Show. Right. Uh, here in just a second.

But to get us there, Doug, uh, you’ve got some work to do first, my friend. Sure do. Joe.

Hey there, stackers. I’m Joe’s mom’s neighbor, Duggan on today’s date in 1306. Robert, the Bruce was crowned King of Scotland only moments after Joe was born. Oh God. True

story.

I’m right here. I’m just fitting facts. The Bruce was a guy ahead of his time realizing that letting Mel Gibson reprise the story of William Wallace’s life might be a better fit.

Although at the time the film Braveheart was made, I’ll bet the Bruce thought he’d made a huge mistake, but I don’t know. I don’t think it was only Gibson who got drunk and made bad decisions. I mean, this guy’s mom named him Robert the Bruce, who chooses a name like that. Just pick one lady. But instead of the Bruce the king could have been called Robert the good real estate developer.

His castle handed down to him by prior royalty, was on a hill above one city where real estate prices are pretty high. Here’s today’s question. What city is the Bruce’s castle? Perched high above and I’ll save you some time. No, it’s not Newark, New Jersey. I’ll be back with the answer right after I go, reconsider this kilt might be allergic to wolf.

Don’t ask me how I know.

Hey there,

stackers. I’m wool scratcher, an accidental kilt flasher. Joe’s mom’s neighbor, Doug. Hey, three words, not intentional and also sincere apologies and regrets to Joe’s mom. Our question today was about Robert, the Bruce and his castle on a volcanic rock high above some city in Scotland. If you go, the castle gets high marks from guests.

One said that you can see the crown jewels and they’re really nice. Funny. That’s what I accidentally showed Joe’s mom under this kilt too far. Okay, then tough crowd. Let’s get you a trivia answer. The castle on cleverly named Castle Rock also has a cryptic moniker. It’s called Edinburgh Castle. Named after the very city where it sits.

And now let’s say hello to today’s mentor owner of the Kansas City Royals baseball team and financial planner, Peter Mallouk.

I’m super happy he’s joining us at the card table. Peter Mallouk is here. Peter, thanks for joining us. Yeah, it’s great to be with you, Joe. Okay, I gotta start off with a hard hitting question right here.

How disappointed is your whole Kansas City Royals organization gonna be When my Detroit Tigers beat ’em this summer, that’s

The royals look a lot better than they did last year, but it’s gonna be, uh, it looks like we still have some challenges ahead of us.

For people that aren’t baseball fans. I want you to just, excuse me for a minute, maybe fast forward one or two minutes, but Peter, the, the whole division, my tigers, the white stocks, you guys actually picked up one of our hometown heroes and I’m friends with his parents.

You guys have Michael Waka pitching for you this uh, this summer?

Yeah. We made some good moves. I feel pretty good about it. Yeah.

I only feel bad that you’re in the same division as the Tigers. That’s right. That’s, that’s the bad part.

I still have memories growing up of Kirk Gibson and, uh, just, uh, taking it to town on us.

I don’t even think we were in the same division at

the time. We were both in the American League. I was gonna say back at you at George Brett, right? Yeah. Gee, holy cow. And all the great, great, uh, Kansas City Royals. I wanna start here. When it comes to investing, I mean, we’re invested emotionally in our baseball team, so we invest real money.

I’m gonna ask you about gambling. Uh, do you go to Vegas? Do you gamble much?

I. I go to Vegas, but I don’t gamble

much. Yeah, me too. I like kind of the shows. The reason I ask that you have a page in your book listing the returns for various table games. Craps 48.6% Chance of winning Blackjack, 48% slots down at 40.

And don’t get me started on Keynote, less than 25%. Why do we always hear, you know, I’ve been doing this for a long time, you’ve certainly been doing this for a long time, Peter. We hear people consistently talk about playing the stock market as if we’re playing one of these table games in Vegas. Why does that persist when people like you?

And I know that’s simply not true.

I think people look at the stock market and they hear, oh, it goes up and down and it depends when you get in what your outcome is. And it does go up and down, but it really, it is going up with intermittent down periods, right? So yeah, every year on average, the stock market goes down.

10 to 14% at some point during the year. We call that a correction. Every few years, maybe three to five, there’s a bear market of 20% drop or more. We call, you know, call that a bear market. Covid 2008, 9, 9 11 tech bubble, all bear markets. So we think, oh, up and down. But if we look at the long history of the stock market, all of these have been pauses in an upward climb.

And the stock market’s the reverse of all the games you were just talking about, Joe, like the longer you play blackjack, the more likely you are to lose. If you go to Vegas and you crush it at blackjack, you win tons of money. The hotel doesn’t say, oh my God, Joe, don’t come back. We’re so scared of you.

They’ll give you free plane tickets. They’ll give you free meals. The buffet, they’ll give you some show tickets, free hotel. ’cause they know the longer you play, the more likely you are to lose. They’re the house and the longer you play, the odds are in their favor with the stock market. The investor is the house.

The longer you play, the odds move in your favors. If you’re in diversified portfolio stocks for one year. The odds you’re gonna have a positive return or 75%. But if it’s just one day, it’s pretty close to 50 50. Any given day it’s a toss up, but you stick around for a year, your odds go up to 75%. You stick around for three years, it’s 93%.

Stick around for 20 years. It’s a hundred percent. So the longer you play, the more likely you are to win. It doesn’t just go up and down, the odds move in your favor, you know, over time.

So it seems like, you know, we should be invested investing for the long term. And yet you don’t start there with your new book, money simplified.

You start on, begin with your goals. Why the attention to my particular goals versus just buy that and hold it for 15, 20, 25 years. So let’s say

that I am retiring next year and I need to have a certain amount of money every year. Well, we know the stock market of the next year might be negative, maybe over two years.

It’s negative. Well, what are we gonna do? Are we gonna sell stocks at a loss? We wouldn’t wanna do that. Maybe that’s why we own bonds or have something else that’s gonna be readily available no matter what’s going on in the world. So we’re not at the mercy of whatever the next bear market or correction is.

So we spend all this time accumulating our wealth. Tens of thousands of hours. Takes about two hours to do a basic financial plan of, Hey, here’s the stuff I own and that produces money income to me, and here’s the money I need to live in retirement. I’m getting some of that money from other things. Maybe a rental property, maybe a social security.

What’s the difference and, and how do I invest to make up the difference? So taking that moment, just pause and go, where am I? What am I trying to do? Then investing much more likely to get the outcome you want. You’re much less likely to panic if I’m retired and covid happens the next day, the stock market goes down 34%, really fast.

The biggest 34% drop in history. If I had a plan, I, I had enough bonds that I was, you know, I had a place to go to for my money, whether it took six months or six years. And that’s why you want to have a plan in advance. You’re not at the mercy of

the markets. It, it’s less than Peter about huge returns than it is about just not being disappointed.

Your money’s where it is when you

need it. Yeah. I mean, there’s money we need tomorrow. There’s money we need over the next couple years. There’s money we need 10 years from now, and there’s money we need more than 10 years from now. And the way you’re invested should match that. It should be tied back to you if the goal is just to get the best returns possible.

No cash, no bonds, you know, all stocks all the time. Or, or other investments like stocks where you’re an owner and you accept. Markets going up and down 50% every now and then, but real people have real income needs and they don’t wanna be withdrawing or can’t withdraw from a portfolio if it’s cut in half because of a tech bubble or nine 11.

So you really have to take the time to make sure that the investments match what you’re trying to

accomplish. Boy, that brings up two things. Number one is you mentioned bonds, and last summer, Peter, you wrote that the bond market was in a dangerous place then. So I guess my first question is, what, nine, 10 months after the book has come out, are we still in a dangerous place for bonds?

And then B, really how do we look at the bond market if we’re an investor?

You know, it’s interesting because the long-term bond market really got crushed. Right. You know? Right. Right after that. Mm-hmm. As rates increased. And what’s dangerous is when interest rates are very low. If you have a bond that is very long, 10, 20, 30 years, and interest rates go up just a little bit, the value of that bond goes down a lot.

I like where the bond market’s at today. Much, much better. Yields have doubled. So if you buy a bond, you actually get paid something maybe over four or 5% instead of one or 2%. And we don’t expect rates to rise, or at least not substantively rise. So I think bonds are much more attractive for people that need to have them in their portfolio today.

I know you’re not a huge fan of lots of bonds in your portfolio if you’re a long-term investor, but I know even more than that. You’ve got a whole few pages about how cash is not king is your, is your title. Cash is not king. And you see people, Peter, when they get worried. And I think where I wanna go next is all the things people are worried about right now.

People get worried, they go to cash. Why don’t you like cash? Even with interest rates, you know, if you’ve got a good money market, high yield savings account, you’re just less than 5% right now as we record

this, right? Well, after taxes, you’re getting three point something percent, which is inflation, right?

So you’re, you’re getting really nothing at best. You’re breaking even if the price of everything around you is going up almost 4% a year and after taxes, you’re getting 4% a year. You’re making no progress, uh, whatsoever. And what we, what we need is even someone who’s retired, they’ve got decades left, that that money needs to last.

And if you fast forward 10, 20 years, it people are gonna be stunned how much more things cost inflation can really sneak up on you. Now, we’ve had very high inflation over the last few years. Inflation’s

not sneaking up on anybody right now. Right, right. Six to 12%. Right. Isn’t it weird though, Peter, how different that is?

I mean, three years ago, four years ago, if you and I were having a conversation about inflation, our whole audience would be asleep right now. Right. ’cause it does sneak up on you. But right now, just one trip to the grocery store and you know

That’s right. And I mean, you know, we fast forward 15 years, everything costs double.

And so you have to have a portfolio that can still buy those things. We have to have things that stay ahead of inflation, stocks, real estate investments like that. Cash is almost guaranteed to not accomplish that. It’s dangerous, it sounds safe, but what we really want is to ensure our ability to purchase things going forward.

So people get cash going, oh, it’s paying pretty good. I can, I can buy things. It’s not gonna go down. It feels safe, but it’s actually dangerous because your purchasing power is getting eroded every year. You wake up 15 years from now and go, oh my God, I had too much in cash and my portfolio can’t keep up with my needs anymore.

I was laughing as you were speaking for people watching the video of this, because I thought of this phrase I heard recently about people in cash, which is very safely achieving

nothing,

right? That’s exactly correct. That’s exactly correct. Very safely, right? Not going anywhere. Yeah. I mentioned all the things people worry about and this is the reason I think a lot of times people think they are safer in cash.

I wanna go over some of the current worries that we have, Peter, because I know you address many of these. One question you address in your book is, what are we gonna do with all these baby boomers? Peter, we look at the aging, not just of America, but aging around the world, right? I mean, we look at the Chinese economy and what’s going on there.

There’s a lot to worry about with so many people aging. One

of the things is the mythology about the aging American, and actually we have a lot more younger people than people think. The most recent census showed our population’s actually growing. Setting aside the p political parts of immigration, even if we just said legal immigration, America could bring in any age group they want.

It’s an advantage we have over say China. You know, if China said, Hey, we’re gonna immigrate people that are 20 to, to 40, I mean, people are not gonna sign up If the United States said they were gonna do that, they’d have millions and millions and millions of people raising their hands that are great and that would be able to contribute on day one, nurses and so on.

And so the United States does not really have it. The demographic problem people think, nor does the world. If you look at most of Asia, India, Africa, the populations are growing. We are very focused on Western Europe and China, but that’s not the world. The United States and the other four or 5 billion people outside of those areas are doing just fine demographically.

So I think that’s a, it’s a, a story that’s very, it’s very fear based and it’s not based on facts.

Well, let’s keep the fear going. Let’s, let’s keep fearmongering here. Peter, we saw the Hollywood Rider strike last summer, right? Yeah. And one of the big issues on the rider strike between management and writers was the role of ai, right?

And now we see ai, we see self-driving vehicles. You hear this all the time, Peter. AI is coming for our jobs. What do you think is an investor when you hear that?

Well, I think AI is coming for some jobs. I think we’re gonna go to a fast food place and AI will take your order and AI will recommend something else, and AI will be involved in prepping it and handling the payment.

I mean, that really is coming. But what we’ve seen throughout history is as we’ve seen technological advances, everyone worries about unemployment going up. It’s been the opposite. So look, I mean, look at the last 50 years you had the, the internet, the tech revolution and unemployment has gone down. The average person’s job has become more high quality.

It’s become less manufacturing oriented and more service oriented. Now, that doesn’t mean there’s not pockets of suffering. There certainly are. So if you take the industrial belt, they suffered because of it. And they don’t care that there’s a whole bunch of wonderful jobs in the West coast because, you know, we had all these new tech jobs and we lost a lot of industrial jobs as a whole.

Though unemployment tends to go down, quality of life tends to go up.

You have a great graphic, I mean this, this whole book has graphics, but a great graphic about how it’s less money than ever to afford those things that are kind of on Maslow’s hierarchy of needs. So things that you really need. And that’s a powerful point.

Yeah, I mean, it wa wasn’t that long ago, almost all of our paycheck went to putting a roof over our head, food on the table and having clothes. And over the last 50 years, more than the previous 10,000 years combined, we’ve seen that compress. I. And so discretionary spending has rocketed. We’ve got more money to go on road trips and go on vacations and, uh, go to a concert or a sporting event and do it by an iPhone and all these things that would’ve been considered luxuries 30, 40, or a hundred years ago and more, for sure.

The necessities is taking such a small part of our paycheck because it’s so, so much more efficient to get clothing and food and so on. And so the quality of life of the average person on earth has gone up very, very subsequently over the last 50 years.

What about home affordability though? You know, you look at, uh, some of these numbers that show that before covid, the average house in America, 260,000.

After Covid, now we’re looking at over 400,000. I feel like if I’m a, a young person outta college right now listening to as Peter, I don’t know when the hell I’m gonna buy a home. Is that gonna drive some fear?

So I think that while if we look over decades, we’re spending less on a home than we ever have.

We are in a, a period of an anomaly. Now, over the last couple years, it will look like a blip on a chart many decades from now. That’s not reassuring at all to younger people, uh, that are coming into the market trying to buy a home. But from a very big picture standpoint, housing has become more affordable if you look at this decade versus 50 years ago and so on.

But we do have a mini crisis happening right now, and interest rates rose so fast. Mortgage rates rose so fast that the cost of a monthly payment has almost doubled from where it was 18 months ago. Making housing unaffordable. We also saw not enough homes being built, and we have got a confluence of factors, not just the supply chain after covid, and not just that a lot of homes weren’t built.

And then you also have mortgage rates going up. We’re gonna see this soften as time goes down, interest rates are gonna come down, boomers are gonna sell. The generation below them is smaller. You’ll have people are building more. It will eventually solve, and we have to get the institutionalization out of this.

We’ve gotta get the big private firms that are running around buying small houses and running ’em out out of the picture too. It will eventually solve itself, but right now we’re in the middle of a real housing. I’m gonna use the word crisis, but significant problem.

Well, well, I love when you called it mini crisis because one big point you make is that there’s always a mini crisis, Peter, no matter what time period we’re in, a lot of us focus on the mini crisis, and that, of course, is built into CNBC.

It’s built into Fox business. It’s built into this daily news cycle, and you’ve got this great phrase, you say that, I don’t have it in front of me, but something about the financial media is a fiduciary for somebody, but not you.

That’s right. And look, I’m on the financial television a lot, but the reality is they don’t wake up in the morning and say, Hey, our mission as an organization is to educate people.

There’s no pep talk happening in the newsroom. That’s not what they do. They are all parts of publicly traded companies. Almost every newspaper we’re reading and every TV show that we’re watching, CBCA, B-C-N-B-N-B-C-M-S-N-B-C-C-N-N, Fox Business, all of them, part of publicly traded company. A publicly traded company team has an obligation to maximize the wealth of their shareholders.

They have a fiduciary duty to their shareholders. So the people that own the stock of that company now, how do they make money, their, their duties to make as much money as possible for them? How do they do that? They sell advertising. It’s not by making news, it’s by selling advertising. How do you sell advertising?

You gotta get people to watch for very long periods of time. Now, if you turn into TV and they go, Hey, look, everything’s pretty good. You, you’re living in the best time in history, technological innovation, everything’s going great. You know, check in next year. That’s not how it works, right? That’s why we get the ticking clock in the bottom right hand of the corner and the world’s always going to end and it makes people, you know, tense and nervous.

There’s was research out it from 2K state professors, maybe five or 10 years ago that showed that people that watch financial media actually had health issues, became more stressed out and underperformed, uh, the markets. And I think that’s a trend. Uh, and the more you can get away from the day-to-day drumbeat of the news, not just financial, the

better.

I thought after reading your book, Peter, that I needed to have across the video screen breaking news, Peter Mallouk on Stacking. Benjamins. Like just have, have. I love it. Have that on. There’s one big thing. One more worry I want to go over that I know a lot of our stackers are worried about as we record this, we just found out that Nikki Haley dropped out of the, the race, meaning that this year’s election is Donald Trump and you have the Never Trumpers on one side, can’t have that person as president.

And then we have Joe Biden, who the other half of America says he’s two old. So we have this leadership crisis everyone’s worried about. And every election year I feel like we get all worried. Where do you stand on the election and investing?

Well, I mean the election, like most Americans, it’s just depressing to me.

But when it comes to investing, I separate the two pretty substantively. So I look at, I remember when President Obama won. I took a call from a client that thought the world was gonna end, wanted to go to cash. Unfortunately, she did. I couldn’t talk her out of it. Huge mistake. Market rallied very, very big.

Uh, Donald Trump won. I took a call from a gentleman that very wealthy person, world’s gonna end, went to cash. First time. I think in history that the stock market went up every month for 12 months. The market tends to go up and to the right, especially over four year periods. No matter who is in office, Republican or Democrat, doesn’t matter who controls Congress, the stock market is not blue or red.

It’s very much green. All it cares about is dollar bills, and it wants to see future earnings. And I think the way to really bring this home for your listeners is no matter who wins, are you going to still go out to eat? Still gonna go to Chipotle, McDonald’s, wherever it is you go. Are you still maybe gonna take your kids to Disney World if they’re the Disney World eight, are you still gonna go on a vacation?

Uh, are you gonna not buy Nike shoes? Are you not gonna buy an another iPhone? If your behavior is not changing based on who’s becoming president, the world’s probably gonna spin. These companies will probably still keep making money and everything will be fine. Just bring it back home to, is it really going to change the spending that creates the earnings for these companies?

And the answer is no.

In owning those companies then becomes more important than ever. That’s right. You, and

that’s why it’s okay to own those companies no matter who’s the

president. During these times of worry, we talked about going to cash and what a mistake that is. Peter, you also point to another spot people go to all the time, which is gold.

You’re not a fan of going into gold. How come?

Well, I look at gold. Like if you look at its return over the last 20 years or a hundred years, or it’s basically always kept pace with inflation. It is a real store of value. So it bought a suit. It buys a suit today, an ounce of gold. It bought a, a suit a hundred years ago and it bought the equivalent when, uh, Jesus was, I was walking the Earth 2000 years ago.

Really, it’s just a store of value. And if you told me, Hey, Peter, I’ve got, you know, $10 million, we’re gonna go in a time machine 2000 years from now, and you can only put it in one currency, I wouldn’t put it in dollars or euros or yet I’d put it in gold and I’d have think of everything that’s out there.

The thing most likely to be accepted as a currency 2000 years from now would be gold and it will have kept pace with inflation. But that’s different than investing as an investment. It’s a disaster. It’s as volatile as stocks goes up and down like crazy, but with a return of cash. No thanks. Right? Like very, very low rate of return.

Uh, doesn’t produce income taxed at a higher rate. Uh, I don’t think it’s a, a smart part of a portfolio.

I love that analogy. All the rollercoaster ride that the stock market gives us and more. And the returns of cash, right? And the returns of the boat ride, right? You knows the really slow ones, right? Yeah.

That goes nowhere. This really leads us to, okay, buying companies great place to be for the long term. We need to beat inflation if we’re going to get anywhere. That leads us to indexing and for a lot of people, they think, okay, keep my costs low, right? I’ll go into the s and p 500 s and P 500. You talk a lot.

Then you go into a big, long thing. Why, directionally that might be you’re getting there, but you’re not quite there yet. Why not just stick with the s and p 500? It’s hard for people

to believe. ’cause we’ve had 14 years of the s and p 500 outperforming everything, but it’s not the norm. Normally, small stocks do better than large stocks.

From 2000 to 2010, the s and p 500, which is large US stocks earned 0% for 10 full years. I remember my career people telling me, Peter, are you stupid? Why do we have anything in large US stocks? Right? That’s the past. It should be emerging markets, growing comp, small companies. Fast forward now that’s the B five hundreds outperforming everything, but it never in all of history has stayed that way.

There will eventually be a rotation where international will do better than the US or small stocks will do better than large stocks. I don’t know when that will be. Nobody knows when that will be, but it’s why you want to have your eggs in different baskets, because you don’t want there to be a 10 year period where you have your investments earn zero, like 2000 to 2010.

So one of the things about diversification is something’s gonna outperform everything, which means there’s things that are underperforming. Everything. You’ve gotta have us, you’ve gotta have international, you’ve gotta have big and small to truly be diversified. View of

a chart in your book that shows this big, long, over a decade run of the stock market in the US versus international stocks.

I know we take calls all the time, Peter, from people going, you know, I’m gonna get out of international. It’s a waste of time. It’s horrible. You seem to be very much a contrarian in that area. Yeah,

I think, well, that’s the narrative. Anytime anything underperforms for a long period of time, that’s what people say.

I definitely think that, you know the us you’ve got Hershey’s and Europe, you’ve got Nestle. There’s lots of examples like that, hundreds of them. And I think having a global portfolio instead of everything stuck in your backyard is a good idea. People tend to do what’s in their backyard. I mean, Swedes have most of their money in Swedish stocks.

Canadians have most of their money in Canadian stocks. Americans have most of their money in US stocks. It’s a mistake. There will be long periods of time. Uh, where investors will be punished for that. That’s not that period of time right now, uh, but having the egg spread out has historically been the much better bet.

When I was, uh, reading that in your book and about how we invest in the home turf, Peter, I’m a guy that knows better. I’m from Michigan, worked in Detroit for a long time, I still own General Motor Stock, right? Ask me, Peter, in your best, Dr. Phil voice, how that’s going for me.

How is

that going for you, Joe?

Not as good as I’d hope. I mean, don’t get me wrong, I love gm. I think Mary Barra, keeping them relevant is huge, but um, you know that stock price man.

Yeah. I mean, Joe, if you look at like in the US people in the West Coast own more tech stocks. People in the south own more energy stocks, the northeast, more financial and where you are more industrial and it’s a bias that also you don’t want to have completely in your portfolio, right?

You have, you wanna be across industries, not just what’s in your backyard.

And it’s funny because having GM makes me comfortable, but the returns aren’t there. It’s comfortable because I quote think I know it, which I think is a very dangerous place to be. And I love that you bring that up. I wanna talk about a little financial nerdery here.

First of all, rebalancing in a portfolio. If you can explain to some of our maybe, uh, beginning stackers, what rebalancing means, but there’s some discussion I’ve seen in financial blogs lately around rebalancing, I’d love to address, but let’s do that first. Peter, if you don’t mind. What is rebalancing all about?

Well, once you’ve done your plan and you decide, Hey, I’m gonna have so much in stocks, let’s say it’s just to keep this simple, 50% stocks and 50% bonds. If we never do anything way down the road, we’ll wind up with 90% stocks and 10% bonds because the stocks are gonna earn more, you know, eight, 10 more percent.

The bonds will probably earn three to 5%. So the stocks will become more and more of the portfolio. Well, you wanted to have a 50 50 portfolio, so a lot of people say, okay, well once a year I’ll rebalance. So if the stocks wind up being 60%, the bond’s 40, I’ll. Sell 10% of the stocks, buy bonds and get back to 50 50.

The research tells us that the best performance will come from opportunistic rebalancing, which is rebalancing when the market’s distressed. So covid, the stock market drops 34%, sell stocks, buy bonds. Then when you get the recovery you’ll or sell bonds and buy stocks. Then you’ll get the, you’ll get the recovery.

And so I’m a fan of that, of really leaving the portfolio alone, unless there’s a crisis and then rebalancing into that crisis,

is it then, so two ways people rebalance now. We’ll, we’ll include our engineer stackers in this, because now we’ll get a little nerdy here. Do you prefer then having a band in which, you know, you can have that rollercoaster, but it’s within an acceptable range?

Or do you prefer rebalancing over a timeframe?

I like the range, so I, I tend to ignore time when it comes to rebalancing and just look at if the market’s dropped a lot, rebalance and if the portfolio gets very out of whack from what you’re trying to accomplish. Rebalance.

Next question. Our friend Nick Majuli, who you may know.

Yeah. Nick runs the dollars in data popular blog. Nick was speaking about this recently and was talking about how increasingly he really prefers if you’re still saving money to just almost like Peter, you’re filling in potholes. You know, take the part that’s down. Instead of doing a full rebalance, just fill in that area.

You’re nodding your head. You like that

too? I, I do like that. Instead of rebalancing, you just add to the part of portfolio that needs to be added to. That’s how you know I’ve done it throughout my career. I think that’s the right approach. Your

book is called Money Simplified and it takes all of this worry that we have.

And I love it, Peter, because when we boil it down, I think it helps us calm down. Maybe we put down the clicker. We we get off, uh, financial media for a while and we live our life and it’s available everywhere. It’s available

everywhere and, uh, Amazon’s the easiest and hopefully people pick up a copy and, and we’ve covered so much more ground.

Well, besides what’s going on with our baseball teams, what’s next for Peter Mallouk?

You know, more of the same. I, my day job is running creative planning and, uh, I love, you know, talking and educating people about investing and trying to make it as straightforward as possible, and I’m just gonna keep doing more of the same.

That’s what I love to do.

Well, and we’ll link to the book and we’ll link to creative planning in our show notes at stacky Benjamins dot com. Peter, thanks for mentoring us today. I super appreciate it. Thanks

for having me, Joe. Take care.

This is Chris from Heavy Metal Money. When I’m not raging in a mosh pit, I’m Stacking Benjamins.

Big thanks to Peter. I’m really excited to see his, uh, baseball team finish second this year in the American League Central, even though we do have the hometown boy Mike Waka from Texarkana. I actually was at the gym getting my butt kicked by Michael Wakas brother, uh, this morning. Who owns this local gym in town.

And did you hop off to him again, Joe?

I know,

but it’s funny, I walk into the gym and his brother Lucas, who owns the gym, has, uh, all this Kansas City royal stuff on now, and it’s, it’s funny ’cause last year when I went it was all San Diego Padre stuff and I’m sure he is burned that now. Like it’s it’s gone.

But Peter doing a lot of singing off your song sheet there, og especially. I wanna highlight again what Peter said about not about gold, which I know you agree with and about sticking with stocks. And also about some of the problems in real estate, but truly this idea that the runup in large company stocks is over the last 30, 40 years.

Pretty unprecedented. And there’s, you shouldn’t be running toward large company. You shouldn’t be running away from it. You should be clearly diversified and just stick with it.

It’s hard to predict what the future’s gonna hold, because I think if we would’ve looked at this same data, let’s say in 2019, we might’ve said the same thing.

Like, oh, it’s done 10 years of the, of large growth companies doing really well. So it’s probably time to diversify. And let’s say that last five year period, if we go 2019 to present, there’s been periods of time where different parts of the economy have just blown past large growth companies. I. Then the large companies will catch up again.

There’s like little pockets of time and if you’re not invested in all of those different asset classes, small companies and value companies and international, let’s say, then you’re missing out on the periods of time when large growth companies, which have been the leader over the last 15 years, when they flatline for a little while and they don’t do anything other parts of the economy do well.

And that’s the whole idea of diversification, is you don’t know what’s gonna continue to do well or start to do well or stop doing well. So own a lot of everything in a manner that produces a result historically, that reaches, helps, helps you reach your goal. So start with what’s your goal? Start with how much money do I need my goal to grow by?

To reach it? You know, if your portfolio needs to grow by X percent, then find the, the, the asset classes, the areas of the market, areas of the economy that statistically have a high likelihood. Of reaching that and, uh, have a little bit of everything. Well, and I love

what

he said about that og, which is that it isn’t about just growing your money faster.

’cause we don’t know what’s gonna grow at any given point in time, but we do know when your goals are and it’s much more about never being disappointed because you have the money available in the right place when you need it. Full stop.

Yeah. Our, our code word this year is no surprises. You know, I, I’m convinced that nobody likes surprises of any kind, good or bad for that matter.

You know, it’s like you hate the, you talked about taxes earlier. You hate the tax surprise. Right? Hey, you owe 3,200. Right? That’s a sucky surprise. Also kind of sucks when I would high five myself. Let’s see. You’ve high five yourself. You only owe 3,200. I owe 32. Yes, I nailed it. Please, please tell me it’s 3,200.

But you know what I’m talking about. 3200, 30 2000. It’s, it’s also a sucky surprise in a different way. If all of a sudden they’re like, Hey, you get 10,000 back. You’re like, really? I mean, that’s good, but what did I screw up in the last year? Oops, that the government’s been hanging outta my money for an entire year or 10 grand.

Like, what the heck? So the same thing is true when it comes to investing. I think people need to get their head around the fact that you’re not trying to compete with the market. It’s hard to not know what to do if you’re winning. You know, how do I know if I’m winning, if I don’t compare myself to something?

And the thing that you need to compare yourself to is what do your goals need? If you’re beating or on track for the, for the money that your goals need, then you’re winning. You’re doing the thing. You can’t say like, well, I don’t wanna invest in small companies ’cause they haven’t done well compared to large companies.

Like, that’s not a, that’s not a comparison because you don’t know what the future’s gonna hold. Build the goal, find out how much money you need for your goal, do the math or hire somebody to do the math and then, and then figure out what to invest in based on the allocation that you need to reach your goals.

And that’s, that’s the

measuring stick. I’m pretty sure that the entire reason you guys have me here is so that you feel like you’re winning.

Uh, I mean, we think of you as a measuring stick. Yes. Right.

Well, I could be Doug,

could, could be

three times a week. We,

we know what the low water market is. That’s exactly what I was thinking.

That’s exactly how I was thinking about it, Joe. Like, well, at least I’m not Doug. Right?

Whenever something goes bad, I get it. I could have this or it could be raining or it could be

Doug, could be Doug. I know my place. Be yelling into a microphone.

Huge thanks again to Peter Mallouk and, uh, you’ll find more of course in our show notes and then a lot more.

Kevin, uh, is gonna have fun with this one as he creates the 2 0 1 around this our, our fantastic newsletter. Hey, time for us to help out a stacker who said, you know what? I better call Saul. See, hi and og. This is where we help a stacker who’s in big time need we swoop in like Spider-Man and help them reach their financial goal.

Doug’s like, no, not Spider-Man. Super. You more a Superman guy. I don’t know.

Well, I just don’t know if super, if Spider-Man swooped. Does he really a swooper? I feel like he’s swooping. Like you gotta have a cape and be able to fly to swoop.

Well, no, there’s, there’s the big time swoop as he, as he latches onto that next building.

There’s the big swoop and then back up, you know? Okay. Alright. It almost hits the top of the bus. I could see us though, just ramming that bus. We just

disc calculate the amount of web.

Yes. Damn it. Again. But now when it, now when it comes to financial advice, we nail that. But I couldn’t do the whole spider web thing.

But today we’re gonna swoop in and we are going to help Eric. Hey Eric. Hey guys. I’m passionate about helping people understand that financial successes are possible. I’m in my late forties and thinking of a career change, I’m contemplating obtaining a chartered financial consultant

certification.

However, I don’t have a bachelor’s degree. Okay, now the question, with a lack of a bachelor’s degree here, my ability to find work to cover the 6,000 hours required to use

this certification, this

appears to be the most efficient and cost effective way to start working in the personal finance field. I absolutely love the show.

I look forward to seeing you guys in the Cleveland

area this

spring. Eric, we will be there. And I’m working on getting the place right now. We’re not only gonna be in Cleveland, we’re gonna be in Boston. We’re gonna be in Detroit. We will be in Kalamazoo, Michigan, where I grew up, and we’re working on maybe Boise, Idaho now.

How about that one? We’ll see if we can get to meet up in Boise while I’m there. Don’t Chanel I’ll

happily. They don’t talk

like that in Boise. They don’t do the Minneapolis accent all the way over there.

No. What the hell would it? No, you betcha. It’s California. It’s all California accents now. In Boise, dude, because all of California’s moving to Boise.

That’s what they say.

It’s just, it’s, I don’t know. I heard it’s beautiful and I’m gonna be there for a conference, so I told Cheryl yesterday, I’m gonna come in a day early, I think, and see if we can do a meetup, but, oh gee, that is an interesting question because to get the CHFC, the Chartered Financial consultant, you do not need a bachelor’s to get that designation.

But does the lack of a bachelor’s, somebody gonna look at that and go, yeah, I can’t hear you.

Um, I, I would say probably not the difference between CHFC and the CFP now is the CFP does require an undergraduate degree in anything. It doesn’t have to be in finance or anything finance related. For years, the CFP did not require that, but they started that in the, uh, mid two thousands.

And to my knowledge, the CHFC does not, which is, uh, a designation by a different company or a different organization, uh, comprehensive in nature like the CFP, but a lot less well known. I think this is one of those questions around does it matter what the designation is? Like, does anyone actually know or care?

And I would say that the vast majority of the answer to that is no. I think if you asked a thousand people on the street what A-C-H-F-C was, no one would know it or very few people. And that’s not a dig at that because I think if you asked a thousand people what a CFP was. Just a slightly higher number might say it like very, very, very few.

No different than if you said, explain to me the difference between an MD and a, do they go Uhuh? I, I don’t know. They’re doctors. Yeah. Yep. They’re doctors. Right? But what’s the difference or what’s a pe If you’re, if you’re in the engineering world, engineers know what that is. People who work with engineers know what that is.

People who have never thought about being an engineer, worked with engineers, have no idea what PE is. They go, I know what PE is, physical education.

I saw a piece on marketing and about what to include in your marketing messaging and what not to include on your marketing messaging. And they said it was interesting.

To your point, OG don’t include things that people know nothing about and they kind of assume. So you might be proud if you’re a mechanic running a shop that you’re a SC certified, but people dunno what a SC certified means and they just assume that you are. So have it on your door and get the designation, do the thing to be certified, but don’t waste time marketing that ’cause nobody knows, cares, and they assume nobody knows the

difference.

It’s like people who say they’re fiduciaries, right? Most people just assume, I mean, I was talking to a real estate person, they’re like, oh, we’re fiduciaries. I’m like, you’re exactly not a fiduciary. You’re like literally a broker. That is exactly what it says on your card. Like, no, we work for you. No you don’t.

You work for a commission. Like it’s okay. We just use terms and we just assume, like to your point, and you meet with a financial person, you assume that they’re licensed and certified and some sort of someone somewhere has signed off on their abilities, right? You know, just like you walk into a doctor’s office, you assume that the doctor has met some qualification somehow.

And if it says board certified, like I go, well isn’t everyone board cer? Like isn’t there a board of some kind that certifies all doctors? I don’t, I don’t know. But that’s a different thing, right? So all of this to say, if you want to go into the financial planning world, I would get into it and make sure you like it before you spend a lot of time, energy, and money getting specific education or specific training around the world of financial planning, right?

Like it’s not a small task to get a designation, whether it’s a CFP or CHFC or any of the other dozens of ones that are useful. And I would look at it much less as a marketing tool and much more of a way for me to. Internalize and learn more information about the stuff that I wanna learn about. I have a lot of financial planning designations that we don’t really ever use, or to your point, Joe Market, because there’s no use in that.

I went to get those pieces of education because I wanted to learn more about that specific thing, not because somehow by having, uh, three letters after my name, somehow I’m more trustworthy. That’s not, I don’t think that’s a thing. So get into the business if that’s what you’re interested in. You’ll have maybe a little harder time if you don’t have experience, but, uh, the degree will or won’t hurt, I don’t think, and then work on the designation if that’s, you know, if, if you still like it after the first couple years.

That’s what I would say, Eric.

So glad to hear you’re entering the field and frankly, OJI part of this is too, we we’re looking at just the demographics around financial planners. Good time to go into this field. Yeah.

There’s not enough help. So the more the merrier.

Yep. A lot of people out there looking for good financial planners, Eric.

So, uh, I think it’s fantastic and more to come on Cleveland and the rest of the cities. We’ll be going to time to, uh, transition here. Before we close out the show, a couple things. Number one is if you’ve got a question for us, head to stack your Benjamins dot com slash voicemail and we will swoop in and help you like we did Eric.

We will also give you some sweet Stacking Benjamins swag for being brave and calling in. And by the way, just had a discussion with Brad Lark from Flying Pork. He’s cranking out some new designs, guys, he and I were just, uh, mulling it over. Can’t wait to see what he always comes up with ’cause they’re always pretty fun.

But if you’re not looking for just a little help around, do I become A-C-H-F-C, you’re looking for, you know what? I really need some good financial planning help, some comprehensive help. Well, Gina’s team are taking clients, so head to stacky Benjamins dot com. Slash OG for a link to OGs calendar. That’s the first way to see how his team can interface with you to make better financial planning decisions.

Stacking Benjamins dot com slash OG is where you go for that link.

Plus he’s a certified mechanic too, right? Isn’t that right On OGs door of his practice. A SC or something like that. A

SC Certified Financial Advisor. Yeah,

a, it’s like a double bonus.

Lemme just make

it up. If there was somebody who would be, it would be

me.

I’ll fix your asset allocation and your shocks. Yeah, it’s gonna be great. Doug, uh, onto the back porch, my friend. This is our community segment of the show. We, we’ve, uh, we’ve had some people saying some nice things about us, uh, lately.

Yeah, Joe, here’s one that I’ve been, uh, I’ve been dying to read actually for a couple of episodes now.

Uh, here’s the title. Love them, exclamation point, but don’t always follow exclamation point. Not exactly sure what that means. Let’s see what he has to say. I absolutely love these dudes. They make learning about money, fun, and understandable. I have called in twice and they gave me useful direction.

Fortunately, one of the times I didn’t follow their advice and made almost 300,000 on an Airbnb in Idaho. But they’re doing their best with the facts. You can tell them they can’t possibly know everything about your financial situation, but I will say they give their best shot and know what they’re talking about.

Most of the time and yes, I want my

spot on. Yeah, spot on. And I had to, they’re like movie reviews. Movie reviews might be bad. Yeah. TV shows

and then they go on to say, and yes, I want my free shirt or Shout out for leaving an Apple review. And that is from Free Shirt.

I would, and yes, I would like some property in Vermont for leaving the review.

Well, I think maybe we could have seen our way to sending him a shirt, but that most of the time comment kind of nicks the deal. Right? So close. Yeah,

it’s, that feels

like what my parents used to always say, Ooh man, we were gonna go out for ice cream sundaes. And then we realized that you didn’t mow. Our lawn and all the neighbor’s lawns, shame on you.

So we can’t do it. And it turns out my dad only had $2 in his, uh, wallet at the time, but that wasn’t the reason it was my fault. You were

the excuse that is from Scrabble, QXZ. And I’ve been looking at that name thinking, okay, I know that Q is worth 10, the X is worth eight and the Z is worth 10. What is the cryptic message behind that Scrabble, QXZ?

I wanna know, hop onto the basement and tell us what that means.

I think actually I met Scrabble, QXZ when they talked about, uh, rental properties in, uh, Idaho. We had a discussion about that with some stackers in, uh, Seattle during a meetup. Oh, do you remember? No.

Well, I believe you.

I remember that. Uh, yeah.

Not at all. Not, not at all. But I think if, if they’re the stackers that I think they are, thanks for the review, but I really appreciate it when I don’t know who people are. Like people come out of the blue to say nice things about some podcasters they don’t know anything about. So thank you for that.

Doug, you still have a pile of TV shows. Why don’t we, uh, looking at the watch, let’s, let’s talk about one more. Oh. And you, you say it’s good and I’ll say no. So go.

It doesn’t matter what I say, you’re gonna say, oh God, you were wrong. I’m sorry, Doug. That’s incorrect.

Or you say it’s bad and I’m like, what are you drinking?

Like, what’s going on? Yeah. I

don’t think that I’ve, I’ve run through so many of those so fast, but I don’t think I’ve talked about the latest, uh, season of True Detective Night Country. Have we talked about that yet? I don’t think so.

I’m still on, uh, true Detective Day City. So I gotta transition to night Country next.

Uh, it’s,

it’s okay. I mean, if you don’t have anything else to watch, give it a go. It’s okay. A raving

review. Yeah,

and that’s, but I’m looking, being honest, this is what I would rather read a book is for the candor and

honesty. If the rest of your Netflix is broken and it’s the only thing left, you’ve read

every book in your house and every magazine.

You’ve already done a 10 mile walk and it’s raining. The Xbox is broken, Internet’s down, then feel free, your phone’s outta battery. Go ahead and watch True Detective Night

Country. Yeah, I think that’s accurate. Thanks guys. You did it for me. Yeah,

you’re welcome. America a in the World. Yes. With, with that one.

Uh, coming up on Wednesday, we have another fun, uh, comedy ride along. Bob Wheeler is not only the CFO of one of the world’s most iconic comedy clubs, the Comedy Store, he of course, is a very funny comedian himself. And does a great podcast himself. But Bob Wheeler is gonna be our comedian ride along on the Wednesday episode.