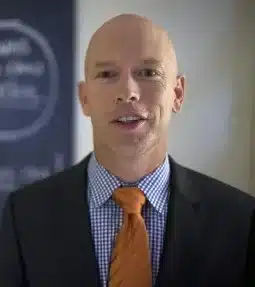

If you aren’t familiar with Carl Richards, NY Times columnist and bestselling author of The Behavior Gap, where have you been? His sketches outline the basics of financial planning in a way that makes the topic fun and access

If you aren’t familiar with Carl Richards, NY Times columnist and bestselling author of The Behavior Gap, where have you been? His sketches outline the basics of financial planning in a way that makes the topic fun and access

Joe: Welcome to the basement, man!

Super excited to be here. I’m surprised you still have these banana chairs.

We pull those out specifically for our awesome CFP guests.

I love these; they’re like a rocking chair and bean bag mixed into one.

I’d love to see a Carl Richards sketch that incorporates these chairs.

(Laughs) Give me a couple of weeks.

Why is it that your drawings speak to people?

It first started when I was working at a big well known brokerage firm that will go unnamed (but it has a bull as its symbol and is owned by a bank)….and I was in this position that….I was in a meeting with clients who had become close friends, and I knew how important the decisions they were making were. I was trying to explain one concept that was important that they understand….in order for them to make a good decision. I thought it was critical that they understand this concept, so I was doing my best to explain it, and I wasn’t doing a very good job. All I got were these blank looks, no matter how hard I tried. These were smart people.

…so it wasn’t that they weren’t smart; it was that I wasn’t doing a good job. Out of an act of desperation, I was sitting at the conference room table thinking what am I going to do? ….I jumped up and grabbed the whiteboard, drew a couple boxes and some arrows and said, “No, like this!”

They said, “Oh!” Right?

The whole mood in the room changed. I don’t know if it was the amateur nature of the drawings—which I think has something to do with it because it’s approachable—or that I was standing up, and there was movement….but I think it had something to do with the visual aspect of something being reduced to a drawing that a four-year-old could do.

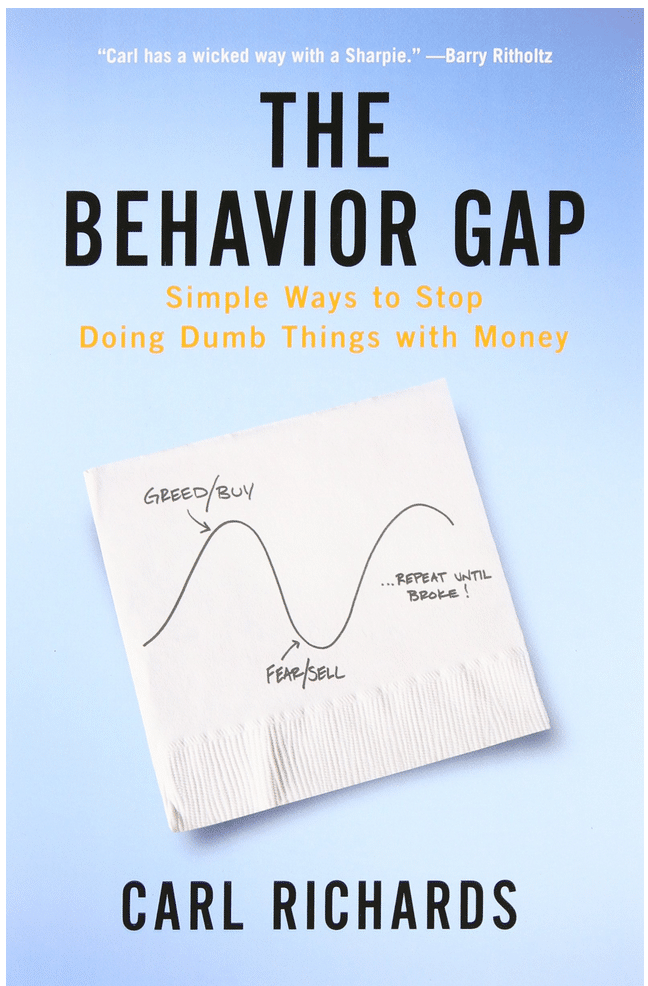

…but it should be simple. I read The Wealthy Barber, and he said if your advice doesn’t fit on a napkin it’s too complicated.

There is something approachable…..you know it’s funny. Sometimes there isn’t a white board, so I’ll grab a napkin or printer paper and before we’re done it’s totally messy. It’s a disaster….you can only barely decipher what’s on the page. It’d start out simple, and then we’d add stuff and add stuff…

…and the clients would say, “Can I take that home?”

I’d say, “Well, no, I’ll do it better for you. Let me just clean it up.” The Client will say, “No, I want this one.” So there’s something about the experience of taking a complex situation and creating a simple souvenir. I think of them as both shortcuts and souvenirs. The shortcut idea is that it helps you get into it faster, and the souvenir idea is that it’s a reminder of the discussion you had.

That’s fascinating because most of us are visual. Your new book, the One Page Financial Plan, is divided into four parts: Discovery, Spending and Saving, Investing, and Strategies For Avoiding the Big Mistake. I laughed when I got to step four because most of the job of a good financial planner is to help people avoid big mistakes. What are some of the big mistakes people make?

Yeah, it’s funny….a friend of mine, we’ll call him Jeff, is a retired investment banker…and he told me he needed to find a financial advisor. He had plenty of money (laughs)…enough money that he could get in the door with ANY financial firm….and he was struggling to find one.

I said, “I have a question for you. Why do you need help? You’re a retired investment banker with all sorts of experience.”

He said, “Carl, I could manage my money…except for the “I” part.” (He said) his point was, “Look, I get as emotional about this as the next person….I’m really good at giving other people financial advice because for them I’m the unemotional third party. I’m not very good at taking my own advice.”

So here’s what a good advisor does for you, which I think answers your question about the big mistakes:

Clarify my goals. The first big mistake is that people don’t know why they’re doing what they’re doing. Most people argue about whether we’re going to take a plane, a train, or an automobile on a trip before they know where they’re going.

Get some process….some sort of guardrails in place to remind you about what you said about your goals…..to remind you what your goals were when…you’re thinking about doing something stupid. Now, that can happen on a one-page financial plan or in the form of an advisor.

Be “the thing.” We want to put something between ourselves and the big mistake….and the biggest mistake people make….which sounds really dumb to say, but we do it all the time, is that we buy high and sell low. We do it because we’re hard-wired that way. We do what gives us pleasure, and what gives us pleasure when it comes to investments is (doing) what everyone else is doing! It’s gone up….yeah! It’s a party…like this financial pornography network’s happy, and my neighbors are talking about it at the BBQ. Let’s join in. Right? What feels bad is when the market’s down. When we feel bad about something we’re hard-wired to get away from it.

Want more from Carl’s interview? Listen to him on the Stacking Benjamins podcast. Want Carl’s book? Here’s our Amazon link (buy the book AND help the site…thanks!).

Question: What does your financial plan look like? Give us one example of something great you’re doing in your plan in the comments below.

Leave a Reply