Think some people just have all the luck? Think again.

Joe, OG, Paula Pant (Afford Anything), and Chris Luger (Heavy Metal Money) break down what separates people who catch breaks from those who don’t…and spoiler alert: it’s not about being in the right place at the right time.

It’s about what you DO when opportunity shows up. And before that: how you create the conditions for opportunity to find you in the first place.

This episode digs into three moves that make luck happen: staying curious (even when you think you know the answer), being generous (yes, it pays off financially), and staying flexible when life throws you a curveball. Whether you’re stuck on a money decision, feel like you’re missing opportunities, or just want to stop watching other people win, this conversation will shift how you see “luck.”

Plus: Doug’s trivia gets weird (what even IS a buttload?), the gang debates pumpkin spice season, and you’ll hear stories that prove the best financial wins rarely go according to plan.

What You’ll Walk Away With:

- The one thing “lucky” people do that creates more opportunities—and how to start doing it today

- Why helping others might be your best financial strategy (and the science behind it)

- How to spot opportunities you’re currently walking past

- What to do when your financial plan falls apart (hint: the flexible win)

- Permission to try something new, even if you’re not sure it’ll work

Before You Hit Play, Think About This:

What’s one time something good happened to you? …not because of random chance, but because you were curious, helped someone, or said yes to something outside your comfort zone? That’s the kind of “luck” we’re talking about.

Got a story? We want to hear it. Drop it in the comments or share it in your podcast app.

Deeper dives with curated links, topics, and discussions are in our newsletter, The 201, available at https://www.StackingBenjamins.com/201

Enjoy!

Our Topic:

How to increase your surface area for luck (Useful Fictions)

During our conversation, you’ll hear us mention:

- Defining luck and probability

- How to increase your “surface area” for luck

- Taking more at-bats in life

- Role of risk in creating opportunity

- Learning through repeated attempts

- Financial decisions vs emotional decisions

- Systems and discipline in investing

- Overconfidence and “lucky” timing

- Diversification vs. experimentation

- Budgeting and adaptability

- Curiosity as a wealth-building tool

- Avoiding transactional relationships

- The “Who, Not How” mindset

- Building meaningful connections

- Luck through generosity and giving

- The Ben Franklin effect

- Manifesting vs. hard work

- Focus and attention in goal-setting

- Being comfortable with feeling lost

- Discipline and flexibility in planning

- Redefining goals over time

- Lessons from charitable giving

- Long-term vision vs. short-term action

- Infinite game of saving and growth

- How curiosity drives lifelong learning

Our Contributors

A big thanks to our contributors! You can check out more links for our guests below.

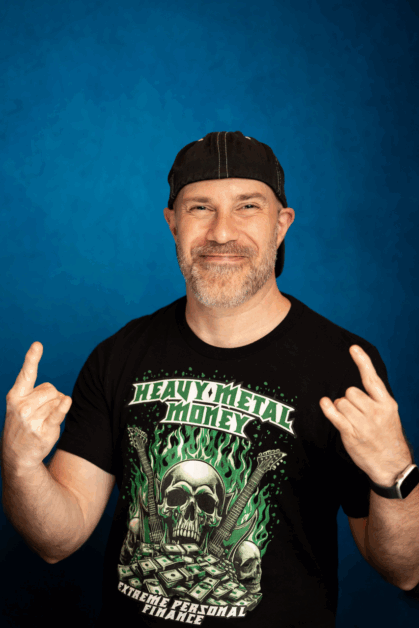

Chris Luger

Another thanks to Chris Luger for joining our contributors this week! Hear more from Chris on his show, Extreme Personal Finance Show at Podcast – Heavy Metal Money.

Paula Pant

Check out Paula’s site and amazing podcast at AffordAnything.com

Follow Paula on Twitter: @AffordAnything

OG

For more on OG and his firm’s page, click here.

Doug’s Game Show Trivia

- How many imperial gallons equal a buttload of wine?

Join Us on Monday!

Tune in on Monday when we put YOU in the driver’s seat with answers to YOUR burning questions.

Miss our last show? Check it out here: How to Deliver the “WOW” in Everyday Life (with longtime former Royal Caribbean Chairman and CEO Richard Fain) SB1748.

Written by: Kevin Bailey

Episode transcript

[00:00:00] opener: Spider pig, spider pig does whatever a spider pig does. Can he swing from a web? No, we can’t. He’s a pig. Look out. He is a spider pig. [00:00:17] Doug: Live from the basement of the YouTube headquarters. It’s the Stacking Benjamins show. [00:00:32] Doug: I am Joe’s mom’s neighbor, Doug. And this Friday, let’s help you find more luck with your money. Sound impossible. We’ll share tactics, strategies, and philosophical ideas on today’s round table discussion with our Money Geek Friends. Plus, at the halfway point of today’s show, we’ll see which of these money nerds is gonna score a point in our year. [00:00:54] Doug: Longs. Stacker trivia contest. And now a guy who’s always feeling lucky because he gets to work with this guy. It’s Joe Saul. See? Hi. [00:01:11] Joe: Oh, nothing more fun, Doug, than working with you. Hey everybody, welcome to the Stacky Benjamin Show. Super happy that you’re here. Welcome to our Friday recording, Doug. Uh, good to see you, my friend. Good to be seen, Joe. Good to be seen. Let’s meet the other people that are gonna be joining us. Of course, we got the gentleman across the card table from me right now. [00:01:34] Joe: Mr. OG joins us. How are you brother? Just, [00:01:37] OG: uh, living the dream. It is fantastic boy, the middle of the chaos of the, you know, right before Halloween and you know, it’s just all the stuff. It’s all the stuff of the thing. PSL season baby. Is there a fall break coming? [00:01:49] Joe: I have not had any pumpkin spice anything yet. [00:01:51] Joe: I feel like I’m. I don’t know what’s going on. Dunno, why not? [00:01:55] OG: Yeah, don’t, I didn’t ask for that. Nope. Don’t need any 1200 calorie drinks. I just need a fall break. Just [00:02:00] Doug: need a break think. I think most schools it’s happening like this week or next week. A lot of colleges, what we do are right here in mid-October. [00:02:08] Doug: What I’m talking about. What’s going on with this show? [00:02:11] Joe: Why [00:02:11] OG: don’t we fall [00:02:12] Doug: break? Oh, that’s what you’re talking [00:02:14] OG: about. I want a fall break. Doug, me, this is about me. I don’t know if this will come as a shock to you, but on occasion I like to talk about me. [00:02:23] Joe: He’s just hitting about what we should be doing. You know, we should be doing, we should be introducing the other people joining us on this show. [00:02:30] Joe: The woman in Manhattan, who I don’t know, does she love a 1200 calorie drink? Paula Pant is here. Pumpkin spice latte for the wind polo. [00:02:39] Paula: Yeah. You know, I’m, I’m not like an enthusiast, but if I’m offered one, I will absolutely take it. Absolutely. If you’re buying, [00:02:46] Doug: I’m accepting an enthusiast. [00:02:48] Paula: I wouldn’t go seek one out, but no. [00:02:52] Paula: If I happen to be drinking one, I enjoy it. You’re [00:02:55] OG: walking down the subway stairs and there was one sitting there like on the stairs next to you. You’re like, Hey, that’s a pumpkin spiced latte. Somebody didn’t finish. [00:03:05] Joe: I might as well finish that up. Look it. There’s a good quarter of it left. [00:03:08] Paula: I found this in the dumpster. [00:03:11] OG: Ugh. Like all the freak freak gum underneath all the railings, just like an elf. [00:03:16] Joe: Well, that sounds like a heavy metal intro, doesn’t it? Like a heavy metal show. Like people would do that. They get all crazy. Which is great because, oh, we got the guy who does that from heavy metal money. Frank [00:03:27] Chris: Chris Lucas here. [00:03:28] Chris: How are you man? Hey, I’m doing well. I’m doing well. I, I am an absolute. Pumpkin spice fanatic and I will eat. Can you take the pumpkin [00:03:36] Joe: spice latte to the heavy metal show? Like is that a, or do they laugh at you? You know [00:03:41] Chris: what, if it was available, I’d have it. I eat and drink all of the pumpkin spice, everything. [00:03:45] Joe: It’s hard to air guitar though, Chris, when you’ve, when you’ve got a pumpkin spice in your hand, [00:03:49] Chris: you know, I just went to, our Minnesota Zoo has this Jacko lantern trail. There’s like 5,000 jacko lanterns you can walk this trail. It’s pretty cool. And I bought one of their special holiday hot chocolates with like, ooh, you know, cinnamon and a, a pumpkin flavored marshmallows. [00:04:07] Chris: It was $13 for a cup of hot cocoa. And [00:04:10] Joe: you joined every second of [00:04:12] Chris: it, didn’t you? It was fan. I mean, like you said, it’s like 1400 calories, but [00:04:16] Joe: it’s, but you know, but you were at the fair, right? If you’re at the fair, it’s fab free. Yeah, that’s right man. Tell the three people that are new to Stacky Benjamin’s land what goes on a heavy metal money ’cause. [00:04:27] Joe: I think you just had like this phenomenal interview a few weeks ago. That was just amazing. [00:04:32] Chris: Yeah. So, uh, people can find, uh, my podcast, my blog over at Heavy Metal Do Money. We talk about spending, saving, investing, all turned up to 11. [00:04:42] Joe: This whole show Heavy Metal Money goes up to 11. Are you excited about the new speaking of 11, the new Spinal tap coming? [00:04:48] Joe: Spinal tap two. The end continues. Yeah, absolutely. It’s gonna be great. Does Paul even know what Spinal tap is? Um, I don’t. She has no, no, no clue. [00:05:00] OG: It’s not a fun medical procedure. [00:05:04] Joe: Uh, we got a great show today because, uh, Chris is here, Paula is here, OGs here. Doug and I, and I found this great substack about luck and we often, you know, how often have you seen somebody who’s wealthy and you go, oh, they’re just lucky. [00:05:19] Joe: Uh, they’re just, I remember that must [00:05:21] OG: be nice. That’s the phrase. [00:05:23] Joe: Yeah. When I was with American Express, I remember there was this top advisor out in Seattle and they go, oh, you know what? Her dad works for Boeing. It was, she just got lucky that she was in the family. And it was later on that I learned how hard this woman worked. [00:05:36] Joe: And don’t get me wrong, she had opportunity, but it wasn’t luck. She took opportunity and she had to run with it. And so we’re gonna talk about luck and increasing your chance of luck on today’s show. But before we get to that, we got a couple sponsors to make sure we can keep on keeping on. You don’t pay a dime for any of this goodness. [00:05:54] Joe: So grab some paper, think about luck in your life, and we’re gonna talk about luck and your financial plan and maybe being lucky at work. [00:06:12] Joe: Our piece today comes from the substack of, and it’s funny, you’d think that, uh, I would’ve, after all these years, I would learn that you should probably have the piece up before you start introducing things. Uh, Kate Hall wrote this on her substack useful fiction, and it’s called How to Increase Your Surface Area for Luck. [00:06:35] Joe: And Paula, I don’t think I’m alone here. You know, you often hear people say, oh, they just got luck with their investments. Or look at how, if I could just get luckier with my investments, if I weren’t so unlucky with my investments, man, my life would be completely different. [00:06:48] Paula: Hmm. Well, she makes a great point in her piece where she talks about how luck is a function of the number of times that you’ve tried. [00:06:56] Paula: Because if you try, like you’ve got two people, one person has fewer tries and the other person has more tries, the person with more tries, assuming that those tries don’t wipe you out, is likely to have luck. Just that it’s just math, like it’s just probability. [00:07:12] Joe: That’s funny. Luck equals math. I think she makes that comment, doesn’t she? [00:07:15] Paula: Yeah, exactly. Like it’s really just probabilistic thinking. [00:07:19] Doug: If you had any idea how often I tried to get lucky in college, you’d know I oh boy, could prove that theorem wrong. It’s not just about trying to get lucky. [00:07:28] Joe: It was so fun. I even thought when I said before the sponsor spots, when I said being luckier at work, Doug was like, oh, I, I’m just, I gotta work it in. [00:07:36] Joe: I gotta find a way. I could tell the 12-year-old was like right there. But Chris, getting back to, uh, maybe the point of the piece, call me crazy. But if we talk about luck to you, is it velocity like Paul is talking about, and Kate’s talking about just the speed of your decision making? [00:07:52] Chris: You know, I think that you, you need a number of at bats, right? [00:07:56] Chris: Like you said, the, the number of tries, like you said, Paul, it’s just math, but I also feel is though it’s more about the people that, that are around you. Like, I mean, people used to always talk about like, like if I mentioned that, hey, I retired at 50. A lot of people say, oh, you’re lucky. You’re lucky that that happened. [00:08:16] Chris: And I believe that there’s always like you’re in the right place at the right time for certain things to happen. But I also feel as though you increase your luck by doing certain things, whether you’re learning new skills, networking and meeting the people around you taking a risk. I think that’s the number one thing. [00:08:32] Chris: Don’t be afraid to take a risk and learn new things. I think that really is a way that you can increase your luck. [00:08:38] Joe: But is there though, Chris, this idea of risk meets like probability management? Because I see some people take these crazy ass risks without really thinking through the probable. Chance that this risk could bear fruit. [00:08:50] Joe: I feel like, and I’m thinking back to when we had Ted Den Smith talking about education early this summer, and he’s talking about how, you know, if we knew statistics better, if we taught, if we taught statistics better in high school to kids, kids might make some better decisions about even career choices in the future. [00:09:06] Chris: Well, don’t you think maybe they would be more afraid to make some of those choices or take those risks and then therefore not be lucky? You know what I’m saying? [00:09:17] Joe: I don’t know. I think og, let’s bring you into the discussion. If we think about velocity, it seems like we all agree that making more decisions works. [00:09:25] Joe: But if we’ve got then three decisions in front of us and we’re gonna keep making decisions at a certain speed, we got three of ’em. Like thinking through probabilities can help you make better ones. [00:09:35] OG: What is the context of this luck discussion? Are we thinking about like luck in terms of investment choices, luck in terms of saving luck in terms of. [00:09:45] OG: Spouse outcome or career choice? Like what’s the ’cause? I think all of those are gonna be different. I mean, I certainly didn’t, you know, you don’t want to go through like a bunch of spouse choices before you get to the one that you wanna sit on. You know what I mean? It’s like, like that one I don’t think works. [00:10:02] OG: I [00:10:02] Joe: tried [00:10:02] OG: this nine times and finally it’s working out. Oh my gosh. [00:10:06] Chris: Isn’t there some math about when you’re hiring somebody too? Like you don’t wanna interview too many people, like you gotta have like the seventh person be the one mm, right? Something like that. [00:10:15] Paula: It’s called the secretary problem, and it’s a mathematical equation that lays out the optimal number of people that you interview before you have interviewed enough such that you can make a good decision, but not so many that you are wasting your time. [00:10:31] Paula: So I don’t fully understand the math of it, but some greater mathematician than I. Somebody [00:10:34] OG: figured it out. [00:10:34] Paula: Yeah, yeah, yeah. So it’s referred to as the secretary problem. [00:10:38] Chris: Would you do that to try to find your spouse? [00:10:40] Paula: Yeah, so people do, uh, apply that to, uh, the Mathematics of Love. There’s actually a book on my bookshelf back there called The Mathematics of Love. [00:10:48] Paula: I just haven’t read it yet. [00:10:51] OG: You took the joke, Paula. We all had it ready? Yeah, [00:10:55] Doug: I read it. [00:10:56] Joe: I actually have, but I guess oji back to your point, I mean, I mean, let’s talk about in your financial plan, right? Can experimenting too much experimenting in your financial plan really ruin your chance of a good result? [00:11:08] OG: It’s a great joke about Doug and experimenting. They’re also in college, but college do anything once in college. I mean, ultimately I think it’s less luck and I think it’s more discipline. I think people think like luck is this thing that just favors you and. Like Paula said, when you make more decisions, when you have more at bats, I was thinking Doug’s wearing a base. [00:11:30] OG: Are you wearing a tiger hat? Is that what you got on Doug? I think it’s baseball tiger hat. Darn right, I am. Right. So, you know, you’re gonna hit more home runs if you have more at bats, that’s just eventually gonna work out. Now that number might just be one. You might just get one, but you’re gonna have a better chance than somebody who just steps up to the plate one time. [00:11:47] OG: And so I think in some cases, as it relates to career choices or, or learning, you know, as you’re developing yourself, the speed at which you can do that, when it comes to money and goal attainment, when we think about, uh, financial planning, I think it’s more about systems and, uh, trying to make fewer decisions actually, maybe is the better way to do it. [00:12:09] OG: Because the more times you have an opportunity to look at your stock portfolio, the more choices you have to go. Uh, am I doing the right thing? I’m gonna mess it up. But the people who just like, just pick an asset allocation. Make a decision once a year to rebalance it, keep putting in 23,500 in their 401k. [00:12:29] OG: They wake up going, huh, I don’t even know how I got 2 million bucks. It’s because you didn’t screw with the system and then you say, well, you got lucky. It’s like, well, there’s other factors there. Right? You know, I have a career that allows me to save the money, or I have a significant other that helps with the bills, or I have a low cost of living, or whatever the case may be. [00:12:45] Chris: But OG someone may still call you lucky for doing that. Okay. Right. [00:12:51] OG: I don’t know how to think about this in a way that’s not systems related. There’s certainly things that are lucky, like we’re lucky that we live in the country that we live in, in the time in which we live. My grandfather was born in 1919. [00:13:06] OG: He, at the time also thought he was probably pretty lucky that he didn’t live in the 18 hundreds. We’re in a good spot compared to, you know, having to forage for our food every single day. Like, that’s pretty fortunate. I mean, just thinking about, thinking about how many people had to like stay alive for you to show up on this planet throughout the couple of dozen generations or whatever, however far back you wanna go, it’s like, that’s pretty lucky. [00:13:30] OG: You know, I’m a million bucks my 401k, that’s not luck. That’s just No. But [00:13:33] Joe: still, I was wondering where the intersection might be here, og, because I do think that that you’re right on when it comes to trying to learn a new skill. You see the statistics all the time. People give up just as they’re about to learn something, right? [00:13:47] Joe: They’re just about there. They’re just to the spot where it’s just starting to take effect and they stop. People don’t see the job till the end, but when it comes to your money, I thought, yeah, I guess you are right. That leaving your hands off it doesn’t work. But Chris, think about this. How many times have you seen people go, well, you know what? [00:14:07] Joe: Budgeting works for other people, but it doesn’t work for me. I try, try to budget, and the budget, the budget, just this whole budgeting thing, just totally just doesn’t work for me. Which, you know. It’s probably the wrong answer. [00:14:19] Chris: Yeah. All the time. Yeah, you hear it all the time. [00:14:21] Joe: It’s incredibly frustrating when maybe that budget didn’t work. [00:14:25] Joe: And I’ll give you an example. Like my, I’ve got this, uh, 20 minute budgeting system that works for me every week for Cheryl and I, and I would teach it to my clients. And you know what was funny was out of the box, it wouldn’t work with 90% of my clients, but when we tweaked it just a little bit so it would work with them versus throwing it away, it worked better. [00:14:42] Joe: I mean, we see this all the time with diets and exercise, right? Paula? I mean, people go, mm-hmm. Well, you know, that whole dieting thing and this whole, you know, spin class. Oh, that was, I tried that twice and it was horrible. I got all sore, so I gave it up. [00:14:55] Paula: Right. And it’s funny because, you know, a lot of times, diets or, or they’re all of these different philosophies. [00:15:00] Paula: There’s whole 30, there’s keto, there’s this, there’s that, there are a lot of ways to eat that are very black and white in the way in which they’re taught. And because of that black and white teaching style, a lot of people will develop an all or nothing approach to it. Because of that all or nothing approach. [00:15:17] Paula: If there’s an element that doesn’t work, people will often just give up the whole thing. So last January, myself and a group of friends, we were all on WhatsApp doing it together, doing this like dry January coupled with sort of like a whole 30 sort of a thing together. Oh god. Um, yeah. Gross. [00:15:35] OG: You know how hammered you have to be on December 31st to make it last? [00:15:37] OG: We thought we would torture ourselves. [00:15:40] Joe: I tried, by the way, wet January, like that one a ton better. Yeah. So much more fun. Let space it out more. [00:15:48] Paula: And I remember, like, I remember one guy, I think we got to like the 17th of the month and he was like, oops, I had a glass of wine. I’m out. And we’re like, dude, it’s, you know. [00:15:58] Paula: If you drop the all or nothing thinking and just give yourself a little bit of grace, you know? And, and for me, like, I found that giving up, part of that was we were supposed to also give up caffeine. I was like, I stuck with that for about 10 days. And then I was like, no, no, no, no. Caffeine is coming back. [00:16:15] Paula: That one is a non-negotiable. Wow. [00:16:17] Joe: But I like that though. When you try something, you go, you know what it is for you? It is the right thing. You know, less caffeine in your life is the right thing. But you know what, for me right now, I’m gonna choose to go a different way. Mm-hmm. I love the fact that I have a budget, I have a budgeting system that works. [00:16:31] Joe: And there’s still times when Cheryl and I decide Paula to go the the other way. We’re like, forget the budget. I’m doing this instead. Yeah. Not bad. Another Paula hanging out with us says, budgeting doesn’t work. Translation. I really wanna spend more money than I make. That is, that is a hundred percent. But when it comes to your portfolio, you know, OG people talk about like different ways to do asset allocation, different ways to diversify, buying individual stocks versus holding onto mutual funds or exchange traded funds. [00:17:04] Joe: How much of that is the diversification is important versus how much of that is learning the right thing to do and okay, I made a mistake getting back in the game. You know, I panicked and I sold when it was low and then I learned my lesson. So I didn’t, didn’t do it that time. So again, trying again and trying again and trying again. [00:17:21] Joe: So is it diversification that’s important or is it getting back in the ring? [00:17:25] OG: Well, I think you’re talking about two different things. One is around how do I take the money that I have and make sure it’s in the right buckets or the buckets that I think that are right. There is no wrong or right answer because everybody’s a little bit different. [00:17:38] OG: And this is gonna come as a shock to a lot of people. Nobody can predict what the future’s gonna be at the beginning of January this year. If we said, Hey, you should probably have 30% of your money in international stocks. People were like, that’s crazy. International’s awful. It hasn’t done anything in 15 years. [00:17:53] OG: Why in the heck would I wanna have any money? Money there? Well, guess what? And by the summertime it was beating the pants off of the US market by a considerable margin. Is that I knew that was gonna happen. Is that why we said that? No. Is it that I could prove to you that it was gonna happen? No. It just makes sense to me that you wanna own one of everything just easier. [00:18:12] OG: Right? So I think philosophically understanding big picture stuff is more important than spending a lot of time and energy on the little idiosyncrasies. I don’t remember this exact number, but I believe that somebody somewhere, [00:18:27] Chris: oh, what? That’s credible. Might have said, [00:18:31] OG: oh, this is what we call it, a primary source. [00:18:34] OG: Somebody somewhere said, no, I, I don’t remember what study this was. Somebody knows, but that asset allocation or merely being invested is 91% of the return. The other nine is the market timing, the exact asset allocation. Did you buy in on the right day or the wrong day? You know, did you get lucky? Did you put your money in on the right day? [00:18:56] OG: There’s somebody who invested a bunch of money, uh, it was like kind of a rollover, you know, so it was already invested, but in their mind it was new money and they invested it on April the eighth this year. And so when they look at their investment account, they go, my goodness, look at how, look at how smart I am. [00:19:12] OG: I’m a genius. I’m a genius. I got out on March 31 when my rollover check went in the mail, and I got it back in on April the eighth. Holy moly, I would argue that’s not skill. That was pure 1000% luck. You know? So in that context, that’s just good fortune to be able to say, I got out on the right day and got back in on the right day. [00:19:33] OG: Not because I was trying to do it, but because that’s just when the checks were in the mail. [00:19:37] Joe: Sure, luck looks great in that scenario over the short run, but 30 years from now, the difference between picking that day versus picking the quote wrong day a week earlier, it’s gonna be infinitesimally small in [00:19:50] OG: 30 years. [00:19:51] OG: Absolutely. Incredibly small. And that’s, and that’s the point. It’s the same thing as, do I have 8% of my portfolio in small cap value or nine and a half, or do I have 25% international or 27% in it? It’s like none of this matters. The fact that you are investing matters. The fact that you’re saving money matters. [00:20:09] Joe: What I really like og, when you were talking about international stocks, I like that. ’cause really that first question and this idea of luck is kind of the framing the entire place. But the place Kate starts in this it I find incredibly fascinating. And that is the idea of being curious, right? She starts off as you are going to be luckier if you find yourself more curious. [00:20:33] Joe: And it kind of strikes me, Chris, that when I’m listening to OG talk, he’s like, of course you don’t international. Well, how do you know? Well, you get curious enough to read back through all the statistics and do some research on what successfully has made an investor. I feel like this is a strong suit. [00:20:50] Joe: Being a friend of yours for a while, Chris, of yours, like you seem to be naturally curious about the world around you. Was that something you were born with or is that something that you developed as an education, a way to educate yourself over time? [00:21:03] Chris: No, I was always kind of like, wanted to know why and how things worked, and then it just kind of me moving up into my career and being a a, an enterprise engineer, I just, that’s the way I learn. [00:21:15] Chris: But I think it’s only part of the story. You know, you can be curious, right? Like she mentions in the, in the article, but you also have to be, you know, you gotta be able to take action on the things you’ve learned. You gotta be able to actually do something because, you know, you can just be overly, you know, educating, soaking up all this stuff, but man, if you’re not actually taking action and taking the risk again, I just, for some reason, I just, I always feel cringey when people talk about luck because I just feel as though there is always something you can do. [00:21:52] Chris: To alter that, whether it’s more lucky or less lucky, right? Like, I mean, if somebody says, you know what? Oh, you’re so lucky because you know you got that job or whatever. Well, you could be unlucky by not keeping appointments, sleeping late, not going to the interview, whatever. Or you could network meet the right people. [00:22:08] Chris: That person introduces you to somebody else that recommends you for the job, and now you’ve got the job so you can again, increase or decrease your luck, so to speak. The actions you take, so you can be curious, but you gotta take action. [00:22:21] Joe: It’s like the harder I work, the luckier I get. [00:22:23] Chris: Exactly. [00:22:24] Joe: Yeah. Yeah. TM trademark that. [00:22:27] Joe: Yeah, I just thought of that right now. Just like last week I thought of this whole idea of you can afford anything, but not everything like it. The brilliance that is me is incredible. Another thing I like about what Kate says here, and I know our stackers don’t have it in front of them, but I think this is really important. [00:22:43] Joe: She really makes a big deal about the fact it shouldn’t be transactional. And I feel like in life now, everything is transactional. When I, when I go online, they’re like, Hey, if you just spent five minutes doing this one thing, the transaction is that’ll make your life a ton better. And I feel like Kate’s saying, you just have to be willing to explore. [00:23:03] Joe: You have to be willing to just get out there and f it up, I guess. [00:23:07] Paula: Hmm. Well, transactional approaches is short-term thinking, right? With a transactional approach. You might get. A coffee meeting you might get, depending on what in industry you’re in, maybe you’ll, you’ll sell some small widget transactional approaches can only take you so far. [00:23:26] Paula: But developing relationships, that’s where you reap these long-term rewards that you don’t even know at the beginning of that, that relationship, what that’s going to unfold into 5, 10, 20 years into the future. And maybe it won’t develop, quote unquote, develop into anything other than you just had a great friendship. [00:23:46] Paula: Yeah, and there’s immense value in that too. Relationships are far more valuable for the long term, but so many people approach strangers with this transactional thinking. [00:23:57] Joe: I think so transactionally, and I didn’t realize this until we interviewed Shemen near Mohammed a couple weeks ago, shemen actually talked about the difference when she lived in France about just being in America. [00:24:09] Joe: We think, well, I gotta trade time for money. I have to get back to my desk and I have to do more processes. And the French will often spend 90 minutes at lunch. But then they come up with the answer to the question much quicker, Paula, because they’re asking who not how, right? Mm-hmm. Because they have so many who’s in their life that can very quickly answer these questions that we are all pounding the keyboard trying to find on YouTube that the relationship ends up being the answer. [00:24:34] Joe: So I love what you’re saying about relationships, [00:24:37] Paula: right? And the notion of asking who not how? I mean, for me, that’s a new aha. That’s something that I’ve only learned recently. Yeah, me too. And that I’m still still trying to incorporate into my life. In fact, I just downloaded the audio book, the Who Not How Audio book. [00:24:51] Paula: Literally downloaded that in the last week. [00:24:53] Joe: It’s such a great lesson. [00:24:54] Paula: Yeah. Yeah. That is a critically important lesson, one that I’m only in the very beginning stages of learning and, and incorporating, but it, it truly is, you know, especially as people become increasingly specialized, it makes no sense to try to take on too much on your own. [00:25:09] Paula: Like we are an interdisciplinary species, uh, interdependent species. Right. Rely on other people to rely on that interdependence. [00:25:18] Joe: And the better we know people and the less transactional we are about it, just we have this deeper knowledge of the people around us, the easier it’s gonna be to know who or who’s are. [00:25:26] Joe: Right. Oh, gee. You know, when you’re an advisor, you naturally have to be curious about what your client wants. Right. To be a good team member and help them get what they want. But I’m wondering how our stackers can use that same curiosity to build a better financial plan. Like how do we think more curiously about our lives to be able to make our financial plan more robust? [00:25:47] OG: There was something that Paula said earlier, and I don’t remember exactly how you phrased it, Paula, but I was thinking in my head that in order to go fast, you’ve gotta slow down. Mm. And so many times we wanna rush through whatever we’re trying to do or, or whatever the case may be. It’s, and I don’t know if that’s just culturally, and that’s the difference between Joe, your example of France and America. [00:26:10] OG: You know, the lunch thing. Very often when you give yourself space to do other things, Steve Jobs, for example, very famously would only do conversations while walking around a because it like move people along. Like they would like, oh, is this your building? Okay, good. Off you go see it. You know, like it could get out of it. [00:26:31] OG: But also, you know, there’s just something about being in the shower and having your thought going like, oh, that’s the idea of that problem. Like when you, when you just give yourself space to think about stuff. And materialized. And so from a planning perspective, when we’re thinking about like long-term financial goals, it sounds really silly, but I would, I would spend 99% of the time thinking about that. [00:26:52] OG: Like, if I’m doing this for myself, I’m thinking about what do I want my life to look like? What do I want my family situation to look like? What do I want my health to look like, my spirituality to look like? That’s what I wanna spend all my time and energy on. And the rest of it’s like, okay, cool. Now how does the money fit into that? [00:27:12] OG: How do I do that? Disney famously said, you know, when your, uh, values are clear, your decisions are easy. Right? That’s his, one of his famous quotes. You know, when you’re struggling with somebody said, uh, if you don’t wanna budget, it’s because you wanna spend all your money. Well, that’s because we don’t have really clear values for people that have a really clear understanding of what the future looks like, the savings, investing, the decision making around that. [00:27:34] OG: That’s not about sacrifice. It’s about like, this is the progress I make to get to the thing that’s important to me. It’s not about going like, oh, woe is me. I need to, you know, I can’t do this because I have to, blah, blah, blah, blah, blah. It’s like I’m choosing to put money in my retirement plan and not go on vacation right now or, or whatever the case may be, so that I can have the life that I really want. [00:27:55] OG: So, going a lot slower I think is super important. And spending a bunch of time on the stuff that’s not money related. The dollars and cents. Spend all your time on who do I wanna be? Like what do I want my life to look like? Then the money just kind of fits in there. [00:28:11] Joe: Part of what I don’t like about changes in financial planning are, I liked way back when I was an advisor, just the idea of getting people out of their house and their natural habitat and coming into an office that is not a part of their life on a daily basis. [00:28:27] Joe: ’cause I found that it was so much easier when we didn’t have all these distractions. I think it’s hard to get to that spot where you dream bigger and you get more curious when you’re surrounded by the daily living stuff still, you know, the chaos that’s going on in your life. Part of the fun for me of Strategic Coach was always just the fact that I go to Chicago and it was on the plane there and on the plane back that I do some of my best thinking just because I, I wasn’t surrounded. [00:28:53] Joe: I think it’s, it’s hard to be curious when you’re in the grind. I think it’s, it’s very, very curious [00:28:59] Chris: and that’s why Joe sometimes, like we have our leadership meetings offsite for a day, right? Just because we’re in that different environment, we can think bigger. You know, we’re not in that day-to-day operational thinking. [00:29:10] Joe: And maybe Chris, I mean, you know, you and I have had fun together at Camp Fires, right? Camp Fire, I think is all about that. You’re just at a, you’re at this retreat center way out of your daily life. So yeah. Great stuff. Well, she’s only begun. We’ve got, uh, two or three more areas of Kate’s piece that I’ll link to in our show notes that, uh, we’re gonna dive into about the idea of luck and increasing your chance of luck. [00:29:34] Joe: But at the halfway point of each Stacky Benjamin Show, we have this amazing trivia, uh, competition on Friday. It’s between our three usual contributors, OG Paula, and normally it’s Jesse Kramer today. Chris, you get to play the part of Jesse Kramer and as member of Team Jesse Kramer. Well, I’ve got some good news and some bad news for you, my friend. [00:29:57] Joe: Which one would you like first? [00:29:59] Chris: I was like the bad news first. [00:30:01] Joe: Well, uh, the bad news is actually the good news, which is that you are in the lead if you’re part of Team Jesse Kramer, which was not the case until just a couple weeks ago. But, uh, Doug, what’s our score so far in this competition? As we slide into man getting into the heat of the fourth quarter, fourth, [00:30:19] Doug: presently, Joe Jesse slash Chris is leading with 12 and a half points. [00:30:24] Doug: Our usual and still reigning champion OG has just 11 points and Paula. Uh, she’s just hanging out in the back with eight and a half points, just like doing her whole 30 being dry. October. It’s, it’s sober [00:30:42] Paula: October. Sober October. [00:30:44] Doug: Yeah. See that’s why. Doesn’t have enough of a buzz to get the trivia [00:30:48] Joe: thing. No. [00:30:49] Joe: That, no, she thought we were talking dry as in, can’t get the answer right. Oh, it was alcohol. I thought it was trivia. Answers. [00:30:56] Doug: Humor. [00:30:56] Joe: That humor I wasn’t supposed to Yeah. Dry. Exactly. Wait what we’re supposed to. Oh, I see. Alright. So that is the score. Chris, you’re gonna guess first. OGs gonna guess second. [00:31:08] Joe: Paula gets to guess third, which you would think would be an advantage, but after all these years, I’m starting to wonder. It’s not over yet. Come on. But every week, Doug, you’ve got, uh, this week’s, uh, question. What are we talking about today? [00:31:27] Doug: Hey there, stackers. I’m Joe’s mom’s neighbor, Doug, and today we celebrate the day a cheater was arrested. Don’t worry, OGs not in handcuffs yet, but if you’ve ever golfed with him, you’d know his use of the unplayable lie rule is. Rather liberal. No. Instead I’m talking about Charles Van Doran, a popular contestant on an early TV quiz show from the fifties and sixties called 21 when he was accused of perjury for lying to a grand jury that he had not been given the answers ahead of time in order to boost ratings. [00:32:01] Doug: Former champion Herb s Stempel was told by producers to give intentionally wrong answers while Van Doran was made to look incredible. I can assure everyone out there that when it comes to the Stacking Benjamins trivia we have, but loads of integrity. Our contestants have zero idea what the answers to the questions are gonna be, and even if they did, they’d still get the answer incorrect. [00:32:25] Doug: Right, right. Paula? [00:32:27] OG: Right. Paula, I was gonna say, this sounds a lot like the talking to that I got. Uh, about, uh, always kicking everybody’s butt at trivia. So go on. Tell me more about, uh, this real life story of me being told to throw it on purpose, to make it more interesting. [00:32:43] Doug: Even, I have no idea what the answers to these questions are gonna be, because like Ron Burgundy, I just read what’s in front of me and I have no idea what I just said. [00:32:53] Doug: Oh, I, yeah, I see what you did there, Joe. Okay. But Van Dorin before he was caught, won a buttload of money, $129,000 to be exact, or the equivalent of over $1.1 million today. I mean, that’s a butt load of money. Am I right to stop saying butt load? Like just, it’s just a lot. No, I’m not gonna stop saying butt load because that’s today’s actual trivia question. [00:33:20] Doug: Turns out that a butt load, I’m gonna squeeze as many of these as I can, uh, is an actual unit of measure. The term butt load. There’s another one originates from medieval liquid measurements, specifically butts, which equate to two hugs heads. I mean, who didn’t know that? So stackers, how many imperial gallons equal a butt load of wine. [00:33:47] Doug: I’ll be back right after I go watch the video to see how Joe’s mom keeps beating me at Rummy. I’m sure that woman’s channeling her inner Van Doran. Alright, listen, I’m gonna jump in here. All of you people watching us tape this. Do not go Google it and put answers in the chat right now. No matter how much you wanna help out Paul, [00:34:06] Joe: Paul is wondering if you keep saying but load because you have a colonoscopy scheduled soon. [00:34:11] Joe: Hey, those are [00:34:12] Doug: great low colonoscopies. [00:34:14] Joe: Yeah, yeah. Don’t talk about Doug’s idea of a good time, Chris, a but load of wine. How many imperial gallons of wine would that be my friend? A [00:34:25] Chris: buttload. I knew it was an actual measurement, but I had no idea if it was like a liquid measurement. Is it like, how do you measure dry goods? [00:34:36] Chris: I don’t know. Um, so we’re talking about gallons. Huh? Gallons? Imperial gallons. I think a but load [00:34:45] Joe: is nine gallons. Nine gallons. Oh, gee. You think that’s high or low? [00:34:52] OG: Um, my original thought was five and a half, but I gotta make Paula make a decision here. So I’m thinking of like a barrel of wine and, um, a medieval times with the, would they have a barrel of wine? [00:35:07] OG: I don’t know. So I’m gonna say a barrel of wine is, uh, somewhere in the neighborhood of about 55 gallons. So I’m gonna say 55 gallons is a butt load of wine. [00:35:18] Joe: Wow. So wait, your first guess was gonna be five and a half and then you go up to 50. Yeah. But, but it was just [00:35:23] OG: largely contingent on what Chris said. [00:35:25] OG: So since he said nine, I, I can’t say 10 ’cause Paul will say eight. And so I’m gonna give her a number that she has to kind really fiddle with, uh, depending on what she thinks. Maybe she thinks it’s 500 and she’s like, oh, you idiots are way off. [00:35:37] Chris: I don’t know, og, that seemed like you were using like data and smarts to figure that out. [00:35:42] Chris: That’s pretty, you did a pretty good job there. [00:35:44] Joe: Like, wait, we’ll see. Like, wait, what? Alright, Paula, you’ve got them. Chris has nine, OG has 55. [00:35:53] Paula: Yeah. So my first question is, is this a base 10 measurement or a base 12 measurement? I feel like it would have to be a number divided. It’s a [00:36:00] Joe: butt load. It’s all about the base and sheep’s heads, hogs heads, hogs heads. [00:36:05] Joe: So [00:36:05] Paula: yeah, I, I, I believe that the number would be divisible by either threes and fours or. Twos and fives. [00:36:13] OG: Threes and fours, [00:36:15] Paula: yeah. Yeah. So that it can be thirded or quartered. Ah, hi. So we’re talking the olden days when it was harder to transport things. So a 55 gallon drum of something would actually be [00:36:32] OG: a butt load. [00:36:33] Paula: Yeah. Like it would be heavy enough that you could roll, you could turn it on its side and roll it without it gathering too much momentum down a steep hill. [00:36:45] Doug: What is happening right now? Where is this going? [00:36:49] Paula: You know, you could, you could take a 55 gallon drum and you can turn it on its side and roll it and that would be an a, a relatively reasonable method of transportation, even if you did not have. Some alternate transportation, right? Because imagine loading like a 55 gallon drum onto a, a wagon. [00:37:07] Doug: But if you cut that drum into thirds, it gets a lot lighter. Yes. It’s like a third of a butt load because all the liquid comes out. I love how overthinking Paula is. [00:37:16] Joe: It’s so great. Don’t they measure butt loads and halves? Possibly. Possibly. Like right and left. If you cleve it, [00:37:23] Paula: I’m going to take the, I’m gonna take the under a 55, so we’ll go with 54. [00:37:31] Joe: 54. All right. So Paula with 54. Oh gee, with 55. Chris with nine, who’s right? We’re gonna find out just a minute, [00:37:45] Joe: Chris, you opened this up with, uh, nine gallons and uh, OG went big to see which way Paula would go. She took the middle. You feeling good? You’ve got nine up somewhere into the mid twenties. I am not feeling good. Not feeling good. No, I’m not og How about you? 55 gallons. [00:38:06] OG: Did your trick work? We’ll find out. I was trying to figure out how big a hog’s head would be. [00:38:11] OG: I’ve seen hogs, I’ve seen their heads and then they don’t seem like they would hold a lot. So 55 gallons doesn’t seem, yeah. But, um, anyways, maybe that was just a phrase of, of some kind. I don’t know. But I wanted to give Paul a big enough number that she had to like, make a choice. I honestly thought she wouldn’t say 54 or 56 or 10. [00:38:29] OG: I thought she’d say 27 or something. [00:38:31] Chris: There is a brand of beer called Hogshead. Isn’t there? [00:38:34] OG: Yes. Yeah, I do recall that. Now that you say that, [00:38:38] Joe: and all of a sudden I’m super thirsty and, uh, og make sure he has one. I’m wet January every year. So Paula, you took 54. Feeling good? [00:38:46] Paula: Yeah. You know, uh, I’m feeling mid because the, the issue is now OG has the entire upper range. [00:38:52] OG: I have all of Infinity. He’s [00:38:53] Paula: got Blue sky, right, exactly. Blue sky. But I might have just seeded too much ground, [00:38:58] Joe: you know, uh, for all the stackers that didn’t hear it, we did put a joke in the question, which is that. Paula convinced me to use a new social media app a couple weeks ago called, what’s it called? [00:39:09] Joe: Be Real. Be Real. Yeah. Be Real. Where you take a picture. So I took a picture that I was getting ready for the show last week, and Paula writes me and goes, Hey, I can see the trivia in your, I can see the trivia in your thing. I know it’s about Spiro Agnew. Mm-hmm. And I know it’s about some date in October. [00:39:28] Joe: I was very honest. Yes. And I was talking to Doug about it, and Doug’s like, well, should we change it? I’m like, no, it’s Paula. And sure enough, Paula still didn’t win. I still [00:39:37] Paula: lost. [00:39:39] Joe: She knew exactly where we were going last week with the trivia. Still did not win. [00:39:43] Paula: I still lost, but I intentionally did not Google that or look that up. [00:39:48] Paula: So I still lost. Yes. You [00:39:50] Chris: lost with integrity, Paula. [00:39:51] Paula: Yeah. Thank you. Lost with absolutely. Thank you. [00:39:54] Joe: Well, let’s see which two of you’re gonna lose with integrity this week. Doug, what’s our answer man? [00:40:04] Doug: Hey there, stackers. I’m trivia host and guy who apparently gets beat at Cards Fair and Square, says you Ma Joe’s mom’s neighbor died. While it turns out that I can drum up zero evidence of Joe’s mom cheating today, we are celebrating the day a cheater was caught. Telling you, og, the sand trap rake cannot be used as a club length. [00:40:27] Doug: Also, quiz show contestant Charles Vandora. I remarked that he’d already pocketed a butt load of money when Joe protested Duff protested. I might add that I shouldn’t use such language. Unbeknownst to him, I actually looked up this week’s trivia and it turns out butt load is a true term of measurement. [00:40:47] Doug: Now I wasn’t using it correctly, so we’ll award Joe a couple of points because a butt load is a unit of measure for certain liquids, not for Benjamin’s. While a butt load of ale is 108 imperial gallons. That’s for ale. I asked how many imperial gallons make up a butt load of wine, which isn’t the same. Of course, we duh. [00:41:11] Doug: The correct answer is. Well, I’ll say this, it’s 117 more than what Chris guessed. It’s 72 more than what Paul had guessed, and just 71 more than what OG guessed because the correct answer is 126 Imperial gallons making golf cheater. OG our winner. Ooh. [00:41:33] Joe: Oh gee. Sprinting back toward the front now only a half. [00:41:36] Joe: He’s back up. Just a half point back. Half point back we’re Jesse’s, had his phone coming in, and now Paul, if you win the next five in a row, you’ll be up there too, [00:41:46] Paula: man. And a hundred, I, I wasn’t even the base 10, base 12 thing doesn’t even work with that. It, no, 126 can be divided by three, but not by four. [00:41:56] Joe: The whole idea of two hogs heads, like, oh gee, you said this earlier, like a Hogshead doesn’t hold that much, which made me think Chris would be right in that one. Okay. Nine gallons maybe, but 120 something. Wow. Alright, let’s uh, jump back into luck and obviously it, I I think we can apply luck to whoever wins our trivia each week, but we really don’t wanna apply luck to our portfolio. [00:42:22] Joe: And we started off this conversation by defining the argument that talking about how curiosity can make you luckier. But a second area, Chris, and we’ll start with you. She points to this idea of if you look to give before you get, you’re gonna be luckier if I live [00:42:40] Chris: to give, did that resonate with you? It, it did. [00:42:43] Chris: There’s a lot of studies and science out there that the more generous you are, the more it comes back to you in a variety of ways. Right? It could be somebody helping you, it could, it doesn’t have to be like monetary, right? And so I’m a true believer of that. So that’s definitely something that, that struck me for sure. [00:43:00] Joe: It’s interesting, Paula, ’cause you know, at the end of the first half we were talking about who, not how. Mm-hmm. It seems you can build a network of who’s easier if you’re a giver. [00:43:09] Paula: Yeah. Yeah. I mean, people like people who, um, are generous in spirit, but it’s also the case. There’s this thing called the Ben Franklin effect that people will like you more if, uh, you reach out to them and, and ask them for small bits of help. [00:43:24] Paula: Occasionally, nothing too onerous. But people generally, they like to both help and be helped. And that’s part of building relationships. So the, the Ben Franklin effect comes from the observation that Ben Franklin made, in which he, he noticed that if he asked somebody if he could just borrow a book, so a very simple request, then that person was a little bit more invested in him. [00:43:46] Joe: I’ve tried to start doing this by practice lately, putting things in my calendar to reach out to people and just ask about them and not make it transactional. Just look through my list of friends and try to be much more intentional. Curiosity. ’cause I have to tell you, I’ve noticed lately, the last several years, the last five years, I’ve, I’ve spent a lot more time noticing that the people I like the best are just these people that are naturally curious, that are naturally givers. [00:44:14] Joe: Especially the more I get involved in my local community and you see it’s the same group of people. It’s a powerful thing. I do feel like the og, you know, as the professional here when it comes to generosity, you know, you’ve said throughout this conversation, well, we gotta draw a line somewhere. I think that some people are so generous they get taken advantage of. [00:44:33] Joe: Like, do you see that sometimes with people in their financial plan that they get further ahead if they were such a damn giver? [00:44:40] OG: No, no. I think there’s, um, I mean, when you say taken advantage of, I’m thinking about the person who. Is, you know, maybe too helpful to family or something. Maybe. [00:44:52] Joe: Yeah. Maybe the kids like, Hey, my kids, [00:44:54] OG: uh, my kids need a car. [00:44:55] OG: And it’s like, well, they don’t need a brand new Lexus. Like, your kids will be fine. You know, if your kid really needs a car, I get that you wanna help, but it doesn’t have to be, you know, a hundred thousand dollars Mercedes. It could be a $25,000 Toyota. That will accomplish the goal of, of transportation as well. [00:45:11] OG: I dunno if that falls in the category of taking advantage, but I will say that people who you said invest in people, people who spend a lot of time thinking about being intentional around any giving strategies, I, it seems to me that those people are the ones that are entrusted. More to do more stuff with more stuff. [00:45:31] OG: Mm-hmm. It’s like, you know, whether that’s the universe, it’s a spiritual being that you believe in. It’s, you know, there’s some sort of life force I think that says, Hey, you’ve done good with what we’ve given you so far. Here’s a little more, let’s see what you do with this. You know what I mean? Yeah. Like, there just seems to be that, and, and whether, I don’t think that falls in the category of luck so much as it’s, it’s just being a good steward and you’re just more responsible, like people see other people’s success, you know, and, and say, Hey, that person’s being very successful, being a very, you know, a good person by our standards of what that is. [00:46:07] OG: And, and so therefore, you know, here’s more responsibility. They get lucky. You know? What are you gonna say? You’re just lucky. [00:46:14] Joe: Just lucky because I was trustworthy in the past and because I give more away. That’s quote luck. Chris, did you ever see this, this book? I, I think it was an Oprah book read that was really controversial along maybe back in the what nineties? [00:46:27] Joe: Early two thousands. The secret, you remember the secret? I I know of it. Yeah. This idea of money Karma, right? The idea that wealth flows back to people who contribute. They manifest. They manifest more, they manifest money. Do you think there’s any truth to this secret that I ask the universe and then I become a giver and then money flows back to me? [00:46:49] Chris: I am not really a, like a woo woo type person, right? I do feel as though I, I learned something very similar through Brian Tracy, some of his books, you know, he has one called No Excuses, the Power of Self-Discipline. And even in that book he talks about, you know, being charitable, being able to give not only your time, but your money. [00:47:08] Chris: And the more you give, the more people will give back to you in terms of whether it’s money, whether it’s time, whether it’s help with something. So, like I said, I don’t know, like my daughter’s really big about manifesting, so she uses that term a lot. Yeah. But I, and it’s just not my, my jam. Paul, you think so? [00:47:26] Chris: Manifesting [00:47:27] Paula: there’s such a hippie connotation to it. It’s not, see, have you [00:47:30] Chris: met my [00:47:31] Paula: daughter? Yeah. If I look past the terminology to the root idea, the notion that what you. Want what you strive for, you are more likely to get, sure. But there’s something, it’s different words kind of either attract people or repel people. [00:47:49] Paula: And there’s something about manifesting that just, it’s not me. [00:47:53] OG: It rubs you the wrong way. The like, I, I was gonna say, I don’t like the phrase so much either because it feels like, you know, you didn’t earn it. Maybe like, we’re all achievers here, people that have been successful because we, we work really hard. [00:48:06] OG: But I think about it in the sense of attention. When you really focus your attention on one particular thing, then all of your energy and all of your mental bandwidth goes to how to solve this thing. Some people might say, I’m manifesting it. Or you could just say, I’m paying a whole bunch, you know, I’m manifesting healthy living. [00:48:26] OG: It’s like, but if all I think about is eating healthy, eating healthy, eating healthy, working out, eating healthy, working out, guess what I’m gonna do? I’m gonna eat healthy and I’m gonna work out. And guess what? Then I’m gonna look skinny and be jacked in tan. Okay. Is it because I manifested it or because that was in my brain the whole time and that’s what I put all my energy on. [00:48:42] OG: Right. [00:48:42] Chris: Just, you succeed at what you focus on. And if you’re focusing on that, then that’s what, that’s what’ll happen. [00:48:47] OG: You manifested it through hard freaking work. Although I, over the course of two decades, I also [00:48:53] Chris: know people that’ll burn this particular type of candle that’s supposed to bring money, stuff like that. [00:48:59] Chris: So who knows? You don’t do that, Chris. I do not do that. No. You burned something. Say Doug burned something to manifest [00:49:06] OG: stuff. He has all sorts of visions of sugar. Flunks. It used [00:49:09] Chris: to have a money tree, like an actual money tree, and it was back. Oh, you got one? Oh yeah, yeah. Do. There it is. [00:49:14] Paula: This right here. [00:49:15] Paula: Money tree. Yeah. [00:49:16] Chris: Mine died. Aww. [00:49:19] OG: Well that explains a lot. [00:49:21] Joe: W But it’s funny, Chris, when you were talking and we talk about manifesting and og, you spoke about manifesting about really what we focus on. I think a lot of times our young stackers, that’s the first thing they wonder is what, what should I be focused on? [00:49:35] Joe: Right? And Kate addresses this at the bottom of her piece, which I also love Talking about the path often starts with this feeling of being lost. I go, gee, what do you say to our young stackers who are like, I’m not really sure what to focus on. Like, you know, you just said international, I should have stayed in, but how do I know to focus more on international? [00:49:57] Joe: Like what do you say to people that are looking to be quote a little lucky by figuring out what the real path is? [00:50:04] OG: But none of those things are things that you should spend any time on. I didn’t say that you should spend time focusing on international or any of that sort of stuff. I said, you should spend time focusing on the things that are important to you about what you wanna do. [00:50:17] OG: Or be or become as you continue on your path. And if you’re 25 years old and you have no idea what 65 looks like, I don’t blame you because Joe’s almost 65 and he has no idea what 65 looks like, you know? So it’s a common thing. Dude, that one was good. I applaud you for that one. Slow clap every episode. [00:50:38] OG: Bravo, sir. [00:50:40] Doug: That was a good [00:50:40] OG: one. [00:50:40] Doug: That was better than most of ’em every episode. But [00:50:43] OG: I bet you could look at your, you know, the next five years of your work career and say, you know, I can see the people that are above me. I can see the career path. This is what I’d like to have my life look like. Or, you know, I’m in a relationship. [00:50:56] OG: I think I would like to have some children sometime. If that happens, that would be cool. And in 20 years I’m gonna have to pay for college so I can spend some energy thinking about what that looks like. Or I wanna buy a house or, you know, whatever it is. That’s not that 30 year goal. It’s, I mean, that’s important. [00:51:13] OG: You gotta have something, uh, way down the line. You’ve talked about this a million times, Joe, that the fun part is planning the vacations. Right. Necessarily always being on the vacation. Right. You know what I mean? It’s like that’s why you have one scheduled right now. You have something to look forward to. [00:51:27] OG: George Burns said that on his, you know, he is booked on his hundredth birthday. Yeah. ’cause it’s something to look forward to. So just have something out there to look forward to. It’s not gonna matter how much international stuff you have, and if that’s the message you got, I apologize. That’s not what I meant to say [00:51:43] Chris: og. [00:51:43] Chris: I like where you were going with that. And if we’re looking at the younger stackers, how do we get those younger stackers to truly start looking at their future selves? They’re doing this now for their future selves. You know, I have a 25-year-old and he can’t look past next Tuesday. You know? How do you start to do that? [00:52:02] OG: Well, I’m, I’m not sure that you can, I just think that you have to get out of whatever it is that’s directly in front of you and if you can pull something that’s six months away, that’s great. If you pull something that’s a year away, that’s great. The reality is, is I, I, Chris, to your point, like 25 year olds only have 25 years of experience. [00:52:21] OG: Mm-hmm. They don’t have experience of thinking about the next 25 years because they’ve only been in this first 25 years, you know, so it’s not really reasonable to assume that they’re gonna be able to, you know, project this thing out there for half a generation. But I do believe that if you get away from the day-to-day stuff and say like, if I could draw this the way that I want, you know, and maybe that’s the answer. [00:52:42] OG: If I could draw this the way that I want, what would I, what would I do? What would I keep that I have? What would I do a little differently? [00:52:48] Joe: Got it. I think that goes back to just getting out of home base. ’cause to be able to, you gotta get outta your surroundings I think, to be able to think that way. And I also think, Paula, that what OGs talking about is a combination of two things. [00:53:01] Joe: It seems to me discipline and flexibility. I mean, on one hand being flexible because you know, he mentioned three things he mentioned, uh, college. Well, how many people that are 18 are sitting on three different college choices? They don’t even know where they’re gonna be 12 months from now. Like, you don’t even know if any of those are gonna happen. [00:53:20] Joe: Children, well, who knows if that’s gonna happen, you know what’s gonna happen there? And then buying a house, you and I don’t afford anything. Talk to somebody who’s like, I can afford a house and I don’t wanna move from my area. Like, should I just plan on not having a house? How do we stay flexible so that as the world tells us that these things aren’t gonna happen? [00:53:39] Joe: We’re flexible around that, but we still have the discipline to continue on building that stack. [00:53:44] Paula: The person that you and I spoke to on afford Anything, I think she’s actually a really good example of someone, you know, she has spent the last eight years saving up for a down payment and then she called us to say, Hey. [00:53:58] Paula: This is what prices look like in the area where I live. This is what prices look like in this other area. But it would be a, a two hour commute to get to work given the amount of money that I have given the, the set of prices, given my goal of eventually, like she was from Australia, she was like given my goal of eventually leaving Australia and living overseas for a while and then eventually coming back and retiring. [00:54:21] Paula: She was like, given all of these circumstances and parameters, should I, even though I’ve been saving for this for eight years, should I do something else with this money? Should I just invest it and, and put it in the market and put it towards just market-based portfolio growth? And what I see there is that combination of discipline and flexibility. [00:54:43] Paula: So she has the discipline to save the money. She also has the flexibility. To at all times reconsider whether or not her initial goal for that bucket of money is the correct one, particularly the goal’s changed. Yeah. [00:54:57] Chris: After eight years or whatever. I mean, your goals can totally change. [00:55:00] Paula: Yeah, yeah, exactly. [00:55:03] Paula: We’re going through this right now with my parents have a charitable endowment and we’re rewriting the, the name and the mission statement of the endowment because the types of charities that they want to fund now is very different than the types of charities that they wanted to fund at the time that they started it. [00:55:19] Paula: Right? And so that involves really restructuring and, and even renaming, going as far as to rename the whole thing. So again, it’s that combination of structure, discipline, whatever you wanna call it, with being able to have the flexibility to respond to changing times and shifting priorities. [00:55:36] Joe: I love the idea. [00:55:37] Joe: Uh, I saw Christina Tosi, the famous creator of Milk Bar. I saw a video with her last week and she said that she would love to be able to ask people in interviews if they were a distance runner. And it was only because of the fact that she thought that Paul was like, I’m out. Yeah, I’m done. No, I’m out. But distance runners like the infinite game. [00:55:58] Joe: You’re not, you’re not a distance runner because you’re looking to win something. You’re out there because you like this infinite game of just being out there in nature running. And you could say the same for hikers or people doing whatever, but she said it translates well into the kitchen. And I kind of think here as we wrap this up, that what you’re all kind of talking about is the infinite game of just saving. [00:56:19] Joe: Flexibility and being curious versus applying them to new goals as you have new things that come along. Steel off tees is hanging out with us and that’s something I thought that was really good here for our younger stackers. And uh, they say, I’d say a 25-year-old really only has like two to three years of experience. [00:56:35] Joe: I think back to younger twenties I struggled to see past a couple years ahead, much like Chris was talking about earlier now, almost 40. It’s easier to see potentialities over 20 years. So give yourself the grace to have time and just play the infinite game, I think over the short run. Mm-hmm. I love this idea of being curious. [00:56:51] Joe: I think that is great. I like being comfortable with being lost. I think that is cool. And then also the idea of giving before you get to increase your surface area for more luck in your life and with your money. I think that’s a great place to leave it guys. I wanna find out what’s going on with all of you before we say goodbye. [00:57:07] Joe: Oh gee, this fine. mid-October weekend on tap. What do you got coming up, brother? [00:57:13] OG: Oh, this is my fall break. I was telling you guys about what you were supposed to say is, don’t you have a fall break coming up? Don’t you have a fall break coming up? Sorry. I’m in the middle of it right now. Uh, this is our annual golf tournament that I play with my cousin, who is a fantastic golfer in fun to play with. [00:57:28] OG: So he’s, uh, he’s hanging out right now and, um, Dougie v played. [00:57:32] Doug: Have you played golf with OGs brother? One time? I have it. It was, uh, um, uh, memorable. You gonna accuse him of cheating too? What does that mean? Uh, there actually was an incident that day we almost came to fisticuffs. Wow. [00:57:46] OG: Wow. What are you talking about fist? [00:57:48] OG: Well, this is my brother. This is, this is my cousin who’s playing. Who is not a cheater. And I think Doug, you have played with, uh, my cousin too. Maybe? I have not, I have not [00:57:56] Doug: played with your cousin, but there was a day with you and steak, I think it was Steak Brother and, and Uhhuh Jim. Yeah. You may recall. [00:58:03] OG: I vaguely remember the finishing hole, but mm-hmm. [00:58:06] OG: I don’t remember anything else about the round. Mm-hmm. Anyways, so we’re playing golf for four days, just having a great time and, um, uh, happy to, uh, happy to be able to do that. [00:58:13] Joe: Awesome. Paula, what’s going on at the Afford Anything Podcast here? mid-October. [00:58:19] Paula: Oh, on the Afford Anything podcast. So we’ve got an interview with Doug and Heather Bonaparte. [00:58:25] Paula: Doug is famous for his Twitter feed. Is sorry, [00:58:28] Doug: hair. His hair. [00:58:29] Paula: Yeah. For his hair, for his hilarious Twitter feed. But he’s basically a jokester. Uh, he has very, very funny tweets about money. But in a more serious realm, he and his wife Heather, wrote a book about being a married couple, trying to figure out money and life together in the context of a family and in the context of a couple. [00:58:50] Paula: And so that is, uh, what we’re talking about. We’ve also got q and a episodes all roughly every other episode as a Q and a with you, Joe. So you and I answer audience submitted questions. [00:59:00] Joe: Douglass and Heather, I know a lot of people have told us as we’ve gone around the country that people like listening to our interviews because they’re kind of a good ab. [00:59:08] Joe: Mm-hmm. I’ll be talking to Douglass and Heather as well, but we we’re saving them for Halloween week. Oh. Where we talk about relationship and money hoarder stories. Oh. With the bona parts. Nice. So, and again, Paula and I talking to the same people about different things, so I think it’s a good one-two punch. [00:59:25] Joe: Nice. Speaking of the guy, that’s a one-two punch whenever we come to a heavy metal concert. I don’t even that, that doesn’t make any sense. But Chris, thanks for hanging out man. What’s coming up? A heavy metal money. [00:59:35] Chris: Yeah. So, um, just recently dropped the Extreme Personal Finance Show with Lauren Almond, a friend of mine, that she was able to hit a millionaire status by the age of 31. [00:59:45] Chris: She was able to retire by the age of 33. She has a portfolio of short-term and long-term rentals as well as. Portfolio investments. So that was really cool. I just recently recorded an episode with Sha Malaney. We’re gonna talk all about taxes, but also more importantly, all about charitable giving. So we’re gonna talk about donor advised funds, qds tax implications, stuff like that. [01:00:08] Chris: So that’ll be really cool. And then I have another episode coming up by someone that we’re gonna talk about how to get ahead and have a professional career without even a college diploma. So getting your GED you, you didn’t get a college degree, but you’re still able to keep moving forward and build a, a great career and family with that. [01:00:27] Chris: So I’m excited. We’ve got some good stuff coming up. [01:00:29] Joe: That’s in the extreme Personal finance show, wherever That’s right. Finer podcast. Podcast, wherever you get it. And [01:00:34] Chris: on YouTube. [01:00:35] Joe: Yeah, the YouTube stuff is fun as well for the Extreme Personal finance show. And, and by the way, you and I have a project we do together. [01:00:42] Joe: If you’re in the Twin Cities, you want to come hang out with Chris and our buddies, Veronica, [01:00:46] Chris: Mike, and some other people. Absolutely. Yeah. So the third Wednesday of every month, we meet in person here in the Twin Cities area and we talk about all sorts of different money topics. We have q and a and trivia with a great group of people. [01:00:59] Chris: And, uh, it’s super fun to get in real, in real life. Getting together with people is awesome. [01:01:04] Joe: You get to hang out with heavy metal, Chris. Yeah. And other stackers in the Twin Cities. So you just look up Stacking Benjamin’s, twin Cities on Facebook and there’s, we have a private Facebook group there and it’s super fun. [01:01:15] Joe: But, uh, I can’t wait. I’ll be back up there next summer to party with you guys as well. Cool. But you’ve got a great, uh, holiday party coming up. I know you’re gonna throw axes, which for a bunch of money nerds. I’m not sure that’s advisable, but [01:01:28] Chris: we did [01:01:28] Joe: it [01:01:28] Chris: last holiday and it was so [01:01:30] Joe: much fun. Oh my gosh, it was a blast. [01:01:32] Joe: So, so fun. Alright guys, that’s gonna do it. Thanks for hanging out everybody on YouTube. If you wanna join us on YouTube, we do this on Monday. I love celebrating Fridays on Mondays talking about what are we doing for the weekend on Monday. So come join us. It’s in the afternoon on Mondays, and if you get the 2 0 1 newsletter, we’ll send you an email that will tell you that we’re what time we’re, we’re going live. [01:01:52] Joe: And it’s either three 30 Eastern or 5:00 PM Eastern check the week that we’re doing it, but it’s usually one of those two times. If you go to our YouTube page and subscribe, you’ll be able to find it there. Alright, Doug’s got it from here. Doug, what are the three big takeaways we should have had after today’s [01:02:09] Doug: show? [01:02:10] Doug: Well, Joe, here’s what’s stacked up on our to-do list for today. First, take some advice from Chris Luger. Wanna find more luck? Be curious, not judgmental. If you’re curious, maybe you’d have asked him questions. Questions like, have you played a lot of darts, Chris? To which he would’ve answered, yes sir. Every Sunday afternoon at a sports bar with my father from age 10 until I was 16. [01:02:32] Doug: Somebody listening will get that reference. Don’t worry. Second, I got it. Got it. Learn from I got no idea, Paula. Nope. No, no clue. No clue. Second, learn from Paula’s mistakes. Don’t try to combine dry January with Whole 30 unless it’s court ordered and you’re being watched by your parole officer. But the big lesson. [01:02:53] Doug: Don’t even try to explain to Joe’s mom that a butt load is a unit of measure. So she’ll ask you just how many bars of soap a butt load equals for your mouth. Thanks to Chris Luger for joining us today. You’ll find Chris’s heavy metal money on YouTube or wherever you are listening to us right now. [01:03:12] Doug: You’ll also find him leading a Stacking Benjamins meetup in the Twin Cities each month. Come by and say hello. We’ll also include links in our show notes at Stacking Benjamins dot com. Thanks to Paula Pant for hanging out with us today. You’ll find her fabulous podcast, afford anything wherever you listen to finer podcasts. [01:03:32] Doug: And finally, thanks also to OG for joining us today. Looking for good financial planning. Help head to Stacking Benjamins dot com slash OG for his calendar. This show is the property of SP podcast LLC, copyright 2025. It is created by Joe Saul-Sehy. Joe gets some help from a few of our neighborhood friends. [01:03:53] Doug: You’ll find out about our awesome team at Stacking Benjamins dot com, along with the show notes and how you can find us on YouTube and all the usual social media spots. Come say hello. Oh yeah, and before I go, not only should you not take advice from these nerds, don’t take advice from people you don’t know. [01:04:12] Doug: This show is for entertainment purposes only. Before making any financial decisions, speak with a real financial advisor. I’m Joe’s Mom’s neighbor, Duggan. We’ll see you next time back here at the Stacking Benjamin Show.

Leave a Reply