I’m in a yearlong challenge against 19 other bloggers to see who’s king of the investing hill. After leading early last year I fell back in the pack with an ultra-aggressive portfolio. This year I created a more thematic, “hands off” approach using MotifInvesting.com, a site where you build portfolios based on a theme.

I’m kicking the S&P 500’s ass.

Okay, I know, that’s over just the period since my last Motif post…..and I know it’s a marathon, not a sprint in the investing world.

But it feels great to finally have some good news in this portfolio.

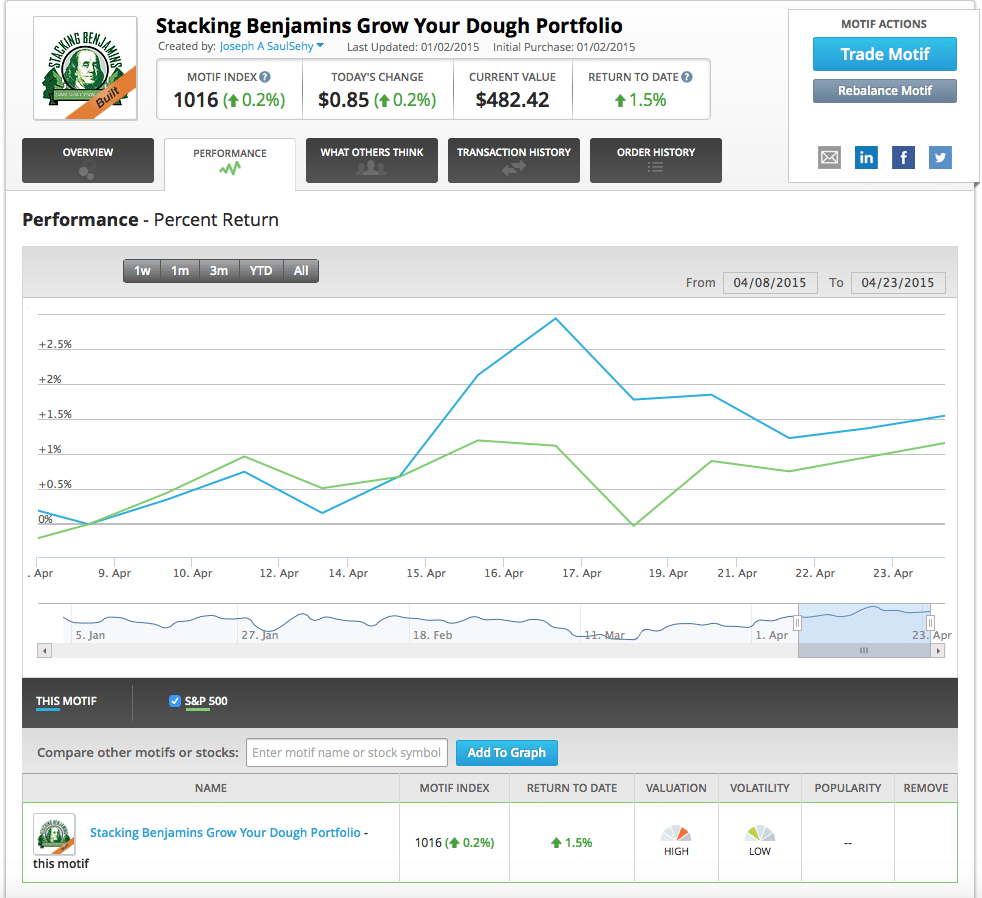

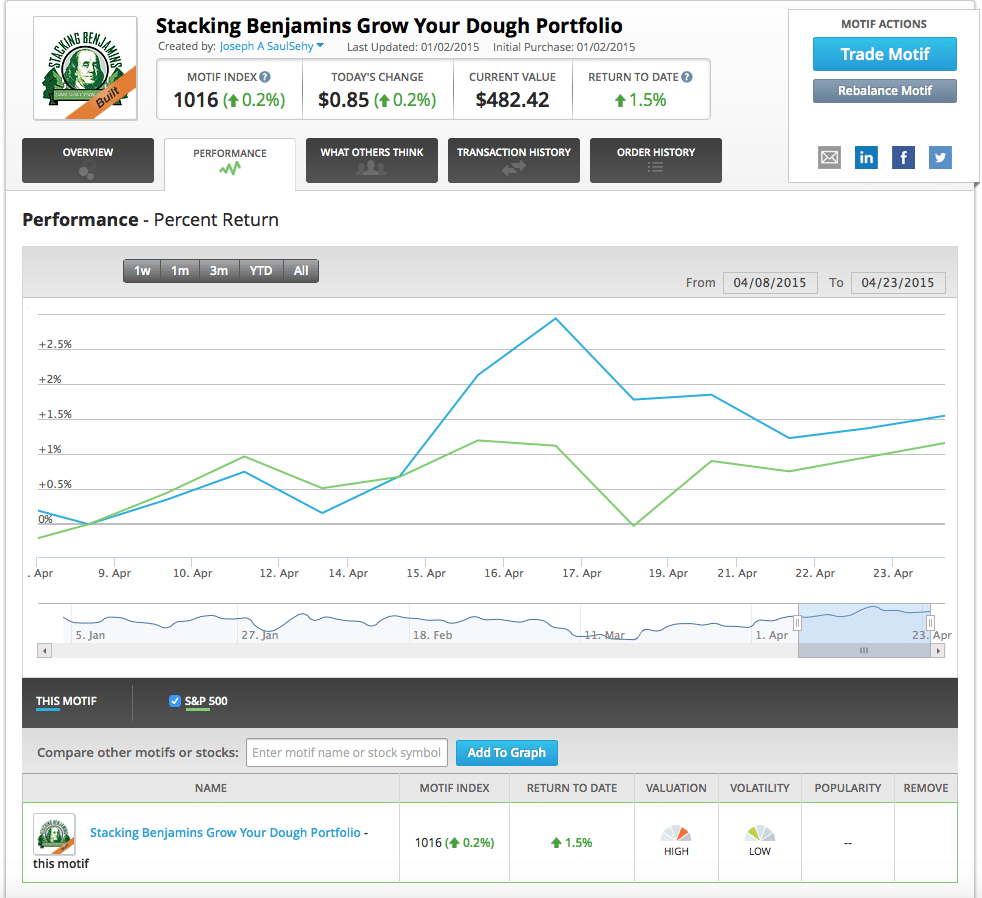

Over longer terms, mediocrity doesn’t bother me. The market, a measure most people consider mediocre, beats the snot out of most investors every year. So, in my book, mediocre = winning. First, how does the portfolio really look? It depends on the time frame you’re evaluating. Here’s the view since January 1, when the challenge began:

Yeah, it’s not as pretty. My bet on oil cratered before coming to life. …and here’s the view since my last update at the beginning of April.

As you can see, over the last three weeks I’m beating the S&P 500. BAM! But there are several reasons you don’t want to make short term evaluations.

1) Looking short term misses longer trends.

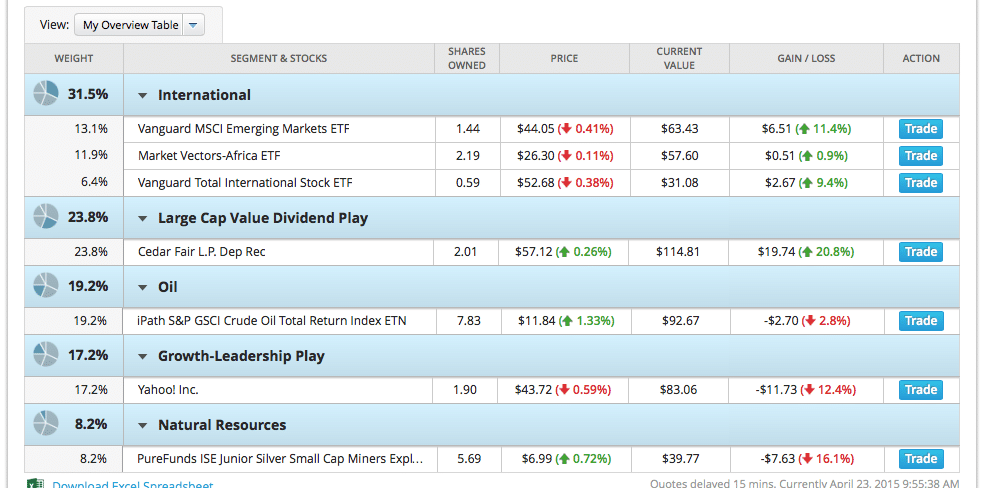

This is easiest to show you using the portfolio. Yahoo stock (YHOO) looks to be a laggard over the short run. Here’s a chart showing how we’ve done since January 1:

That looks ugly, doesn’t it? But haven’t we heard that Marissa Mayer has done some amazing restructuring at Yahoo!? This chart doesn’t seem to reflect any increased confidence in the company. But pull that chart back to one year and you see a much different story.

See how Yahoo! is leading the S&P 500? I still firmly believe this is going to be a good stock. I bought it to bet on Marissa Mayer. I’m willing to leave my money alone to see if she continues this improbable turnaround.

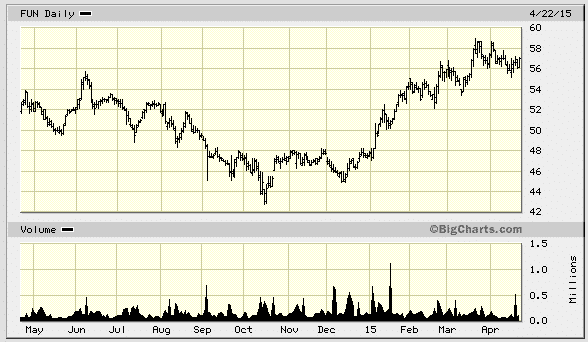

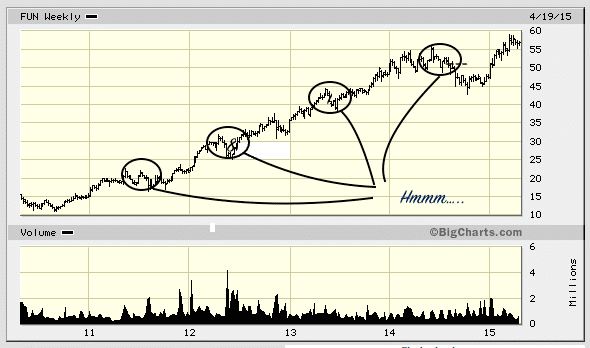

On the opposite side, one stock we’re crushing it with is FUN.

There’s a problem, though that once again, the one year chart doesn’t show. Check out a longer term chart of FUN.

Notice the first few months of every. stinkin’. year. See a trend? FUN rises early EVERY year, not just this year. I knew that already (these are trends you should look for, especially with seasonal businesses like theme parks). I expect FUN to fall off over the next few months. Am I going to sell it? Nope. I’m in there long term….not just for the appreciation, but also for the dividend. If you remember, Cedar Fair also pays a dividend that currently equals 5.25% of the stock price. That’s a mighty sword in this market.

2) You don’t give the plot time to thicken.

I’m hoping that’s the case with YHOO! a above, but I have a better story to tell you. Let’s take a look at my commodity bet on OIL. I was sure that this was a great play, but later learned that I should have purchased oil companies, not the commodity. Many managers think we’re now going to see an oil glut for some time. However, if I’m a long term investor, I know that when commodity prices change, they move quickly. It’s the same with my silver purchase in the portfolio. If I believe these to be the trend of the future, why switch?

I should, however, learn my lesson. I needed to do a lot more homework on oil before buying. I instead read a few headlines and pulled the trigger. Yeah…..

3) Trading fees and taxes can eat you alive.

At Motif, you won’t pay high trading fees if you’re investing for the long term ($9.95 to set up your Motif, buying ALL of your positions). However, if you trade often, you will get socked with them. Additionally, every time you buy and sell, there’s a tax hit unless you’re trading within a shelter like an IRA. You can’t win if you’re constantly paying someone else. Set up your account and let your strategy play out. That’s the way toward….mediocrity. Just like the S&P 500.

Interested in trying out Motif? I have to say….it’s pretty fun (more than I expected). You can follow my account and comment (try and be kind) OR set up your own. If you do, use our link and you’ll score $150 toward your own Motif!

Next time? We’ll dig into our emerging markets positions. Should I have purchased Africa?

Leave a Reply