When Jeff Rose from Good Financial Cents asked if I’d like to join the Grow Your Dough Challenge, I jumped at the chance….not because I thought I’d win, but because I like to experiment with individual stocks.

You and I both know that chasing alpha (returns greater than the market) is a fool’s errand. It’s especially silly for someone who spends the majority of their day creating podcasts or writing financial stories.

That said, I think I can learn important lessons when playing this investing “game”:

– I learn more about companies. I’m fascinated by good and bad management, and my desire to learn more about the inner workings of a company increases when I have skin in the game. I also remind myself of the importance of metrics in a business and of the news cycle. (There’s lots of lessons on metrics at my friend Marvin’s site Brick By Brick Investing. Check out his analysis of Microsoft from a couple months ago.)

– I like learning lessons that I know the “pros” on Wall Street learned long ago. I’m fascinated by figuring out the “right” place to put a stop loss. I’m always intrigued when a stock I invest in plummets. I like digging into the reasons that a stock might go up or down. I even think using options as a defensive strategy is intriguing, though I haven’t used any for this game.

– I love games, and playing this stock market game combines my love of the stock market with my love of gamesmanship.

Every time I make a mistake….or do something that appears to be “right,” I learn a little more. I definitely trade better now than I did when I started investing, and that’s a result of years of mistakes and maybe a few good moves.

Before I get into my results for the month, let me remind you of a few rules:

– This is a one year challenge. Buying stocks for a 12 month period is silly. Stocks fluctuate wildly over that time period. Because of this, I’m looking to achieve higher relative returns than the other contestants, not high returns. There are markets when everything stinks….and unless I’m smart enough to just stay in cash (I’m not), I’m going to lose money in a down market.

– This is not the way I invest in real life. I’m playing a game, not investing. If I were investing for a year, I’d never bet on anything that could decline in value. Even bonds are too risky for a 12 month time frame.

– Don’t follow what I do here. Although I like Stacking Benjamins to bestow some positive points upon my readers, trying to mimic my trading strategy–when even I don’t know if it’ll work–is portfolio suicide.

Okay, with those out of the way, let’s take a look:

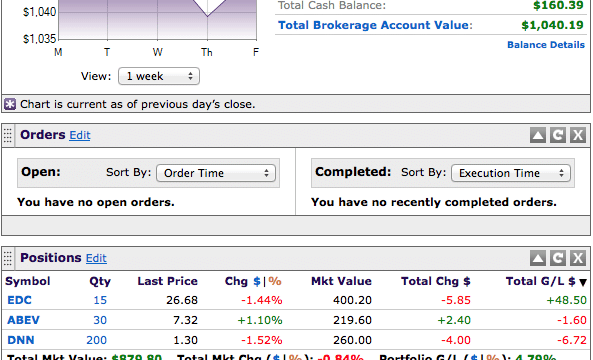

In March, I was already nearly fully invested. I’d purchased a mining stock in late January and added a high risk emerging markets exchange traded fund and an international stock in February.

Immediately in March the market began to drop. My portfolio descended very close to the amount of money I’d placed in it. That was depressing, especially since I know that to win this competition, my positions have to outperform my opponents, and most of them took a more straightforward approach.

However, the market reversed itself, and (as I’d hoped when picking) the asset classes that had performed poorly last year (the ones I’d chosen) rose faster than the market in general. So because of that, I end the month looking (again) like I’m smarter than I really am.

I’ve applied two principles that investors can learn from:

1) There’s no such thing as a “bad” asset class. When I was an advisor, clients would tell me that “I don’t like small cap stocks” or “there’s no money in utilities.” Both of these are incorrect. Asset classes have good times and bad times. They also have good investments and bad ones.

2) Reversion to the mean is real. Because there’s no such thing as a “bad” asset class, the key is to look for underperforming asset classes and try to find the one that’s going to rebound most quickly. I went with mining and emerging markets because both of them struggled more last year than experts had expected. Therefore, much of the downside had been priced out of the positions.

Normally, an investor should use reversion of the mean as a reminder to continue with dollar cost averaging and also to not second guess their asset allocation. If you’re looking long term, markets will come back. As long as your position is performing favorably when compared to other positions around it, there’s no need to panic.

In my case, I’m using it differently, but only because I have a very short leash. Normally, I wouldn’t pick investments based on “what I think is going to rebound soon.” That creates a horrible portfolio full of positions that either don’t rebound or that I have to figure out when they’re going to “top out.”

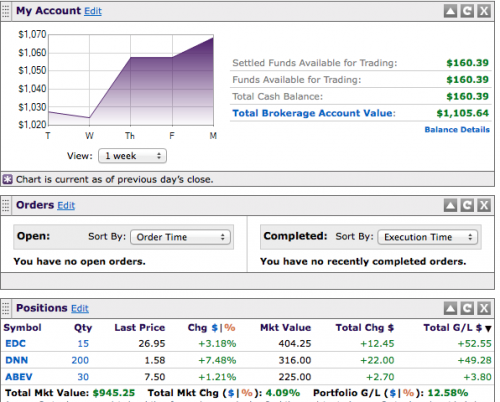

So, here’s my screen shot from 4/1. 10% in three months? Yup.

What’s The Plan?

For now, I’m riding these investments. I’m really nervous about ((my emerging markets position)) because it moves double the amount of the emerging markets index in any given day AND it resets at the end of each day. Therefore, I’m only betting that we’ll have more up days than down and there will also be a general upward trend. If emerging markets go down, I can get completely crushed with this strategy.

I like how you explain your strategy and beam with pride, yet tell others not to do it. Ha! Anyway, good job! I don’t mess with individual stocks because I’m afraid it would stress me out.

What a great reminder that there are no bad asset classes (and, I guess as a corollary, no asset class that’s always good).