Written by: Kevin Bailey

Executive Summary

- Attending and graduating from college has long been considered a requirement for high achievers

- College costs have been growing at 5+ times the overall rate of inflation

- When does college make sense today?

Having grown up in a household with two parents that were former teachers – and later one of them became a guidance counselor – going to college was never in doubt for my brother nor me. Seed money was gifted to each of us by family members to start college funds, we were always expected to do our best in school and rack up accolades on our high school transcripts, and college prep/AP classes filled our schedules. SAT prep was a way of life for a couple years. It was, and still is, assumed that getting a college degree leads to a better life.

However, today’s economic and education environments are not the ones of 40 years ago. Online learning makes education and specific subject mastery available to anyone with an internet connection. “YouTube University” empowers anyone to dive deeper into a particular topic – from learning how to change the oil in your car to learning about the origin of the universe to even not learning a damn thing about money with a couple of misfits and their overlord (let’s call him “Doug”); the information is readily available 24/7/365.

Which begs the question, is college really worth it today?

That’s a loaded question! Chew on this:

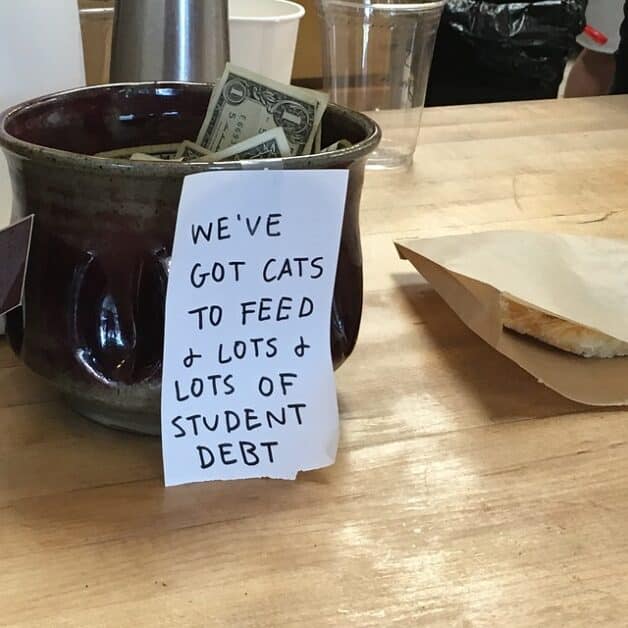

The cost of college has increased at a rate far exceeding inflation over the past two decades, and student loan debt in the United States has reached all-time highs at $1.57 trillion (with a “T”), despite recent loan-forgiveness efforts. In the age of information, how is this possible?

We are going to explore the state of higher education, the trade-offs, costs, alternatives, and the cases for/against a traditional 4-year university program.

Getting started

First things first – what do you want to be when you grow up? If you aren’t sure, how do you go about deciding? Does it require a college degree, or are other paths available? How much time is required to successfully complete a degree? Will a graduate and/or postgraduate degree be required/helpful? How much money will this cost? How long do you have before starting college?

Let’s tackle these one at a time:

- What career? Think about your interests and talents, and also think about what degrees would best serve you in this pursuit. It is wise to think about alternative careers that are in line with your degree – always have a Plan B

- What colleges will give you the best bang for your buck? Is it possible to start at a community college and transfer to a four-year school after one or two years? Are in-state schools available that will allow you to keep costs down? Is a local university available so you can save on room and board? Is continuing to live at home an option?

- Will graduate/postgraduate school be required?

- What scholarships and/or grants are available?

- Have you completed the FAFSA? (If not, DO IT!)

- How do you plan to pay for school?

If you are in high school already, a great place to start is to sit down with your guidance counselor and discuss your career aspirations, and whether or not higher education is right for you. Explore scholarships! (affiliate link) There are many available, if you know where to look!

If you are younger (or are parents with younger children), look into your state’s 529 plan options; or, at the very least, start saving/investing for his/her college education.

Are student loans likely to be in your future? Our friend, Farnoosh Torabi, recently published an article about managing student loans, and it’s worth a read. We will discuss financing options and scholarships more in depth in an upcoming post.

Long-term trends – The good and bad news

Let’s be frank…there are lots of disturbing trends in today’s economy, not the least of which are the growing mountain of student loan debt, the ever-increasing costs related to higher education, and the downright scary job market for recent graduates.

Student loan crisis

For decades, going to (and graduating from) college has been an assumed step into a higher lifestyle and income bracket. While that may still be true in certain situations and professions, the onerous cost of many institutions of higher education can place an almost insurmountable burden on many students.

For example, take a look at the upward trend of expenses for a four-year university, and compare it to the overall rate of inflation (CPI):

(Source: https://www.visualcapitalist.com/rising-cost-of-college-in-u-s/)

While there are many reasons why the cost of a four-year degree has increased at nearly 5 times the rate of overall inflation over the past 40 years, the question remains: is it still worth it for the majority of students; if not, who benefits the most from a four-year degree; and what alternatives make sense for others?

Post-college Employment Picture

When graduating with major student loan debt, those fortunate enough to find a job are often delaying the “normal” life order – marriage, kids, buying a house – in order to reduce expenses and dedicate a (sometimes large) portion of their income toward paying the loan(s).

And, for some, it’s not quite that easy: bleak job prospects in times of economic uncertainty can lead to a snowball effect of having to defer repayment, which can really add up to the final total owed. To add insult to injury, student loans are not dischargeable in bankruptcy.

However….

While some fields of study result in a tough time for student loan borrowers after college, many careers absolutely require an undergraduate degree. For example, professionals who go on to graduate and postgraduate school (doctors, attorneys, engineers, high-skilled professions) have an absolute requirement to have successfully completed an undergraduate program that aligns them with further pursuits.

It’s a trade off – pros and cons

So, shrewd money wizard, what is a responsible Stacker to do? Like everything finance, it’s all about you and your situation.

If…

You are in the fortunate position to have saved/invested (particularly in a college savings plan) enough to pay for the majority, if not all, of your college expenses, then pursuing higher education could definitely set you up for a lucrative future without putting you deep in the hole.

Putting it all together – Part One

We covered a lot here, right? College planning warrants a more in-depth look, don’t you think?

Initial steps in creating a successful college plan:

1. Decide if college is right for you

2. Create a plan to pay for college responsibly. Scholarships, grants, work-study programs…even….loans *shudder*. If it makes sense, start and contribute to a college savings plan (parents – start this ASAP)

3. Decide on a career path and weigh the opportunity costs of higher education

4. Scout out college options – local vs. distance vs. online; public (in-state) vs. private/out-of-state

5. Work with local resources to seek out scholarships and/or tuition forgiveness plans

Up next…A deep dive into education financing

Leave a Reply