Buying vs. renting: it’s one of the most emotionally charged—and financially misunderstood—topics in personal finance. This week on The Stacking Benjamins Show, Joe Saul-Sehy, OG, and guests Jesse Cramer and Chris Luger enter the ring to challenge the conventional wisdom behind homeownership.

It’s not just a polite chat. It’s a full-on basement debate where no side goes unchallenged.

You’ll hear:

- The surprising math behind renting—and why it’s not “throwing money away”

- What most homeowners don’t budget for (and pay dearly for later)

- Why buying a house might be one of the best—or worst—decisions you ever make

- How lifestyle, mobility, and flexibility factor into long-term wealth

- The emotional traps, practical benefits, and tough tradeoffs on both sides

Plus, Mom’s neighbor Doug gets into full trivia-host mode with a Star Wars challenge, and we sprinkle in some good-natured jabs, marketing wisdom, and a reminder that there’s no one-size-fits-all answer.

If you’ve ever bought a home, sold one, rented, or even thought about doing any of the above—this episode will make you think twice.

Deeper dives with curated links, topics, and discussions are in our newsletter, The 201, available at https://www.StackingBenjamins.com/201

Enjoy!

Our Topic:

Why I Am Never Going to Own a Home Again (James Altucher)

During our conversation, you’ll hear us mention:

- Renting benefits

- Buying benefits

- Homeownership stability

- Family control

- Equity growth

- Property taxes

- Insurance costs

- Market efficiency

- Supply-demand balance

- Landlord profits

- Rental property

- Real estate investment

- Property value

- Mortgage rates

- Investment return

- Home maintenance

- Location costs

- Opportunity costs

- Personal finances

- First homes

- Colonial house

- Selling experience

Our Contributors

A big thanks to our contributors! You can check out more links for our guests below.

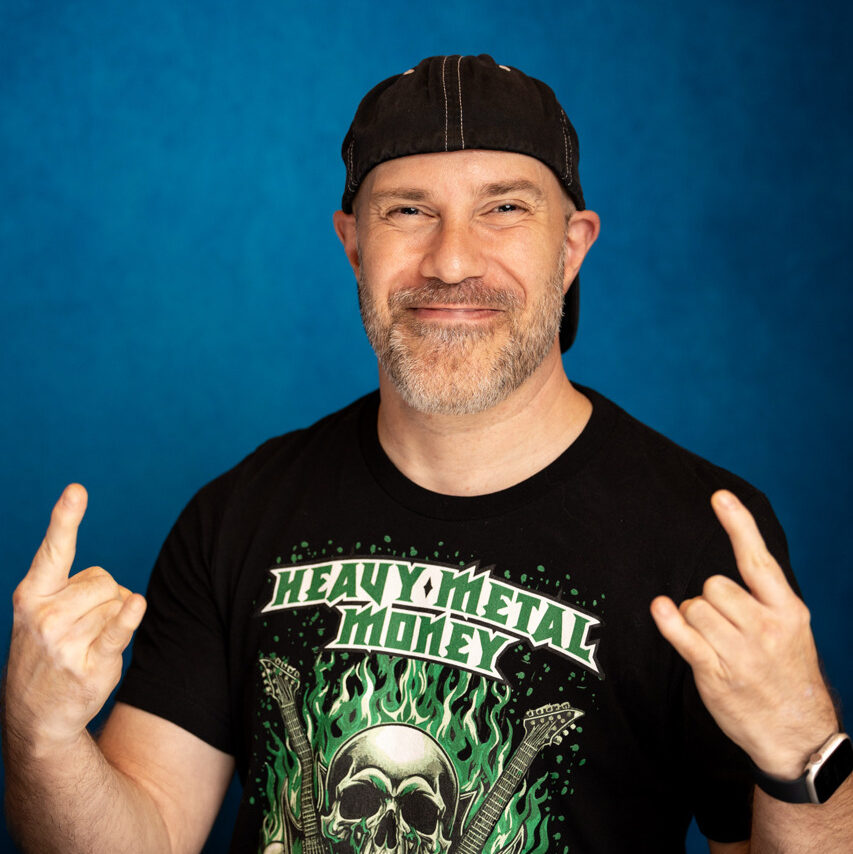

Chris Lugar

Another thanks to Chris Lugar for joining our contributors this week! Hear more from Chris on his show, The Extreme Personal Finance Show at The Extreme Personal Finance Show – Podcast – Apple Podcasts.

Jesse Cramer

Another thanks to Jesse Cramerfor joining our contributors this week! Hear more from Jesse on his show, The Best Interest at The Best Interest – Complex Personal Finance Made Easy Podcast Series – Apple Podcasts.

Learn how you can work with Jesse by visiting The Best Interest – Invest in Knowledge.

OG

For more on OG and his firm’s page, click here.

Doug’s Game Show Trivia

- How old is Yoda in the Star Wars movies?

Join Us on Monday!

Tune in on Monday!

Miss our last show? Check it out here: Retirement Roadblocks & Resilient Planning: The Squirrels Gone Wild Edition (SB1676).

Written by: Kevin Bailey

Episode transcript

STACK 05-02 Owning a House -steve

[00:00:00] bit: Hello there, Peabody here, and this is the way back machine. We’re traveling through time and this is my boy Sherman. Speak Sherman. Hello. Good boy. [00:00:15] Doug: Live from the basement of the YouTube headquarters. It’s the Stacking Benjamin Show.I’m Joe’s mom’s neighbor, Doug. And here’s a question, buy or rent? One fin influencer. Oh God. I just threw up in my mouth a bit saying that word said he will never own a house again. What’s he thinking? We’ll debate it with our crack team of financial podcasters and bloggers and also the three people on this episode.

But that’s not all. Of course. We’ll pause halfway through to see who’s gonna win today’s edition of my year long trivia challenge. And now a guy who loves Zero Down, but even more Loves Zero do later. It’s Joe Saw. See?

[00:01:14] Joe: Hey there, stackers. Happy Friday to you. Welcome back to the Stacky Benjamin Show. Sit back and relax because we’re about to have a good time talking about buying versus renting a house. So if you know somebody who thinks that buying a house is a horrible idea, you should never buy a house. Or if you have somebody that says renting is throwing money away.We’re gonna take both of those sides today. But let’s introduce you to the merry band of characters that we have with us. First of all, across the card table from me right now, Mr. OG is barely here, but he’s here. He made it. Glad you could join us. I’m emotionally here. Does that matter? Emotionally invested in this topic, right?

Indeed. Buy versus rent. The age old. I’ve done both Age. Old topic, you’ve been there, and a guy who, let’s see if he’s done it both ways as well. Jesse Kramer’s here. Jesse, if you’ve done it both ways.

[00:02:06] Jesse: Have I bought and rented? Yes. Yes. I have bought and I have rented. [00:02:10] Joe: So you have experience, uh, galore when it comes to both of those topics?Yeah.

[00:02:16] Jesse: In including in some recent markets, by the way. Which is a little bit crazy. Sorry Joe. Keep going. [00:02:20] Joe: Well, wait a minute. Buying in a recent market or renting in a recent market, [00:02:23] Jesse: uh, sorry. Buying, buying and selling in recent markets. Oh, it’s a wild world out there. [00:02:27] Joe: Like buying when you should have sold and sold when you should have bought [00:02:30] Jesse: TBD. [00:02:31] Joe: Oh, foreshadowing. I love that part of the show. And let’s, we don’t need any foreshadowing for this guest. He is the man behind the Extreme Money Podcast and Heavy Metal Money. And the guy who, who we could just do ands all day with this dude. ’cause he also leads the Twin Cities, uh, co-leads, I guess the Twin Cities Stacky Benjamins Meetup group.Chris Lugers here. How are you man? Hey, I’m doing well. Thanks for having me, Joe. Yeah. So let’s talk about, first of all, about the Extreme Money Show. Which is, is, if you couldn’t tell by my voice is written in all heavy metal, fond. ’cause you have to tell everybody about what you do.

[00:03:10] Chris: Yeah. It’s the extreme personal finance show, man.We talk about saving, investing, earning, spending, all turned up to 11.

[00:03:20] Joe: See, Jesse likes that too, because just like I got the name of his show wrong when he was on. Yeah, I’ve, I’ve known Chris forever and I managed to mess up the name of your show. It’s all good, man. See Jesse Equal opportunity. [00:03:31] Jesse: Can I tell the story, Joe, of my recent listener who reached out to me?Oh, please. I had a listener reach out to me from New Zealand, wanted to connect via Zoom just to have a quick chat. We had a really nice chat and he’s like, you know what Jesse? I, I do like your new name change, but I also really liked it when it was the better interest,

[00:03:47] Joe: which for people following along at home, it never was. [00:03:50] Jesse: It never was the better interest. It’s just what Joe called it for like six months. So the fact that Joe’s mistakes are now infiltrating their way out into the real world and making my life harder. Thank you very much Joe. [00:04:02] Joe: What did I tell you, Jesse? It’s what the show should be called until you decided that, uh, uh, now I’m gonna try to get the new name right, but instead of having it be the Personal Finance podcast for long-term investors, [00:04:16] Jesse: almost, almost personal [00:04:18] Joe: finance for long-term investors podcast. [00:04:21] Jesse: That’s it. [00:04:21] Joe: There we go. That’s it. See, I’m messed up everything. Let’s see if I can, uh, mess up the next spot, which is, oh, Chris, we didn’t ask, uh, have you also done it both ways? No. You know what? [00:04:32] Chris: I have never rented. I never rented never. Because like you mentioned, growing up, renting was throwing away money.Everyone in my family told me so. So I bought my first house at age 20 when I moved outta my dad’s place. Wow.

[00:04:47] Joe: Age 20. All right, well we’ve got uh, Chris here. We’ve got Jesse here, we got OG here. We got Doug and I. We’re going to hear first from a couple sponsors who make sure this goodness is all free.You don’t have to pay a dime for it. And then we’re gonna talk, buying versus renting. We’re gonna talk outta both sides of our mouth. Talk both sides of this argument.

You know, in this community, I think most people think, Chris, what you said is not true. So I wanna start with the case for renting all the time. Let’s start with the obvious one in this community. By the way, if you’re brand new to this, people who are finance nerds, they think buying a new car is a trap.

They think that owning a home can be a money trap. So generally think a lot of things that society in general that you won’t hear elsewhere. But then the second half, I’m gonna want you to argue the other side. Let’s argue where renting is throwing money away. The piece that was the inspiration for this, by the way, comes from, uh, James Alt Alterer.

James writes this piece called Why I’m Never Going to Own a Home again. So we’re gonna use his points to kind of walk us through this. You don’t need the piece in front of you stackers, but if you want it, just go to Stacking Benjamins dot com. Today’s show notes, and uh, click on the link because we’ll have it there for you.

James writes, many people have said to me in the past month, I’m going to buy a home. Or, what do you think of the idea of me buying a home? I like the second batch people. They’re my friends and it seems like they are sincerely asking for my advice and I’m gonna give it to them whether they meant it or not.

And he’s talking about, um. Going to tell you not to buy a home. So the first one, the first one, and let’s start with you, Chris. First one he says is, your cash is gone. You gotta write a big fat check for a down payment, but it’s an investment. You say to me, he says, it’s not an investment. You’re out just a bunch of cash for that downstroke.

What do you think of that?

[00:06:47] Chris: Yeah, um, I used to say that all the time. I used to say it was an investment. It is not. It is not with maintenance, with not only maintenance, but the taxes, the insurance, all of the stuff that you’re gonna be paying. I actually did the numbers on my own house, believe it or not.So I, I’ve been in this house for 23 years and the amount I paid for it was about two 40 back then. It’s now worth about four 50. And if you look at all the money I’ve paid for, you know, after 20 years, I had to get new carpet, new appliances, that type of thing. You’ve added up my, my annual rate of return was like 0.05%.

Wow. I mean, it’s, it’s pretty bad. So I don’t think of it as an investment. I it is not. And I, I always come back. Well, let’s

[00:07:35] Joe: talk, hold on, hold on. Let’s talk about, let’s talk about just this piece, which is the cash being gone. How much cash did you put toward that down payment? I put about 20%. Okay. So, so what’d you say it was 2 22 40.Two 40. So you put roughly $48,000 down.

[00:07:49] Chris: I did. ’cause I sold the previous house and I sold a bunch of stock. Correct. [00:07:52] Joe: So if we use this thing called the Rule 72, which is, uh, you know, you take the interest rate, you think you’re gonna get, you divide into 72, it’s this mathematical magical equation tells you how long it’s gonna take your money to double.Let’s say that you would’ve gotten 8% on your money. Is that fair? I think that’s fair. Yeah. So 8%, so every nine years it would’ve doubled. So $48,000 down. You bought it at what age?

[00:08:17] Chris: Um, gosh, what was I, I don’t know how many, how many years ago? [00:08:22] Joe: 2002? Yeah. 23 years ago. Correct. Okay. So 23 years ago. So every nine years it would’ve doubled. [00:08:28] Chris: Yeah. [00:08:29] Joe: So it would’ve doubled two and a half times. Go make me sick. Roughly. Sick. Meaning you’re making me [00:08:33] Chris: sick to my stomach, Joe. [00:08:35] Joe: 48,000 becomes 96,000. I get around this to a hundred thousand just so I can do this. Yeah. Uh, live. But 50 becomes a hundred, uh, half of another double. 125,000 bucks you would’ve had versus that money just, just sitting there.Oh, Jesse saying more than that. What am I talking about? 150? Be 150.

[00:08:55] Jesse: Well, I think you, I think you forgot a double, didn’t you? It doubles from 48 to a hundred. That’s the first doubling, and then it would’ve doubled again from a hundred to 200. Then the second one, you’re right to 250. [00:09:05] Joe: 50 to a hundred. Sorry.A hundred to 200. And then you’re get half your

[00:09:08] Jesse: double. Yeah, [00:09:09] Joe: that’s $300,000. Thank you. Our math whi Jesse Kramer is here. Everybody weird that I was a financial planner. Thank. Can, I [00:09:17] Chris: think also think of all the other expenses you’ve also paid, right? So, well, insurance, think of the insurance. 2,500 bucks a year over that many years is like 15 rent.Hold on,

[00:09:27] Joe: we’re gonna read through his list. Okay. You’re, you’re covering all of them. Luger. Sorry, Luger’s taken that Luger, that, that gun, and he’s using every bullet right here. Right here at the beginning, Jesse, the cash gone. Does that factor into your decision making? [00:09:44] Jesse: Uh, did it factor in? It didn’t really factor into my personal decision making.I mean, the way I, I view it, both of them. If, if we wanna look strictly at the financials, I mean they’re both losing propositions. I think you can be charitable, and this is something I did yesterday in preparation for this talk. If, if you wanna make some charitable assumptions, you could say that buying a house is gonna come out, like you’re probably gonna lose something like one or 2% a year on it.

Like, uh, if you do some sort of IRR math, I think renting is gotta be worse. ’cause I’m not sure what the redeeming quality of, of renting is as far as getting money back. I mean, or if you wanna do what you just did there, Joe, and you wanna look at opportunity costs. I mean, they both have these massive opportunity costs.

But the thing is, you know, right, Chris could have $300,000 more today if he hadn’t bought that house in 2002. But you can’t live inside of a portfolio as far as I know, right. You, you have to have some sort of a roof over your head. But maybe the, the dangerous part is where some people, they only look at some of the numbers involved and they convince themselves that buying a home actually is a net positive investment.

That it is going to grow over time and they’re gonna be able to pull more out of it than they put in. I think it’s kind of hard if you really look at all the numbers involved, I, I think it’s hard to come to that conclusion.

[00:10:54] Joe: Well, and is that og, is that kind of a false comparison Alterer doing when he takes a look at this downstroke and comparing it to an investment?Or is it, is that accurate?

[00:11:05] OG: Well, I think the thing that we’re missing here is you’re looking at it in a vacuum, obviously, and I think that’s what Jesse’s saying is like at the end of the day, it’s not, you can’t just look at one component of this. There’s multiple layers of it, but you’re assuming, hey, if I would’ve kept my 40,000, in our case, our down payment was a hundred K 10 years ago.And so you could do the same calculation and say, well, you’d have 200 grand today, but I didn’t, my balance sheet didn’t change when I put a hundred thousand dollars into my house versus a hundred thousand dollars in cash. I moved it from one line item on my balance sheet to another line item on my balance sheet on even the same side of the balance sheet.

It was a cash asset, and then it became a real estate asset. So the question is, is what happens to that cash or what happens to that real estate versus the other thing it was in? Now, obviously you could’ve said, well, you, you might’ve invested that a hundred K and in 10 years that money would’ve doubled.

You’d have 200,000.

[00:11:58] Joe: Yeah. We talked about with Chris’s house. [00:12:00] OG: Yeah. But what happened to the value of the house? The house that we bought has doubled in value. It’s also done that rule of 72. Now we live in a different community than some places, and maybe that’s just a short period of time, but I don’t look at that a hundred thousand as wasted.It would just, I, I didn’t consume it, you know, I didn’t spend it on Amazon. It just moved on the balance sheet to asset of real estate and it’s grown there. What’s the difference?

[00:12:25] Joe: That is true, Chris. I mean, your money in the house did double once during that period. So It did. It did make some money. [00:12:32] Chris: Yeah. I think now that I’m older and maybe wiser, I do think of the opportunity cost. [00:12:39] Joe: Growing it faster. Yeah. Yeah. Well, number two, speaking of costs, closing costs, right? Nobody OG thinks about this. I mean, the same people that get super analytical about the management fee on a mutual fund or the 1% fee, the advisor charges are like, no, but I love real estate. Yeah, [00:12:59] OG: I’ll pay the 6% commission all day long and, uh, and, and 5% closing costs.But, but advisors are the real crux. Yeah. I mean, this is a cost to doing business. And I think there’s a couple of things here. First of all, from a value standpoint, I think that if you have a good, just like anything, you know, it’s, it’s not a cost, it’s an investment. When you have professionals on your team, and if you’re getting a good value for.

The check that you’re writing for that professional, you’d pay it over and over and over again. If every time you, you know, put $10 in a slot machine, you got 11, you would just think about, how fast can I put $10 in you? You wouldn’t, you wouldn’t, you’d say, well, that’s ridiculous that it’s $10. I’m only getting a dollar.

That’s ridiculous. It’s like, no, I mean, you’re getting something. So if you’ve got a great relationship and you can lean on that relationship and that person frees you time, frees you money or frees you from making mistakes that you might’ve made on your own, and only you can be the judge of that, by the way.

Right? You can’t say, well, I, I might’ve made that mistake, or, or I, I prevented you from potentially making that mistake. Can’t prove a negative. But if you think that you’re getting good value for that, then you pay what you pay. But it’s a cost, it’s a definitely a line item. And the same thing with the banking fees associated with, with the purchase.

The banks are gonna make money. The title companies are gonna make money. The insurance companies are gonna make money on, on, you know that and, and I’m probably getting ahead of the game, but then there’s all the other stuff that goes into purchasing a house too, like inspections and your time and all this stuff that kind of wraps around that one light item that you see.

My closing costs are $14,000 for this mortgage.

[00:14:36] Chris: Oh gee. I got a question for you. Or actually just a point. So you mentioned the closing costs and the professionals. I absolutely agree with, not only are you paying for saving time, but their expertise and how well they can do the negotiation on on your behalf.I mean, I’ll pay for that every time.

[00:14:54] OG: Yeah, that’s all part of that. I think some of, again, when you just see the dollar amount, it gets a little frustrating, right? Because you see, hey, I bought a million dollar house and I got an 800,000 mortgage. My closing costs are, you know, $16,000 and you just go 16, what are you, $16,000?Like? What? What for what? And then, you know, title insurance is what title insurance costs, and you know, there’s stuff in there that’s negotiable obviously. And if you’ve got a good relationship, hopefully that person will go to bat for you and help negotiate those things down. But remember, these people make money too.

There’s layers of cost in transactions because of the fact that the person who’s sitting at the desk pouring through your box of financial documents needs to eat. They’ve gotta put food on the table too, and the bank’s gotta pay ’em. And this is how they do it.

[00:15:42] Joe: You know what’s, uh, interesting, Chris, is that, you know, the negotiation piece is the part that I have the biggest problem with just because I really.I like thinking about how people are paid. Like people talk about commission-based financial planners are gonna want you to buy this fund ’cause they get a commission, right? They’re gonna want you to buy this annuity. And we just gotta remember, and again, a lot of times we make commission-based people the devil.

When I know a bunch of people that work on commission who are phenomenal people and are great at what they do, and they do the right thing, but we still gotta remember how they get paid. If you’re buying a house, your real estate professionals being paid a percentage of the final price. And so having them negotiate on my behalf and they don’t get paid until the deal’s done.

Like there have been some real estate professionals I’ve dealt with that I could clearly feel was just like, yeah, no, no, no. We gotta, we gotta wrap this thing up. And I realized with one professional in particular, I’m thinking of like, I felt like there was a car payment looming that they needed, they needed to make and it didn’t have anything to do with me.

A boat payment they needed. Yeah, exactly. A boat payment. Even better. You know, it’s funny, Jesse, when it comes to closing costs, uh, James Altucher writes lawyers, title insurance, moving costs, and I depressant medication includes when he looks at that number, OG talks about like, would, do you remember buying your first house and seeing the closing document and how much this was gonna be?

[00:17:09] Jesse: Yeah, I do. It was 2017 when I bought my first little starter home on the, the western suburbs of Rochester. And uh, it is always a little disappointing ’cause I think. Something I’ve learned about the real estate industry is that they really do churn, meaning like the, the attorneys who specialize in real estate closings, the agents, the bankers, the, the mortgage lenders, like it’s kind of all they do.And they’re really efficient at, you know, here are the documents you need to sign. Here’s the way this works, here’s the way that works. And when you see how efficient and quick they are, and then to think that man, again, going back to OGs example, like for a million dollar house, they just slap on a, a percentage.

It’s, you know, it’s 2%, it’s 3%, it’s whatever the closing costs are, and you’re like, it was $30,000 for how much work, like 10 hours of work or whatever it may be. Like that’s where it is a tough pill to swallow.

[00:17:53] Joe: I feel like they should be better Jesse at telling me what documents I need before 10 minutes before the meeting.I feel like every single property I buy,

[00:18:03] OG: we just had a client that was buying a property and you know, obviously really stressed big deal. And I said, listen, we need the information. 72 hours. Your title agency will give it to you six hours. We cannot fund it in six hours. Like it’s just not possible for us to get all the transaction stuff done on our side.Mm-hmm. To verify it, to make sure it’s secure. It’s just not possible when you drop it in our lap at four o’clock in the afternoon to get you the money by 7:00 AM I’m telling you it’s not possible. That’s what they’re gonna do. So tell them, don’t do that to me. Josh said he can’t help. And sure enough he called on Tuesday and went, alright, hey, we’re ready to close.

Here’s the number. They said it’s gonna be about 680,000. I’m like, oh. So we just send an about number via wire, like what are you talking about? How do we do, how do we send about to, you know, ish, ish. Give or take, you know, ah, you’re good. Well you can use that little

[00:18:54] Chris: tilde button on the keyboard. It’s like, yeah, just about all that [00:18:57] OG: ish.Round up Schwab accepts that we sent you 700 ish just to round up. We, you guys are gonna send us money back. Right. You know, he was frustrated, obviously. And to your point, Joe, it’s like, it’s like surely you could figure this out, I don’t know, call me crazy two days in advance. Yeah. This is the largest single transaction that anybody usually makes in their entire lifetime.

And I’m not throwing a bunch of shade here. I’m just saying it feels like. They’re used to such big numbers all the time that it’s like, oh yeah, it’s just 6 81 7 22 decimal 41. Just wire that just whenever you can just get, just, you’re like, I’m wiring three quarters of a million dollars. I’m gonna take my time and make sure I don’t move the wrong decimal point or send it to the, you know, wrong place.

So, gimme the, gimme a second of breath here. That poor woman we had

[00:19:43] Joe: on the show, Shannon, who accidentally [00:19:44] OG: sent it to a hacker, had sent the wire money to the wrong place, and, uh, $40,000. Bye. [00:19:50] Joe: Yeah, it amazes me because I’ll ask them og point blank. I know there’s gonna be stuff you’re gonna need to last. No, we’re good.No, we’re good, we’re good, we’re good. And then 24 hours before we are not good. And I’m the one holding up closing if I don’t get them the stuff like right now.

[00:20:04] OG: Yeah. The loan guy said he needs your most recent pay stub. You’re like, really? You didn’t know that a month ago? He didn’t know that four days ago.You just, today’s the day you decided you needed it. Okay.

[00:20:13] Joe: Chris, when you did your calculations, uh, the third thing on James list is maintenance. So let’s go there next. It sounds like this is what dragged down your ROI when you were looking at how well you did with your money by owning this house. [00:20:26] Chris: Yeah. I, I estimated over the 23 years I probably just repairs and maintenance.It probably was around 35 grand just because after 20 years I, I got new appliances. Um, I had a couple times I had to repair like my washing machine. Then also. After 20 years, I got all new carpet throughout the entire house. I mean, that was like 13 grand just for that. Mm-hmm. And then, um, COVID, I did a bunch of stuff, you know, ’cause I was trapped in my house, so I, because that’s what everybody did.

I know. So I, I, like you said, 17 trips a day to Home Depot. Like I did a lot of that. So you add all that up, you know, it, it definitely starts eating in where again, if you were renting something breaks, you just make a call. They come out, they repair it, they replace it, they fix it. Where it, it’s my water heater goes out.

I need to get a new water heater.

[00:21:17] Joe: I feel like besides having all this money for the downstroke that I don’t need, I get to keep that and I get to deploy it elsewhere. Jesse, I really feel like this is the place where renting might win biggest because when everything, anything goes wrong, when you were renting, I bet you just made one phone call and said, Hey landlord, send somebody over because the dishwasher’s broken. [00:21:38] Jesse: YI mean, that’s fair, but I’m gonna, I’m gonna throw a little, uh, a wrench in the system here. Because if renting truly was this miracle where you are, you are benefiting from renting, right? Like you’re gaining money from renting, it’s net positive for you as the renter. Clearly we would have a bunch of really poor failing landlords out there who weren’t making a dime.You know, landlord being a landlord might as well be a charity, right? Because you’re just giving your money away to the renter. Well, okay. I, yeah, I’m being facetious here. Being a landlord, I mean, someone’s being pretty successful at being a landlord, hence all the rental properties we see out there in the world.

And as far as I can tell, unless there’s someone else involved, it’s a zero sum game. And every dollar that the landlord profits would be a dollar that the renter is, is not benefiting from. Okay. My my point is, yeah, I’m, I’m sure the maintenance specifically, it is better being a renter than, than being a, an homeowner.

Like from my experience, no doubt about it. But still, I, I just go back to this idea that, go ahead Joe. Well, just

[00:22:38] Joe: like one of the biggest mouse in social media, uh, grant Cardone. Yeah. Drives a hard wedge in the middle of what you’re saying there, Jesse, he’s like, owning a property that you live in is a waste of money.Renting to somebody else is a phenomenal use of money. It’s a, he’s, he’s got these, those is two totally different realms. In fact, I think Cardone and his family even rent a place while they, uh, looking at some of these high-end things that they show on social media. He even rent. So, I mean, he’s he’s talking specifically about a house that you live in, Jesse.

[00:23:15] Jesse: Yeah. I mean, I guess, show me the math, right? What’s, what’s the phrase? Um, I can’t think [00:23:21] Joe: of it now. Show me the money. [00:23:22] Jesse: Yeah. You know, there’s some phrase out there about like, in God we trust, but all else bring data. I think that’s what it is. So bring the data. Show me the numbers. Grant Cardone, that shows it.’cause I, I’m just trying to wrap my head around it. It just, on its face, it doesn’t make sense. It doesn’t make sense if Grant Cardone was living in the same exact place he’s living in now. He was owning it, he would be making a worse financial decision than if someone else is owning it. Well, that means that, that someone else, therefore is losing in their current setup and in a capitalist society that doesn’t make sense that landlords would consistently and constantly be losing.

’cause no one would do it then.

[00:24:00] OG: It just doesn’t make sense. Well, I think the diff Jesse, the difference is, is that being a landlord is profitable. Being an owner of your own house is not profitable. You’re not the opposite of a landlord. Well, there’s no [00:24:12] Doug: income. [00:24:12] OG: Yeah. There’s, you’re missing the income part of it. [00:24:15] Jesse: No. Saying how, how can a landlord be profitable though? Unless the tenant is unprofitable? [00:24:21] Chris: I, I don’t think one has to win. The other has to lose. [00:24:24] Jesse: Yeah. [00:24:24] Chris: How [00:24:25] Joe: is that [00:24:25] Chris: possible in a zero sum [00:24:26] Joe: game? Jesse? I see what you’re saying. Here’s, here’s a differentiator for me. I. I talked about on Monday show about how we just started this construction project, this construction project.Everybody that knows what the construction project is, know that this is financially stupid. This is absolutely stupid. If I was, if I own this as a property to rent out to somebody else, I would not do this. ’cause the ROI is horrible, but I’m not moving again. And I’m not doing it for a profit motive. I’m doing it because I work from home.

I live in this house. I want to be in this badass space that we’re building out behind our house. But when you look at what it’s gonna cost, I think it’s because homeowners do things that are not great with the property when it comes to resale value or, or they make emotional decisions. Not ROI based decisions.

I think that’s where homeowners lose zero sum, Gabe. But to your point, it’s not because renting is a miracle. Like it’s fantastic. Um.

[00:25:26] Jesse: Yeah, I mean, I guess just to expand on your example there, Joe, you’re right, so if I’m a homeowner, I get to choose to do things in my house that might be dumb financially, right?That you’re absolutely right. That’s

[00:25:36] Joe: coming. That’s coming in the second half of this. ’cause I do think that’s an upside of owning. [00:25:40] Jesse: But if I’m a tenant, what you’re saying there is, well, I don’t get to choose if I do the dumb thing with my money. My landlord gets to choose if they’re gonna do the dumb thing with their money.And my argument is, well, if there’s something that you want that’s really nice to be done to your rental that, that you’re renting out as a tenant and you go to your landlord and you’re like, Hey, can you please put a marble fountain in my kitchen? It’s what I’ve always wanted. That landlord is gonna say no.

Like, my point is the landlord is not gonna do stupid things with their money so that you as the tenant benefit and that they, as the landlord lose out on that.

[00:26:12] Joe: But does that make it better off for you then too, as the tenant because you didn’t do something stupid with that money? [00:26:18] Jesse: Well, what it means is that you’re not, you’re not getting more efficient [00:26:20] Joe: use of money. [00:26:21] Jesse: Right. You’re not getting capital improvements to your living space that you want. Sure. That, that’s what it means. I think. [00:26:27] Joe: Well next on this list is taxes. You don’t have to pay any of the property taxes, the holding taxes. You’ve said this before, og, you don’t really own your house even when you pay off the mortgage. [00:26:39] OG: Yeah. [00:26:40] Joe: Miss a few tax payments. We’ll see who actually owns that property. [00:26:43] OG: Yeah. And, and, and different municipalities have different rules for, you know. Senior citizens and that sort of thing for squatting after you [00:26:50] Joe: don’t pay the property taxes [00:26:51] OG: also that, yeah. I don’t, I don’t know that, that gets a little too political.You, you, you squat in a rental and it takes you five years to get kicked out, but, uh, you don’t pay your property taxes and they’ll be there on Tuesday. But no, I mean, you have property taxes and you have insurance that you, I mean you, so you don’t have to have insurance if you don’t owe any money on the house, but there’s an ongoing cash flow responsibility.

I think that one of the big misses that people have in that calculation of buying versus renting is they just purely look at the, the rent expense versus the mortgage. Or they, maybe they look at the rent expense versus the mortgage and taxes and insurance and they go, oh, well this is dumb. My rent payment’s 2000 a month, my mortgage payment would be 1950.

This is a great deal. Like I’m, I’m gaining equity on this. Forgetting the fact that insurance goes up every year. Property taxes go up every year and to, you know, kind of put a footnote on the maintenance cost. I think that the average maintenance cost, if you’re. Keeping up with your home is roughly 1% of the house value.

I think every year. If your house is worth 500 K, I bet that you’re putting five grand a year on average into that place just to, you know, keep it up the way that you need to keep it up. Whether it’s like a big expense like Chris was talking about, like, hey, every so often we put new carpet in ’cause that’s what we.

You know, it’s wore out and the kids are gone, and now I want to have some better utility or if it’s required maintenance, like, uh, AC repair or you know, waterline breaks or something like that. But I bet if you added it up, you know, Chris, you were saying 30 5K over the, you know, you’re not counting stain for the fence or like you said, the one-off trip to Home Depot where you had to get a wrench to.

Fix the, you know, whatever it’s thing for the stuff. It’s the, yeah, the things with all the stuff, it’s, there’s, our refrigerator just started making a weird noise. Like we can’t even figure out what the noise is for when you get, when you get water out of the, out of the water thing, it just goes,

this is an ongoing, multi-year saga.

[00:28:44] Doug: This is the appliance we hear about more than any other thing in OGs house. Whatcha talking about refrigerator [00:28:50] OG: refrigerator’s? Fine. I think you’re confusing me with somebody else. No, you had [00:28:53] Joe: this problem, what, a year, 18 months ago [00:28:55] OG: maybe. We’ve [00:28:55] Joe: never had this problem. Oh, [00:28:56] Doug: there was the, should we just buy a new condenser or should, or buy a new refrigerator?Anyway,

[00:29:01] Joe: let’s get to the last two on this list, because I really wanna argue the other side where I, ’cause I feel like, uh uh, Jesse’s already kind of headed in that direction. Number E. What is the A, B, C, D number? Number five, I guess that would be. James writes, you’re trapped, which means that if you decide to move, I had this happen.I became a landlord inadvertently because we were moving to Texarkana and the market in Detroit got so bad I was trapped in that house. Like I wasn’t gonna be able to get rid of that house. So you are trapped when you own the property. And then the last one on his list is he says, ugly, all of the ugliest types of investments.

It’s a liquid, it’s high leverage, there’s no diversification. And uh, uh, well those are the three big ones as I scroll up. And no diversification need to be a little bit more definitive. I think we all grasp those. Uh, it’ll be interesting to see the other side of this though. Let’s do the positive side for owning a house here in a second while you should own a house.

We’re gonna do that in just a moment, but at the halfway point of every. Friday show. We have this phenomenal year long competition between our three frequent contributors, Chris Luger, you’re gonna be playing for team Paul Pant today, which is amazing ’cause Paul is on a two game win streak, which by the way, corresponds with the fact Doug, the Paul Pant has not been here the last two weeks.

Mm-hmm. She seems to be winning by, by not being here. So no pressure Chris, but um, but she seems to be winning with her surrogates like you. But do you want the good news or the bad news about how this is gonna go? I always take the bad news first. Well, the bad news is, is that you are still

[00:30:49] Doug: type for last, right, Doug?Yes. Of the people in second place, you’re the closest to third place because you were third place last year. What is the score, Doug? The score, Joe is Paula most recently achieving a tie at three and a half points that just happened last week. Uh, Jesse also has three and a half points. By the way. The half point for those of, uh, you who were not with us maybe a month ago, was somehow, uh, negotiated by Jesse and Paula who wanted to split a point.

Wow. So somehow they, yeah, I know. And they wanted to

[00:31:27] Joe: trade it for a player to be named later, which we didn’t allow to happen. [00:31:30] Jesse: Yeah. And I’m like, we wanna, real, real estate agents can split a commission, but we can’t split a point. What’s this? The, [00:31:34] Doug: the most I would grant them was a half point each. So Jesse and Paul are now tied for last place at three and a half points.Uh, just one and a half points behind OG who has five points.

[00:31:44] Joe: One of these two people though, Doug is gonna get within half a point if they stop OG from becoming a freight train again like he was at the beginning of the year. So, Chris, those are the stakes I was told to make it competitive. Well, you gotta throw a couple games.The Chicago Black Socks, uh, scandal on Stacking Benjamins. All right. Uh, we know what the stakes are, Doug, you’ve got the trivia. What are we talking about this week?

[00:32:11] Doug: I would love to share the trivia with everybody. Joe. Hey there, stackers. I’m Joe’s mom’s neighbor, Doug. You know, I’ve been digging in and reading about great marketing lately.You know, I love a win-win scenario, so I’ve been thinking outta the box about value added solutions for this podcast. I’m gonna ramp things up and really think out of the box, get everybody in a circle, and I’m just picking up all these great phrases. One book says that the customer should be Luke Skywalker, and the brand should be Yoda.

Well, that makes sense here in mom’s basement. We like thinking of our stackers as Luke Skywalker, or heck, even Ray Skywalker now. Right? So I guess that would make us. Yoda. Then, I guess, I know Joe’s pretty old, but Yoda’s even older. Oh my God. How much older? Not that much. Here’s today’s question. How old is Yoda in the Star Wars movies?

I’ll be back right after I go drop a diagram to explain to Jesse who Yoda is. It’s gonna take a while. Jesse was quoting Star Wars, I think the first week you were on this show. Yeah. But he’s like, he’s, he’s young. He’s into the new Star Wars. Gotta go. The Doug. Yeah. Which,

[00:33:19] Jesse: which movie are we talking about here?There’s a long saga, the timeline of Star Wars, of the movies. That’s out. It’s kind of long.

[00:33:26] Joe: Well, we’ve got, uh, I believe this is from the first one in New Hope. We’ll go with his agent in New Hope. Cool. So that means og you’re going first the Star Wars movies. To Jesse’s point, it made a ton of Benjamins, ton of money.How old is Yoda?

[00:33:43] OG: I mean, how old was he when he died? Is that what you mean? Uh, spoiler alert, [00:33:53] Joe: if you’re saying spoiler alert on a, what, 50-year-old movie or 40-year-old movie, do you think it’s might be your problem, not ours. [00:34:01] OG: So I’m gonna say that Yoda, I feel like I should know this. Um, I’m gonna say he was nine hundred and sixty [00:34:09] Joe: five, nine hundred and sixty five, and you just pulled that out.Just,

[00:34:14] OG: it sounds like I might have nailed that right on the money based on your response. No, like you’re [00:34:18] Joe: thinking he’s a, I don’t know if you’re right or wrong. What I’m saying is, oh, okay. Usually Doug, he’s got like a 85 minute explanation, right? [00:34:28] OG: No, I was literally, as he was talking about it, the only thing that I thought in my head was I remember there’s some old people in the Bible, and for some reason in my mind I was thinking that they had some sort of connection to that.Like they used the, that same. Timeframe as the oldest Bible person. I, I don’t know why I thought that. The fact that you

[00:34:49] Joe: didn’t point that out to us in glaring detail. [00:34:52] OG: Well, you just asked for it. I, you know, time is money. So it also shows [00:34:55] Joe: how badly he wants to get on the road. As soon as we’re done recording, uh, just give me nine and 65. [00:35:01] OG: Yeah. Put me down for 9 65. [00:35:02] Joe: Yeah. Alright, Jesse. He’s got 965 long years old. How about you? Mm-hmm. [00:35:07] Jesse: I was actually, I was a little disappointed when OG said that ’cause I’m pretty sure somewhere in the recess of my brain, I mean, I grew up on Star Wars, right. I thought Yoda was in like the upper eight hundreds.So to hear OG say 9 65, I was a little bit bummed. ’cause that’s gonna, it’s gonna make my guessing a little bit harder, but still, I’m gonna guess eight 50. Eight 50. Yeah.

[00:35:31] Joe: Those darts are kind of close together. Chris. [00:35:33] Doug: I know. What if he was 26? And just didn’t put his nightly, his, his cream on at night. [00:35:39] OG: 26 In yoti years, [00:35:41] Doug: they’re gonna, [00:35:42] Chris: I mean, I have friends that are really gonna, they’re gonna take away my geek cred card because I know I’m gonna get this wrong, but in my head, when you asked the question in my head, it was 928.I know that’s really close, but I’m saying 9 28, you’re going right in between these two

[00:35:58] Joe: dorks 9 28. We always told, uh, Paula, don’t trust your gut. We’ve always said that. ’cause Gro was only like 50. Right. Was only what really? Gro was 50 years old. Yeah. Oh really? Yeah. He’s talking about Mandalorian for people that don’t know what the hell we’re talking about.Yeah. Doug’s got no idea.

[00:36:21] Doug: I have no, [00:36:21] Joe: no [00:36:22] Chris: clue. Who, [00:36:22] Joe: what? Oh my [00:36:23] Chris: God. Doug, [00:36:23] Joe: come on. Fantastic, sir. And, and I can’t wait to watch Andor. I’m so excited about the Andor. The new season coming. I tried twice to get into it. I just could not do it, Joe. Oh, I agree with, uh, JD Roth on this one. It’s the best one of all.Best. Okay. Different podcast. Podcast.

[00:36:37] Doug: You’re on the wrong podcast. Sorry. [00:36:39] Joe: All right. Who’s gonna win this thing? We’re gonna let you know in just a minute.Og, you kicked off this love fest with, uh, just shy of a thousand that everybody seems to be gathered around with 9 65. How you feeling?

[00:36:55] OG: Uh, I feel pretty good. Yeah. I mean, it’s, I’m in the ballpark [00:36:59] Joe: apparently, because, uh, Jesse thinks you are Jesse. Eight 50. Chris came. Over top of you. Uh, 9 28. You feeling good? [00:37:09] Jesse: I’m feeling good. I think, you know, by my math, I’m kind of doing it right now. What if it’s like eight 90 or lower? I think it’s me. And if it’s eight 90 or above, it’s Chris. Because I, I was gonna say, like, I, I still think he was somewhere in the upper eight hundreds If my trivia memory is right, [00:37:25] Joe: Chris, you’ve got a, uh, small window there in the middle by kicking the field goal.You feeling good at all? I, you know what? I

[00:37:34] Chris: am. [00:37:35] Joe: I’m feeling good. You’re feeling good? All right. Everybody feels confident. One of these three, Doug, or gonna be. I guess, uh, proven correct. Two of the three are going home empty. Who’s winning? [00:37:51] Doug: Hey there, stackers. I’m basement based marketing thought leader and guy who’s been told he’s got a great lightsaber. Joe’s mom’s neighbor. Doug, did you hear about what Yoda said the first time he saw Star Wars in 4K HDMI?So what about the time Joe asked him what his favorite dinosaur is? No. And Yoda. Yoda answered, do Ceratops because there is no try Joe. There’s only dough. There’s only do, do tops. Please God give us an answer. So make an end. Now I know how people feel when I go on with a. Dad jokes. So how old is Yoda?

Well, I’ll tell you that, uh, Darth Vader’s Offspring OG was off by 65. My nemesis Jesse was off by 50 Chris slash Paula, only off by 28 because the correct answer is 900, meaning Paula has now got sole possession of second place. Unbelievable. Jesse, your cutting stake Right on. Oh. More importantly, Chris gets to remain a nerd with all of his buddies.

Right?

[00:39:11] Joe: You don’t think I’m a nerd? Go listen to that episode of Stacky Benjamins. Fast forward through all the important buy versus rent stuff, it just listen to how I did on the trivia. Nice job, Mr. Luger. Thank you. It’s fabulous. And OG your instinct was correct. And yes, that was me going, how the hell do you get that close with your first guess?I should have I, Doug, I should have disguised that. Maybe slightly better. Yeah, I was like, really?

[00:39:36] OG: I thought I hit it right on the number based on that response. [00:39:39] Joe: Yeah, you were. I was feeling pretty good. You were so close. I’m like, nobody’s gonna get that. He’s 900 years old. And then Jesse’s like, I think it’s high, like eight nineties.I’m like, oh my God.

[00:39:48] Doug: I would’ve been Paula if I were playing I, because I’m just not a sci-fi guy. I would’ve no idea. I would’ve said he was like 74 [00:39:56] Joe: based on Paula’s results lately. We’re gonna tell her this and she’s never coming back. I mean, doesn’t, she doesn’t watch any movies, right? She doesn’t. Well, she, she joined a theater now where she goes and watches like one a month.Okay. That is her. Yeah. She’s turned over a new leaf, but she’s got like 40 years of catch to do. She’s got so much ketchup. Imagine if you hadn’t seen movies until just lately. Oh man. What a cornucopia

[00:40:21] Chris: dude. She go, this is true story. I was out on a date the other day that it does happen. You were on a date.That’s a true story. Yeah. Yeah. And I asked, I said, Hey, what’s a movie that you could watch over and over again? Like, what’s one of your favorite movies? And she said, why would I ever watch a movie twice? And I was like, thank you for the time. I gotta go and scene. I mean, what?

[00:40:45] Joe: We are not a match. [00:40:46] Chris: Yeah. [00:40:47] Joe: Yes.Say we’re not a match without telling me we’re not a match. That’s fantastic. Hopefully that was right at the beginning. Was that like question one? It was, oh God. This was a very odd conversation after that. Check please. Just a great night. Let’s go into the other side of this argument, Jesse. This is, uh, renting is throwing money away.

Let’s buy a house. What’s the pro side? You never hear in the financial community about the upside of let’s buy the property?

[00:41:15] Jesse: Well, you kind of have full discretion over anything you wanna do. I guess again, I, going back to the numbers, if we wanna stick to the numbers, I still wanna see someone, uh, show me that I.Buying a house really is gonna be throwing more money away. I, I kind of have a hard time believing that based on all the, the number crunching that I’ve done, but I’m open-minded to it. And then there’s again, maybe I’m now a bit more of a family guy than I was say five years ago. But I think the idea of raising your family in one place, that you get to call your own in one neighborhood, et cetera, et cetera, et cetera, one school district, whatever it may be, uh, it kind of gives your family a sense of, of home that I think has a, a really nice intrinsic value to it.

So the list goes on from there, but that’s where I’ll start.

[00:41:57] Joe: I was just thinking while you were talking, when you said, I, I want somebody to show me the chart, and I realized that I just saw one. But what I also realized, Jesse, was that the chart kind of points out something that you pointed out in the first half of the show.By the way. It points it out the wrong way. It points it out a way that looks like it’s apples to apples and it’s not. Uh, Jeremy Schneider Personal Finance Club, I generally like his charts, but I do find some of them misleading. I find some of them just frankly. Jeremy, I find some of your charts misleading, and one of them is, he had a chart talking about this, that if all of the things are equal, the monthly expenses to buy a house versus the monthly expense to rent, so you make the rent equal your mortgage payment.

He said you still have all of these other costs on top of it, right? If you’re a homeowner, if you’re a homeowner, you’ve got property tax, you’ve got homeowner’s insurance, you’ve got Euro own maintenance cost, you’ve got all this other stuff that we talked about in the first half of today’s show. But I just realized while you were talking, Jesse, how that is wrong.

Because if it was apples to apples, your point earlier on is the landlord has no upside. The upside is those numbers are not going to be the same because the landlord needs to make some money. So you’re gonna be living in a crappier house if you rent. Than if he had the mortgage payment for the same amount of money.

Does that, does that track?

[00:43:25] Jesse: Yeah, no, that’s correct. And I think I even, I was, while you were talking, I was searching for, for Jeremy’s post rent versus mortgage. Your rent is the most you’ll pay. Your mortgage is the least you’ll pay. And then he shows these extra fees and he, he kind of shows the rent and the mortgage being equal.Yeah. He shows this. But then these, this equal, right. Which is,

[00:43:41] Joe: is to your point, not gonna be, ’cause if you actually put the two houses next to each other, there’s no way in hell you’re gonna rent the house for the amount that you would have for that mortgage payment. Well, correct. Well, I think that [00:43:52] Jesse: there’s also equity involved too.Sorry, go ahead, OJI. There’s also, I was just, no,

[00:43:56] OG: I was just gonna say from a landlord standpoint, you know, we, we had a rental, two rentals for a while. Multifamily. It was very clear to me when I bought this place that the previous owners used all of the available cash flow for themselves. Like they, it was very clear.They were like, every dollar we can ring out of this, we are taking. Because you could tell. They were not interested in upkeep, they were not interested in maintenance, they were not interested in, they were saving that for you. They were. Well, where they saved it for me was the value of the property was commiserate, was, was commensurate.

There we go. Comm. It was also commiserating. I was commiserating a lot on that property. Um, was commensurate with what? What was going on in both the rent, income and profits and, and then also the status of the building. And so when we went in and bought it, I was very clear that I was not interested in the cash flow of it.

If it broke even, that would be great if it made money. I was interested in taking all the available cash flow to buy the equity side of it, if that made sense. And so this guy bought the property at 750 k, sold it to me at 300. I have no idea how much cash he took out of it, but he owned it for 20 years.

I bought it for 300, lost my. You know what on it for two years in terms of cash flow, I was upside down 40 KA year for two years, sold it for seven 50 because we rehab departments and we improved the landscaping and we resurfaced the parking lot and we did the roof and like we did the stuff that made it beneficial on the equity side of it.

So I don’t know that it’s exactly fair. And maybe this helps you, Jesse, or helps your point, or it doesn’t help your point. But you know, when you think about the landlord, like they have to make money, you know, you make money different ways. It doesn’t always have to be break even cashflow wise. I was very comfortable with losing money 50, $80,000 over this two year period because I knew that whenever I sold it, that’s when I got my payday.

You’re never gonna find an apples to apples comparison on this because if you start with the concept of housing cost, cost for dwelling, you can always say, well. If you bought it, you would, maybe you would, uh, wanna have a little bit nicer place or maybe you’d wanna live in a different neighborhood, or you would never buy a two story, you would only buy a single story, but you’re happy to rent it’s two.

You know what I mean? Like there’s no way to compare what maybe what this guy is trying to decide on, or you know, what the article’s about. It’s, it’s so personal. It’s ridiculous. Well, but I

[00:46:34] Joe: think we can, I think we can draw a few truisms and one is the longer you stay in a house, the, the more renting makes less sense [00:46:46] OG: and the longer if the equity value of the house goes up.Absolutely. The first house that I, okay, so here’s another personal example. Our first house that we bought, we bought a four bedroom colonial because we had zero kids, it made a bunch of sense to have 3000 square feet by ourselves. You had to have all those bedrooms, right? Had to have all those bedrooms.

And we had no kids for five of the 10 years we lived there. We had no kids. We sold the house for the same price. We purchased it for 10 years later. The terms that we had on the mortgage was interest only, so we paid effectively a rent payment to the bank for 10 years. We had a little bit of a principle on the mortgage, ’cause we had a primary mortgage and then a HELOC separately.

So the HELOC was actually making, we were making a dent on the heloc, not the primary. How effed up is that? So weird. Yeah, so weird. Anyways, the long and short of it was 10 years later, we walked outta there with $7,000 in our pocket, barely enough to afford Stevens to pack our stuff and ship it to Dallas after 10 years of those payments.

Now you could have said in that example, well dude, if you’d have just rented a place, you’d have come out way ahead. Yeah, but if I was gonna rent a place, I would’ve rented a two bedroom apartment, not a four bedroom house. And to your point earlier, Joe, maybe it would’ve prevented me from doing the dumb thing of buying a freaking big giant house that I couldn’t afford with all that money, with no money down and interest only, and you know, whatever, all that other sort of mistake.

So, you know, again, I just come back to, it’s hard to make a apples to apples comparison here because you’re trying to prove that you would make the same decisions given two different sets of circumstances.

[00:48:19] Joe: And let’s talk about that too, Chris. You know, you talked about how your money didn’t grow all that quickly.Your rate of return pretty low. But we look at these things and we go, if I would’ve only had an index fund. Let’s do that. When you actually look at the numbers of people that own index funds and you look at their returns, which company did that? OG Fidelity went and looked at their people. It was at Schwab.

Some, one of the big companies went and looked at their average investor. The average investor makes enough dumb decisions with their investment that the primary property. The fact that you have this trapped equity in there for a lot of people and they say, my house is my retirement. Right. You know, you heard that a lot from older people.

My, my house, that’s, that’s, that’s where all my, my equity that that, that’s my, I don’t need a 401k. I got my house. Well, that may be a little more true than we think it is for the average person and how poor we are at actually investing. The forced saving for some middle America is actually a

[00:49:20] Chris: good thing.I think for those people that are doing very little to save for retirement, it is something that they’re counting on for sure. I think the argument of why. Someone would own or buy a property. I think there’s just something to be said about having a paid off home owning it. A place you can call your own, and I can do as many stupid decisions as I want, right?

I can knock holes in the walls. I can run cat five cable throughout every nook and cranny. I can do the things that I want to do and I don’t care. I don’t have to ask permission. I don’t. There’s just something to be said about that.

[00:50:04] Joe: Is that a 1980s video game behind you? It is. I was [00:50:07] Chris: just looking at that.I think that’s a psycho genesis. I have, uh, classic n the ass as well. But

[00:50:13] Doug: yeah, dude, your nerd card is safe, [00:50:16] Joe: Chris. [00:50:17] Chris: Don’t worry about it, [00:50:17] Joe: man. I was like, great points. Chris, is that a video game? Glad you made those points. Jesse, anything else in the one for, uh, buying category? [00:50:28] Jesse: Well, I, I thought when Chris was just talking right there, a thought popped into my head, Joe, and, and maybe this doesn’t exactly answer your question, but you know, what do we call, well, it does [00:50:35] Joe: answer my question.Thoughts do pop into your head from time to time.

[00:50:39] Jesse: So that’s the eternal question. What’s that hollow sound? Oh, Jesse’s knocking on his forehead. So what do we call a market when there’s millions and millions of participants buying and selling? Everyone’s looking out for their own best interest and they, through their own, you know, supply and demand and their own choices, they, they find an agreed upon price.What do we call a market that behaves that way?

[00:51:00] Joe: Uh, open market. [00:51:02] Jesse: Yeah. Oh, that’s a good, that’s a good answer. That’s a fair answer. Efficient. I was gonna say efficient. That’s what I was gonna say, Doug. And so part of this whole argument today, or anytime someone comes forward and they’re like, no, it is absolutely renting, or like, no, it is absolutely buying.That’s the smartest thing to do with your money. What they’re saying in essence is that like the market’s not quite efficient and that their argument has to be the better one. And so this thought kind of popped into my mind that it’s like, huh, considering that you have, here in the US you have hundreds of millions of people who are making their living, uh, decision on where to live and what to pay, and all that kind of thing.

To think that that market isn’t at least somewhat efficient in finding the right price. Or that, you know, in other words that like, that market isn’t somewhat efficient at balancing the scales between renting and buying. I, I gotta think there’s some of that probably going on behind the scenes that if we really did look at the numbers, we might be surprised to see they’re, they’re more even than we think.

[00:51:56] Joe: I don’t, I get that part of your thinking, but OG don’t you think he’s talking more about rental real estate than real estate that you know? [00:52:03] OG: No, I mean, from a big macro standpoint, I would agree with that. I mean, if there’s a lot of rental properties being built that are not supported by market demand, then what’s gonna happen?The rent prices are gonna go down and then someone new that moves to the community is gonna say, what do I do? I need housing. I, I need to find some housing. What should I do? Should I. Go buy a house or rent one, and they’ll look around and they’ll say, well, renting is so much less expensive because of this inefficiency that has now materialized that it makes more sense for me to, I mean, you can see that’s going on in little micro communities across the country.

You know, we live here in Texas, Joe, so, you know, and, and Austin’s a great example. Tons of people moved in. They built a ton of multi-family housing and a ton of, uh, single family housing. And now people went, oh, it’s hot in Texas. Maybe it’s not as cool as we thought in Austin. And so now there’s a little bit of an exit from, I don’t think, probably net net, but maybe in any event I’m reading the articles on this of like, sure, there’s a little bit too much housing, there’s a little bit, it’s too overbuilt.

That’s what they’ll say, right? Built a little too much built quickly. And so that’s gonna manifest itself in lower housing prices or lower. Rental prices and to Jesse’s point, an educated consumer with all the facts will make the most efficient decision for them in those circumstances. I mean, if the material required to build your deck tomorrow was five times as much as what you thought, are you still building it or would you say, eh, I should wait, I should do something different?

Now that I have that information, maybe I’ll use a different material. Maybe we’ll make the plans a little smaller. You know what I mean? Like you, you’ll do something new with, with new information, with a radical change. So I, I can get behind Jesse’s SIP perspective. I

[00:53:55] Joe: do think a lot of people behave ally.When you think about, I’ve only rent this place, you’re not gonna make some of the behavioral. Moves to spend money on things that you would spend it on if you own the place?

[00:54:06] OG: No, from a big picture, like I think Jesse’s point maybe is from a bigger picture. If you just think of the word housing, sure, I need shelter. [00:54:13] Joe: Yes, [00:54:14] OG: I’m gonna make an efficient decision based on the facts that are at hand. And if there’s such a disparity between one or the other, then it will gravitate to that. It will change the pricing of that back to more of an equilibrium. And um, and then it becomes a personal choice versus, uh, wildly radical financial one. [00:54:34] Joe: I think that’s a great place to leave it because Yes. [00:54:37] OG: What you, we left it on my topic. Bang. [00:54:41] Joe: Uh, because I think it is, I think it is what you do with the money, what you do with the decision that you made, right? If you make a decision to purchase a house and you’re only gonna live there three years, or you’re gonna put a, you know, expensive thing on the back of your house like I am, well then so be it.That’s gonna influence what you do with the rest of your money. It’s that opportunity cost that we were talking about and for savings. And I think it’s great Chris, that you, you did the ROI behind behind that decision kind of as a cautionary tale, but I don’t know that end up badly. I think you

[00:55:11] Chris: like where you [00:55:11] Joe: live. [00:55:12] Chris: I do. And I think that the fact, I mean, you mentioned too, Jesse, about having a place to raise your kids, a community, a neighborhood, the friends they grew up with. I wasn’t gonna move anytime soon and yeah, I do. [00:55:24] Joe: Let’s find out what each of you are doing. Og we mentioned, uh, that you’re outta here right after this many big plans this weekend. [00:55:33] OG: Yes. Huge plans. Uh, so a little bit after school activity Saturday morning, and then a very, very important husband, wife, golf tournament, affectionately known as the divorce open. Um, because I was just gonna say, ’cause when you play alternate shot with your bride, invariably you, one of you, and I’m not gonna say who, I’m not gonna point fingers, but one of you leaves the other person a two foot putt for par and the other person leaves them a seven foot for bogey.And you just go, how is that possible? And I don’t wanna throw someone’s putter into the lake because that doesn’t make any sense. But, uh, no, it’ll be fun. We’re, um, we have no expectations this year. We we’re gonna have some fun with it. And then, uh, Mrs. Ji’s birthday’s on Monday. Oh, awesome. CCO de Mayo, she’s got, uh.

Somewhat of a milestone ish birthday in her mind. She gets a big party

[00:56:25] Joe: every year on her birthday [00:56:26] OG: every year. The entire southern half of, of America celebrates for her. That’s great. I haven’t made [00:56:30] Joe: sure when I was in Detroit, I celebrated [00:56:32] OG: and south, south of America. [00:56:33] Joe: Yeah. As [00:56:34] OG: a matter of fact, [00:56:35] Joe: I’ve, yeah. Uh, a lot of the world’s celebrating that day.That’s fantastic. Yeah. Uh, let’s have our guest of honor go last, Jesse, what’s happening at the Personal Finance for Long-Term Investors podcast? Better known as the Better Interest Show?

[00:56:49] Jesse: Well, I think, uh, we’ll see, you know, as we’re talking, there’s still a couple a, a week left or so in April, but I’m pretty sure April is gonna be our best month of all time, which is an exciting thing.Uh, we’re about to release an episode with Bill Yun from Catching Up to Phi, and then following up from that is going to be, I think, an a MA episode. And then we’re gonna have, uh, we’re gonna have Don Don from, uh, who, uh, what’s Don’s last name? Joe Jo Don just joined us here on Stacking Benjamins.

[00:57:19] Joe: Don from the, the Don, [00:57:22] Jesse: uh, Don.Not, not the mafia. Don we’re talking. Don McDonald’s. Don McDonald’s. Thank you McDonald. Very excited to have Don McDonald join us from talking Real

[00:57:28] Joe: money. Yeah, yeah. From talking [00:57:29] Jesse: real money. Exactly right. So fun, fun things happening over at, you’re not [00:57:32] Joe: talking about Don. You’re talking about Don Don. [00:57:35] Jesse: Correct. Amazing radio voice. [00:57:37] Joe: Oh my God. Amazing. Just incredible. And see, he makes it about him every time, Jesse. Every time Doug’s like, don’t forget there’s somebody else with a radio voice. Chris Luger, thanks for hanging out with us again, brother. Ah, thank you so much for having me. This was fun. So, what’s happening at the Extreme Finance Better [00:57:56] Chris: Interest Podcast?The Extreme Personal Finance Show? Um, that too. Yeah. Yeah. We got some great episodes coming up. I got one coming up talking about is real estate investing right for everyone? How some people think, you know, they don’t want anything to do with real estate investing at all. So we’re gonna talk about the pros and cons there.

We’re also got an episode coming up talking about how to prioritize. Your passions and purpose in life, especially after you’ve reached phi. So how do you do that when there’s so many other things that you wanna do? So, yeah, a lot of fun stuff. You can find out everything over at Heavy Metal, do money

[00:58:31] Joe: watching, uh, all kinds of movies with, uh, people who are not that date.That’s right, yeah. Great times. Everybody. Uh, if you’ve, uh, hung out with us live on YouTube. Thanks a ton. If you wanna hang out with us, live on YouTube, we’re normally here. Tuesday after, or excuse me, Wednesday afternoons. We’re recording at a weird time today because of our schedules, but if you wanna hang out on a Wednesday afternoon, come join us.

Please. If you know somebody that needs to listen to this because they haven’t truly thought through the buy versus rent thing, give them the name of the podcast. Pass this along to somebody that needs to hear it. Otherwise, give us a review and Doug will read those on the show on our crazy Monday, Wednesday shows.

As long as they mention me in the review,

[00:59:14] Doug: those are the ones I read. [00:59:15] Joe: That’s the old only thing. All right, that’s gonna do it for today, Doug, what’s the three things we should have on our to-do list at the end of today? [00:59:23] Doug: Well, Joe first takes some advice from Chris. He says it’s better to be a renter because if you’re a homeowner, you gotta make sure the carpet matches the drapes.Did I get that? Did I get that right, Chris? I think I nailed it. No, I think what I

[00:59:36] Chris: said was that, um, I, I can’t think of anything. I can’t remember what I said. ’cause that was pretty funny. [00:59:46] Doug: I totally, I totally got distracted. That was pretty good. Second, this, this is the best to-do list ever already. Okay.Number one. I don’t know. Yeah. So basically I nailed it. You nailed it. Second, Jesse said you need to own a home so you can be like family guy. Jesse, would you say you’re more like Peter or Stewie or maybe Lois?

[01:00:07] Jesse: I thought for sure you were gonna make a comment about the carpet in, in Joe’s mom’s basement. [01:00:12] Doug: No, that was a good one. Oh my. Look at the time. Wow. We gotta finish this up. What’s a big glass of Doug? About the big bro? That was that.I can’t even talk after that. But the big lesson, buying versus renting. Don’t overthink it. I guarantee you, there’s a corner in your neighbor’s basement. They never look in, and that is where you put your blow up mattress. Problem solved.

[01:00:44] Joe: Thank God you said mattress. Mattress. Yeah. Woo. [01:00:50] Doug: Thanks to Chris Luger for joining us today.You’ll find the Extreme personal finance show wherever you are listening to us right now. We’ll also include links in our show notes. It’s. Stacking Benjamins dot com. Thanks also to Jesse Kramer for hanging out with us today. You’ll hear the latest episodes of the Personal Finance Show for long-term investors wherever.

I’m sorry, I’m out of breath. Wherever you are listening to us right now, is there an acronym we can use for that show title or something? Thanks also to OG for joining us today. Looking for good financial planning. Help head to Stacking Benjamins dot com slash OG for his calendar. This show is the property of S SP podcasts, LLC, copyright 2025, and is created by Joe Saul-Sehy.

Joe gets help from a few of our neighborhood friends. You’ll find out about our awesome team at Stacking Benjamins dot com, along with the show notes and how you can find us on YouTube and all the usual social media spots. Come say hello. Oh yeah, and before I go, not only should you not take advice from these nerds, don’t take advice from people you don’t know.

This show is for entertainment purposes only. Before making any financial decisions, speak with a real financial advisor. I’m Joe’s Mom’s Neighbor Dug, and we’ll see you next time back here at the Stacking Benjamin Show.

Leave a Reply