I’ve teamed up with Nvestly, a fun, social site where you share your portfolio moves with others in the community. As part of this exercise, I’m sharing my results in one IRA account….the one where I buy individual stocks. I’m also sharing with you here….but you can join in the fun at nvestly.com.

This week I placed a limit on my VXX shares. This’ll help me exit this position.

The Back Story

If you’re like me, you don’t pay attention to the short term results from your portfolio. This is a good thing. However, Nvestly sends me a weekly statement telling me how I’ve done with my picks. The email looks like this:

While glancing at it before sending the email to the trash, I noticed something…..this was the fifth email in a row where I’ve lost money. I like this alert. That means it’s time to take a look at my results against the market.

I know from my Nvestly dashboard that my portfolio takes nearly 35% less risk than the market, but before I panic I want to know how the general slide has compared against the market. Is everybody down? If so, I’ll think differently about this downturn than I would if I’m down and the market is up. To give me a long enough view, I use the slider at the bottom of my Nvestly chart to look at results since December first.

I feel slightly better, knowing that the market and I are down relatively the same….but the fact that the last few days I’ve taken a lot less risk than the market and I’m not kicking it’s butt are a little disturbing.

That means the next step is to still dig in and look at the positions. On Nvestly you and I can both see what I own, although you can’t see the actual amounts.

Here’s the pie chart of this IRA:

While I’m not happy with all of my results, I’m fairly happy with my picks. As an investor who enjoys taking less risk than the market, I expect to be rewarded when the market tanks. That hasn’t happened yet, but I’m still expecting good things, based on backtesting. Part of the problem, if you’ve been following along, is that two weeks ago I purchased oil (OIL ETF) and I haven’t yet bailed on my mining stock….something that’s dragged down my results for some time.

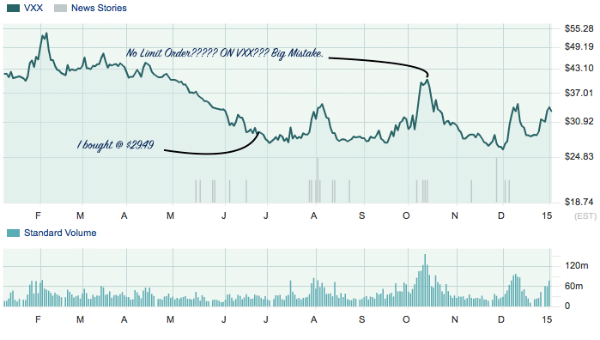

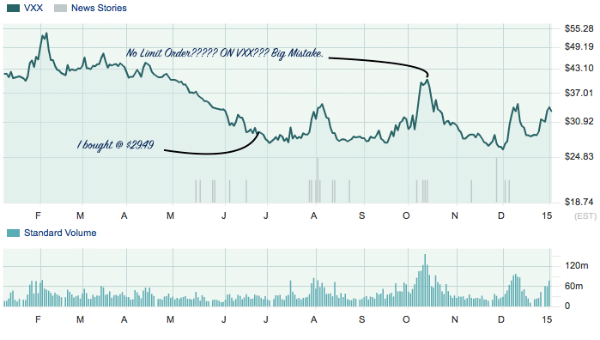

However, one move I made this summer that I knew was risky at the time was to purchase the VIX….the volatility index. Here’s the chart of my activity in the VIX.

You can see I bought it low, should have sold when it spiked, but didn’t. Now that the market is bouncing around, I’m going to use this to (hopefully) exit on a position I purchased specifically to hold for only a short time.

Why did I buy the VIX? Historically, it’s always seemed to me that bad things happen when everyone thinks they won’t. That’s why when the VIX hit historical lows in July, it said to me that the average person thinks the market is safe….something I see as foolish. Therefore, I bought.

My mistake: had I been smart about this trade, I would have immediately placed a limit at the amount I wanted to make. I don’t do this for most of my trades because I’m a long-term investor. My core portfolio companies, like Disney, Allstate and Chevron, I plan to hold for a long, long time.

This Week I Got Smart

Looking at the chart, I placed an aggressive limit on my stock at $44 per share. Nuts? Not as nutty as you’d think. VXX bounces very quickly as investors run for cover. A sale at $44 represents a 32% return for me, which will go a long way toward changing my portfolio results. If volatility rises over the next couple weeks and then the price of oil rebounds slightly, I’ll see some nice returns in short order.

….I’ll share in two weeks what that looks like, plus we’ll turn our attention to my mining stock disaster. Want to follow sooner? Check out my portfolio at Nvestly.com.

Side note: For those of you wondering…is this how he invests all of his money? The quick answer is, “Hell, no.” As I’ve detailed on our podcast, I enjoy investing and like to have some money in what I call a “sandbox account.” This IRA is my sandbox. Sure, my end goal is to learn every trick available and get rid of mutual funds and ETFs….but until that day, this will be for play.

Joe, first off, I really love the post: as a newbie (and passive) investor, I like hearing how the sausage is made. I’m also interested in creating a little sandbox with my employee stock purchase plan money. It’s not a huge sum or anything, but I’m maxing out my contributions because the company basically gives us free money if we sell right away.

Is there a percentage of total invested funds you’d recommend capping the sandbox at? I’m thinking maybe 1%?