Have you built the road map to your goals?

Often I’d hear some inspirational goals:

Hypothetical meeting with Penny and Mike, where I teach them to sketch out their goals.

Penny: We’d love to buy a nicer house.

Me: How long until that goal?

Mike: Wow. We haven’t thought about it. I’d say five years from now.

Penny nods.

Me: What other goals?

Mike: Let’s talk retirement. I’d like to be aggressive on that part of the plan.

Me: When would you like to do that?

Mike: Let’s shoot for age 50.

Me: Awesome!

Penny and Mike smile.

Penny: We can’t forget Penny Junior. We’d like to at least help with college. How about we pay 2/3 of the cost of an in-state school….for four years.

Me: Good. How old are you all now?

Mike: 39. Junior is 9.

Me: Cool. (standing) Let’s see how these goals work together.

Mike and Penny share a quizzical look.

Me: Okay, here’s the two of you:

(two people drawn, then a line out to the right)

Me: Now let’s add in the house in five years. That’ll change your cash flow pattern. Have you thought about how that’ll affect your ability to save for retirement or Penny Junior’s college?

Mike: We know it’ll be tighter.

Penny: We’d like to make it a nice house, though, because we’ll spend the rest of our lives there, hopefully.

Me: Okay, we’ll talk details later, but that’s our first concern….how does the new house change your cash flow, debt and tax situation. Right now you think you’re saving enough to retire at 50, but will the house affect that goal?

Mike: Agreed. The house can’t hurt that retirement goal.

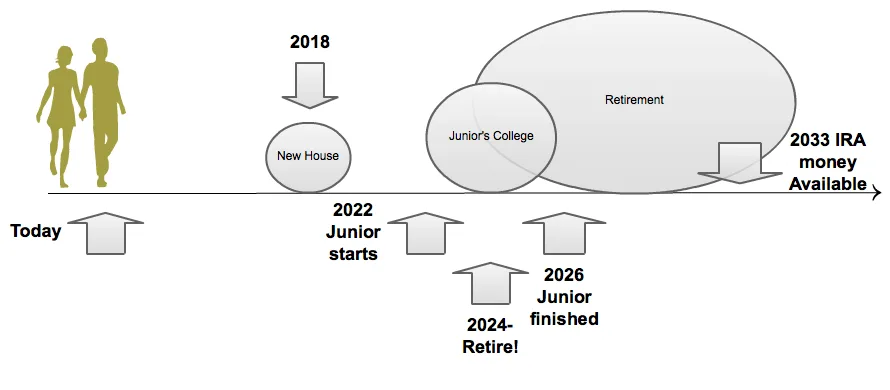

Me: (drawing again) Here’s junior’s college…and now let’s add in retirement and when you can safely take money out of your IRAs without using SEPP rules.

Take a look:

Penny and Mike Together: Wow.

Sketching Your Goals

Now Penny and Mike can see clearly some issues that they hadn’t yet addressed.

Retirement at 50 falls at the two-year mark in Junior’s education goal.

How will these two goals work together? They’ll be fine if there are dedicated dollars….but what about healthcare? If Mike and Penny have healthcare through work, do they want to abandon that while Junior is in school?

I don’t know, but the reason we even ask is because we mapped out the goals.

Retirement at 50 is a great goal, but Mike and Penny have nine years before 59 1/2 to plan for and haven’t saved a dime outside of their IRA plans. Sure, there are ways to grab those dollars early, but wouldn’t we rather begin building a flexible pot of money to bridge the gap? That could lower the tax bite during retirement immensely.

Drawing out your plan is a ton of fun. Sure, it’s a little scary until you realize that it’s the same procedure you use every time you program your GPS for your next long car ride. Seeing the future is a powerful tool that any serious Stacker uses to achieve financial freedom.

Great illustration here. Similar to choosing investments, you really can’t look at things in isolation. It’s all about how they work together. Doing this kind of planning might be a little more work, but it’s definitely necessary to get a realistic view of what you’re trying to do.

Could you actually see the illustration? It was there when I did the piece, but then was curiously missing this morning…..

Yep, I can see it right now.

I actually couldn’t see it originally. I just meant the way you wrote it illustrated the issue well. I can see it now though and it is cool.

I love it when personal finance is broken down into steps that are easy to follow. Excellent post! Your analogy with a GPS was spot on!

Thanks! I learn detail from the Moneycone posts! 😉 I didn’t realize my illustration wasn’t up correctly! Unfortunately, that was the point of the entire post….

Great stuff!

I really do think that people just don’t think very far ahead. Instead, they just keep trucking along and hope that it all works out somehow.

I agree….we think that maybe if we just don’t look the future will all turn out okay. Imagine if we did this while planning a vacation!

Love the point of this post, Joe. You can have goals all day long, but if you don’t have a plan to get you there, your chances of success are risky, at best. You’ve laid this out wonderful Joe!

I always know when my goal is just “in my head” that there are critical pieces I’m missing. Mapping it out is a hugely effective way to see what’s going wrong.

Love this, Joe! Dreaming about what we want is the fun part, but we have to see how those goals work together. So many people don’t break out their goals and amass one big pile of money, thinking they have more than enough to fund their dreams. But on closer inspection, they really don’t. Love the illustration!

I think I mapped out what you do every day, Shannon! I hope this post wasn’t like being at work 😉

This is an awesome example! I have never mapped out my goals, but it looks like drawing a timeline like that can be very helpful in seeing how our goals fit with reality.

It’s amazing how much more helpful it is than you think. Then it gets more powerful when you draw lines back to today to see what each goal is going to cost you now (budget and returns on current investments).

Excellent article, Joe. I really enjoy creating goals, but I rarely put them all together. It’s not until you put them all together that you really start to see which goals are possible and which aren’t based on time and money constraints. I really like your illustration above and I’ll try to use a similar method with my goals, thanks!

I think that drawing out the plans like this adds a new perspective. Did you use a program geared toward this (like mind mapping software) or just something from the Office suite?

In my office I used a whiteboard, then answered the questions we raised with financial planning software. For this article I used a free site called Creatively.

I’m guilty for now mapping out a more long term plan. I was really good about it when I had a full time job, but that has fallen short since I started freelancing and the month to month goals change to quickly due to irregular income. It’s been challenging…

That always was difficult for any of my self-employed clients. While it was difficult to reach the goal (often things happened in fits and starts), it wasn’t hard to put goals on paper. We knew that my clients would want to retire, would need a new car, etc. Drawing those out was pretty easy still. The hard part was what you did with it.

Wow, this is beautiful. I always make my plans with words and numbers (granted on paper, but still…); I’ll need to work on some spatial organization for a time line. I’ll let you know if I see any new snags after I try this out.

Thanks! I think of it as “beautiful” too! I always see things that I would have never seen when I draw out the timeline. Strategies show themselves and flaws that never seemed obvious suddenly are right in front of me.

We have to take goals slowly thanks to a lot of expenses sleeting down around us at any given moment. So next year — once we have the ridiculously large sum for my husband’s dental implants — I’m going to focus on fully funding the SEP.

Once we can comfortably do that, which may take two years, we’ll increase how much we pay on the mortgage. Once the mortgage is paid off, we’ll save for a rental property. It’s frustrating that our progress is slower than a lot of the PF blogosphere, but at least we don’t have to worry about goals vying for our attention.