I’ve agreed to blog about my portfolio using Nvestly, a cool social sharing app. It shows you exactly what your friends (and new friends) are buying while never sharing how much money you have invested in any position or your net worth. Check it out at nvestly.com.

Kevin at Nvestly emailed me about a new tool on their site last week. It’s a ticker search. I’ll admit: I never would have found it if Kevin hadn’t emailed me. Because the Nvestly people keep a clean interface, sometimes it’s easy to miss some of the cool features under the hood.

I tried it out to pull up Dennison Mining (DNN). Novelty tells me only one user owns it. Guess who that is?

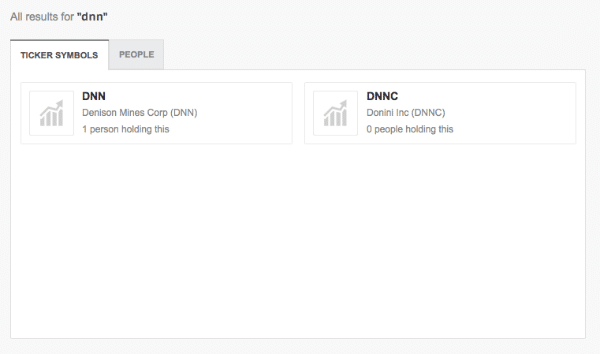

Today’s portfolio result

BUT you aren’t here to read about new Nvestly features….you want to know what we’re doing to steer this portfolio! Let’s tackle it now.

Late last week I fired up Nvestly and saw this:

The S&P 500 has come down since the start of the year and I’ve actually matched it. While in the end I’m not as worried about beating the S&P 500 as I am making money….I’m still happy that I’m taking about 25% less risk to achieve similar results.

So, is there any work to do?

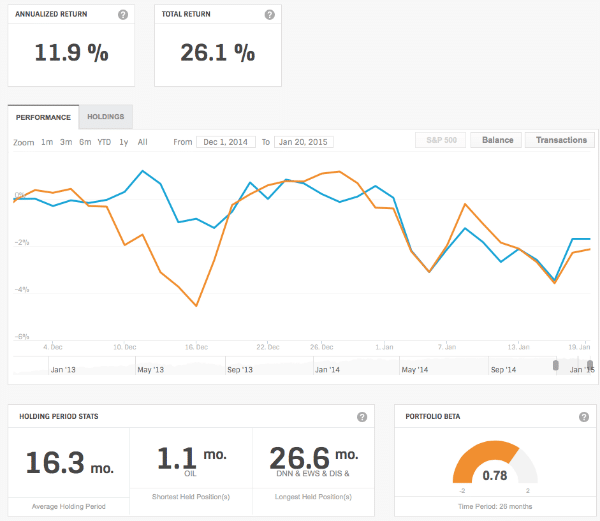

Looking through the portfolio, I flip over to the page with my holdings to examine my positions so we can see what needs to be weeded today, if anything (the best course of action is to lean toward inaction).

Last time we talked, I placed a limit on VXX. That position has risen toward my limit. The plan is working!

DNN, while not a position I love, is great in volatile markets. I need a long term plan on that position, but not today.

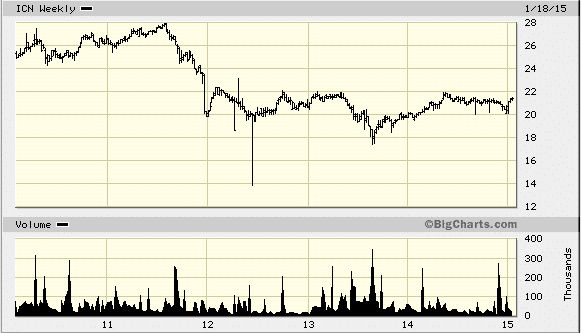

ICN, the Wisdom Tree Rupee position….why again do I own it?

Let’s Explain My Rupee play.

As I’ve mentioned before, I like growth at a reasonable value. I’m definitely a growth investor, but I generally buy when positions look weak (such as OIL, our oil commodity ETF). Last summer the rupee was trading VERY LOW against the dollar. I knew two things:

– The Indian economy, over the long term, should continue to be more and more robust.

While there’s a currency exchange play here, without going into details, that partly factored into my decision to buy.

– There is ALWAYS a chance that a country will deliberately devalue their currency (or just simply unpeg it, as Switzerland did last week). Dealing in currency can be risky.

I was willing to take the risk…but once again, this was a short term play. I bought it at $19.89 a share and as of today, I’m up 8%.

It’s time to plan my exit.

Here’s the WisdomTree Indian Rupee:

There’s no long term reason to stay in this position. The upside is limited, so I’m going to exit. While I could sell today, I’m going to place a trailing stop loss.

Trailing Stop Losses

What is a trailing stop loss? It’s a position that some brokers allow, which will continue to raise the stop loss if the position appreciates, but will sell if it drops below the target price. Using a trailing stop loss, I’ll give up a little “insurance” (money I could have made if I just sold outright today) to bet on future growth. I’m going to set my price at 21.30, which just beyond the daily volatility average. I don’t want to get washed out in a single day during the position’s normal “breathing.”

End Result

I like Nvestly’s new tool bar. While it won’t add to my deep analysis, I can find out a few things about a position without having to toggle between Nvestly and my trading platform or another site. I also like finding out how many people own the same bizarre stuff I own.

In the case of DNN….apparently I’m a loner. We’ll address that position and share our rupee results next time!

Leave a Reply