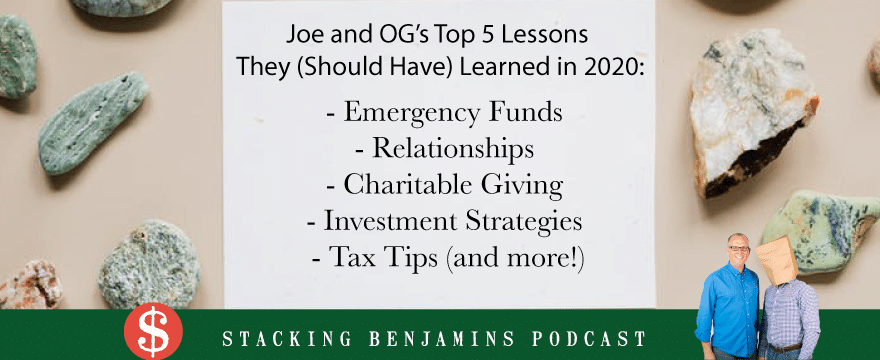

What was YOUR biggest lesson from 2020, besides avoid pandemics? Today we’ll share our top 5 (plus an “honorable mention”) events from maybe the weirdest year in recent memory. There were MANY great takeaways this year, so it was difficult to decide. Today we’ll talk about the importance of emergency funds, relationships, giving, sticking to your investment strategy, and more!

Plus in our headline segment, we’re joined by IRA and tax guru Ed Slott, who shares a few last-minute tax tips. He’ll talk about your Roth IRA, giving, and (gasp!) spending money.

That’s not all. Doug shares trivia about today’s Festivus holiday AND Joe and OG answer a Haven Life line call from a guy named Nick in Alaska.

Enjoy!

Discover

A big thanks to Discover for supporting Stacking Benjamins! Discover matches all the cash back you earn on your credit card at the end of your first year automatically with no limit on how much you can earn. Learn more at Discover.com/yes.

Geico

Whether you rent or own, Geico makes it EASY to bundle home and car insurance. Go to Geico.com today.

MetPro

Thanks to MetPro for supporting Stacking Benjamins. Get a complimentary Metabolic Profiling assessment and a 30-minute consultation with a MetPro expert at metpro.co/sb.

Today’s Headline: Last minute Advice from IRAHelp.com’s Ed Slott.

A big thanks to Ed Slott for spending some time with us today and sharing some smart last-minute tax moves you could be making. Find more at IRAHelp.com

Joe and OG’s Top Lessons We (should have) Learned in 2020

Joe’s Honorable Mention:

- Day-trading seemed to get a LARGE increase in public attention this year. From the runaway “that could have been me!” stories, to tragic events that don’t need repeating, we’ve seen it all this year. Bottom line: day-trading isn’t going to lead you to anywhere good. Stick with proven buy-and-hold strategies, and you’ll do great over the course of your lifelong investing window.

Joe’s and OG’s Top 5 (like the long-time co-hosts they are, some were repeated):

The Election

- Just about every study shows the election won’t have as big of an impact on your money as you’d think. But, that didn’t stop a lot of people moving their money around this election cycle. (OG points out this was the best November for you money in 33 years). STOP paying attention to the election for your money choices.

Estate Planning

- Tony Hsieh, long time Zappos CEO, passed away in November. As the weeks go by more and more reports are being released about Hsieh’s disorganized estate plan. Dealing with the aftermath of losing your loved one is always hard – don’t add more stress by leaving your family to run circles trying to understand your finances and final wishes.

Stop worrying about low interest rates!

- Go to the bank and refinance your mortgage. Enjoy the much better relative savings from that than concerning yourself with the interest your savings account is making.

Get your mask on first in case of emergency

- This year has proven how quickly a financial situation can turn on its head. It’s fantastic to want to be giving and help others. Like Joe said, many of our favorite figures in the financial field are huge givers. Even so, you have to take care of yourself first, and there’s nothing wrong with that.

PROTECT YOUR DATA

- Joe opens up with mentioning Robinhood – which has faced scandal after scandal, and that now includes a data breach. Beyond ditching a company that has shown it’s not the best place to be sitting your investments, you need to make smart choices with which companies you you trust with your data. It’s valuable, and no one cares about it more than you do. (But like they said – having a simple Netflix password is different than your bank password being… password.

Covid gave us a front-row seat to market-timing

- Don’t get us wrong – we understand how emotional and scary it is to see your portfolio plummet, but that’s all the more reason to make objective decisions about how you’ll handle your portfolio before the crisis comes. That way, no matter what happens, you know you’re following the plan and NOT your emotions of the day.

OG’s #1: Preparing yourself for times of crisis

- Beyond simply having preset decisions for your portfolio, you would do well to take an honest look at your emergency plans and attitudes for an array of possible emergencies.

- What would you (and your family) do in case of a fire? Does everyone know how to get out safely?

- What natural disasters could happen in your area? Are you prepared, or is your plan to “wing it”?

- Are you prepared if you had to change jobs, or suddenly found your way of working differently? The sudden shift to working from home proved just how quickly things can change.

Joe’s #1: A case study in overcoming crisis

- Joe shares OG’s final point in being prepared to overcome crisis. He points to Nick Kokonas, co-owner of the 3 Michelin Star restaurant Alinea, and how he pivoted this year before the restaurant industry got shuttered from Covid. You can listen to Nick’s story on the Tim Ferriss show HERE.

Doug’s Trivia

- Where did the holiday Festivus originate?

- Nick… from Alaska (or did he say North Pole)? Our caller’s dilemma sounds awfully familiar, but I can’t quite place it. You’ll have to listen to this one and see what I mean.

Want the guys to answer your question? You can call into the Haven Life Line and get your question answered on-air HERE.

Did you enjoy today’s show? Check out these interviews you’ll like too:

- What Should We Have Learned In 2017? (with Jean Chatzky)

- What Money Lessons Should We Have Learned In 2018 (with Jill Schlesinger)

- What Should We Have Learned in 2019 (with Liz Weston)

- Takeaways From 2019’s Best Interviews

PLUS, want to read up on R.L. Stevenson’s selfless act of giving his birthday away to someone in need? Click HERE.

Written by: Richie Rutter-Reese

Leave a Reply