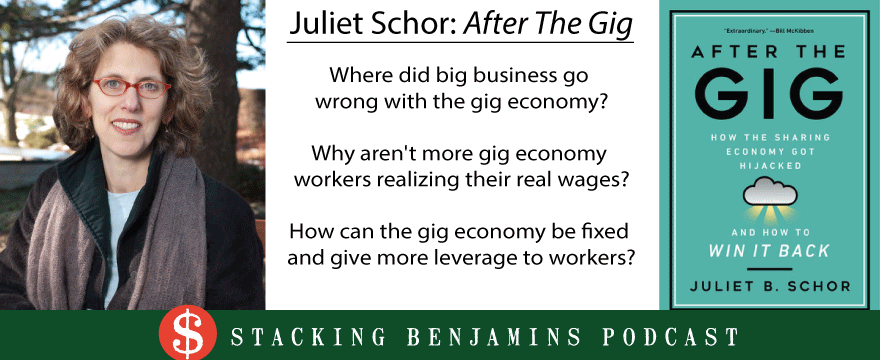

What happened to the sharing economy? The new work model promised to give workers flexibility and new income streams, while people with excess could share what they had with people looking for help. What it turned into is a different matter: lots of people earning below minimum wage, an over-saturation of workers all competing for the same prime hours, and headline-making lawsuits from companies looking to minimize their responsibility to workers. These are all things new gig workers can expect when joining the new “gig” field. Today we chat with Juliet Schor, author of the new best-selling book, After The Gig. During our interview Juliet will share the business strategies that kick-started the shift in direction large gig and sharing companies made, how gig workers don’t know how much they’re truly making, and we’ll also dive into possible solutions to the gig economy’s current problems.

In our headlines segment, we’ll ask, “Why half of the millennial generation have canceled their travel credit cards?” Plus, Fidelity is now offering their first Bitcoin fund. Should you pay any attention?

We’ll finish out the show with our Haven Life Line. Retired clergyman Bill calls in asking if he can really take out a tax-free housing disbursement from his 403b if the money was made through clergy work.

Edit Post

Add titleWho’s Sharing in the “Sharing” Economy? (with Juliet Schor)

Today’s Headlines:

- Fidelity offers first Bitcoin fund (InvestmentNews)

- Nearly half of millennial travel credit cardholders have canceled their card during the pandemic (Consumer Affairs)

Juliet Schor

A big thank-you to Juliet for taking the time to be on the show! You can connect with Juliet on Twitter here: @JulietSchor

Want to hear more on the sharing economy and gig-life? You can order Juliet’s book, After The Gig, below:

Doug’s Trivia

- This week in history back in 1985, Major League Baseball got a new leader in all-time hits, and he STILL holds that record today. Who is it?

- Bill has a 403b through his clergy work. He’s heard that because his money was clergy income, he can take the money out tax-free for a housing allowance. Bill asks, after taking the money out, could he then deposit earnings from he and his wife’s jobs into their Roth or Roth 401k plans.

Want the guys to answer your question? You can call into the Haven Life Line and get your question answered on-air HERE.

Join Us Wednesday!

Written by: Richie Rutter-Reese

Leave a Reply