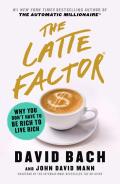

On today’s show we’ll sit down with David Bach, the nine time bestselling author. What’s keeping you from achieving your financial goals? Is it a latte a day? While it doesn’t necessarily have to be a latte, our discussion with David will shed some light on the simple things in your life that could be holding you back from reaching your destination.

And in our headlines segment we’ll be joined by Ashley Boucher of Sallie Mae. Sallie Mae has released their Majoring in Money 2019 report, and among some of the more surprising discoveries is that some students hold FIVE credit cards. We’ll discuss more of the big takeaways from the report during our call with Ashley, along with covering an article from InvestmentNews about Schwab’s new portfolio management tool.

Later in the

Then, in our letters segment, Dano has some questions about how he should allocate his retirement funds. With Dano paying a percentage of his money to a pension, wouldn’t that be considered his “safe” investment? When Dano is putting money into his Thrift Savings Plan account, couldn’t he put all of the cash into the more aggressive funds?

Of course, we’ll also make some room for Doug’s trivia, so don’t you worry.

Show Notes:

Today we talked a lot about Ben Hamm’s show The Secret Room. Ever wish you could be a fly on the wall and hear people’s deep, dark secrets? Check out Ben’s podcast, “The Secret Room,” and listen to the true stories that no one ever tells.

MagnifyMoney Voicemail

Thanks to MagnifyMoney.com for sponsoring Stacking Benjamins. MagnifyMoney.com saves users on average $450 when they compare, ditch, switch and save on credit cards, student loan refinancing, checking, savings and more. Check out MagnifyMoney.com for your savings.

<5:00> Headlines

- Next-gen portfolio management tool from Schwab is now live (InvestmentNews)

- Want to learn more on Sallie Mae’s latest report? You can read the report for yourself HERE.

<21:44> David Bach

You can check our David’s latest book, The Latte Factor at: TheLatteFactor.com

You can get your hands on a copy of The Latte Factor AND help out our show by ordering though our independent bookseller, Powell’s: The Latte Factor: Why You Don’t Have to Be Rich to Live Rich

Amazon link to The Latte Factor:

The Latte Factor: Why You Don’t Have to Be Rich to Live Rich<44:28> Doug’s Trivia

- Which Friends cast member earned the highest salary?

<49:33> Haven Life Line

- Thomas has a question for his son. Thomas’ son has gotten all of his college paid for this past year. With about $3000 in excess scholarship money, could they put the extra money in a Roth IRA?

<56:39> Letter

Dano has some questions regarding how he should allocate his retirement contributions. You can read Dano’s letter below:

I’m probably going to put this information in an order that won’t make sense until it’s read in its entirety, but my question is regarding the proper allocation of retirement contributions….

I am a new federal employee (with 9 years prior military service): If you pay 4% of your salary into the federal pension plan, which I do, is it necessary to contribute any amount to bond funds, such as the TSP’s government securities (G) fund, to have a balanced portfolio?

It seems that with the federal pension, that would be my ‘safe investment’ contribution, and I would have the ability to direct all of my TSP contributions to more aggressive funds (C, S, or I).

I contribute 15% to the TSP, and there is an additional 5% matching added, for a 20% total. The 4% to the pension is separate of the 15%. I have another small pension earned from a previous employer (a large global chemical company.)

I am 49 years old, married, two teenage daughters, make 100K salary, no debts other than my mortgage ($20k remaining). I have 32K in an emergency fund, $280k in 401ks, $65k in the TSP, and a few thousand in 529 plans for my daughters. Any suggestions to ANY of this mess would be greatly appreciated. Love the show.

Leave a Reply