When I mentioned my strategy for Jeff Rose’s investment throw down, I also mentioned that I’d be playing to win….so I’d do a BUNCH of stuff that long term investors shouldn’t do.

However, if you’re a money geek looking for short term results, AND you know the huge potential downsides, you can make some moves that (hopefully) can win the day. I list a few of my (potential) strategies and thoughts in my announcement post here.

So How Have I Done?

The markets since January 1 have been horrible. Because I felt that this might be a “salmon”-type year, I decided that the best thing to do would be to take my time.

This course of action is great for long-term investors. By making sure that I have reasonable data and making rational choices, I’m going to avoid getting into messes caused because I was anxious.

I Opened My Account

While I prefer TD Ameritrade’s Think or Swim tool to anything Scottrade offers, I decided to open a Scottrade account. Why? Because the marginally lower trading costs, in such a small account, could be the difference between winning and losing.

For long term investors: While I worry about investment fees, I’m not normally an active trader, so I’ll look for better tools over low cost trades. Frankly, when you’re trading thousands of dollars at a time, the difference between a $9 trade and a $14 trade is laughable. However, when you’re going to try to diversify a small amount of money ($1,000), every buck counts. I’d recommend long term investors find good tools that’ll help them steer the ship (the reason I like Think or Swim) and stick with those.

I Researched

My goal was to purchase several small companies with a high standard deviation.

What the hell is Standard Deviation? Are you swearing at me, Joe?

Ha! While it’s true I have a potty-mouth, standard deviation is the amount of swing a stock will produce. For this competition, I want stocks that have a propensity of swinging A TON. Generally speaking, for lots of not-really-important reasons, stocks that trade closer to zero swing more than those that trade further away. So, I looked for those.

I Also Looked For An Asset Class That Was A Salmon

I needed something that was going to be hot enough that it would buck a downward market trend or that would move on it’s own. As the market deteriorated, my choices for any short term picks became less and and less obvious.

Health care, something I thought would be perfect for short term trading, didn’t seem to be moving against the market.

Peer-to-peer lending, always risky but potentially profitable, isn’t a strategy I can use in Texas. Yes, the land of “I want my guns and you can’t tell me what to do, dammit,” has decided that I’m not a big enough boy to lend someone else money….or buy beer at my local grocery store. It’s hypocritical and absolutely mind-numbingly stupid, but I’ll leave that for another article.

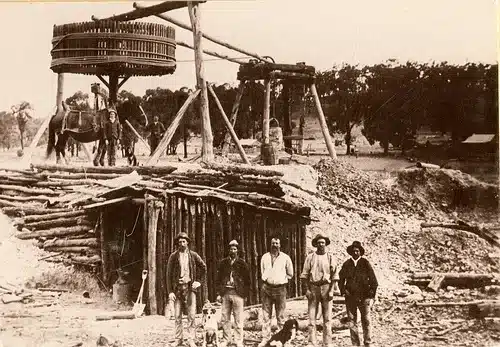

Instead, I set my sights on mining. While prospects weren’t great for mines, I had two criteria to target this asset category:

1) If the financial markets go in the tank, precious metals normally show little to no correlation. I’d prefer negative correlation, but I’m not going to try and sell short in my little $1,000 account. Therefore, I wanted to remove the stock market as much as possible.

2) Historically, if you invested in the worst-performing asset classes from the year prior, you had a pretty good year. While the stock market is up still (even after the drop) about 10% over the last 12 months, the ETFS Precious Metals Basket Trust exchange traded fund is down a dismal 40%.

Tea leaves and reading smoke signals? Yup. Remember what I said about “bunch of stuff long term investors shouldn’t do?”

I Pulled The Trigger…Kinda

Based on an article written by my friend Andrew at 101 Centavos some time ago, I’d had my eye on Denison Mining. It wasn’t a particularly great company….and the balance sheet wasn’t my favorite, but I was looking for a mining operation that I thought wouldn’t go belly up any time soon and that could buck a downward stock market trend. I also needed a really low cost stock….bingo.

On 1/17 I bought 200 shares of Denison Mining, ticker symbol DNN for $1.30 per share.

How Am I Doing?

Not surprisingly, I’m down. However, there’s good news. I ate $9 on the trade and the stock is trading at $1.28 today, so I’m down $.02 plus the trading cost. Because the cost, in relation to the amount of money I spent, is so big, I’m down just over 1% for the year…my account balance as I write this is $989.28. The Dow Jones, in comparison, is down around 8%.

My Strategy

Here’s the investor’s dilemma: you know the market is going to go up at some point (it moves north about 70% of the time). Therefore, I know that I’m sitting in dangerous waters. Bonds still stink and stocks are looking ugly. I’m going to continue searching for salmon in this market, but don’t be surprised if I’ve still done nothing between now and my update at the end of the month.

ha! I almost guessed right. I was thinking you were aiming for GDX ETF shares or something like that. Those gold miners were beaten down last year…

In the real world that’s COMPLETELY where I would have went…and you, as usual, would have been right on. But because I wanted even MORE volatile, I went single company. Not a great idea in real life, but fun for the throw down.

Is it within the rules just to plop that money down on “Black” at the roulette table?

I like the strategy. To give yourself a chance to win among a field of 10, you need to go contrarian. Anyone who goes out and does something similar to the pack is likely going to finish middle of the road, even if they’re ‘right’. I love that you’re swimming against the stream, if only because it differentiates your strategy and, hopefully, your results.

Hmm, your idea of selling short is actually really interesting. If everyone else is putting money into the market, wouldn’t that actually give you a great chance to win?

Buy, that’s a hard one, though. I decided not to mostly because 1) I don’t know how low the market will go; and 2) Selling short means risking more than my original $1,000. That’s too much betting for me.