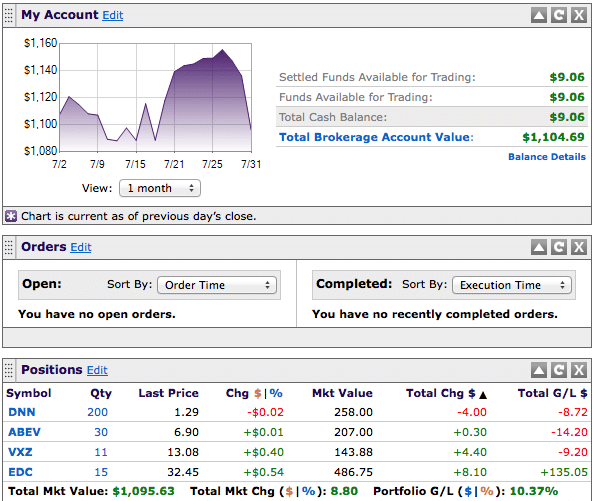

I’m competing in the “Grow Your Dough” challenge with a handful of other bloggers. We all started on January 1, 2014 and the contest goes until January 1, 2015.

What a month. The market continued to soar until the last day of the month….and then the house of cards finally came tumbling down.

If you’ve read my previous updates, you’ll know that I’ve structured the portfolio against this backdrop. I don’t like betting against the market (I feel like the guy playing the “don’t come” line at the craps table), but if I’m going to win the competition (my goal when I began) I need to think differently than the herd.

How my positions fared.

Obviously, the move into the VIX (the volatility index) last month is looking great…initially I was down but now I’m back at break even since the market began dropping. However, that move up for the VIX wasn’t big enough to withstand the drops in my more straightforward positions. While the VIX finally approached “making money” territory, ABEV dropped through the floor.

No matter. While those contest participants who focused on all “long” positions (those types of investments that perform well under positive market conditions), all I need is a relative win. What does that mean? It means that if the stock market bear is chasing us, I don’t have to outrun the bear….I just have to outrun the other competitors. I can lose money….I just have to lose less.

Still, ABEV is disappointing. Don’t people drink alcohol more when the market falls? Come on! Let’s all go get hammered while we lose money! That’ll get my portfolio up…..maybe. My precious metal/mining play is performing as expected. My emerging markets position is still rocking…..so overall I’m not unhappy.

But if I’m going to succeed, it’s becoming clear that I might have to figure out something to do with ABEV.

Should I sell ABEV?

Before I evaluate this stock, here are the problems with selling:

- Trading fees will eat me alive. I only have a $200 position. Each trade is nearly $9. That means that I’ll be out $27 (buying ABEV, selling ABEV and buying the new position) on a $200 position. That’s ugly…..

- I’m not sure that ABEV is actually performing poorly. What do I mean? While it isn’t helping in my perceived portfolio mission, I’m not sure how it’s doing vs. it’s competition. If ABEV is succeeding relative to everyone else in the category, I’ll have to think long and hard about whether my strategy is wrong (because that would be the problem….not the position).

So, with those two points in mind, let’s look at ABEV on a fundamental level:

Note to new/non-investors: people evaluate stocks two different ways, on fundamentals and on technicals. What are fundamentals? Those are the stats about the actual company….how the company is growing, how much they’re selling, whether they have debt….that sort of thing. Technical analysis involves looking at the stock price and how the charts/graphs are playing out.

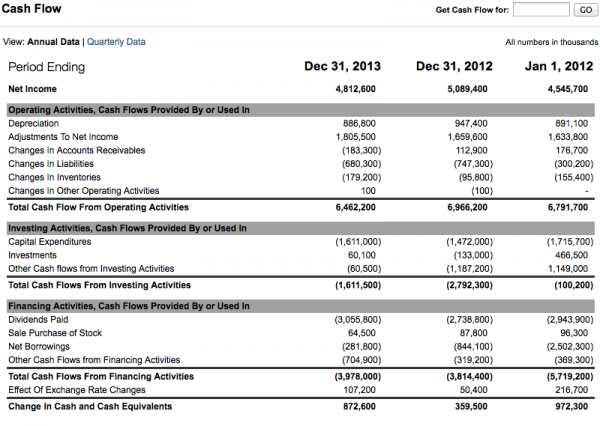

Here’s ABEV at Yahoo! Finance….let’s look at cash flow first.

Cash flow for ABEV actually looks healthy. The bad news about ABEV is that the numbers they’re required to release as an ADR (stock of a company abroad trading on a US exchange) are only released annually. Different than US companies, these numbers are months old. Traders will tell you these numbers are dinosaurs. The big picture? Can we glean anything? Sure. Long term, cash flow seems to be improving over 2012 and stable vs. 2013.

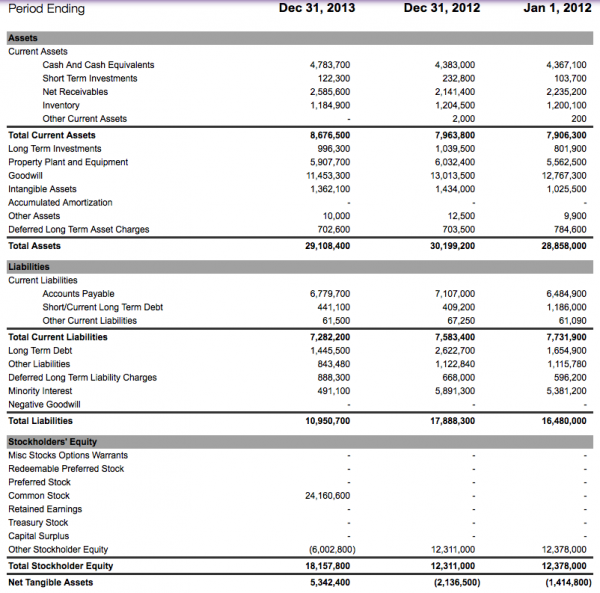

Let’s move on to the balance sheet:

Check out how the amount of debt is going down and assets are rising. This looks good, too.

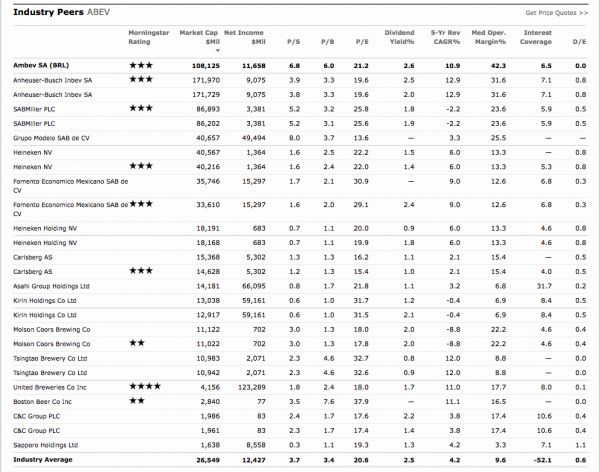

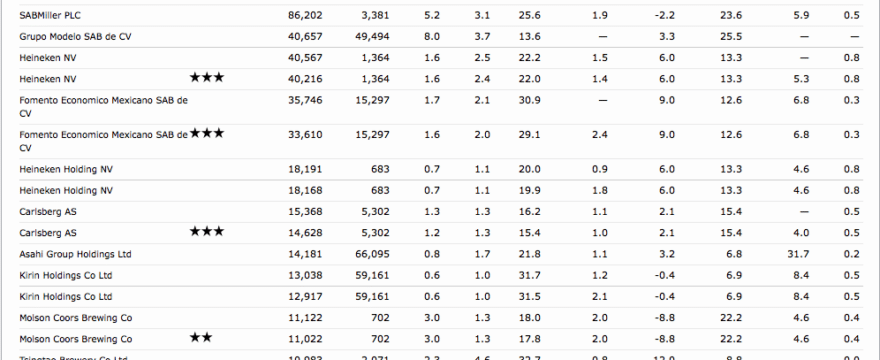

So, let’s look at ABEV vs. competitors. Unfortunately, Yahoo! Finance doesn’t examine this for ABEV, so I’ll turn to morningstar.com:

Notice the PE ratio? If you look at the bottom of the page, you’ll see that ABEV has a slightly higher PE than competitors. That may mean that the stock is a little below average when it comes to expectations for the sector vs. this individual stock. However, check out the dividend. ABEV is best in class.

What does that lead me to believe? Looking a fundamentals, I have a stock that’s set up decently for the long term….it won’t go bankrupt any time soon, but is performing just slightly worse than its competitors.

That sucks. There’s nothing worse than a stock that’s just good enough that you shouldn’t get rid of it. Sigh.

Finally, I looked at the headlines. I always look at headlines, but read them last. Why? I want to have formed my own opinion of the company before seeing what everyone else is saying.

Not surprisingly, the headlines are ugly. Here’s one from Forbes. Here’s another from SeekingAlpha.

Great. Even the headlines give he said-she said guidance.

A key date coming up? The ex-dividend date is September 4th. Can the stock hold on until then? As a global play, my thought process is yes, it can. With a 4% dividend, that’ll help soften the blow of selling this loser. Therefore, I’m going to hold on until September 5th to sell….hopefully not the same idea everyone else has who’s getting out…..

Leave a Reply