When we last heard from our hero: He’s in this crazy (and some will say silly) contest to grow $1,000 as quickly as possible. It started January 1 and runs until Dec 31 of this year.

My take on this contest: Growing your dough over 12 months is a fool’s errand, but hell, let’s have some fun, right? Anyone familiar with investments that grow at speeds reliably faster than inflation know that in a 12 month period these types of investments fluctuate wildly. You can’t predict a growth investment’s next turn.

My strategy: I decided to play to win, so I did a couple things:

– I purchased asset classes that were in the tank, hoping that they’d come roaring back within twelve months. Historically, your best chance of a short term win is by buying last year’s goat.

My positions: a mining stock, a 2x risk emerging markets ETF and an international alcohol stock.

– I bought nearly everything in the portfolio internationally, because the USA has been hot for a long time. I don’t love betting against the United States, but if I’m looking to win against blogger who’re probably going with more straightforward approaches, this is my path to victory….if there is one.

What’s happened so far: After being shot out of a cannon when the market went south earlier in the year, my portfolio stagnated while the straightforward investors roared back. I’ve gone from 2nd place toward the back of the back in a hurry.

This month:

Guess who’s back?

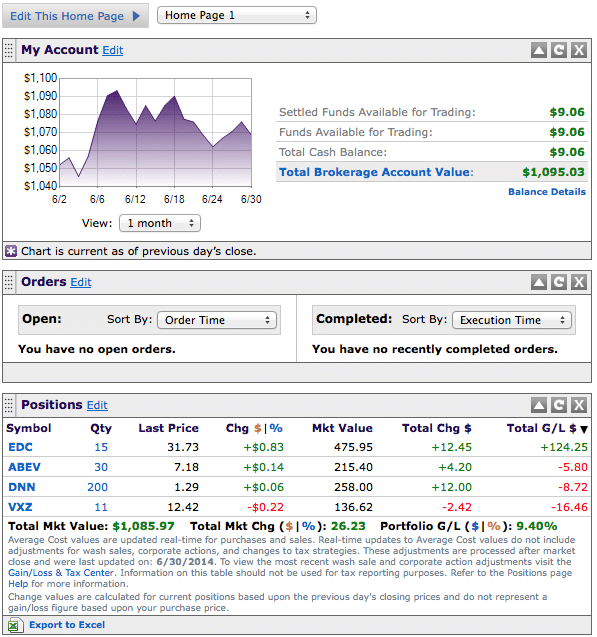

Here’s how the portfolio looks.

Pretty nice, huh?

You may remember that in my last update, the portfolio sat at $1,054.46. I made $40.57, or 4.057% in a month when the stock market returned just over half that, or 2.07%. I’ve gained 9.5% so far this year while the market’s returned 6.95%.

Wow.

But, as with anything, it’s a mixed bag of results. The real truth is in the details.

The Ugly Underbelly: What’s Really Happening In My Portfolio

I actually only have one position that’s doing anything: my 2x Emerging Markets fund, EDC. This fund grows at double the rate of the emerging markets index each day (or shrinks….but let’s keep it positive!). That’s the good news. The bad news: it resets every day, so the fund monitors a single day of activity instead of a trend. This is a tool most used by day traders, not investors. I wouldn’t recommend it in a portfolio.

Besides that, it’s all doom-and-gloom. My mining stock isn’t moving (no surprise there….that’ll be dead until downward market action happens). As I’ll mention later, my new position is also slightly down.

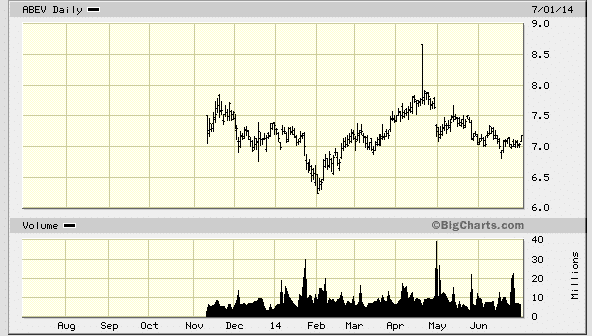

The only position that has me worried is AmBev. I purchased this international alcohol company because I thought I had a great opportunity to make some money AND stay out of the USA. Overall, I was hoping for USA-type returns whether the US economy went up or down.

That isn’t happening. Here’s a chart:

So, what do I do?

The bad news about this contest is that each trade costs me nearly 1%, so I’m going to have to be really certain that something is better than what I currently have. Besides liking the numbers behind this stock, Jim Cramer’s been talking about it on his show a ton, continually touting what a great buy it looks like. I was hoping for some short-term trader action on Cramer’s recommendation, but that isn’t happening.

Even though I think Cramer’s from the moon on his 401k position, I love it when he talks about stocks I already own. Bam!

My Moves This Month

I made one purchase this month because I had a little cash sitting around doing nothing. I knew it would have to be one heck of an opportunity for me to jump on it….and I thought I found it.

I’ll admit, after dropping toward the back of the pack last month, I felt a little panicked and wanted to make a move. I wasn’t about to go against my theme and bet on the usual USA stuff that everyone else was in….that wouldn’t move me past the other competitors.

In real life you’re competing against your goals. Here I’m competing against actual people, so I need to think a little differently than I did as an advisor.

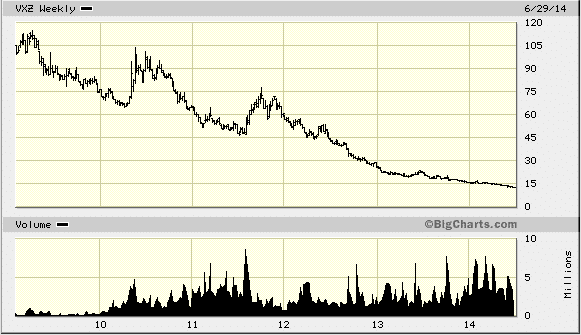

So, I pulled the trigger on something I never would have gone after in my financial planning days (I probably wouldn’t have done this contest in those days!). But, this time I kept hearing over and over in the financial press news about how low the volatility index was, so I had a look at ticker symbol VXZ (a volatility index).

Here’s what I saw:

Not impressive, huh?

Volatility sits at seven year lows. The market is topping all-time highs. Interest rates are near record lows. Guests on my podcast have talked about this market walking a knife’s edge.

So, I bought it. 11 shares worth now leaves me $9.06 in cash.

What this trade means: I’m now the guy at the table hoping that the market retreats….a position I really don’t envy. However, if I’m playing to win this competition, I can’t think of a way that I can catch the leaders more quickly. Throwing long? Not really. I have a whopping $136 invested in this position, or just around 13% of the portfolio. Currently I’m down nearly $8 more than the trading cost. To say I’m not happy with my hand is an understatement. However, there’s no way I lose this competition if the market goes south.

….and, just to put things in perspective, I’m beating the hell out of the S&P 500 with this portfolio that’s designed to run contrarian.

What’s Next?

Sadly, I’m sitting here hoping the market goes down. If August and September do what they normally do, you should expect to see me explode through the pack and then we’ll have to see what the fall months bring us.

….no matter what, we know there’s more fun to come.

I love your approach, Joe. I tell the same thing to people picking in football pools: you have to be a little different if you want to win. You need to pick some upsets, or you’ll always be middle of the pack, even when you do well.

Interesting!! I’ll be eager to see what Sept. 1st brings. 🙂

It will be fun to see how things go. As one of those “straightforward” investors (who is still ahead of you this month, BTW), I’m interested to see how your portfolio and PT’s does, since I think you guys have the most gambling-like portfolios of any of us. PT is, of course, destroying us all, and it will be interesting to see if you really do come roaring back. But for now, I’m comfortable with my position.

I have never done a challenge like this before. This might be something to think about.