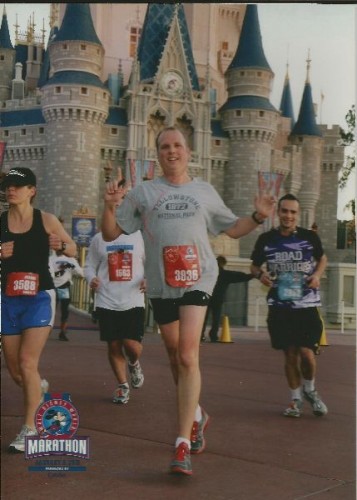

This last weekend I ran my fastest marathon: three hours and forty four minutes. I know, right? An old, balding guy sweating for 26.2 miles…and the big shocker is that I actually lived.

My legs might not have made it….my quadriceps feel like someone ran over them with a bus.

But it’s finished and I met my goal (3:45). That was amazing also…26.2 miles and I executed on the plan to within a minute.

I’m not really interested in show-and-tell….but this marathon represents a case study about why people succeed with a good financial plan. I didn’t meet my goal because I willed myself to “win.” I don’t think I got especially lucky (though the conditions for success were nearly perfect). Let’s go over what lessons there might be here for someone (you) trying to begin your financial plan.

Joe’s 5 Big Marathon Goal Setting Points

1) I started with a reliable plan.

When I began running longer distances, job number one was to avoid hurting myself.

I met with my doctor. I asked distance running friends what plan they use. They shared two facts: don’t use the Hal Higdon plan (that’ll get a new runner hurt); and try Galloway. While nobody talked about having a top time on the Galloway plan, they all said that you’d finish your marathon and you’d stay upright. Since those were my two biggest goals, I followed the Galloway plan and finished the Disney marathon in 2011. Time? 4:06.

Now, fast forward two years. The first plan worked. I’d finished five marathons. Two of them had been half marathon Saturday/full marathon Sunday doubles. Yeah, baby!

Now I want to run faster.

I again researched to find a plan that wouldn’t get me hurt and that could add a little fire under my fat little feet. I was advised to a) not use Hal Higdon if I was worried about getting hurt; and b) maybe I might try the Hanson’s plan. After much worry and more research into the positives and negatives of a plan that called itself the “maverick” way to run your fastest time, I decided to give it a shot.

It fit for me.

Within months I was running faster than ever before. There were problems: I was tired nearly all the time. I was running much bigger mileage on a daily basis than ever before. However, because I had done my homework and knew these downsides ahead of time, I was ready for the exhaustion. I planned my days better. I felt like I had a reliable weather forecast when it came to how I’d feel.

In financial planning, it’s similar.

You win or lose based on having the right plan. I used to see people bail on great plans just because they got fidgety. That’s not going to get you anywhere.

Is your hoped-for result to speed toward the finish or to enjoy the run toward your goal? What commitments do you have along the way that are going to influence your “training program?” How much time will your plan require? Do the goals you’re chasing match your personality?

By building the right financial plan for you, you’re crafting a working document that allows you to succeed inside of yourself, without having to prove that you’re something you aren’t. A good financial plan gives you a daily list of tasks to work from that’ll make sure you’re focusing on the key areas of your life, and not on some rules of thumb proposed by a book.

Key question #1: Have you build a financial plan that fits your life and your personal end goals?

2) I found a support network.

It’s true: you are a product of your thoughts.

I wanted to live and breath running to achieve my goal. Therefore, I relied on a great group of friends who all had similar goals. Several running groups meet around our little city of Texarkana. I didn’t bite off more than I could chew and run with the fast boys. I knew that this would land me in some injury fairly quickly. I already had a plan, I just needed people to run with who would be supportive and who would encourage me to stick to my plan.

While I often ran alone, there were many Tuesdays and Thursdays that friends would run my speed workouts with me. They began adding parts of my workouts to their plans. On my end, I sometimes switched up my mileage so I could reciprocate.

The great part about my plan? It taught me to feel comfortable running at 8:20, the pace I knew I’d need to maintain for the duration of the race to get me to the finish line on time. My friends didn’t always run this pace with me, but they were always there with the high five when I stayed on course and continued to fight during the hot months of summer and the freezing days the last couple of weeks. It also felt good to spur someone else toward an important goal. I felt honored to help my sister achieve a huge running goal this fall while prepping for my own.

A good financial plan is the same.

While it’s a written document, it’s easy to get off track. You’ll need people in your corner to help you succeed. I rehired my business coach as soon as possible after beginning Stacking Benjamins so that I could focus on the right areas. I try to email other bloggers and attend the yearly conference with my peers. This helps my business succeed, but also (because I’m in finance) keeps me working hard on my financial plan.

Key question #2: What reliable people do you have in your corner?

3) I was patient.

Over 26 miles, let’s be honest. It can get pretty boring. You spend a good part of the run thinking about the finish line. Because I had some experience, I knew that priority number one was to keep my legs moving and to focus on consistency, not speed. Because my goal was based on an 8:30 minutes/mile pace, I needed to stay just ahead of that for inevitable problems in the last miles. So, I constantly looked at my watch for four hours and tried to maintain an average pace of 8:20. That worked. When my hips began to tighten at mile 21 I had some room to give because I hadn’t flamed out earlier in the race. By mile 23 my hamstrings were saying, “Hello!” When the last mile arrived I looked at my watch: to get my target goal I only needed a 10 minute mile. Luckily, because I was patient, I had a 9 minute mile left “in the tank.” Mission accomplished.

Good financial plans mean that you execute little by little on a daily basis. You cannot give in to your lust to “have it all right now” or you’re flame out and your long term goals will disappear in a pile of rubble. You’ll realize (often too late) that, “Man, I shouldn’t have done that.” Let success come to you with your plans. If you’ve taken the time to create a great document, build milestones, reach those milestones, and have supportive people around you, you’ll reach that goal.

…and what a great day it’ll be when you get there.

Key question #3: What are the milestones toward your goal? Have you set a “pace” that you need to keep toward your end game or are you working from “rules of thumb” that might not actually apply to you?

Congrats, Joe! That is an amazing time! Is it a BQ for you? Mind sharing what training plan you used? I seem to have topped out with my PR just a little under 4 and would love to get over that hump. I can run shorter races faster, but then always seem to wall it at mile 20 and my speed drops dramatically. =)

Thanks! I used the Hansons plan for my recent races. As I mentioned above, that was probably the single key to me getting this accomplished.

I ran cross country for one season (and walked for the portions of races where the coach couldn’t see me) before I said, “No thanks!” But it at least taught me to respect people who can run for long distances. You are crazy, clearly, to voluntarily run that far… but you are tough.

I like the comparison to financial planning. Like you noted, having a plan (and the right one) goes along way to actually achieving the goal.

OMG I can’t even imagine running that pace. Even a 1/2 at a 10 minute mile might kill me, but that’s the point of this article isn’t it? You have to run your own pace and go at your own speed so it works for you. And geez I hope my training plan is an OK one! I also think finding the right support is key. I see so many parallels between distance running and personal finance. Not so much with beach volleyball and personal finance. 🙂

Great job! My sister-in-law is a hardcore marathon runner and she didn’t even exercise until two years ago. Once she got started, she just couldn’t stop and now she’s addicted!

When we enrolled in our debt management plan, we knew it was going to take about 5 years. There are superstars that pay extra and finish early…..we didn’t. It took all we had to make the payment we had to in the beginning. As our income grew over the last few years, we kept our “pace” the same, growing our monthly budget and even having some fun (GASP) while we were still paying off our credit card debt. I honestly believe it helped us from getting burned out, AND from putting even more stress on our marriage. That finish line is less than 3 months away…..

Well done! I always use music as a pacer as to not have to check a watch. Did my first run with no music a few days back and it was unsettling.

Joe, as usual, your posts HUGELY inspire me to stay on our path. First of all, BIG congrats on making your goal – that’s awesome!! You hit the nail on the head with the analogy here. I feel like we are indeed running a marathon, so I always try and make sure we’re focused on what we’ve already accomplished, not what’s left to do. We look at percentages too, as opposed to dollar amounts, lots of times, and we set those milestones, or short-term goals, you talked about. It really does help!

Congrats on finishing the marathon, Joe! I ran a half marathon but could never imagine running a full marathon. I think sometimes setting a pace is a good thing, but it can also mean hitting a plateau. Sometimes I feel like my blog is going well but I’m so stuck in a pattern that I can’t hit the next level.

Oh, wow! Congrats! I’m pretty sure that’s a great time! Love the analogy. I once had a co-worker that did races all over the country…he had a side business of teaching people how to properly run so you don’t injure yourself…something about the way you set your foot down or something. Plus probably a million other things that went over my head when he was telling me about it. Point is…it’s no joke! The planning/research is crucial!