…wow, another month and my portfolio is even more interesting than ever.

If you’re new to “the show,” let’s quickly get you caught up:

- I joined the Grow Your Dough Challenge in January. It was a challenge between several bloggers to grow a portfolio in twelve months. I love absurd challenges, and this one is as absurd as it gets. Using long term assets for a 12 month challenge is like a trip to the casino.

- I decided to use a strategy that ran contrary to what I expected from the competition. I used asset classes that had been down last year to “bet” on the fact that they’d rebound (often the worst performing asset classes from a previous year are among the best the following year).

- To accomplish that goal, I purchased an extremely volatile emerging markets index, a mining stock and an international beverage stock.

How’s The Portfolio?

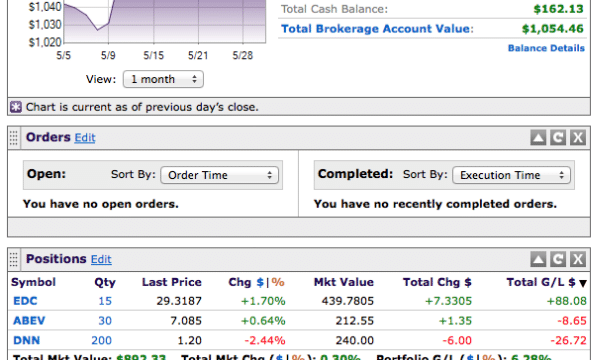

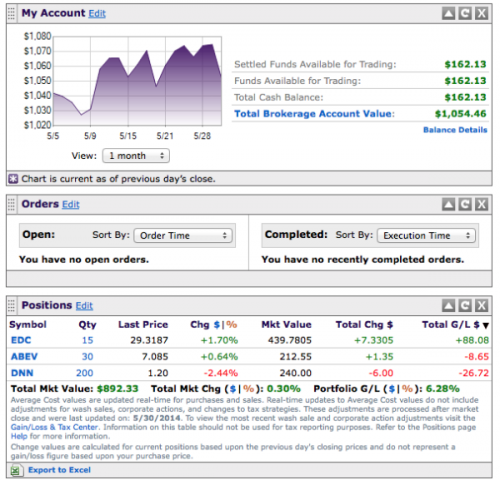

As of June first I was up nearly 5.5 percent. Here’s the screenshot:

May Market Update

While the market overall continued to rise, many in the media and financial communities began talking about the “other shoe dropping.” This is good for me, because in April the straightforward competitors were nipping at my heels and a few were outperforming me. If the market climbs overall, I sure I probably won’t be the winner.

What Moves Did I Make?

None. Frankly, I didn’t move for two reasons.

First, and the most honest reason, is that I was really busy in other areas of my life. That’s why I liked being a financial advisor. It was my job to schedule periodic and systematic meetings for my clients to look at their money. I found that many people don’t do that simple task without someone outside the family pushing them. If you don’t have a systematic plan for looking at your financial situation, use this blog post as an excuse to go get one!

Second, while there’s little to cheer about if there’s a shaky market, it’s good for my portfolio competitively. Therefore, I wanted to (and still want to) sit and watch.

Most of the time, sitting and watching is the best thing you can do for your money

What’s On My Mind

I’m only making money in one of my positions, and I’m up 20 percent. Normally I’d look to rebalance my portfolio, assuming that I like all of my positions. In this case, I’m going to let my winner (emerging markets) run. All I’m reading about is how much the pros love emerging markets right now. Therefore, hopefully this means that I’m in the drivers seat.

That said, I don’t have hope for what the experts say. I read early this year while choosing the position that emerging markets could be down for another five years, yet it’s now the hot position everyone seems to want. Everyone, it seems, is great at falling in love with yesterday’s winner.

If my position continues to rise, I may place a stock loss on it, however. That would allow me to lock in my gains in emerging markets and secure a decent return on that investment.

As for my other two positions? Mining and international beverage companies are still great places to be in shaky markets. I’ll just need more “shake” for them to become winners. At some point, I’d unload investments that aren’t keeping up with their indexes, but in both cases these investments are performing identically to their larger index.

Great job on your earnings! When is this thing over?

Well, I’m starting to get smoked by the more straightforward crowd.

We’re done the last day of December. It can’t come soon enough for this portfolio!