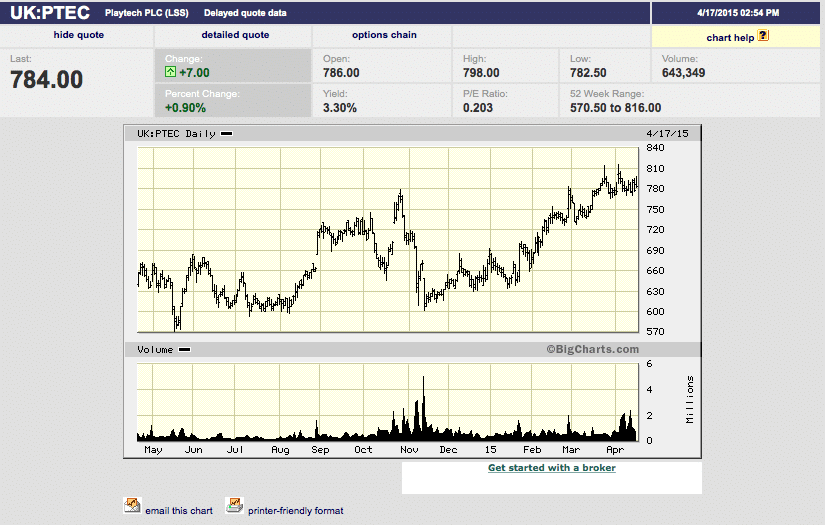

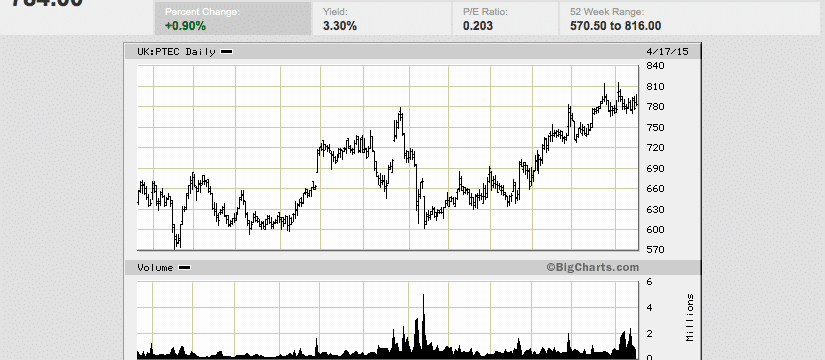

If you’ve read SB for an length of time, you’ll know that I’m constantly searching for new investment opportunities. That’s why when I saw this chart:

…I thought, “Hmmm….is this an investment for me?”

Then I saw that this particular stock was in the UK. Should that matter? No, it shouldn’t, although there are a few extra steps I’ll have to take before deciding to pull the trigger on buying.

Let’s dig in….I’ll show you some of my work.

Decide How You Evaluate Stocks

There are two roads to success pros use when evaluating individual stocks….either they:

start with a wide, macroeconomic funnel and work down to the company and how it operates

OR

….begin with the company and then spiral up and out toward competitors and the investing environment.

What do I mean? If you’re a person who starts with a wide lens, you’ll ask questions in roughly this order:

- What are the international conditions in the marketplace?

- How does this country compare to others in which I might invest?

- How does this industry fit into this country, vs. similar companies in other countries?

- What’s the trend for this industry?

- How does this company compete in this industry?

- How does this company make money in ways others don’t?

- How is this company doing financially?

- Should I invest?

See how the funnel narrows down to the company over a series of steps? If I see a single company that want to evaluate, I’ll often flip this funnel to make a decision. Neither way is correct…..but my brain works macro to micro. I generally think about prevailing opinions and trends and then walk down to “which companies will benefit from this?”

So, let’s use my current toy above as an example. This UK-based company is named Playtech.

While the chart above looks awesome, you still need to ask the question, “is this a great investment?” We’ll dig into the actual company over on TheFreeFinancialAdvisor today, but let’s focus here on the bigger picture. Is this the type of company we should be jumping in to right now?

Let’s ask our questions to find out!

What Are The International Conditions In The Marketplace?

Gaming is expanding across the globe…but in pockets, according to independent researchers at Spectrum Gaming Group. While traditional gaming cities such as Macau struggle, this is due as much to Chinese government crackdowns on corruption in the city rather than fewer people gambing. Overall, Asia is a hotbed of gaming expansion.

Playtech, though, supplies online gambling firms. In the United States fewer people have been gaming in legalized states than experts had predicted. This trend isn’t true in the UK, however. UK government statistics show that over the last four years the number of people “remote gambling” in the UK has nearly doubled (from just over $600M to over $1.1B). Also, with social gaming making huge inroads on devices, manufacturers are looking increasingly toward moving gambling into social games.

How Does The UK Compare To Others?

The UK already has comprehensive laws in place around gambling. China is struggling with corruption. Russia is the wild, wild west. The US is only beginning to open up certain states to online gambling legalization and there’s an uphill battle fight. While online gambling is strong in the EU as well (according to EU statistics), I’m not convinced that investing in companies in a consortium of countries makes as much sense as investing in a company whose home country has one set of rules to follow.

How Is This Industry Doing IN This Country vs. In Other countries

I’ve found no evidence to suggest that online gambling is spreading appreciably more quickly in any other developing country than it is in the UK.

How Does this Company Compete In This Industry?

This is where the rubber meets the road. Playtech is the world’s largest supplier of gaming equipment and is traded on the London Stock Exchange. That means that any US based investor has to be interested in the relationship between the dollar and the pound on top of any data related directly to Playtech. They supply companies from Sky to Titanbet….with a wide range of successful customers.

So, Is Playtech A Good Buy?

We’re not there yet, but look at what we already know by examining this company from the top down. Had I only glanced at the chart, I would have thought that I had found a company that “looked good” but I really didn’t know anything. By focusing on macroeconomic factors, I’ve learned a ton:

- The UK is a fine place to run an online supplier of computer equipment, with strong demand from a growing customer base.

- While other countries also have strong demand, the USA and China have hit hurdles. That means possible competitors in those countries may be struggling.

- Before I invest I need to take into account that this company is in the UK and I’m in the US. I need to also look at the dollar/pound relationship and research where that’s headed.

- THEN I need to actually dig into Playtech as a company. How are they actually performing?

While I haven’t yet decided to invest, you can see that in a short amount of time (an hour), I’ve begun developing a much better picture of this company—or any company, for that matter—than the vast majority of investors.

What questions do you think I’ve missed? Do you agree with my macro assessment of the gambling landscape? Are there other questions I should have asked, but have skipped? Let’s talk in the comments.

Want to know how I look at Playtech itself? I’m running that story today over on TheFreeFinancialAdvisor.com.

Good stuff, Joe. I’m not an individual stock investor (yet?…don’t know if I’ll ever stray from the index).

Do you feel the average investor ought to try this sort of analysis? Maybe only with the help of a CFP?

Great point….but I think the average person can easily dig into these numbers. It’s like riding a bike….not difficult!