Last Thursday I discussed the simple secret behind managing your investments. Now that we know about managing your investments, it’s time to learn how to focus on them and not the market.

OG & I, after taping a recent Stacking Benjamins episode, were sitting on the deck enjoying the late afternoon. Our discussion turned toward how advisors work with clients.

He was preparing for a difficult meeting with a client, and had his discussion points ready. He was going to be talking about the market in general, and then talk about this particular client’s portfolio.

I mentioned that he may want to turn that around. Talk about the client’s situation first and then talk about the markets later.

Here’s what he decided to do:

OG decided to open the meeting by pulling out the client’s financial plan. They’d look closely at his goals and the progress they’ve made. They’d pull together all of the statements to see if they were still on pace for the goal. Then they’d calculate together if they were ahead or behind.

If they were ahead, he realized, they’d have a completely different conversation than if they were behind. That talk about the market in general? Out the window. Complete waste of time, and now OG would have more time to talk relevant strategy with his client.

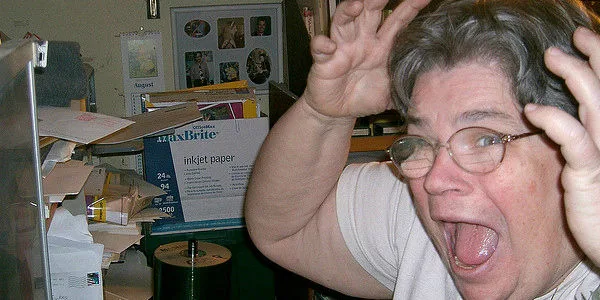

My aunt is on Facebook all day reposting conservative points of view that she finds from sources. She’s angry about Benghazi, about the recent trade of a POW for Taliban captives, and about anything in general that the President does. It’s all negative and frustrating. I can hear my aunt’s anger through my computer. But how much of it has to do with her?

Zero.

That’s why, when you’re looking at your money, it’s a complete waste of time to think about the market in general. Just like my aunt complaining about everyone who isn’t in the Tea Party on Facebook, it’s just spinning your wheels. What does it have to do with you? Without knowing where you are in relation to your goals, it has no relevance. Only in relation to you and your goals does the market have any relevance.

A good friend of mine has an advisor who speaks in jargon and constantly talks about recent market performance and their firm’s placement to keep up. Who cares about the jargon? Do you really care what the market’s doing if the market risk is double the risk you need to reach your goal?

Here’s the Key: Stick To Your Plan

The biggest financial planning mistake you can make is to ignore it, and instead pay attention to the noise. Markets, the Fed, Wall Street jargon, prognosticating….it has nothing to do with you.

You (hopefully) worked hard to build an investment policy statement and now your job….your only job….is to reach your goal.

So, here’s the path OG & I talked about him taking with his clients. I’d recommend you do the same:

1) Start by looking at your benchmark. Where do you need to be today to reach your goal?

2) Add together your investments. Are you ahead or behind?

3) Make financial decisions based on the answer to (2) above.

4) Schedule a time to look at your investments for the future (these should be at regular intervals unless your investment policy has a trigger that trips….such as a stop loss).

5) Worry about saving money into your plan until your next scheduled review.

That’s it. Consistent. Systematic. Reliable.

I know it sounds good…but here’s the real question: are you doing it?

Want more on investing? I like this series at Mom and Dad Money entitled: Guide to Investing

If you’re even more interested, I suggest reading the book The Truth About Money 4th Edition

Photo: Bev Sykes

I check in on my progress towards our “big picture” goals (early retirement, mostly) once a year, on my birthday. We do track our net worth every month but I don’t benchmark it against where I “should be” that often…once a year is enough I think, to get a sense of the trend.

So very simple, Joe, yet so many of us fail to follow the steps listed above. And I agree that, like your aunt, most people waste way too much time worrying about stuff that really doesn’t impact them directly, when they could be improving their own situation by simply focusing on improving their own situation. 🙂

Joe, I love this. “Look at where you SHOULD be and compare to where you are. Don’t just look at if you’re up or down for the month, that’s a waste.

genius.

Honestly at this point I’m so busy that I’m mainly focused on one thing: consistently putting money in my 401k, HSA, and ESPP. I also focus on consistently paying down debt. Oh, I also try to increase my income any way I can (right now that involves looking for a “next level” job at work). I don’t worry a ton about where the market, nor do I think I have enough assets for it to really matter. I do sometimes analyze stocks and companies, but more so to stay familiar with high-level financial analysis, which I do in my day job.