You know what’s truly terrifying? Realizing you and someone you share money decisions with have completely different ideas about finances—and you’re both convinced you’re right.

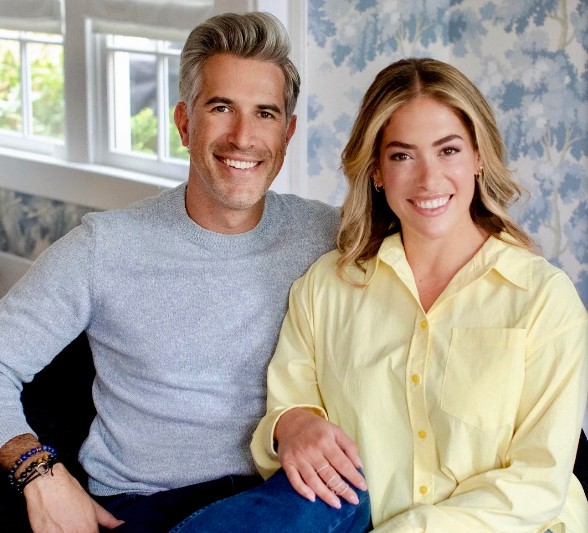

Joe Saul-Sehy and OG welcome Doug and Heather Bonaparte, a CFP and business partner duo who’ve mastered the art of not killing each other over finances. And when you work together AND live together? Let’s just say they’ve had plenty of practice navigating the financial frights that haunt any relationship where money’s involved.

Whether you’re married, dating, splitting rent with a roommate, or partnering on a business venture, the same money monsters show up: the “fair split” debates, the family expectation zombies that won’t stay dead, and those vampiric spending habits that drain shared accounts when you’re not looking. Doug and Heather share what actually works—the timing tricks, the tone shifts, and the teamwork strategies that keep financial conversations from turning into horror shows, no matter who you’re talking to.

This isn’t about becoming perfect financial partners overnight. It’s about exorcising the money demons before they possess your most important relationships—romantic, professional, or otherwise.

Plus: Joe and OG stir the cauldron with Halloween movie talk and trivia, because even the scariest conversations are better with a little basement humor.

What You’ll Walk Away With:

- How to start money conversations without summoning the spirits of past arguments (works for spouses, roommates, business partners, you name it)

- Doug and Heather’s hard-won strategies for navigating disagreements when money and relationships overlap

- Why “financial transparency” isn’t about policing every purchase—it’s about understanding each other’s money ghosts

- The three things any financial partnership needs to align on before the little stuff stops haunting you

- Permission to be messy while you figure this out (even CFPs have money fights)

This Episode Is For You If:

- You share financial decisions with ANYONE—a partner, roommate, business associate, or family member

- Money conversations feel like walking through a haunted house blindfolded

- Someone else’s financial habits make you want to scream louder than a horror movie victim

- You’re tired of being cast as the villain every time you want to discuss shared expenses

- You need proof that even professionals who literally do this for a living still have to work at it

Deeper dives with curated links, topics, and discussions are in our newsletter, The 201, available at https://www.stackingbenjamins.com/201

Enjoy!

Our Mentors: Douglas and Heather Boneparth

Big thanks to Douglas and Heather Boneparth for joining us today. To learn more about Doug and Heather, visit The Joint Account | Heather and Douglas Boneparth | Substack. Grab yourself a copy of the book Money Together: How to find fairness in your relationship and become an unstoppable financial team

Our Headline

- 15 Times Money Caused Shocking Family Drama (BuzzFeed)

Doug’s Trivia

- Back in 1692, the governor of Massachusetts dissolved the special court of Oyer and Terminer, which was convened for what purpose?

Have a question for the show?

Want more than just the show notes? How about our newsletter with STACKS of related, deeper links?

- Check out The 201, our email that comes with every Monday and Wednesday episode, PLUS a list of more than 19 of the top money lessons Joe’s learned over his own life about money. From credit to cash reserves, and insurance to investing, we’ll tackle all of these. Head to StackingBenjamins.com/the201 to sign up (it’s free and we will never give away your email to others).

Join Us Friday!

Tune in on Friday when our roundtable shares ghoulish tales of financial horror!

Written by: Kevin Bailey

Miss our last show? Listen here: Real Money Horror Stories (And How Not to Star in Your Own) SB1753 » The Stacking Benjamins Show

Episode transcript

[00:00:00] OG: Guys on occasion, you know, I just think it would be appropriate for us to fold our hands, bow our heads, and start the show with a little prayer. [00:00:11] opener: Heavenly Father, we thank you tonight for all your blessings. You said in all things give thanks. So we want to thank you tonight for these mighty machines that you brought before us. [00:00:20] opener: Thank you for the Dodges and the Toyotas. Thank you for the Fords. And most of all, we thank you for Rouse and Yates partnering to give us the power that we see before us tonight. Thank you for GM Performance Technology and RO seven engines. Thank you for Sonoco racing fuel and Goodyear tires that bring performance and power to the track. [00:00:43] opener: Lord, I want to thank you for my smoking hot wife tonight, Lisa, my two children, Eli and Emma, as we like call the Lord I pray. Blessed tonight may put on performance this great in Jesus name. Amen. [00:01:10] Doug: Live from Joe’s mom’s semi haunted basement. It’s the Stacking Benjamin Show. [00:01:26] Doug: I’m Joe’s mom’s neighbor, Doug, and you think Halloween week is creepy. Try working next to the hot water heater in the basement of an old house. You aren’t even creepier. Failing to communicate with friends, a spouse or loved ones. Today we’re sharing money, communication, horror stories with two people who’ve seen them, Doug and Heather Bonaparte. [00:01:46] Doug: This conversation will be like an exorcism for your communication demons. In our headline segment, you heard our stacker money horror stories. On Monday, one publication shares tales. A financial ruin that are just plain trashy. And you know what? What’s Halloween week without me slipping some sweet Halloween flavored trivia into your bag? [00:02:09] Doug: And now two guys who think the best candy is tax deferred growth. I don’t even know what that means. It’s Joe and oh, [00:02:24] Joe: hey there, stackers. Happy Wednesday. Happy Halloween week. Hope you got your costume on. You got the candy ready? And you know what? Hope you’re ready to have some financial Nerdery this week too, because we’re bringing it over the next hour. I am Joe Saul-Sehy, and across the card table from me is the one and only backed by Popular Demand, OG Boogey Boogey boogey. [00:02:48] Joe: I actually watched that race on tv. I wasn’t there live, but it was, it was a spectacle. I was like, what? Wait, what? What? The whole time as he is just going bigger and bigger and bigger, like, [00:03:00] OG: I like the part where he says, thank you for the tires. That it was like the ad clip. Yeah. It was like the ad read that pre performance and power to the track. [00:03:09] OG: It’s like, did you read the tagline? [00:03:11] Joe: I wonder how much the guy got paid to, Hey, uh, general Motors is gonna pay you X amount of money if you can search this into the prayer. The [00:03:18] OG: prayer. [00:03:19] Doug: Yep. Yeah. I’m pretty sure his wife had a hand in writing that too. [00:03:23] OG: That was pre Chad [00:03:24] Joe: GBT [00:03:25] OG: folks. [00:03:26] Joe: That that was, that was, that was a number of years ago. [00:03:29] Joe: Yeah. You know what, Doug, to your point, his spouse having a hand in writing that, she’s like, Lisa, you’re just gonna say my, my wife Lisa. I think it’s your smoking hot wife, Lisa. Right. Right. I think. I think if you know what’s good for you, Mr. Yeah. We got a great, and see, and that’s bad communication right there. [00:03:46] Joe: People yell at each other. I thought that [00:03:47] OG: was great communication. [00:03:49] Joe: Well, once they finally got over the hump mm-hmm. You know, it was great. But Doug and Heather, Bon Arthur here. Doug is a certified financial planner. Heather is a long time attorney who just, uh, became Doug’s business partner. Talk about people that need to communicate you work with your spouse. [00:04:05] Joe: Might need, might need to know a little bit about communication. These two know what it’s like to be with people that just their money’s not going the right way because their communication’s not going the right way. Investopedia has listed, Doug Bonaparte is one of the top financial planners in the United States as they have our own og by the way, just a little humble brag there. [00:04:28] Joe: So we get to hear from scoreboard, our own og, our own top financial planner in the United States. We get to hear from him all the time. We’re gonna hear from Doug and Heather Bonaparte here in just a moment. Before we get to that, we got a couple sponsors who make sure that we can keep on keeping on. You don’t pay anything for all this Halloween week, goodness. [00:04:46] Joe: So we’re gonna hear from them. And then coming down to Mom’s basement, Doug and Heather Bonaparte. [00:05:00] Joe: It is Halloween week, and you know what that means? Very scary. Couple coming down to mom’s basement. Douglas and Heather are here. How are you guys? No, we’re [00:05:08] Douglas B: good. Hey Joe, [00:05:09] Joe: we’re feeling spooky. [00:05:10] Douglas B: Yeah. Halloween’s my birthday, so we’re not messing around here. [00:05:14] Joe: Now you have two kids. What do they dress up as? [00:05:16] Joe: They know their costumes yet? Oh yeah. [00:05:18] Heather B: Well, our younger daughter is wearing the costume of the season. She is being a K-pop demon hunter. [00:05:24] Douglas B: She’s Rumi, specifically [00:05:25] Heather B: Rumi, the one with the purple hair. And then our older daughter is Saquon Barclay from the Philadelphia Eagles. Wow. Proud mama. Proud mama. [00:05:35] Joe: That’s fantastic. [00:05:36] Joe: And I was gonna be a K-Pop star and she stole mine, so there you go. [00:05:40] Heather B: That’s going to be Aja boy. [00:05:42] Douglas B: I’m gonna be Aja boy from, you know, one of us actually watched the movie here. You can, you can tell which one, but yeah, I’m gonna pair up with our younger daughter, be the Sja boy to her Hess. [00:05:52] Joe: That’s fabulous. [00:05:53] Joe: Well, hey, money-wise, most people afraid of ghosted monsters, but the truly terrifying stuff happens, as you guys know, when we try to open a joint checking account. Right. Bu, bu bu, uh, yeah. What’s the scariest money conversation you two have had as a couple? [00:06:09] Douglas B: Oh, that’s quite recently, or at least in the last three years. [00:06:14] Douglas B: We had to make some big changes in our lives around what wasn’t working for us and what wasn’t working for Heather in terms of her ambition. And ultimately it led to her joining our now family business, which was kind of always a family business. But Heather leaving the corporate world in law, uh, after a 13 year stint, if you will, to join the family business was [00:06:37] Heather B: foregoing my corporate salary and our benefits package was a huge deal, [00:06:42] Douglas B: huge move. [00:06:43] Douglas B: Probably the biggest one since buying our house, I would say. [00:06:47] Joe: How did you work through that together? Because Heather, I can’t imagine going from, I work for myself now, I work with my spouse. Like there’s a whole lot of different dynamics going on there. [00:06:58] Heather B: Look, I was a corporate girlie for a long time, which meant like there were benchmarks and you could either meet them or not meet them, right? [00:07:06] Heather B: And you receive feedback. There’s a feedback loop. You, you find out every year how you’re doing and you either receive a bonus, you receive a raise, or you don’t. [00:07:13] Douglas B: They literally give you a review, [00:07:15] Heather B: right? Every [00:07:16] Douglas B: year [00:07:16] Heather B: working for yourself. And now that I’ve joined the family practice and Doug’s been an entrepreneur his entire career, I mean like talk about a mindset shift. [00:07:24] Heather B: So I had this like scary delusion that. The only way I would be able to prove my worth at the firm is if I could replace my salary within a year of being there. Mm-hmm. Which is the most like, shortsighted, misguided idea ever [00:07:40] Douglas B: told you not to do it. You [00:07:40] Heather B: know, entrepreneurship. Like, that’s just not how it works. [00:07:43] Heather B: Like Doug was playing a long ga, like a decades long game to get where he got in his career, and I thought that I could just like throw a few cards against the wall and within a year I would just be like, you know, you did it right, right there. You know, I’ve succeeded. But I think worse than that is really like the, the sentiment underneath of that, which was. [00:08:03] Heather B: My value can only be proven through this set amount of money. And when I decided to forego that money, I began to question my self-worth deeply in ways that I was not expecting. And you know, part of that was due to my own thinking, but I think a lot of that is societal too. I mean, like a lot of people really did not get it. [00:08:24] Heather B: They’re like, wait, so you’re retiring from being a lawyer? Or like you’re going to help your husband, or you’re just really staying home, right? Like you’re just, you’re a stay at home mom. Now, like there were really people that did not understand what we were going to do. And because family, family members, family, family members really did not understand we were going to do. [00:08:40] Heather B: And I did not realize until I left corporate law how much I relied on other people’s perception of my career to define my own self-worth. And I really had to work through that. So it wasn’t one conversation. It was years of conversations that led us to getting where we are right now. [00:08:57] Douglas B: And that has nothing to do with the work that needed to be put in to learn financial things right from p and l of the business to even our own reexamination of our financial lives together. [00:09:07] Douglas B: That was all just like [00:09:09] Heather B: the feels. [00:09:09] Douglas B: How do we feel? It [00:09:11] Heather B: wasn’t even the, how [00:09:12] Douglas B: do we cope with these feelings here that clearly are gonna have an impact on our relationship, our family, and everything around us. [00:09:18] Joe: Well, and I’m gonna ask you to tell some stories about this type of stuff today, from your new project on this very topic. [00:09:26] Joe: You guys make the point of talking about part of it, and especially in in a relationship. We might know our partner, but we don’t know their culture. We don’t know their internal talk. And Heather, I gotta imagine that for you, it’s gotta be culturally where you come from. There must be this, I gotta succeed, I gotta drive, I gotta like, is that, is that built into your family life as you were growing up? [00:09:50] Heather B: That was inscribed for me in many different ways. I’m an only child and grandchild on both sides of my family. My parents got divorced right as I entered my teenage years, and so the money scripts that I was taught were really flipped upon their head at a very pivotal moment in my life. So I don’t know if it’s as much what I was taught as to my defense mechanism and my reaction and the way that I came into adulthood saying I need to make as much money as possible so that I can seek my own version of independence from a lot of the pain and things that I was experiencing in those formative years of my life. [00:10:24] Heather B: Um, there was a lot of that. There was definitely a lot of that and a lot of my self worth being tied up in my career had to do with just the way that I came into adulthood for sure. [00:10:33] Joe: How’s that different than where you come from culturally, Doug? [00:10:37] Douglas B: Yeah, I, I grew up the son and grandson of serial entrepreneurs. [00:10:40] Douglas B: You know, I was taught always bet on yourself and build something and was encouraged to do so. My older brother and I ran many businesses as kids from fixing computers to hawking stuff on eBay. When the internet came around, we, we were privileged with technology early on. So that obviously carried forward into my adult life when I chose to build a business for real, to provide for our family and to build a life together with Heather. [00:11:07] Douglas B: Of course, there are challenges associated with that. I learned lessons in what overextending yourself or growing too quickly and leverage can do to a family unit, can do to a business, but couldn’t create any more stark of a contrast between Heather. I mean, my parents. Actually got divorced when I was an adult, like when we had our first child together. [00:11:28] Douglas B: So, you know, I grew up in sunny south Florida in a stable household where dad was an entrepreneur, mom was an elementary school teacher, you know, a learning disabilities teacher. It was like that classic combo of mom had the benefits, had a steady salary, and dad built, you know, a business. And we, we replicated that. [00:11:47] Douglas B: You did. [00:11:47] Joe: I was thinking the same thing. You totally had that replicated and you changed it. It [00:11:52] Douglas B: worked. But, and I do this with, you know, you see it with clients all that time too. It, it does work. But it worked [00:11:57] Heather B: until it didn’t. [00:11:58] Douglas B: Yeah. Until it doesn’t. And [00:11:59] Heather B: I think that that is something. Was such an eyeopening experience for us and our own relationship. [00:12:05] Heather B: I think it’s really easy to believe. You get married, you kind of like set up a way of doing something and you start doing it that way for a long time, forever. Maybe you can reach those, you know, kind of like stereotypical financial benchmarks. Like it’s amazing. It’s amazing. We could buy a house, we refinance some student loan debt and we’re able to tackle that together. [00:12:23] Heather B: We had a baby. You kind of convince yourself, you’re like, [00:12:26] Douglas B: gotta figure it out. Got [00:12:26] Heather B: this all figured out. Right? That is not true. That is not how life works. And I think one of the hardest things for a couple to do is to say, we’ve been doing something this way for a really long time, and now it no longer works for me. [00:12:42] Heather B: It’s not serving me anymore. Not even just not serving us anymore. Yes. I feel a certain way around this. That is an incredibly yeah. Hard thing to do. It’s like an intimate thing to say to someone, [00:12:55] Douglas B: a personally intimate thing. You, you, you’re not this homogeneous blob of a couple. You’re still your own person in your relationship. [00:13:01] Douglas B: You do a lot of, we do everything together, but Heather’s hobbies are not my hobbies. Heather’s experience as a child is not my experience as a child, but she has an appreciation for my hobbies as I do her. More importantly, she has an understanding of my feelings and experience from when I was growing up, the decades of learning scripts around money, specifically, as much as I needed to learn Heather’s same, uh, script so that I could have perspective, just like she could have perspective. [00:13:31] Heather B: Do you want, do you want to share that story that we know about the couple? [00:13:34] Douglas B: You can share it. [00:13:35] Heather B: Okay. [00:13:36] Douglas B: We can share it together. This might be [00:13:37] Joe: the story I was gonna ask you about anyway. Somebody that thought they were getting it right and they had a thing that worked for them until, like you said earlier, Heather, for you two, it didn’t until it didn’t. [00:13:47] Heather B: So we met a couple who, for very well-intentioned reasons, decided early in their relationship, he ended up, he was living with her family, um, before they were married. They were financially enmeshed in some different ways, like from a very early stage in their relationship. And they decided that the fairest Farris, which I will put in quote, fairest way to handle this, was that they would split. [00:14:09] Heather B: Everything 50 50 and I mean everything like down to the studs, down to the, [00:14:16] Douglas B: there was a log. [00:14:17] Joe: Well, and I would feel like if I was living with Cheryl’s family, just with my upbringing and you know, I just think about my dad and thinking, man, you don’t do that. Like, you just, okay, fine, I need help at the time, but you’re gonna pay for your, your freight. [00:14:32] Joe: You’re gonna pay for your part of the relationship. Yeah. And that sounds a little bit like why they did this. [00:14:37] Heather B: Yes. Well, and there was also, he had offered this because he said that he didn’t want her family that had, you know, she came from a different wealth background. She had, her family was wealthier than the way that he grew up. [00:14:49] Heather B: And when he had moved into their home, it was kind of a joint decision because at the time her father had actually moved out, her parents were splitting up. And it was mutually beneficial to everyone to have him move into their family home and be like. A man in the house. It filled, it [00:15:03] Douglas B: filled a gap in a very transitional period. [00:15:06] Heather B: But at the same time, he wanted to demonstrate to them that he wasn’t in it for the money. He wasn’t in it for a place to live. [00:15:13] Doug: Yeah. The [00:15:13] Heather B: intentions were really good. Yeah. They were benevolent intentions behind this we’re gonna split everything. 50 50 worked for a couple years. Okay. But as time went on, I mean, they were really splitting everything. [00:15:25] Heather B: They were splitting down to the date night dinners 50 50. They were reconciling it on a spreadsheet for a very, very long time. Turns out that maybe things weren’t feeling quite as fair. At, at 50 50 as when they had begun, [00:15:39] Douglas B: someone was consuming more. [00:15:41] Heather B: Someone likes to order an appetizer every time they go out to dinner. [00:15:44] Heather B: Somebody gets the second cocktail whenever they, you know, have a plan or, or go meet friends at the bar. Turns out 50 50 wasn’t quite what they had planned, but instead of talking about it and kind of saying, you know, Hey, I think at a, at a calm and cool time and place, this all came to a head very late at night, after like a drunken night out in Tokyo when they went into a seven 11. [00:16:09] Heather B: And he wanted to get a croissant. [00:16:11] Joe: It’s always the best time, by the way, when I’m loaded to solve our, our long running problems in my relationship, [00:16:18] Douglas B: the emotions come out, [00:16:19] Joe: get hammered and have it out. That always works well. I think I saw a Dr. Phil episode about how this is the way to solve everything. [00:16:25] Douglas B: Number one, psychologist recommended approach to this. Yeah, [00:16:28] Heather B: get hammered and fight with your spouse at a seven 11 in Japan. That’s a hundred percent the way to go about this. But that was the moment that she just exploded. She lost it. She lost it, and she said, this is not fair. Okay. We’ve been doing it this way for a long time. [00:16:43] Heather B: It’s not, and I don’t feel like this is fair. And you know, something that we started to think like, we’re like, well, what is it about that moment? Like why then? Why the croissant of all the moments, right? Yeah. And then you find out she had some job insecurity. There was a chance that she was going to lose her job and she was reexamining and harboring a lot of anxiety about money and where that money was going to come from moving forward. [00:17:05] Heather B: But they didn’t talk about that. They blew up over the croissant. And so in the sober light of day, they were able to reexamine this and kind of move to a new system that felt more reciprocal and I think was also like more romantic and left room for romance and doing something kind for somebody else. [00:17:22] Heather B: And I think one of like the best parts of this story that, that we heard, um, in speaking to this couple on numerous occasions was that. Kind of like allowing for more fluidity, uh, in their finances, allowed for more fluidity in other areas of their life as well. Like it allowed them to pick up chores for the other person without being like, well, it’s your job to do the trash, so I just let it rot and sit there when you weren’t home. [00:17:46] Douglas B: That, that’s such a great example of why their approach does not work. It’s not pragmatic. It is not practical. It does not scale whatsoever. And the thing I took away from it was that you’re communicating around money. Whether you’re saying the thing that needs to be said or not, and it will either break good or poorly and poorly, is when you’re not actually doing the work and sitting down and expressing why something is the way that it is, or why you feel the way that you do, you end up. [00:18:15] Douglas B: Fighting on the streets of Japan after some teki. It’s not. It’s not the way you gotta go about it. [00:18:21] Joe: It’s so funny for our stackers who might not be in a committed relationship right now. This isn’t just about committed relationships. This is also about with your friends. I remember in college, my roommate, whose name was also Joe, blew up one day because he had bought milk twice in a row. [00:18:38] Joe: I just hadn’t noticed. But it turned out it wasn’t about the milk, it was about, I wasn’t noticing a lot of what was going on in our apartment as roommates. Yeah. And he was keeping score baby. He was keeping every little score and I was keeping no score and I learned I need to keep a little score because it was important. [00:18:55] Joe: Obviously, it’s important to me to make my roommate happy that he’s sharing an apartment with me on his side. He still tells me today we’re 30 years older than we were then. I talked to him about this like six months ago. He laughed. He goes, I still can’t believe I blew up about the milk. He goes, but it taught me so much that my friends aren’t as anal about stuff as I am, and I just sometimes have to relax. [00:19:16] Joe: Like it was, it was a good lesson for us both. [00:19:19] Douglas B: So I think that’s an incredibly important part. You saw it worked out in the end. They actually, you know, from the ashes of their late night argument rose, you know the phoenix of finding a better way to go about it. And unfortunately, all too often it takes these very dramatic moments to come back together. [00:19:37] Douglas B: It’s a test and a testament to relationships to endure that kind of event and say, Hey, let’s fix it. The bad news is sometimes those blowups actually result in the end of relationships and it underscores why it’s so important to take that proactive stance and to do the work. And hopefully we’re gonna be able to help people identify these things so that they don’t have to get to a moment of crisis to sort these things. [00:20:01] Heather B: And when you love or care about, right, not just the spouse, [00:20:05] Douglas B: you also remind me of all the situations. With friends where you know someone who maybe is in a, a better financial spot, they either make more, they come from money and they go out to the nice meals and you as the roommate or the best friend, are constantly being roped into, you know, whether it’s a Michelin star restaurant or something that’s just a little too expensive. [00:20:24] Douglas B: And you see relationships and friendships struggle because they don’t know how to pull their friend aside and say, I totally understand, you know, your ability to afford this. I don’t wanna get in the way of your enjoyment, but can I share with you why this is a little difficult for me? And maybe next time we can pick a restaurant that doesn’t have a tasting menu associated with it. [00:20:44] Joe: I remember being a part of that too. All of our friends wanted to do. A tasting menu at a Michelin star restaurant in France. Cheryl and I did not wanna do it. We weren’t in the right mind frame. We didn’t care. And we had so much pressure from the other people we were with going, everybody’s doing it and they won’t do it unless you do it too. [00:20:59] Joe: And I ended up spending so much money that night that I didn’t want to. And by the way, the people that wanted to do it at the end of the meal complained about how bad it was, which made it even worse. Made it even even worse. But you know, not that, not that I’m bitter about it. It didn’t happen like seven or eight years ago and I’m still bitter. [00:21:13] Joe: Not at all. Yeah, you can’t tell. Yeah. Yeah. [00:21:15] Heather B: This happens to us with skiing. All of our friends ski, but us. And I cannot tell you how many people try and convince us to go ski every single year in like a million different ways. And I just said I am as clear as they and, and again, but this is just about setting expectations with your friends. [00:21:33] Heather B: Even anyone you care about. Being able to say, Hey, look, I love nothing more than getting away with your family for a weekend. This is not something that I choose to spend my money on or that I’m really that interested in us doing. We don’t really, we’re not cold weather people. It’s just not how we spend our money. [00:21:46] Heather B: We would be happy to play on a beach long weekend with you or find something else for us to do, but you know, you don’t have to lay it on thick about the skiing. Like the answer’s always gonna be. No. [00:21:56] Joe: Is that the technique? Because we love talking about the tactics and how do you do this stuff, but I noticed in both of your examples that you just gave, that you both offered an alternative, is offering the alternative. [00:22:08] Joe: Is that the technique? [00:22:09] Douglas B: In a lot of the stuff that we saw, we noticed that it takes just a small adjustment or turning something upside down. I’ll give a few examples of this. When you’re talking or wish to talk to your partner about money and you’re leading with the the criticism, what went wrong, what needs improvement, I can guarantee you no one wants to start conversations with the negative. [00:22:33] Douglas B: You start with the positive, and particularly around money, we have this propensity to see what went wrong instead of celebrate the win for the week or the month or the quarter, what did you do right? Build upon that, create the momentum. So by the time you inevitably get to the areas that need improvement, you are able to say, Hey, you know, listen, good on us. [00:22:57] Douglas B: We did some things we needed to do, and everyone’s motivated now to attack the things that need the improvement. Little shift right there. You wanna have a conversation around finances. I say what I used to do, can we sit down and talk about this? So first time and place. Right. I would bombard her with something when the kids had just come home from school or it was time to do the dinner stuff. [00:23:21] Heather B: Greatest moment, [00:23:21] Douglas B: because I was running up from a meeting, you know, for the last meeting of the day before the meetings of the evening. This is family time. And she would do this to me too. She’ll own up to it. It’d be at like 1130 at night when her Sunday scaries, or basically any week, any day of the week, scaries would [00:23:36] Heather B: kick. [00:23:36] Heather B: I have scaries every night. [00:23:36] Douglas B: Yeah. And you know, I’d be like, Hey Doug, let’s talk about this really critically important thing that’s been bothering me. And I’m like, tapped out. It’s 11:30 PM We’re we’re trying to rely. I’m like, why is now the time? So time and place is a big one. And how you start the conversation, I would show up with a net worth table and the numbers and the spreadsheets. [00:23:54] Douglas B: That is a quick way to have a very unwelcome conversation. Why don’t we start with something we both want, honey, you remember how we said we wanna take the kids away for spring break this year? Can we have a convo about that? She had already poured some hot tea and is sitting at the table to have that conversation. [00:24:12] Douglas B: I’m motivated to have it, and guess what we’re gonna do? We’re gonna do a little backdoor into, can we look at the numbers to see how we make this happen? Yeah, let’s cancel this babysitter. We don’t need to see these friends again. We just saw them for someone, someone’s birthday party and before you know it, there’s an extra 1200 bucks or whatever for this thing that we really wanna do to. [00:24:31] Douglas B: And she and I are now aligned with the numbers as well as what the goals are. So again, all we did was either do it backwards, flip it on its head, and logically think through, well how are we going to meet each other in a place that allows us to facilitate a conversation. We’ve been too trained to do things the wrong way for a whole host of reasons. [00:24:53] Joe: Yeah, I don’t like this. I don’t like that. Not a great way to start. And, and by the way, I love the idea of time and place and also thinking about it from. Whoever, whether it’s a roommate or a partner, your spouse, however, think about it from their point of view. I, I often know that our Money Geek Stackers, you know, we love nothing better than a Camp David Summit. [00:25:14] Joe: Doug, like you were saying, with spreadsheets, graphs, and all kinds of stuff, and it lasts 17 hours. There’s nothing more fun. Nothing would be a horror story for Cheryl, my spouse than that. She wants nothing to do. But the 20 minute weekly meeting where we go through Monarch together and we look at our finances over pancakes or wine, totally fun. [00:25:32] Joe: Great, great, great time. [00:25:33] Heather B: It’s really important to embrace this idea that sometimes you just have to meet your partner where they are. Yeah. That concept is so important when it comes to money. Like, I mean, it, it applies to other things too, but I think, well we money in particular, [00:25:45] Douglas B: we spoke to neurodivergent couples, you know, for this project, and the biggest takeaway that I had is, yes, meet them where they are, but for one couple it was. [00:25:56] Douglas B: Get a whiteboard. Like it was literally drawing things out because that’s how one of the partners learned. So [00:26:03] Doug: we [00:26:03] Heather B: learned differently. [00:26:04] Doug: We just, that’s cool. Digest. [00:26:06] Douglas B: Yeah. It was super cool. Or, uh, the one couple that figured out the kind of content the other one liked to consume, like dialed into the podcast, they would love obviously this one. [00:26:17] Douglas B: Duh. It got got into which, you know, Instagram accounts really spoke their language and now they’re consuming content that’s mutually beneficial around this topic for the household. There’s so many opportunities to get into this. It just doesn’t need to be the things that, you know, most people find boring are to be a turnoff. [00:26:36] Joe: Not only did you talk to a lot of different people in a lot of different types of relationships, you spoke to a lot of experts too. And one thing that this Henry and Chloe situation speaks to was not only did they split everything, but they had the separate checkbooks. Right. And so for me, you know, whenever I hear Dave Ramsey bring this up, I generally have rolled my eyes and went, oh god. [00:26:58] Joe: You know, the most overblown discussion in history. But you actually talked to some people, I think maybe at Indiana University or someplace like that, that were some researchers that actually looked at shared checkbook and what that does in a relationship, [00:27:13] Heather B: joint banking, right? At least to some extent, even in a yours, mine, and ours situation does create. [00:27:20] Heather B: That teamwork, that element of success, the more you can find a way to collaborate together, the more you can start to really see things as, yeah, a team and you see a future together where you’re building towards shared goals. And I think that that’s like a great place to start. It doesn’t have to be everything all at once. [00:27:38] Heather B: And I don’t want anyone to get the impression that, that we, or that Doug sitting down with his clients would say, there’s only one right way to do this, and this is the right, there are [00:27:49] Douglas B: best practices, but you’re individual people. You know, it’s personal finance. That first word’s personal, but [00:27:54] Heather B: yes, when it comes to how we handle our money and where it should be, there is some. [00:28:00] Heather B: There is really something to be said about being able to work together as a team from the same pot. Because we’re not bean counting, right? We’re not saying, well these two are yours, this one is mine, like we’re supposed to be doing this together. It builds trust, it builds intimacy, it builds a shared future together. [00:28:19] Heather B: I dunno if you’re gonna get there. And I would even argue too, like you may think you have it all figured out now, but things change. That’s a lot harder to keep up when you start [00:28:28] Joe: sharing children. Well, that also brings up the fact that this needs to be revisited. Right? I know Doug, you’ve been a planner for a long time. [00:28:35] Joe: They don’t call it making a financial plan. It’s financial planning because of the fact that what worked yesterday for Chloe and Henry doesn’t work tomorrow for them, [00:28:45] Douglas B: life is fickle. Man plans. God laughs. Just as Heather and I said previously, like it was all working for us until it wasn’t. And here’s the thing about, you know, money in your own life or in your household, it is a game. [00:28:59] Douglas B: That you have to play. You cannot opt out weird, you know, get off the grid stuff, I’m sure, but you cannot opt out. And what is so insidious about it is you can’t win the game. You only get to keep playing it. And at different levels and perhaps different, not only different levels, but different levels of difficulty. [00:29:21] Douglas B: For people who think, you know, like, Hey, we’ve made it, uh, or are so shocked that everything has changed, or maybe a little piece of the thing has changed. That’s because it’s the rules of the game. That’s what you opted into play. So let’s stop pretending to be so surprised and instead focus on the type of communication and pieces you need in place in order to play the game well so that you don’t find yourself, you know, pulling the, uh, you know, Seinfeld scene where they flip the risk board over someone, you know, uh, what’s it called? [00:29:50] Douglas B: Crashes out and rage quits. Like, that’s probably the end of your relationship if you’re rage quitting on money together, right? That’s not good. It’s the worst thing that could happen. [00:29:59] Joe: Rage quitting a relationship with friends is not a, not a good, not a great way to go [00:30:04] Douglas B: the game. Do not recommend the video game, not recommend game. [00:30:06] Douglas B: Don’t do it. [00:30:08] Joe: I find that you call this book Money Together, but a lot of the monsters that we face are in the mirror. I mean, they’re right there in front of us. So it feels like Heather, like it’s a two part game. Like not only are you facing your own demons, but also making sure the person that you’re playing this game with knows what you’re facing. [00:30:28] Joe: But it’s so hard for us to not just look at those demons, but to tell our partner about that or to tell our friends that this is what I’m fighting against. How do we overcome that fear? Not the fear that they’ll reject us, but just the fear of being that vulnerable with the people around us. [00:30:47] Heather B: It’s a really good question. [00:30:48] Heather B: It’s really hard. That’s the point I think that a lot of us have not done the self work to even be able, I think that you have to reach a certain level of comfort. And humility and vulnerability with your own story, your own past, and how that presents itself today before you ask your partner to understand it, which is why we talk about it as the hardest work. [00:31:12] Heather B: Like you are not an enigma that your partner has the onus of figuring out. You need to figure some of that out for yourself first to know who you are showing up as like you. Yes, you owe it to yourself. You owe it to them too. And of course, it’s incredibly vulnerable. It’s incredibly scary, and it may require the help of outside professionals. [00:31:33] Heather B: You may need help from a financial therapist. You may need help from a couple’s therapist in order to kind of lay down a safe zone, if you un realize that some of these feelings, you know, we touch on feelings like shame. If you are harboring shame from your past around a, a regrettable financial decision or outcome, and that shame is impacting the way that you treat your money together today, it may not be enough for you to just admit to your partner. [00:32:02] Doug: Yeah, [00:32:03] Heather B: I’m carrying shame about this decision I made from years ago. No, like, we have to start unpacking the way that you can change your own thinking as an individual to show up as the work in progress that you are. It’s not easy stuff. If it was where people would be doing it. [00:32:19] Joe: It seems like it’s so much juggling. [00:32:21] Joe: I’m juggling what’s going on in my head while I’m trying to be quiet enough to listen to what’s going on in my partner’s head and the people around me. That’s right me’s head. It’s so, so difficult. We talked about your beginnings and about how we all have our own beginnings. Certainly the two of you shared. [00:32:35] Joe: Thank you so much about your beginnings. We talked about mistakes and about how the croissant is really not about the croissant. You also talk about contributions and about power and about risk. Can you guys talk a little bit about those for just a couple seconds about why those things are so important to this project of having money together? [00:32:56] Heather B: I think a really important goal, probably the most important goal for us was not just to help couples communicate better around money, but to really create and solidify calcify that equity in a household, which does require continuous work. And it kind of requires you to reframe the way you think about some things, because we all have a lot of societal scripts, institutional scripts that embed themselves in the way in which we operate in our household over [00:33:23] Douglas B: over decades. [00:33:24] Heather B: Decades. And yes, some of that came from the way you grew up, the way you were raised, but a lot of it is just stuff that we consume today too. We still consume it through social media. We consume it at work, we consume it everywhere we go. So how we create that fairness, that equity at home is what you need to really have a sustainable, loving, happy relationship when it comes to not only money but each other. [00:33:47] Heather B: So for us, contribution was really. The heart of this whole thing, right? How do we view contribution? I think traditionally people, you’d say, how do you contribute to your family? And I bet more than half the people would say, I earn this amount of money. [00:34:00] Joe: Wow. [00:34:01] Douglas B: Yeah. That’s the most classic [00:34:03] Heather B: and, and a hundred [00:34:04] Joe: percent is I just think that that’s, I don’t know. [00:34:06] Joe: I’m 57 years old. I’ve learned over time that that is like people that aren’t watching our video don’t know. I’m looking at, that’s a minuscule part. Like contribution is so much more than just the, but that would, if I was 30, it would’ve been the first thing I probably would’ve answered. [00:34:18] Heather B: Absolutely. Yeah. [00:34:19] Heather B: And I think it is important for us to elevate the status of caregivers so that people understand that people who care in which we’re all caregivers, right? Caregivers for each other, caregivers for our children, for our loved ones. I think more of us are falling into the sandwich generation now. So there is, it is like more important than ever to expand our definition of what it means to contribute, and that caregivers are providers too, because we want to really honor and value each other’s time better. [00:34:46] Doug: Correct. Time [00:34:47] Heather B: is the greatest currency that we have. So it’s incredibly important to reframe that. Um, and when it comes to power, that’s another really interesting reframe. When we talk about power in the context of a relationship, it’s you probably think, well, which one of us has more of it? Is it me or is it you? [00:35:03] Heather B: You’re thinking about only one person. You have to take from one person for me to get more, but that’s just simply not true. [00:35:09] Joe: That could even be toxic, I would think. [00:35:11] Heather B: But it’s really easy to do, especially like, let’s say for example, like Doug and I grew up together, like we went to college together. Mm-hmm. [00:35:17] Heather B: So it’s very easy to look for competition. Closest to home. [00:35:21] Douglas B: Yes. Usually the first place you go. I know parents that love competing with their kids. I find myself competing with my older daughter ’cause she wants to compete with me. It must be a thing kids do. But when you’re competing with your partner, your spouse, um, and [00:35:34] Heather B: it’s not just competing professionally. [00:35:35] Heather B: You be competing for time. [00:35:37] Douglas B: Yeah. Energy resources, who gets to do more than whatever it may be. You know, you take a minute, you push back on that and you realize, wait, wait, wait. You know, this is a team game. We’re we’re not the people. We’re, we’re not the people that should be competing against one another here. [00:35:51] Douglas B: Imagine if, you know, two, two small forwards started playing, you know, against each other. It’d be crazy. [00:35:56] Heather B: We really want for people to see not only the individual power that they bring to a relationship, but how. This idea of collective ambition, there’s going to be a time for you and there’s gonna be a time for me, and we are more powerful together when we operate this way. [00:36:11] Heather B: That’s incredibly important. We, I’ll let you talk about risk for a sec. Yeah, absolute. Well, and I love that. [00:36:15] Joe: Before you talk about risk on this topic of power, I got really excited at the end of that because it’s just reminiscent of this idea. Stephen Covey had about families having a mission statement, which I remember when he said that at first, what blew me away, like, why would our family have a mission statement? [00:36:31] Joe: He’s like, why wouldn’t you? You bring home all these things and you’re in this group. These are the people closest to you. Why wouldn’t your family have some shared value and shared mission? Like it’s so, it’s so cool. Using that power for good. [00:36:45] Douglas B: I forget where I heard it. It was definitely a show, but it was family is your team to help you get through life, to help you deal with the challenges of life. [00:36:54] Douglas B: So starting to compete against the very people that help you navigate how fickle, how sad, how challenging life can be. Of course, there’s so many beautiful things in it, uh, is antithetical to why we’re all here in this unit in the first place. And as far as risk is concerned, yeah. After you discover yourself and are able to have perspective of your partner’s self, and you start to think about what you did wrong or maybe what you did right, and you work your way through, you get to plotting your future together and how to make decisions together because Heather’s appetite for risk might not be my appetite for risk, and that’s gonna make things a little challenging when you go into the decisions that inevitably need to be made in order to get to the goals that you have for yourself, whether it’s. [00:37:39] Douglas B: Buying that house. Financial independence. Even sending children to college is a conversation that we have where we don’t need to be one-to-one on it. We need to find the compromise in terms of how we feel about what we’re willing to do or not willing to do. So risk is extremely important when it comes to moving the ball forward, [00:38:00] Heather B: and ultimately it’s really important to leave everyone with this idea that no one has any idea what tomorrow will bring. [00:38:07] Heather B: We all like to pretend that we know, but that is again, like the final reframe here is that. We can’t predict the future, but we can prepare ourselves for as many ways to get to the place we wanna get as humanly possible. There are 10, 20 ways to get to the thing that you both want, not just the way that you originally set out. [00:38:27] Heather B: Being nimble as a couple is such a super power. Yeah. For getting to where you wanna be and to being happy while doing it and and removing friction. So that we wanted to leave people with that idea of risk too. Risk in saying like, I think the greatest risk is not finding out. Right. Losing opportunity. [00:38:46] Heather B: Regret. And regret because you weren’t willing to be that nimble. You weren’t willing to be that curious about your partner or to find another way to get where you wanted to go. I think that’s the greatest risk of all [00:38:57] Douglas B: when we start to accept the fact that. Things will not go according to whatever plan you have as well intended as it may be. [00:39:07] Douglas B: You may get to the goal or the end of, you know, whatever it is you’re looking for, but your pathway there will 100% not be the way you thought it would be. Putting yourself in a position to adapt is just one of those things that, as Heather said, is the superpower here. So when you are communicating, when you are understanding, when you are reaching for fairness, that is why you say you become an unstoppable financial team. [00:39:30] Douglas B: Because things that inevitably hit you or you will face, can be conquered, can be handled together because you did the work. And that’s what creates happiness. And everyone deserves to be happy. I’m with Heather because she makes me happy. I believe the same is true. Our children may, our children make us happy. [00:39:51] Douglas B: She’ll let you [00:39:51] Joe: know. Yeah, [00:39:53] Douglas B: stay tuned. We’ll find out after the sales come in. No, but that’s what it’s all about, right? And no one should be able to argue with that. [00:40:00] Joe: The book is called Money Together, and I believe it’s available everywhere. Correct. [00:40:07] Heather B: Yes. Anywhere books are sold. Yeah. You [00:40:09] Douglas B: know what to do. [00:40:10] Joe: I had one criticism. [00:40:11] Joe: I wish you guys were passionate about this and educated on this topic. If only you would’ve had those two things. [00:40:17] Douglas B: Ryan, we’re dying. Joe. Listen, maybe two and a half years of ignoring friends and family was not enough. [00:40:26] Joe: Well, thank you for helping us get rid of the monsters and the scary things under the bed that really aren’t there, and helping us clear those up. [00:40:34] Joe: Happy Halloween guys. [00:40:39] Doug: Hey there, stackers. I’m Joe’s mom’s neighbor, Doug, and some people say this Halloween ghost thing is a sham. Some really weird stuff’s happened today in mom’s basement. First, I don’t know what came over me. I accidentally filled the El Camino with, oh God, premium gas. Scarier. Just before we hit record today, Joe opened bomb’s budget spreadsheet and saw rows upon rows of divide by zero errors. [00:41:07] Doug: Hashtag shiver. OG screamed louder than when I tried to do my own Roth conversion. I’m telling you it’s bad, man, but there was some good news that happened on today’s date. Back in 1692, the governor of Massachusetts dissolved the special court of Oyer and Terminator, which was convened for what purpose? [00:41:29] Doug: I’ll be back right after I try to figure out this mystery. You’ve heard of the black hole, right? I gotta go help Joe’s mom find a Home Depot receipt that’s been missing since 1998. She swears she put it in her filing system, which is a black hole of paper called the Tupperware Bowl, labeled miscellaneous. [00:41:49] Doug: Don’t make me go there. [00:42:02] Doug: Hey there, stackers. I’m Candy Corn Hater and Guy. You know, I gotta pause there because the first two candy corns are good. I mean, I think we can all agree like two of ’em. You’re like, eh, these are bad. You grab the handful and then you’re like, I’ve made a horrible mistake anyway. And Guy who’s a black hole of financial knowledge, Joe’s mom’s neighbor, Doug Black Hole of Candy Corn Knowledge. [00:42:27] Doug: I think I’m spitting truth bombs here. I’ve got good news and bad news. The bad is that I have nothing to report about Joe’s mom in that Home Depot receipt the good news. Is that I just discovered, I still have an active A OL premium subscription [00:42:46] Doug: and I gotta cancel it. And I’ve also got movie pass and something called Beef Jerky of the Month. Oh, that explains those little wooden sticks that are piling up over there. I was wondering about that. You were wondering about today’s trivia answer. The question was this, back on today’s date in 1692, the governor of Massachusetts dissolved the special court of Oyer and Termer, which was convened for what purpose? [00:43:13] Doug: Of course that was for the Salem witch trials. See, that’s what’s wrong now. All those witches are running free and signing me up for a OL premium. Well, I mean, or at least not canceling my subscription witches. It’s probably the witches. And now. I gotta get outta here. Take it away, Joe and og. [00:43:37] Joe: There goes Doug running up the stairs. [00:43:39] Joe: What [00:43:40] Doug: a, what a well, piece of trivia running you’re using, running in a loose, in its loosest definition. Well, [00:43:45] Joe: the fact that you’re still here at the mic is just how slow you’ve run. Uh, big thanks to Doug and Heather Bonaparte for joining us. You know, communication OG is the key. They call it the soft skill. [00:43:58] Joe: And yet when people are in a relationship and the money’s not going the way that they hoped that it would, it’s generally, we’re not, we’re, we’re not talking about it. [00:44:07] OG: Nothing gets better by not talking about it, whether it’s health or fitness or money or relationships, or whatever the case may be, bearing my head in the sand, that will totally make it better. [00:44:18] Joe: That is a great point. I’ve never once thought, you know what, I’m gonna wait to bring this up with Cheryl later. And it just miraculously got better. [00:44:26] OG: It just, it went away. Like if I just don’t address the big elephant in the room. It will get way better. It’ll eventually disappear. No, you have to. And being conflict proficient is, is a skillset too, right? [00:44:40] OG: It’s like a lot of people are conflict avoidant. That’s super easy. But being proficient in, you know, how to deal with that sort of stuff, you know, it doesn’t make it any more fun to send that crappy email or to have that tough conversation or, you know, whatever it may be. But quite often it’s, um, it’s a lot easier once you get into it. [00:45:00] OG: So. Don’t put it off. [00:45:02] Joe: You know what’s funny about communication year around people for a long time, and there’s things that they do that end up being the sandpaper in the relationship. And Cheryll and I were talking about this just a couple weeks ago. Like, what is it? You’re [00:45:15] OG: the sandpaper in the relationship. [00:45:16] OG: It [00:45:17] Joe: turns out it’s been me this whole time. [00:45:19] OG: Who knew? [00:45:20] Joe: Who knew? The thing that drives Cheryl crazy that I say is, Hey, guess what I did today? She’s like, I don’t like guessing games. I’m never gonna guess. Just tell me what you effing did. Just, just, just tell me. Guess what I did today? For me, the sandpaper is what Cheryl goes, Hey, don’t be mad, but, and we were laughing that when she says, don’t be mad. [00:45:44] Joe: I’m instantly mad. I have no idea what I’m mad about. I have no idea. But when Cheryl says, don’t be mad. Oh, okay. All right. Here comes, [00:45:54] OG: I don’t know that we have any of those in ours, but, um, from our team standpoint, everybody knows this. When people start out with, can I ask you a, a question and then I go, [00:46:03] Joe: no. [00:46:03] Joe: Yes, [00:46:07] OG: because apparently you’ve already asked it. Oh, oh, no. You need to ask another question. Oh, okay. [00:46:14] Joe: Oh, that’s like that joke. The guy goes to see the [00:46:18] OG: stop. Just, just ask it. [00:46:20] Joe: Guy goes to see the lawyer and, uh, ask, what do you charge? The lawyer says, $3,000 for three questions. And the guy goes, isn’t that a lot of money? [00:46:28] Joe: Lawyer says, yes it is. What’s your third question Right there. Good stuff. All right. Into our headline. [00:46:40] Joe: I love Halloween week. ’cause I get to say words like this, phrases like this. Today’s headline comes to us from Buzzfeed. How often during the 52 weeks of the year do you get to say it comes from Buzzfeed? Things people reveal The headline is people are revealing how money caused shocking drama in their family. [00:46:59] Joe: And I’m actually speechless of course. And number six will make you LOL. These are financial horror stories that people shared. Speaking of LOL, [00:47:09] OG: hold on. Speaking of LOL, I saw this picture the other day, meme or whatever that said, your brain will automatically translate in your brain WTF, but won’t translate. [00:47:20] OG: LOL. Like when you see WTF, don’t you think of the words [00:47:24] Joe: immediately? Yeah. [00:47:26] OG: And when you see LOL, do you think laugh out loud? [00:47:28] Joe: No, [00:47:28] OG: I, [00:47:29] Joe: I just think LOL. Yeah. That is weird. Why is that? That I, I dunno, that’s the end of today’s show. Everybody. We can, anyways, we can’t do better. I can’t. Do you think Buzzfeed’s gonna get better than that? [00:47:40] Joe: I don’t think so. [00:47:41] OG: Made you LOL See you Just think of the letters. LOLI [00:47:44] Joe: saw this one in this list. I’ll link to the whole list in our show notes for people that love doing these, uh, these, speaking of black holes, Doug, these black holes of Buzzfeed. What do you think about this idea of ruling from beyond the grave, you know, putting all these stipulations OG into your estate plan? [00:48:00] Joe: My grandfather died in the early 1970s. Long before I was born. He left $120,000 to be split among his six kids, but with two conditions. One, his second wife was entitled to the interest on the money for the rest of her life. And two. The oldest and youngest kids were entitled to $500 a year for serving as the executors of the estate until it could be dispersed. [00:48:20] Joe: My God did this cause drama. The wife lived another 30 years, which substantially diminished the value of the money. No one said they wanted her to die earlier, but they sure felt that she could, that she should give up her claim. But most contentious is that my aunt and uncle each collected about $15,000 in fees and $500 installments. [00:48:40] Joe: Several of their siblings felt they should deduct their riches from their inheritance, which of course, they refused to do. And finally, there was about $4,000 extra after all was said and done. My mom suggested donating to cancer research. Both their parents died of it in their early sixties, but nope. It became another six month fight over whether the executor should get a part of it or whether the other four should get a cool thousand bucks each. [00:49:02] Joe: Just ridiculousness. [00:49:04] OG: Well, the interest to the living spouse. That’s a very normal part of a trust. [00:49:09] Joe: Incredibly normal. And why do they think, by the way, if she was married to them that she shouldn’t get that? I don’t understand their problem. Yeah. May maybe a second marriage had to be, yes, his second wife. [00:49:24] Joe: But the second one, the fighting with the executors. [00:49:26] OG: Hey, maybe you should have been first or last born and then you could have been an executor. [00:49:30] Joe: You know what, OG two executors here I think is the problem too. I think just pick somebody. Pick one. Don’t pick two. These two people are gonna fight. They’re gonna fight every time. [00:49:40] Joe: They didn’t [00:49:41] OG: fight. They got all the money. [00:49:42] Joe: That’s true. But they were fighting. That is, that is a good touche. That’s a good point. Money’s torn. My in-laws apart. My husband’s grandfather and his three adult children have been at each other’s throats for nearly two decades over his money. My husband wants nothing to do with them or the money. [00:50:01] Joe: His grandfather isn’t rich. He just invested well and worked hard. Instead of getting the golden years he deserved, he has to watch two daughters disinvite each other from holidays, rip each other on social media and refuse to see each other. The other is always trying to position herself to oversee the will. [00:50:18] Joe: There have been ruined dinners, physical altercations, people not speaking for years. It’s awful. It’s so sad what money does to people. [00:50:24] OG: It happens. That’s why you don’t tell anybody what you got. Stealth wealth. What was that? It was kind of hard when you show up and you’re like, Hey, can you pick me up from the airport? [00:50:34] OG: DFW? No, no, no. We, [00:50:36] Joe: no. The private [00:50:36] Doug: airport. Yeah. There’s a private hanger around the [00:50:39] Joe: corner. [00:50:40] OG: You’ll see it. [00:50:41] Joe: I hitched a ride on this, uh, Learjet. Remember a few years ago, speaking of stealth wealth, that guy who had the brilliant idea, og, he said, I don’t want my relatives to know how much money I have. I don’t want them to ask me for money. [00:50:57] Joe: Okay? So I’m gonna ask them for money. So every time I go to Thanksgiving, I ask them to borrow money. If I can borrow money. [00:51:03] Doug: Yeah. [00:51:04] Joe: So good. There you go. How about this horror story? Our mom blamed us for her gambling addiction, saying that we abandoned her. How’s that for a first sentence? We stopped talking to her only after we found out that she wiped clean all of her and dad’s savings and the money and trusted her by her dad’s sister. [00:51:22] Joe: She also blamed our dad for it because she said she knew he was cheating on her. They had to sell all of their property to return the money to our aunt. It took a year to resolve the issue and help everyone to get back on their feet financially and mentally. Only learned that she borrowed money, invested the money on a farming business with the attention of keeping the gains from a cooperative where she’s a member with, tasked with keeping the money safe. [00:51:44] Joe: I’ve seen this in my own family where you have a relative who, you know, OG is stealing money. Is just stealing money, and what do you do? You know, in fact, in this case, the person that was being stolen from knew they were being stolen from, and another relative said, well, it takes two. You know, why does she get access to the checkbook if you know she’s gonna steal the cash? [00:52:07] OG: Yeah. I don’t, I don’t know [00:52:08] Joe: what to say about that. No. Painful. These are all painful, ah, Halloween horror stories. We’ll link to these on our show notes at stack your Benjamins dot com. Doug, time for us to mosey out on the back porch. What do we got brewing today? [00:52:22] OG: See what you did there brewing? [00:52:23] Doug: The only thing I was gonna bring up is, uh, we got a great review very recently regarding episode 1747 from just some guy, literally the name of the poster, just some guy NYC, so it’s just some guy in New York City that narrows it down. [00:52:41] Doug: Thanks. I think we’ll find you. And the whole review is just the title and it says OG was insufferable on this show. [00:52:50] opener: Oh boy, I, [00:52:51] Doug: I especially appreciated that he, that insufferable was two words in the title. He was insufferable. [00:52:59] Joe: I had so many people write to me about episode 1747 and how much they enjoyed it. [00:53:05] Joe: How much you wanna remind, remind everybody [00:53:06] Doug: what we talked about. [00:53:08] Joe: 1747 was the show where our headline was about gold prices hitting all time highs. And so many people told me that, uh, that was a show. Uh, and it was a show. I think, I think we could, apparently I was [00:53:24] OG: inseparable, so we could [00:53:25] Joe: definitely say that we [00:53:26] Doug: had a show. [00:53:27] Doug: Yeah. [00:53:28] Doug: I’ll tell you what, just some guy that’s maybe one of the best compliments you could have offered. Og. He is got a smile ear to ear right now. Yes. [00:53:39] Joe: Success. I was insufferable Doug poking him again. Yeah. Good stuff. Thank you so much. So much better than being sufferable, right? For the kind review, if you’re [00:53:49] Doug: gonna do something, do it really well. [00:53:51] Joe: Yes, please [00:53:52] Doug: be [00:53:52] Joe: intolerable. They used to say that about Norm McDonald, Doug, that, you know, when Norm McDonald would be doing the set and the joke wasn’t going over, he could feel the audience starting to turn ’cause it wasn’t going over and he would just lean further into it. Mm-hmm. And just, he’s like, oh, you think this is bad? [00:54:09] Joe: I can make it really, really, [00:54:11] Doug: really bad. And a lot of people try that. Not everybody can turn that from being really bad into funny, like Nor McDonald could, like we try it all the time just leaning in and rarely does it turn that corner to finally being funny for us. [00:54:26] Joe: Well, I can’t wait to hear in a, in a future back porch Joji, what it’s gonna be like at Disney this time of year if it’s just, if the park’s packed or if it’s gonna be really fun. [00:54:35] OG: Uh, we’ve been there many times this time of year. This is kind of the time we would normally go with the kids when they were younger and um, it’s gonna be great. Yeah. It’s also the Food and Wine Festival at Epcot, so Oh, fabulous. Yeah, those festivals at [00:54:47] Joe: Epcot, albeit Dollywood, they’re doing a festival at Dollywood, the Fall Harvest Festival, which should be fun too. [00:54:53] Joe: It’s not the balloon festival. Does Dollywood have a balloon festival [00:55:00] Joe: pivot Time for us to pivot insufferable. Doug, quick get us outta here, man. What are our, uh, top three things we need on our to-do list today? [00:55:08] Doug: Well, Joe, first take some advice from Doug and Heather Bonaparte. While things happen to you, it’s the stories you tell yourself that can create a struggle. What horror stories might you be telling yourself? [00:55:21] Doug: Second, and also from Doug and Heather, how are the people around you thinking about money? I can guarantee it isn’t the same way you are looking at it. Take some time and find out. That’ll clear up some confusion. But the big lesson, don’t even talk to Joe’s mom today. Don’t even she’ll share the creepiest story of all. [00:55:42] Doug: She’s thinking about starting a podcast about extreme coupon. [00:55:52] Doug: Thanks to Douglas and Heather Bonaparte for joining us today. You’ll find their new book, money Together, wherever books are Sold. We’ll also include links in our show notes at Stacking Benjamins dot com. This show is The Property of SB podcasts, LLC, copyright 2025, and is created by Joe Saul-Sehy. Joe gets help from a few of our neighborhood friends. [00:56:16] Doug: You’ll find out about our awesome team at Stacking Benjamins dot com, along with the show notes and how you can find us on YouTube and all the usual social media spots. Come say hello. Oh yeah, and before I go, not only should you not take advice from these nerds, don’t take advice from people you don’t know. [00:56:35] Doug: This show is for entertainment purposes only. Before making any financial decisions, speak with a real financial advisor. I’m Joe’s Mom’s Neighbor, Duggan. We’ll see you next time back here at the Stacking Benjamin Show. [00:57:38] Joe: I love this, uh, newish studio that’s out. I’ve talked about these guys before, angel Studios, where they make these, these films that are meant to just bring people together. I really like the one, if you guys remember about Mother Cabrini and New York City. I [00:57:52] Doug: can’t watch it yet. It’s nowhere unless I pay for it and [00:57:55] Joe: Yeah. [00:57:56] Joe: Yeah. And they make you, they do make you pay for it. If you don’t catch it in the theater, man, they got this whole Yeah. System. [00:58:02] Doug: I wanna see that you’ve, I’ve remembered you really recommended that highly. And I’m annoyed that I can’t, I’m already paying for a streaming service. I know [00:58:08] Joe: Im not paying again. I know. [00:58:10] Joe: And yet another one, the second movie I saw was nearly as good. I didn’t like it as much, but I liked it a lot. And it was the young women in Afghanistan, if you remember, who wanted to work on computers and who, uh, got into this robotics competition, and that was really a good, uh, feel good movie. The third movie, this movie is not, uh, definitely not a, a feel good movie. [00:58:32] Joe: But it is, uh, every bit as important as those movies, and it’s called Truth and Treason. [00:58:44] trailer: Hitler’s twisting the Truth Beyond Recognition. [00:58:47] Doug: No, don’t be any [00:58:50] trailer: Straight Up the Wire. We report the truth, not the propaganda. Spoonfed to you by your leaders. [00:59:00] trailer: Gestapo must not remain. [00:59:06] trailer: This concludes our broadcast for this evening. [00:59:13] Joe: Can you keep a secret? So this is a story of a true story of a 16-year-old kid and his friends. He is a Mormon in Germany, and he watches a friend of his who is Jewish get, uh, taken away and he decides that he’s gonna do something about it as a 16-year-old. It’s in Hamburg, it’s in the early 1940s. And it’s the story of him deciding that he’s going to. [00:59:43] Joe: Type out all of these messages after his brother who was a German soldier comes home and he has smuggled into Hamburg, uh, wireless radio, which is illegal. You’re not allowed to hear anything that doesn’t come directly from the government. So he gets the wireless radio. What you heard at the beginning was him listening to the BBC and hearing the other side of the story and realizing that they were being lied to. [01:00:09] Joe: And so he decides to create these flyers and it’s his story and the story of the SS officer who is investigating and is trying to find him and is trying to figure out who is creating this act of treason against the Third Reich. It is a pins and needles movie. Uh, I looked at my watch three times, not because I wasn’t in the movie, but because I didn’t know how much I could take. [01:00:33] Joe: I’m not that I’m, I’m not that into just suspenseful, edgier seat, realizing this was a true story, uh, kind of movie. But it’s a movie. It was an important movie. It’s a movie I think we all need to see. It was really, really, really very compelling. Yet another Angel Studios movie that I like. So if you get a chance to see Truth and Treason, highly, highly, highly recommend it. [01:00:57] Joe: You guys have been watching a, a show that I’m actually ashamed that I’ve not started watching the show yet. Season three, the diplomat just came out on Netflix. [01:01:07] Doug: It did have, are you watching it, og? [01:01:09] OG: I haven’t turned on season three yet. No. Hopefully I’ll get some, uh, airplane time here this week. [01:01:15] Doug: Yeah, we started watching it we’re, I think, three episodes in and it’s fantastic. [01:01:21] Doug: Uh, it’s better than I remember. There was a long break, seemed like a long break between season two and season three, and so the recap was usually I skip right past the recap, so I’m like, I need, I need to go back and watch that recap ’cause I forgot some, some important things, but it was really good. I’m actually. [01:01:39] Doug: Because thank God it’s one of those shows that you can stream all the way through all at once. You can binge, you don’t have to wait like a caveman of every week for a new episode to come out. I gotta just churn through the rest of it. ’cause it’s super good. [01:01:53] Joe: I either want it all at once, Doug, or I want you to do it week by week. [01:01:57] Joe: I think the stupid thing Netflix does where they will release the first half of the series and then make you wait. Because if I gotta wait and just make it once a week, there’s a little bit of a, I don’t know, deliciousness to that where I’m like, Ooh, it’s Thursday night, the new thing is coming out. Yeah, [01:02:12] OG: it Wednesday’s time for the new show. [01:02:13] Joe: Yeah, I like that. But the problem I have when you release the first half of the season and I binge all those, then I gotta wait like eight, eight weeks. [01:02:21] Doug: Yeah. You dump it. What [01:02:22] Joe: the hell? Oh, if it’s [01:02:23] Doug: that long of a gap. I agree. [01:02:25] OG: I still haven’t watched the last five, whatever it is, five or six episodes of Yellowstone. [01:02:30] Joe: Just ’cause they did it that [01:02:31] OG: way because it came out like the first half. It was, I think there was a writer strike maybe or something that happened. Yeah, there was some weird there. And so they, they didn’t intend to do it that way, but they did. And then the contract with Kevin Costner and all that sort of stuff went up and so you knew what was gonna happen. [01:02:46] OG: And now I’ve seen enough clips on YouTube and stuff that I have pieced together, like, you know, basically I know what the ending is. I just haven’t watched it, but I’m just not invested in it anymore to go back and, and say, you know, exactly how did they piece all this together? I’m sure it was great, but, but there was a year space or 10 months or whatever it was between the first half of season five and the back half of season five. [01:03:09] OG: Yeah. Whatever next, [01:03:12] Joe: last week I loved. Well, uh, last year there was a new series that was out, which was, uh, Kristen Bell. And Adrian Brody. Nobody wants this. And, uh, that was a good comedy. I really enjoyed that. She’s agnostic and he is a rabbi and nobody wants the two of them. Together. They get together and it was a, I thought it was a really good first season that came out last week. [01:03:35] Joe: There’s a bunch of other stuff coming out too. Some of the movies coming out now. Of course. Why is it that for, I feel like 40 of the weeks of the year, there’s no really good movie, and then all the great ones come out Yeah. At the same time. And you miss half of ’em because of that. [01:03:51] Doug: Yeah. [01:03:51] OG: I still haven’t seen the second half of the last Mission Impossible movie. [01:03:55] Joe: Yeah. [01:03:56] OG: Very good. Dead reckoning, part two. Enjoyed it. Oh, I’m sure it’s, I know, I know. Doug has never seen any Mission Impossible movie, so I haven’t. It’s worth a weekend. You know, you winter, there’s nothing going on. Like I know you go Friday, Saturday, Sunday and just binge all, what are the 12 of them or something? [01:04:11] OG: Yeah, man. Go ahead and start from the beginning. You’ll, you’ll, you’ll piece it together. There’s some crossovers that happen later. [01:04:18] Doug: I really should. I just, I’m sitting there scrolling, looking for the thing to watch. It just never pops into my mind. Oh, we should start on the, the whole series. [01:04:28] Joe: I saw a preview while I was in the theater watching the Angel movie that I just mentioned, uh, truth and Treason, and it’s, it’s for the new Brendan Frazier movie. [01:04:37] Joe: Have you guys seen the trailer for the new Brendan Frazier film? [01:04:40] Doug: Is it just as uplifting as whale? [01:04:42] Joe: It is it, by that I mean, it seems a little uplifting, but still it’s, it’s a, it’s another, I’m going for the Oscar movie. Definitely that, but he is an outta work actor. In Japan and he goes to work for a company where his job is to act like he’s a member of the family. [01:05:06] Joe: He’s a rental part of the family and, and the movie’s called Rental Family. And so it shows him in these different scenes pretending he’s a husband, pretending he’s a boyfriend, pretending he’s a family friend. He goes up to this young girl and says, uh, hi, I’m your dad. And the girl obviously gets mad and is like, you left us when we were young. [01:05:25] Joe: He’s like, what do I do with this? Uh, so rental fa, it looks, it looks so good. I’m excited about seeing, seeing that, but not if it’s as deep as bit of despair is The whale. The, the whale was kind of a bridge too far for me. I remember Doug when, when that came out, I was so excited to see the whale and then I watched it. [01:05:43] Joe: I got two thirds of the way through and I was like, oh my, this thing starts off depressing and just gets worse. [01:05:48] Doug: Yeah, it’s like, like, what was it? Leaving Las Vegas. Where Nicholas Cage is just basically trying to drink himself to death, and you’re like, oh my [01:05:55] Joe: God, [01:05:56] Doug: just get [01:05:56] Joe: on [01:05:57] Doug: with it. [01:05:58] Joe: I do remember feeling bad during The Doors movie because you know, Jim Morrison is gonna commit suicide at the end. [01:06:04] Joe: And I, it’s the only movie I’ve ever walked out of. I’m like, oh my God, please die. Just please. It was horrible. Wow. Just ’cause you knew it was coming. [01:06:12] Doug: Yeah. [01:06:13] Joe: Not good. Well, that’s a fun way to end the week talking about this. Yeah, there it is. You know, let’s end this on a fun way. What have you seen stackers? [01:06:21] Joe: What movies have you seen? What, uh, you know, let’s add some stackers to the after show, Stacking Benjamins dot com slash voicemail. What’s your review of a movie that would you just that Awesome. Why don’t we [01:06:30] Doug: done that before? I don’t, because look at us. We’re not that bright. We, we.

Leave a Reply