I don’t know about you, but I hate tax season.

To all of you accountants out there who actually love what you do, I tip my hat to you. As much as I hate tax season and working on my taxes, though, this recent article from Bloomberg makes me realize that my tax concerns are simple compared with what the rich and famous have to contend with.

I confess that I am one of those people who always wonders why celebrities end up in tax trouble. After all, they make enough income that they should be able to give Uncle Sam his fair share…but now I realize why their tax life is a mess. Why? They don’t pay attention to the details, and I bet a number of everyday people miss these same details as well when it comes to filing their taxes.

Receipts are a must!

Networking is a large part of a celebrity’s business growth, and many of their networking activities are tax deductible; however, many are not very good at keeping track of all of those expenses. Apparently, celebrities frequently pay with cash when they go out and don’t have room in their designer duds and purses to stash receipts with notes on them.

Lesson: Keep your receipts.

Working in multiple states means multiple returns

If you are a touring artist, you or one of your handlers not only needs to keep track of the income you incur in the state in which you primarily reside; however, you need to keep track of what is earned in each state where you tour. It’s hard to hide tax money from the State of New York when they can easily pull up your band’s webpage and see that you played Madison Square Garden in the fall of that particular year.

Lesson: Where you earn income matters…not just where you live.

Beware of giving gifts

It’s nice to have money to give away to all of the people who come to you for hand outs once you make it big, but the process is not as simple as writing a check or handing out some cash, there are specific tax forms that should be filed and if the amount is larger than the gift tax allowance, then taxes will need to be paid on that gift.

Lesson: Big gifts require tax forms.

Celebrity is not forever

I think the biggest detail that many celebrities miss, though, is that celebrity is not a full time and permanent position. You may be a star athlete today; however, one twist of an ankle can make you unemployed tomorrow. You may have just starred in the biggest movie of the year (talking to you Dakota Johnson); however, you can easily get pigeonholed and there isn’t a great future for sex movies starring senior citizens. (note from Joe: there goes my movie career….) So instead of spending money or trying to hide it from the government, make a plan to preserve it so that you can not only avoid tax trouble down the road, but you don’t have to work with your clothes off the rest of your career.

Have you done your taxes yet? Are yours as complicated as those of a celebrity?

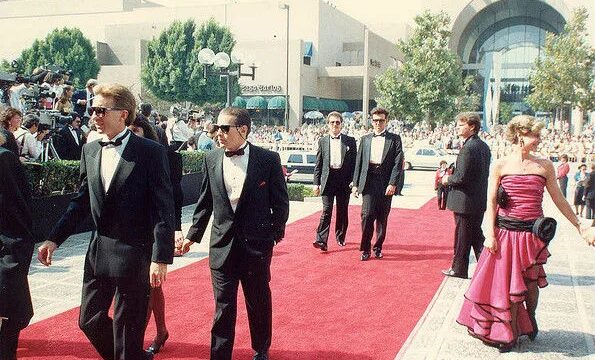

Photo: Alan Light

Mine definitely aren’t that complicated, but I do have an S-corp. I get that return done by a CPA. I deal with our personal return myself. The only real complication is that we rent our guest house. So I have to keep track of depreciation, but there are calculators online.

And I will say that it can be difficult to estimate taxes, even when your income isn’t variable. I don’t understand why stars don’t rely more strictly on their CPAs.

It can definitely get a little complicated once you start dealing with S-corps and LLCs, but thank goodness for CPAs!! And I agree with you, the celebs should just listen to their CPAs.

Our taxes are more complicated than they once were but we still do them ourselves. Well, Greg does them =) I can barely get through a page on the IRS website without my eyes glossing over!

I hear you!! We actually still do our taxes as well because I can’t imagine an accountant more well-versed than the business version of TurboTax. That program asks a ton of questions!

I am the furthest thing from a celebrity and I can attest to the working in multiple states thing being an absolute nightmare in the arts. I get so excited when I work for companies that just pay us based out of their address no matter where we are, as opposed to the companies that pay by which state you worked in.

We like to keep our taxes simple. We do have the sole proprietor stuff, but I keep it mostly organized with Quickbooks. I’m not organized by nature, so the simpler I can keep it, the less chance I’ll end up in the slammer for some unintentional tax evasion charge. 🙂